The recent Bitcoin price drop has stirred considerable concern among investors, as the cryptocurrency slipped below $64K, marking a significant downturn. Veteran trader Peter Brandt has raised alarms about an alarming trend known as “campaign selling,” which is putting additional pressure on Bitcoin’s valuation. Simultaneously, Bitcoin miners and U.S. spot ETFs are reducing their BTC exposure, further exacerbating the situation as market dynamics shift. This has led to a notable 22.5% decline within just a week, erasing over 15 months of gains for the asset. As Bitcoin’s market analysis shows, the bearish target could approach $63,800, indicating a potential for additional losses ahead.

In the ever-evolving landscape of cryptocurrency, the recent downturn of Bitcoin is resonating through various sectors and investor circles alike. Alternative terms such as ‘BTC decline’ and ‘digital currency market fluctuations’ are becoming commonplace as traders attempt to navigate this turbulent period. The implications of reduced exposure from Bitcoin miners and financial instruments like spot ETFs are reshaping market sentiment, igniting discussions about future Bitcoin price predictions. Analysts now face the challenge of deciphering trends while addressing the potential impacts on profitability for investors. Amidst this turmoil, many remain on the lookout for signs of market recovery or further decline.

| Key Points | Details |

|---|---|

| Bitcoin Price Drop | Bitcoin price fell over 22.5% last week, reaching $69,000, erasing 15 months of gains. |

| Campaign Selling | Veteran trader Peter Brandt warns of ‘campaign selling’ pressures from miners and ETFs reducing BTC exposure. |

| Potential Bottom Zone | Technical analysis suggests a potential bottom near $54,600 to $55,000. |

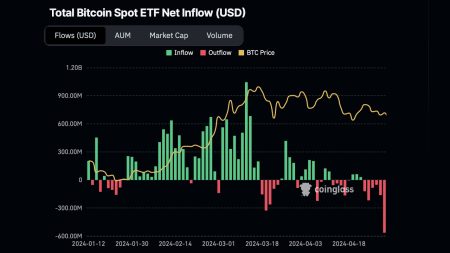

| Market Dynamics | Miners and U.S. spot ETFs lowering their BTC exposure have increased supply pressure during a downtrend. |

| BTC Miner Net Position | On-chain data indicates miners are sending more BTC to the market, shifting towards net distribution. |

| Coinbase Premium | The Coinbase premium has fallen to yearly lows, indicating reduced institutional interest in BTC. |

| Bearish Target | Bitcoin’s potential bearish target is around $63,800, suggesting another 10% decline might be imminent. |

| Historical Trends | Past analysis showed significant price movements correlate with particular price zones, potentially signaling buying opportunities. |

Summary

The recent Bitcoin price drop has raised concerns among investors, suggesting it may fall below $64K. With a significant 22.5% decline last week, many experts highlight the impact of miners and U.S. ETFs reducing their market exposure, contributing to an ongoing downtrend. Furthermore, technical analysis indicates a possible bottom near $54,600 to $55,000, emphasizing the fragility of the current market conditions. Investors are advised to stay informed and assess risks before making decisions.

Understanding the Current Bitcoin Price Decline

The recent Bitcoin price drop, which saw BTC fall over 22.5% in a week, is causing significant concern among investors and traders. Analyst Peter Brandt has raised alarms over what he terms ‘campaign selling,’ whereby both miners and institutional investors through U.S. spot ETFs are liquidating their holdings. Such actions are indicative of a shift in market sentiment, contributing to increased supply and heightened selling pressure on Bitcoin. With experts recommending close observation of market trends, this downturn highlights the volatility and unpredictability of Bitcoin prices, leaving many to speculate whether BTC could dip below critical support levels.

At present, the price of Bitcoin has teetered around $69,000, effectively undoing 15 months of gains in a matter of days. The underlying causes for this drastic decline tie into broader market patterns, where various factors, such as miner behavior and ETF dynamics, play crucial roles. Technical analysis suggests that Bitcoin could potentially find a bottom near the $54,600 to $55,000 mark, a significant point that traders are watching closely. The interrelationship between Bitcoin price predictions and market analysis reveals not only investor sentiment but also how external factors like regulatory changes impact the ecosystem.

