The recent Bitcoin price drop has sent shockwaves through the cryptocurrency community, marking the largest single-day decline in history with a staggering loss of over $10,000. This unprecedented fall reflects the current state of the Bitcoin market analysis, where selling pressure has ramped up significantly, leading to over $2.6 billion in liquidations. Analysts have noted that this brutal BTC price trend mirrors previous bear markets, sparking fears that recovery could take years, with predictions suggesting that Bitcoin might not see a price above $93,500 until 2028. The cascading effect of such a drop leaves investors wary as they track Bitcoin’s future forecast amidst a turbulent market landscape. With discussions around the Bitcoin bear market of 2023 heating up, many are left wondering when a genuine rebound will finally take place.

In a striking downturn for the cryptocurrency landscape, the recent drop in Bitcoin’s value has captured the attention of traders and investors alike, leading to an influx of discussions about its implications. This drastic decrease, the largest recorded in a single day, has left a significant mark on BTC price dynamics, triggering a wave of liquidations that few could have anticipated. As the market grapples with this setback, the analysis of Bitcoin’s performance suggests that we may be in for a prolonged period of downturn, ultimately culminating in a potential recovery phase projected for 2028. With terms like ‘crypto bear market’ frequently surfacing in dialogue, the future outlook remains complex and fraught with uncertainty. Investors are urged to stay informed about price trends and forecasts as they navigate this challenging environment.

| Key Point | Details |

|---|---|

| Record Daily Drop | Bitcoin experienced its largest drop ever, declining over $10,000 in just one day. |

| Liquidation Total | $2.6 billion in liquidations occurred, surpassing previous major events. |

| Market History | This drop was the steepest percentage-wise since the 2022 bear market. |

| Rebound Predictions | Analysts predict Bitcoin won’t rise above $93,500 until 2028. |

Summary

The recent Bitcoin price drop has marked a historic decline of over $10,000 in a single day, a first for the cryptocurrency. This significant drop, which resulted in $2.6 billion worth of liquidations, indicates the severity of the current bear market. Analysts forecast that a full recovery to past highs won’t happen until 2028, leaving many investors and traders apprehensive about the future trajectory of Bitcoin. As the market navigates this tumultuous period, understanding the implications of such a dramatic decline becomes crucial for any participant in the cryptocurrency landscape.

Bitcoin Price Drop: A Momentous Event in Crypto History

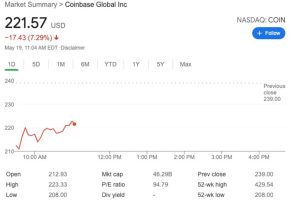

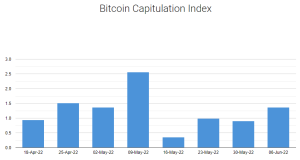

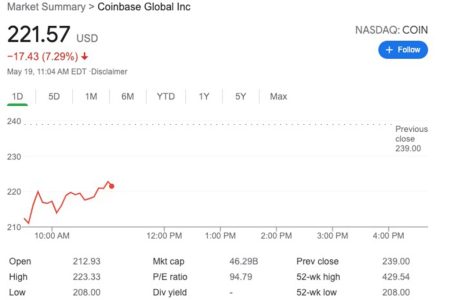

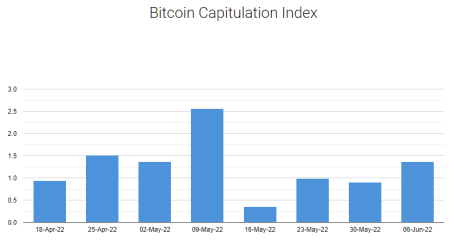

The recent Bitcoin price drop, marking a staggering decline of over $10,000 within a single day, has raised significant alarm in the cryptocurrency community. This historic downturn not only highlights the extreme volatility of BTC but also serves as a reflection of broader market conditions. Analysts are emphasizing that this is more than just a simple fluctuation; it is a defining moment in a bear market that echoes similar patterns observed during previous downturns. With $2.6 billion in crypto positions liquidated, the sheer magnitude of this sell-off is unprecedented in Bitcoin’s history.

As traders and investors scramble to assess the implications of this price drop, discussions around Bitcoin market analysis have intensified. The current bear market has elicited comparisons to previous crises, like the COVID-19 crash and the FTX collapse, both of which resulted in significant liquidations. This situation prompts a closer examination of BTC price trends and the resilience required to navigate such turbulent times. While the community holds onto hopes for recovery, the road ahead is fraught with uncertainty, showcasing the challenges inherent in cryptocurrency investments.

