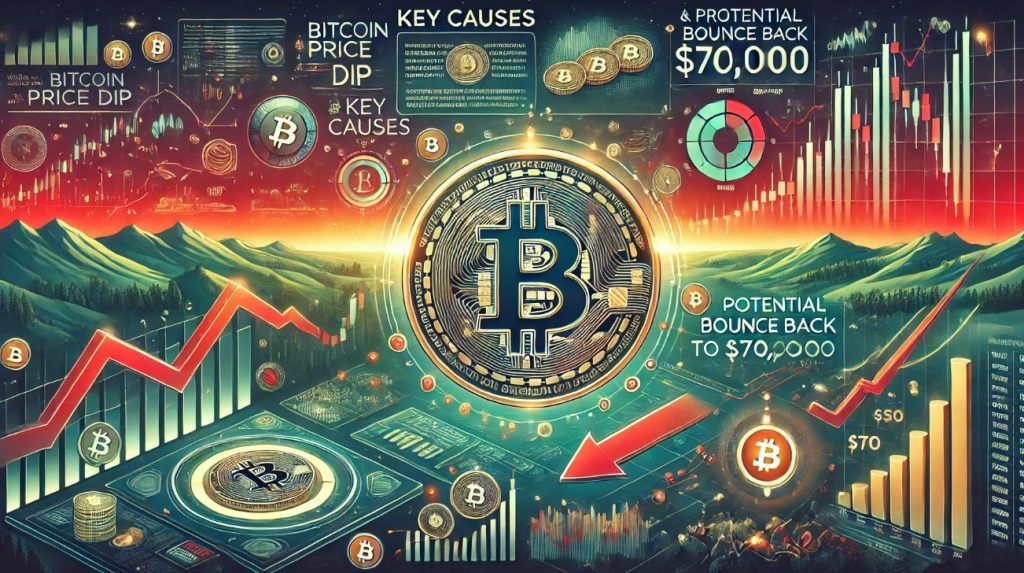

The recent Bitcoin price dip has stirred significant attention in the cryptocurrency market, marking a crucial moment for traders and investors alike. As Bitcoin’s value fell toward $60,000, a staggering $2.56 billion was lost in liquidity across crypto derivatives markets, highlighting the severity of this sell-off. This downturn can be attributed to various factors, including the outflows from Bitcoin exchange-traded funds (ETFs) and concerns over US monetary policy. The ripple effects of such volatility have drawn analysts to conduct extensive Bitcoin market analysis to understand the underlying causes of price fluctuations. The interplay between economic factors and investor sentiment is crucial in navigating these turbulent waters, especially given the growing scrutiny on cryptocurrencies during liquidation events.

In recent times, the cryptocurrency landscape has been characterized by notable fluctuations, with the price of Bitcoin experiencing a significant downturn. This dip has been influenced by widespread investor reactions to instability in the financial markets, as well as external factors such as liquidity issues and regulatory developments. As market participants interpret these signs, it becomes increasingly important to monitor ETF outflows and liquidation events, which can signal broader trends within the crypto sphere. The interplay of these elements not only drives the sentiments around Bitcoin but also impacts various blockchain projects and their potential for growth, such as the advancements seen with the Avalanche blockchain.

| Key Point | Detail |

|---|---|

| Bitcoin Price Dip | Bitcoin dipped to $60,074 after experiencing a massive liquidation event totaling $2.56 billion. |

| Market/liquidity concerns | Investor fears over US liquidity and interest rate changes led to a sell-off in the crypto markets. |

| ETF Outflows | Bitcoin ETFs saw outflows of $431 million over three days, contributing to market volatility. |

| Federal Reserve Nomination | Kevin Warsh’s nomination may signal a stabilization of market liquidity. |

| Other Market Events | Significant activity in blockchain investments and security breaches in DeFi protocols have influenced market dynamics. |

Summary

The recent Bitcoin price dip, which saw the cryptocurrency drop to around $60,000, reflects ongoing volatility in the crypto markets driven by significant liquidations and investor concerns about liquidity. As the market adjusts to shifting policy implications and institutional movements, this dip highlights the sensitive nature of Bitcoin’s pricing amidst broader economic factors.

