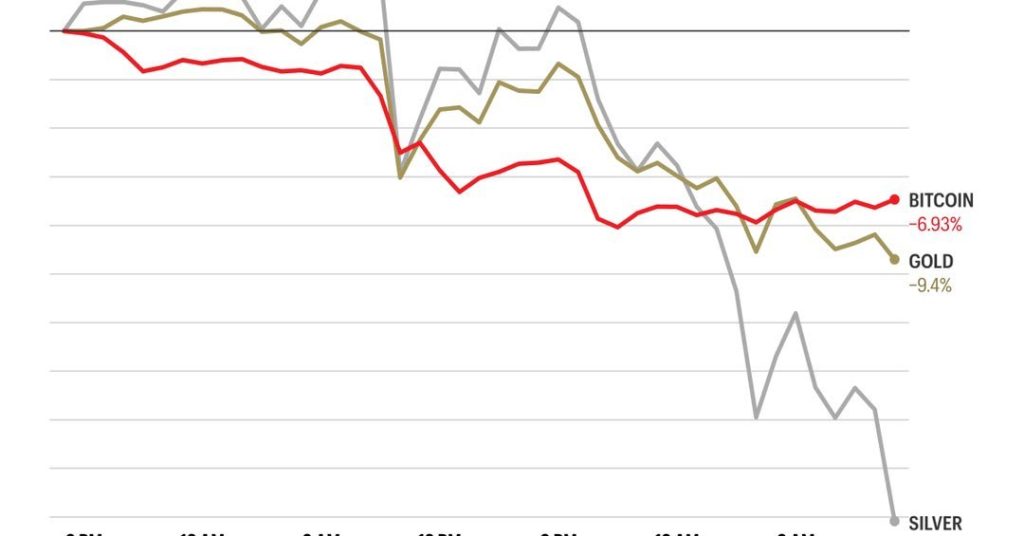

The recent Bitcoin price drop has sent shockwaves throughout the cryptocurrency community, as it tumbles to levels not seen since Donald Trump’s presidency. On February 3, 2026, Bitcoin experienced a sharp decline, falling approximately 8% and briefly dipping below $73,000 before making a slight recovery. This Bitcoin decline underscores the volatile nature of the crypto market, which has been further exacerbated by macroeconomic pressures and significant leverage effects. As traders reevaluate their Bitcoin trading strategies, critical Bitcoin support levels from past cycles are being tested anew, posing questions about the future direction of this digital asset. For enthusiasts and investors alike, understanding this downturn is essential in the context of broader crypto market analysis.

The recent downturn in Bitcoin’s value has sparked intense discussion among market analysts and investors alike, as the major cryptocurrency faces significant challenges. This situation highlights broader trends within the cryptocurrency sector, where financial pressures and shifts in investor sentiment can trigger pronounced price fluctuations. As Bitcoin’s market performance continues to be assessed, the implications of leverage adjustments and support point evaluations are rising in importance. Observing these dynamics provides valuable insights into potential trading strategies, especially in light of recent institutional movements and cautionary stances from key players in the market. Overall, comprehending the current Bitcoin landscape is crucial for those looking to navigate the complexities of crypto investments effectively.

| Key Point | Details |

|---|---|

| Bitcoin Price Drop | Bitcoin recently fell approximately 8%, hitting its lowest price since Trump’s presidency. |

| Forced Selling | CoinGlass reported $2.56 billion in forced selling contributing to the price decline. |

| Macro Factors | Concerns from Trump’s Fed chair nomination and broader risk-off sentiment affected Bitcoin and crypto markets. |

| Support Levels | Key support levels include $73,500 and a lower band around $73,581. |

| Market Conditions | Thin liquidity and inconsistent institutional flows have made the drop more severe. |

| Recovery vs Bounce | A single-day rebound does not indicate a sustainable recovery without confirming conditions. |

| Future Scenarios | Two potential scenarios depending on whether Bitcoin can hold key support levels or not. |

Summary

The recent Bitcoin price drop highlights significant vulnerabilities within the cryptocurrency market. As Bitcoin experienced a substantial decline, falling below $75,000, it highlighted deeper issues involving forced selling and a lack of consistent institutional support. Market sentiment remains fragile, driven by macroeconomic uncertainties and the unwinding of leverage. The road to recovery would require overcoming current resistance levels and reclaiming solid support, making the ongoing situation critical for traders and investors alike.