Bitcoin Bear Market 2023: Understanding the Implications

The 2023 Bitcoin bear market has been characterized by erratic price movements and substantial sell-offs, culminating in the recent historic decline. The fear of prolonged downturns has left many investors anxious, as the landscape of cryptocurrency is increasingly unpredictable. Current discussions in the realm of Bitcoin market analysis reveal concerns about prolonged low trends and the potential for further deceleration in BTC values. The market is witnessing strong bearish signals, compelling traders to reconsider their strategies for the foreseeable future.

Market analysts are advising caution, as the past year has revealed significant indicators of a bear market echoing the lows of 2022. This aligns with what some experts are predicting—a year of bottoming out before any significant recovery can take place. The current predicament reflects not just a temporary dip, but a larger cycle that needs to be recognized by market participants. As Bitcoin navigates through this bear market, it becomes crucial for investors to understand the cyclical nature of BTC price trends and make informed decisions during adverse conditions.

Bitcoin Future Forecast: What Lies Ahead?

Looking ahead, the Bitcoin future forecast paints a challenging picture, as some analysts assert that a genuine recovery might be years away. Predictions suggest that it may take until 2028 for Bitcoin to reclaim its previous highs, with a potential bull market resurgence expected around that time. Such forecasts highlight the need for patience among investors who may be tempted to react impulsively to volatility. In this context, it’s essential to engage in comprehensive Bitcoin market analysis to gauge when to buy or sell, ultimately mitigating the risks associated with fluctuating prices.

As part of the Bitcoin future forecast, there are discussions about the potential catalysts that could drive a rebound. Factors such as increased institutional adoption, regulatory clarity, and macroeconomic conditions will likely influence future BTC price trends. Analysts stress the importance of not losing sight of the long-term potential of Bitcoin, despite its current struggles. The crypto market’s inherent volatility requires vigilant monitoring of trends and forecasts, with an informed perspective to navigate the complexities of investment decisions in these uncertain times.

BTC Price Trends: Historical Context and Current Analysis

To better understand current market behavior, examining BTC price trends from historical contexts is essential. The recent dip has triggered a reevaluation of past performance during similar bear markets, particularly drawing parallels to the events that shaped the market in 2022. Historical trends indicate that after significant declines, Bitcoin often experiences substantial recovery phases, albeit with notable volatility. By analyzing historical BTC price movements, traders can gain insights into potential future trajectories and develop strategies accordingly.

Current BTC price trends suggest that a cautious approach is warranted, especially as the market reacts to unprecedented selling pressure. Analysts suggest closely monitoring key resistance and support levels to identify potential entry points for long-term investment. Understanding these trends can help investors navigate the complexities of the Bitcoin ecosystem, preparing them for future fluctuations. Adapting to market conditions is critical in this environment, emphasizing the importance of maintaining an informed perspective on Bitcoin’s price trajectory.

The Role of Market Sentiment in Bitcoin Price Decline

Market sentiment plays a powerful role in the movements of cryptocurrency prices, and the recent Bitcoin price drop has been heavily influenced by prevailing emotions within the trading community. Fear, uncertainty, and doubt often lead to rapid sell-offs, as was witnessed with the recent liquidation of $2.6 billion worth of Bitcoin. Understanding the dynamics of market sentiment can offer valuable insights into price movements, as traders often react emotionally rather than rationally. The current atmosphere following the historic drop underscores the necessity of emotional discipline in trading.

Furthermore, as Bitcoin experiences this price decline, responses from both retail and institutional investors become critical to the broader market landscape. Sentiment analysis shows that negative market perception can amplify bearish trends; hence, monitoring social media and news outlets can provide clues about the shifting mood within the crypto space. Additionally, effective Bitcoin market analysis should incorporate sentiment indicators alongside traditional technical analysis to offer a comprehensive view of market conditions and anticipated price actions.

Comparing Bitcoin’s Current Bear Market to Previous Cycles

In examining the current bear market, it’s beneficial to compare it with previous cycles to identify patterns that may emerge. Historical data indicates that bear markets often follow extensive bull runs and can last for over a year, as evidenced in 2018 and the unprecedented decline witnessed in 2022. This comparison serves to highlight the cyclical nature of BTC price trends, encouraging investors to prepare for the potential length of the current downturn and the subsequent recovery phase expected in years to come.