Understanding the Recent Bitcoin Price Dip

Recently, Bitcoin experienced a significant price dip, dropping to around $60,000. This decline was prompted by a massive $2.56 billion in liquidations across crypto derivatives markets, marking one of the largest sell-off events in recent history. As traders faced increasing pressure to close leveraged positions, the cascading liquidations triggered a substantial downturn in Bitcoin’s market value, leading many investors to reassess their strategies amidst the volatile landscape.

The implications of this Bitcoin price dip extend beyond immediate losses for traders; the overall sentiment within the cryptocurrency market has been weighed down by external factors. The potential stabilization of US liquidity, following President Trump’s nomination of Kevin Warsh to the Federal Reserve, has raised concerns among investors. With Warsh’s background suggesting a conservative approach to monetary policy, the market’s appetite for risk could further diminish, impacting Bitcoin and other cryptocurrencies in the coming weeks.

Frequently Asked Questions

What caused the recent Bitcoin price dip?

The recent Bitcoin price dip can be attributed to a significant sell-off in the cryptocurrency market, spurred by investor concerns over US liquidity. After US President Donald Trump’s nomination of Kevin Warsh to lead the Federal Reserve, uncertainty regarding interest rates intensified, leading to a reaction in Bitcoin’s price. Additionally, liquidation events totaling $2.56 billion in the crypto derivatives market played a crucial role in driving down Bitcoin’s price.

How did Bitcoin ETF outflows contribute to the price dip?

Bitcoin ETF outflows significantly impacted the Bitcoin price dip. Over three consecutive days, approximately $431 million exited Bitcoin exchange-traded funds (ETFs), creating additional selling pressure. This trend, combined with the broader market sell-off, contributed to Bitcoin dipping to $60,074 before recovering slightly above $64,930.

What are crypto liquidation events and how do they relate to the Bitcoin price dip?

Crypto liquidation events refer to the forced closing of leveraged positions in the market due to falling prices. This week, the cryptocurrency market experienced its 10th-largest liquidation event, with over $2.56 billion liquidated. Such events can lead to rapid price declines as the liquidation of positions tends to amplify market movements, further contributing to the Bitcoin price dip.

What is the impact of the Bitcoin price dip on the overall cryptocurrency market?

The Bitcoin price dip has had a significant impact on the overall cryptocurrency market, with most major cryptocurrencies posting losses. As Bitcoin often influences the market, its downturn can trigger a broader sell-off, putting pressure on altcoins and leading to a loss of confidence among investors.

Can we expect further price volatility in Bitcoin after this dip?

Given the current economic climate and ongoing uncertainties around US liquidity and interest rates, further price volatility in Bitcoin is likely. Factors such as market sentiment, cryptocurrency ETF outflows, and upcoming regulatory changes could all contribute to future fluctuations in Bitcoin’s price.

How does the Avalanche blockchain growth relate to the Bitcoin price dip?

While Avalanche’s growth and developments like tokenization may seem disconnected from Bitcoin’s price dip, they highlight a broader trend in the cryptocurrency market. Institutions are increasingly exploring diverse blockchain platforms, which could influence overall market sentiment, potentially offsetting bearish trends in Bitcoin due to innovative projects and increasing adoption.

What strategies can investors consider following the Bitcoin price dip?

Following the Bitcoin price dip, investors may consider strategies such as dollar-cost averaging, which involves buying Bitcoin at regular intervals to mitigate the impact of volatility. Additionally, analyzing market fundamentals and diversifying investment portfolios into alternative cryptocurrencies or blockchain projects like Avalanche could help manage risk.

What does the Bitcoin price dip signal for future market trends?

The Bitcoin price dip signals potential shifts in market trends, including heightened volatility and cautious investor sentiment. As regulatory frameworks evolve and macroeconomic factors play a role, the cryptocurrency market may experience both risks and opportunities, necessitating close monitoring by investors.