Market Analysis Amidst Bitcoin Price Drops

The recent market analysis reveals dire trends for Bitcoin as the price continues to show signs of instability. With miners increasing their market supply due to net position changes, BTC’s bearish trend has solidified. This addition of liquidity from miners, combined with ETFs reducing their net BTC balances, means that the increased supply pressure could push Bitcoin prices even lower. Investors and analysts are closely monitoring these shifts as they could determine the next potential decline, possibly targeting the critical levels of $63,800 as outlined by Brandt’s technical analysis.

Moreover, the decline of institutional interest, signified by the falling Coinbase premium, indicates a shift in market confidence. As spot ETFs lower their exposure, it suggests that major players in the market foresee troubled times ahead for Bitcoin. Data supports the narrative that the drop in prices may influence new buying patterns, with some indicators hinting at possible accumulation opportunities in the near future. Understanding these market dynamics among Bitcoin miners and ETFs provides insights that could shape future Bitcoin trends and investor strategies.

Potential Future of Bitcoin Prices

Looking ahead, the future of Bitcoin pricing remains uncertain amidst current selling dynamics from miners and ETFs. On-chain analysts emphasize the significance of the $54,600–$55,000 area as a possible accumulation zone, suggesting that this price range could serve as a crucial pivot point for investors. Historical trends indicate that Bitcoin has previously bounced back from similar dips, making this area a focal point for those aiming to capitalize on potential upward movements moving forward.

Moreover, understanding the potential impacts of broader economic factors, such as credit spreads and interest rates, will be essential for predicting Bitcoin market behavior. Analysts believe that a shift towards an accumulation phase may begin around July 2026, suggesting that while current outlooks may appear bleak, there could be underlying strength setting the stage for future recovery in Bitcoin prices. Investing in BTC requires careful consideration of these possibilities; thus, a thorough analysis of market patterns and predictive metrics is vital for making informed decisions.

The Role of Bitcoin Miners in Price Dynamics

Bitcoin miners have always played a critical role in the cryptocurrency’s ecosystem, but their current behavior is notable given the recent price declines. Recent data indicates that miners are significantly increasing their distribution of Bitcoin to the market, a trend that coincides with the alarming price drop. This selling pressure from miners stems from various factors, including profit-taking behaviors and the decreasing market price, which can signal to other investors that the bullish momentum has reversed.

As miners contribute to the heightened supply, their actions directly influence Bitcoin price predictions. If the trend continues, it could lead to heightened volatility, affecting both retail and institutional investors’ confidence. Miners hold considerable amounts of BTC, and their decisions to sell or hold can sway market dynamics significantly. Therefore, understanding the strategic behavior of Bitcoin miners is essential in anticipating potential price movements and developing effective investment strategies.

ETF Dynamics and Bitcoin Price Volatility

The impact of U.S. spot Bitcoin ETFs on the cryptocurrency market cannot be overstated, especially during periods of price volatility. With the recent decline in Bitcoin prices, these ETFs have reportedly reduced their exposures, indicating a lack of confidence in Bitcoin’s near-term viability. This trading behavior from institutional funds illustrates the interconnectedness between Bitcoin’s market health and ETF interest, making it essential for investors to monitor these trends closely.

As institutional interest wanes, Bitcoin’s price faces additional downward pressure, compounded by the selling activity of miners. The decline in net balances of Bitcoin held by ETFs reflects broader market sentiments, potentially threatening Bitcoin’s recovery and overall stability. These dynamics hint at a complex interplay between institutional sentiment and retail investor behavior, emphasizing the importance of ongoing market analysis to predict future trends in Bitcoin pricing and their implications for investment strategies.

Technical Analysis Insights on Bitcoin Price Trends

Technical analysis provides crucial insights into Bitcoin’s potential price movements, especially amid the recent downtrend. Key indicators suggest that the possibility of Bitcoin dropping further towards the $63,800 level is quite real, as reflected by Peter Brandt’s assessments. The technical patterns emerging from recent price actions depict a market facing strong resistance against upward trends, while bearish signals continue to dominate the landscape.

Moreover, understanding the charts, including moving averages and RSI indicators, is essential for investors aiming to navigate these turbulent waters. A comprehensive analysis of these technical metrics can reveal critical support and resistance levels that are likely to influence Bitcoin price dynamics. Amid the fluctuations, traders are advised to stay informed and utilize analysis tools for making well-informed decisions in a notoriously unpredictable market.