Understanding the Bitcoin Price Drop

Recently, Bitcoin experienced a significant price drop, falling approximately 8% on February 3, 2026, dropping below $73,000. This decline marks its lowest value during Donald Trump’s administration and reflects broader volatility within the crypto market. Such price fluctuations are a reminder of the inherent risks associated with cryptocurrency investments, which could be attributed to macroeconomic factors and rapidly changing market sentiments. Investors should closely monitor market trends and leverage impacts that may exacerbate these declines.

The sharp drop in Bitcoin’s price highlights critical support levels that traders have been observing, such as the $73,500 mark that encapsulated Bitcoin’s all-time high from March 2024. Understanding these support zones can help traders formulate strategies against further declines, especially in a bear market. The interplay of macroeconomic variables, including interest rate concerns and equity market performance, creates an unpredictable environment in which Bitcoin’s price could either stabilize or face further downturns.

Macro Risk Factors Influencing Bitcoin

The recent macroeconomic landscape has had a profound effect on Bitcoin and the broader cryptocurrency market. A significant risk-off sentiment was triggered by recent announcements related to Federal Reserve policies, particularly Trump’s nomination of Kevin Warsh as new chair. As concerns grew over a hawkish monetary policy and tightening financial conditions, investors retreated from high-volatility assets like Bitcoin. This shift exemplifies how external economic factors can significantly impact crypto valuations, often leading to dramatic sell-offs.

Additionally, fluctuations in the US dollar have traditionally influenced the crypto markets. In the face of tightening monetary policy signals, a stronger dollar can become a headwind for Bitcoin and its peers, intensifying downward pressure on prices. Furthermore, the connection between the performance of tech stocks and Bitcoin suggests that negative sentiment in one sector can spill over to the other, creating a vicious cycle of selling. Analyzing these macro factors gives traders a clearer view of potential Bitcoin trends and supports strategic trading decisions.

Leverage Effects on Bitcoin’s Volatility and Price Downturns

The recent downturn in Bitcoin prices can also be attributed to the adverse effects of leverage within the crypto trading community. Data from CoinGlass reveals a staggering $2.56 billion in forced liquidations, showcasing how leveraged positions can amplify market movements, particularly during volatile times. Initially driven by broader market trends, this forced selling quickly escalated as traders were caught in a negative feedback loop, further driving down Bitcoin’s price.

Utilizing leverage in Bitcoin trading can increase both potential gains and losses. In the current market scenario, traders were forced to liquidate positions as prices dipped below critical support levels, showcasing the destructive potential of over-leveraged trades. The ongoing unwinding of leverage, coupled with already thin liquidity, creates a precarious environment for traders. Understanding these leverage dynamics is essential for effective Bitcoin trading strategy and avoiding the pitfalls of excessive risk exposure.

Critical Support Levels and Market Monitoring

As Bitcoin’s price fluctuates, identifying critical support and resistance levels becomes imperative for traders and investors. The price has dipped below the $73,500 mark, initiating discussions on potential further declines towards the next cluster of support around $72,757 to $71,725. These levels are significant because they represent previous price points where traders have historically entered the market, indicating potential reversal points that should be closely monitored.

Crypto analysts emphasize the importance of maintaining awareness of these technical levels when devising trading strategies. For instance, a daily close below the identified support range could signal continued selling pressure and panic among investors. Conversely, if Bitcoin can reclaim and maintain support levels above $74,500, it might indicate a possible recovery phase. Thus, incorporating technical analysis into investment decisions is critical for navigating current market conditions.

Navigating the Bitcoin Recovery Landscape

As traders evaluate potential recovery scenarios for Bitcoin, it is essential to distinguish a reliable bounce from a more temporary dead-cat bounce. The evidence suggests that solid recoveries require not only price stability above certain support levels, such as $74,500 but also a noticeable decrease in liquidation pressures. If these conditions are met, the market could set the stage for sustained recovery efforts.

However, caution is warranted, as Bitcoin’s historical volatility indicates that short-lived rallies can quickly reverse. As such, investors should be prepared to act quickly should macroeconomic conditions worsen or liquidation pressures persist. This assessment illustrates the importance of a well-defined trading strategy that can adapt to rapidly changing market dynamics within the crypto space.

Institutional Sentiment and ETF Flows in the Crypto Market

The current conditions in the cryptocurrency market also reflect changing institutional sentiment, as evident through exchange-traded fund (ETF) flows. January 2026 witnessed net outflows from Bitcoin ETFs, highlighting a cautious approach among institutional investors. Such flows can be indicative of broader market attitudes and suggest a lack of confidence from larger players in the market, contributing to further selling pressure during price declines.