By studying past bear market behaviors, analysts posit that Bitcoin has shown resilience and capacity for rebounding sharply once certain cyclical indicators align. Understanding the correlation between these past cycles and the current market can allow investors to develop better strategies, giving them a roadmap for navigating the present volatility. As the cryptocurrency landscape continuously evolves, recognizing how previous bear markets have affected BTC prices can provide insight into future forecasts and potential recovery timelines.

Bitcoin 2028 Prediction: Preparing for the Next Bull Cycle

The Bitcoin 2028 prediction has captured the attention of both enthusiasts and skeptics alike, primarily citing that it may take until this year for Bitcoin to break significant price barriers once again. Forecasts suggest that $93,500 may become the critical resistance level to watch for. This long-term perspective urges investors to remain patient and focused on Bitcoin’s fundamentals, rather than getting swayed by short-term market fluctuations and news. While these predictions can offer guidance, it’s crucial to approach them with caution, given the unpredictable nature of cryptocurrency.

Investors should also consider the wider implications of Bitcoin’s future trajectory, including technological advancements, adoption trends, and regulatory developments that could shape the market landscape by 2028. The Bitcoin community’s focus on development and innovation will undoubtedly play a role in stabilizing prices post-bear market. As we anticipate the next bull cycle, understanding the variables at play will be essential for preparing investment strategies that align with the anticipated bullish sentiment and trends heading into 2028.

Navigating Bitcoin’s Uncertain Future: Strategies for Investors

In light of the recent Bitcoin price drop and the prevailing bear market, developing effective investment strategies is more critical than ever. Investors must navigate through uncertainty not only by staying informed about market analysis but also by adopting prudent risk management techniques. This includes diversifying portfolios, setting stop-loss orders, and avoiding emotional trading decisions—practices that can mitigate losses during downturns. As the trends suggest potential for a drawn-out bear phase, these strategies are essential for safeguarding investments.

Furthermore, long-term holding (HODLing) might emerge as a favored strategy among seasoned investors, particularly with predictions projecting a recovery towards the tail end of the decade. Patience and resilience will be necessary as the market stabilizes, allowing investors to capitalize on future growth opportunities. Monitoring global economic factors, market sentiment, and technical indicators will prove valuable in crafting adaptive strategies that respond to the evolving landscape of Bitcoin and the larger cryptocurrency market.

Frequently Asked Questions

What caused the recent Bitcoin price drop of over $10,000?

The recent Bitcoin price drop of over $10,000 was driven by persistent selling pressure in the market, leading to a significant liquidation of $2.6 billion in crypto positions. This marked the first time Bitcoin experienced such a large daily decline.

How does the Bitcoin price drop relate to the bear market of 2023?

The Bitcoin price drop is a key indicator of the ongoing bear market of 2023. Analysts suggest that this significant liquidation is reminiscent of historical bear market events, indicating that the market is currently under severe pressure.

What predictions are being made about the Bitcoin price trends for the future?

Predictions regarding Bitcoin price trends indicate that a genuine rebound may not occur until 2028. Analyst Rekt Capital speculates that Bitcoin could surpass $93,500 only after going through a bear market and bottoming out in 2027.

What are the implications of the Bitcoin price drop on market analysis?

The implications of the Bitcoin price drop on market analysis highlight the increased volatility and potential for further declines. Analysts are emphasizing cautious approaches, while market participants should stay informed about ongoing trends and potential recovery timelines.

How does the Bitcoin market analysis predict the future performance of BTC prices?

Bitcoin market analysis suggests a slow recovery trajectory for BTC prices, with some forecasts indicating that substantial increases won’t be realized until 2028. Analysts are using historical data to assess Bitcoin’s price cycles and likely future performance.

What should investors consider during the Bitcoin bear market of 2023?

During the Bitcoin bear market of 2023, investors should be cautious and conduct thorough research before making investment decisions. The recent price drop shows the importance of understanding market dynamics and being prepared for a potentially extended downturn.

Could the Bitcoin future forecast be impacted by the recent price drop?

Yes, the recent Bitcoin price drop will likely impact future forecasts. Analysts may adjust their predictions based on market behavior observed during this bear market, including potential timelines for recovery and price milestones.

What historical patterns should we observe in BTC price trends following this drop?

Following the significant Bitcoin price drop, it’s essential to observe historical patterns in BTC price trends, as this can provide insights into potential future movements. Patterns from previous bear markets suggest recovery may take years, emphasizing the cyclical nature of Bitcoin’s performance.