Historical Bitcoin Price Patterns and Predictions

Examining historical price patterns in Bitcoin provides invaluable context for predicting future price movements. For instance, the trends observed during previous bear markets yield lessons on potential recovery dynamics. Analysts note that Bitcoin often displays recurring cycles of decline followed by eventual support and recovery phases, as evidenced in 2022 when BTC bounced from lows near $20,000 to subsequent highs above $30,000. This cyclical behavior offers intriguing insights into potential future price performance.

As the current market faces pressures from miners and ETFs, observers are speculating about where Bitcoin might position itself moving forward. Historical data suggests that significant bottoms may lead to substantial recoveries, making it essential for market participants to identify such patterns early on. By synthesizing past occurrences with current dynamics, traders can effectively articulate realistic Bitcoin price predictions, thereby enhancing their strategic investment approach.

Understanding Investor Sentiment in Bitcoin Markets

Investor sentiment plays a pivotal role in shaping the dynamics of Bitcoin price movements, particularly during downward trends. As news of price drops circulates, this sentiment can quickly shift, leading to increased selling pressure and further exacerbating declines. The recent actions of Bitcoin miners and ETFs reveal a clear sentiment of caution among major market players, indicating a potentially prolonged period of bearish outlook within the cryptocurrency space.

To effectively gauge market sentiment, analysts often turn to various indicators, including social media trends, trading volumes, and price action analytics. This data provides insights into how investors are reacting to current price movements and forecasts. As understanding investor behavior becomes increasingly crucial, effective sentiment analysis can assist traders in making informed decisions within the volatile Bitcoin market, helping them navigate uncertainty and strategize for future potential reversals.

Strategic Investing in a Declining Bitcoin Market

In light of the current Bitcoin price drop and increased volatility, strategic investing becomes incredibly important. Investors are encouraged to focus on key metrics that could signal when the market may recover or continue its decline. Monitoring the behavior of miners and the actions of ETFs will be vital, as these elements play significant roles in defining Bitcoin’s price action. Staying disciplined and utilizing comprehensive market analysis will help navigate through these challenging periods.

Furthermore, establishing clear investment strategies based on risk tolerance and market conditions is essential. DCA (Dollar-Cost Averaging) could prove beneficial for those anticipating a market rebound; gradually purchasing Bitcoin as prices dip may lead to better average buying positions when momentum shifts. Consequently, fortifying investment strategies through close attention to ongoing market developments and leveraging robust analytical tools will be crucial for capitalizing on future opportunities in the Bitcoin landscape.

Frequently Asked Questions

What factors are contributing to the recent Bitcoin price drop?

The recent Bitcoin price drop is primarily influenced by increased supply pressure from Bitcoin miners and U.S. spot ETFs reducing their BTC exposure. This ‘campaign selling’ has created a fragile downtrend, causing BTC prices to fall significantly.

Is there a predicted Bitcoin price forecast amidst the current price drop?

Currently, market analysis suggests that Bitcoin could see further price declines, with key analysts predicting a potential bottom around $54,600 to $55,000. This forecast takes into account ongoing distribution by miners and decreasing ETF holdings.

How are Bitcoin miners affecting the current BTC decline?

Bitcoin miners are impacting the BTC decline by shifting towards net distribution, meaning they are selling more BTC into the market. This behavior contributes to increased selling pressure which exacerbates the price drop.

What role do spot Bitcoin ETFs play in the Bitcoin price drop?

Spot Bitcoin ETFs have been reducing their holdings, which has led to a decrease in overall BTC demand. As these institutions lower their exposure, the additional supply in the market can drive down Bitcoin prices further.

Can we expect Bitcoin to recover after this price drop?

While there is potential for recovery, the Bitcoin price movement largely hinges on market conditions and miner behavior. Historical patterns indicate potential accumulation phases after significant price drops, but market volatility remains a crucial factor.

What technical analysis support is there for a Bitcoin price drop?

Technical analysis by veteran traders, such as Peter Brandt, shows that the current downtrend may continue, with bearish targets around $63,800. Analyzing the BTC/USD daily chart reveals patterns indicating ongoing selling pressure.

How should investors approach the current Bitcoin market analysis related to price drops?

Investors should remain cautious amid the current market volatility regarding Bitcoin price drops. Conducting thorough research, understanding technical indicators, and considering historical trends can help in making informed decisions.

What implications does a Bitcoin price drop have for future market conditions?

A Bitcoin price drop can lead to increased volatility in the cryptocurrency market, affecting investor sentiment. It may create an environment for accumulation among savvy investors looking to capitalize on potential lows.