The observed behavior of institutional investors primarily revolves around tactical rebalancing rather than aggressive buying. These patterns illustrate the need for further development in institutional interest for Bitcoin, as robust demand is essential for establishing significant price support during downturns. Without a consistent influx of institutional capital, Bitcoin’s price remains vulnerable to broader market trends and negative sentiment across the cryptocurrency ecosystem.

Future Scenarios Following Bitcoin Price Decline

The potential outcomes for Bitcoin in the wake of its recent price decline hinge on its ability to maintain specific support levels and respond to macroeconomic shifts. Should Bitcoin stabilize around the $73,000 range and successfully breach the $74,500 resistance, it could position the price towards higher targets like $78,300 or even $80,000. This scenario would rely heavily on an absence of new macroeconomic headwinds and traders’ renewed confidence in the market.

Conversely, if Bitcoin closes below crucial support levels, it could plunge further into established downside targets around $72,757 to $71,725, raising significant concerns of breaching the $70,000 threshold. This potential triggering of continued liquidation pressure from leveraged positions may perpetuate a cycle of rapid declines. As such, keeping abreast of both technical indicators and macroeconomic developments is vital to formulating an effective Bitcoin trading strategy.

Utilizing Technical Analysis in Bitcoin Trading

As Bitcoin navigates through its current bearish trend, leveraging technical analysis becomes paramount for crypto traders. By meticulously charting price movements and applying various indicators—such as moving averages and Relative Strength Index (RSI)—traders can gain insights into potential price reversals or continuation patterns. Recognizing these patterns allows investors to better time their entries and exits, which is crucial during periods of high volatility.

Moreover, understanding past price behavior can aid traders in anticipating future movements. Historical data reinforces the importance of level testing, where previous support and resistance zones can inform actions amidst market uncertainty. Thus, embracing a robust technical analysis framework enhances the likelihood of formulating a successful Bitcoin trading strategy, even in turbulent market conditions.

The Impact of Market Sentiment on Bitcoin Performance

Market sentiment plays a crucial role in influencing Bitcoin performance. The prevailing emotional state of investors—whether fear or greed—can drive market trends, often leading to swift price changes. In light of recent price declines, sentiment appears largely negative, which may exacerbate ongoing selling pressures. Keeping a pulse on market sentiment through social media analytics and news reactions can provide valuable foresight into potential market movements.

Additionally, sentiment is often intertwined with external economic developments. Factors such as regulatory changes, technological advancements, or macroeconomic shifts affect how participants perceive Bitcoin’s value. As such, traders must remain agile, adjusting their strategies according to prevailing sentiment to mitigate risks associated with sudden downturns or upswings.

Frequently Asked Questions

What caused the recent Bitcoin price drop?

The recent Bitcoin price drop can be attributed to a combination of macroeconomic factors and leverage unwinding. A risk-off sentiment across markets, triggered by concerns over tighter financial conditions after Trump’s nomination of Kevin Warsh as Federal Reserve chair, increased volatility. Additionally, over $2.5 billion in forced liquidations exacerbated the decline, transforming initial selling pressure into a cascade of sell-offs.

How low did Bitcoin fall during the recent decline?

During the recent decline, Bitcoin briefly fell below the $73,000 mark, hitting its lowest price since President Trump’s administration. The decline pushed it down to around $72,945 before a minor rebound brought the price back to approximately $74,500.

What are the critical support levels for Bitcoin amid this drop?

Critical support levels for Bitcoin amid this recent price drop include the $73,500 level, which is linked to previous highs, and the intraday low of $72,945. A broader support band identified by IG Markets ranges from $73,581 to $76,703, which must hold to avoid further selling pressure.

How does Bitcoin’s leverage impact its price volatility?

Bitcoin’s leverage significantly impacts its price volatility, especially during downturns. As leverage unwinds, forced selling due to margin calls can amplify price declines considerably. In the recent situation, over $2.56 billion in Bitcoin liquidations contributed to a sharp drop, illustrating how leverage can turn minor market movements into significant losses.

What should traders consider when adjusting their Bitcoin trading strategy during a price drop?

Traders should consider key support levels, the effects of leverage unwinding, and macroeconomic conditions when adjusting their Bitcoin trading strategy during a price drop. Monitoring price movements around critical levels like $73,500 and being cautious of further liquidations are crucial for making informed trading decisions.

Is the recent Bitcoin price drop a sign of a market trend reversal?

While the recent Bitcoin price drop indicates vulnerability and testing of support levels, it is not necessarily a definitive sign of a market trend reversal. Traders need confirmation from sustained price recovery above critical resistance levels and an easing of liquidation pressure before drawing conclusions about market trends.