The recent Bitcoin price crash has sent shockwaves through the crypto community, erasing an impressive 15 months of gains and plunging below the crucial $70,000 mark. This dramatic decline, driven by a staggering $840 million in liquidations, underscores the heightened volatility that the crypto market currently faces. As traders analyze the situation, all eyes are on the BTC support levels around $65,000, which could determine the next movement for Bitcoin. This unprecedented Bitcoin correction reveals a broader trend in the crypto market decline that is impacting altcoins as well. With market sentiment shaken, investors are now contemplating their next moves in the wake of this massive upheaval in Bitcoin prices.

In the wake of recent turmoil, the cryptocurrency landscape is grappling with a significant downturn characterized by the abrupt fall in Bitcoin values. Often referred to as a market correction, this particular event highlights the intertwined fates of assets within the crypto ecosystem. It raises questions about Bitcoin liquidation events that lead to cascading effects across exchanges, affecting overall stability. As the community assesses the implications of this decline, the focus shifts to BTC support levels and future crypto price forecasts which could guide investor decisions in this volatile environment. Understanding these dynamics is crucial for navigating the complexities of the current market decline.

| Key Point | Details |

|---|---|

| Bitcoin Price Decline | Bitcoin temporarily fell below $70,000, erasing 15 months of gains. |

| Liquidations | Over $840 million in leveraged long positions were liquidated during the crash. |

| Market Impact | Triggered a wider crypto market sell-off affecting major altcoins. |

| Support and Resistance Levels | Current support sits at $70,000; resistance is at $72,000. |

| Long-Term Trends | The market has seen significant Bitcoin outflows from exchanges, suggesting long-term holder confidence. |

Summary

The Bitcoin price crash has resulted in the cryptocurrency erasing 15 months of gains, prompting widespread concern among investors. This sudden drop below the $70,000 threshold, combined with massive liquidations in leveraged positions, has shaken market confidence and triggered a ripple effect across the crypto landscape. As traders navigate this turbulent period, watching key support levels becomes crucial for assessing the future price trajectory of Bitcoin.

Understanding the Recent Bitcoin Price Crash

The recent Bitcoin price crash has sent shockwaves through the cryptocurrency community, as BTC plummeted below the $70,000 mark, erasing a significant portion of its 15-month gains. This drastic decline reflects a broader trend in the crypto market, where traders are re-evaluating their positions amid heightened volatility. As Bitcoin trips below crucial support levels, concerns about potential liquidation events loom large, creating a climate of uncertainty for investors and traders alike.

Market analysts note that such a sharp correction is not uncommon, especially in an asset class as volatile as cryptocurrencies. This Bitcoin price crash highlights the risks involved, as liquidity conditions tighten, and leveraged positions become vulnerable. The cascading effect of liquidations during this downturn exemplifies the fragility of the current crypto market, leading many investors to reconsider their strategies and overall crypto price forecasts.

Bitcoin Liquidation and Its Impact on the Market

The wave of Bitcoin liquidations has significantly amplified the market’s downward momentum, leading to a challenging environment for traders who bet on rising prices. As BTC’s value dipped below key thresholds, many leveraged positions were automatically liquidated, resulting in over $840 million lost within a matter of hours. This phenomenon underscores how the interconnected nature of crypto derivatives can escalate a price decline, forcing some traders into unwelcome market positions amidst the chaotic sell-off.

These liquidations also disrupted normal trading dynamics, as the rapid price drops not only affected Bitcoin but also resonated across the entire crypto market. Altcoins felt the brunt of the impact, as they followed Bitcoin’s downturn closely, diminishing investor sentiment and furthering the perception of a market-wide correction. Understanding these liquidation triggers becomes essential for traders looking to navigate potential future corrections and develop effective risk mitigation strategies.

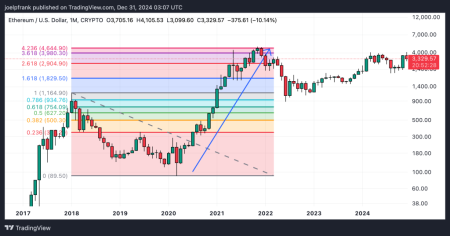

Market Corrections: Historical Context and Future Implications

Historical context reveals that Bitcoin corrections are common occurrences in the cryptocurrency space, often paving the way for future growth and stability. In this case, the recent drop has inadvertently returned Bitcoin to critical support levels that many analysts had anticipated. Some experts argue that such market corrections serve as a necessary mechanism, cleansing overleveraged positions and resetting the market’s trajectory. By fostering a healthier trading environment, these corrections may ultimately lead to stronger sustained growth in the long term.

Investors must remain vigilant and adaptive, as the implications of this correction could shape the near-term outlook for Bitcoin and the broader crypto market. The question remains whether Bitcoin can maintain its position above critical support levels, particularly around the $65,000 mark. If the currency re-establishes upward momentum and breaks cognitive barriers around $72,000, it may signal a return to risk appetite amongst investors. Overall, the blend of market history and current events will dictate Bitcoin’s immediate future trajectory.

Analyzing BTC Support and Resistance Levels

In the wake of Bitcoin’s recent price plunge, the focus has shifted to analyzing crucial support and resistance levels that could dictate its future movements. The $70,000 level now stands as an immediate support, and a breach below this threshold could invite bearish sentiment and further sell-offs. Observers are closely monitoring the $65,000 range, which aligns with previous consolidation points, as this area could potentially act as a strong defense for bullish traders looking to re-enter the market.

Conversely, if Bitcoin can reclaim its stance above the $72,000 mark, it may indicate the easing of selling pressure and generate renewed interest among investors. Resistance levels are pivotal in determining whether the cryptocurrency can mount a comeback or will remain in a downward trajectory. Traders must remain astute in the evolving dynamics, watching price fluctuations closely as the crypto market continues to journey through a challenging correction phase.

Crypto Market Decline: Broader Trends and Dynamics

The broader collapse in the crypto market signals an urgent need for introspection and strategic reassessment among traders. As Bitcoin and altcoins alike experience significant price declines, it’s essential to recognize the interconnectedness of various cryptocurrency trends. The market downturn is not merely a Bitcoin phenomenon but reflects underlying patterns across multiple digital assets, indicating a decline in overall investor confidence and appetite for risk within the space.

Crypto market decline can often be traced to factors including macroeconomic conditions, regulatory developments, and shifts in investor sentiment. The patterns observed in Bitcoin’s recent sell-off raise questions about the sustainability of previous bullish trends and highlight the necessity for individuals and institutions to adapt their approaches in navigating this evolving landscape. As the market continues to grapple with declines, staying informed about these broader trends will be critical for making sound investment decisions moving forward.

Future Projections: Bitcoin Price Forecast

With Bitcoin’s recent crash raising questions about its near-term trajectory, traders and analysts are formulating projections and price forecasts. Key levels such as $65,000 and $72,000 are vital benchmarks to monitor, as they could determine whether BTC can establish a recovery or succumb to further pressures. The potential for Bitcoin to rebound in a significant manner hinges on its ability to maintain key structural levels that provide confidence to investors.

Forecasting the price of Bitcoin involves considering both technical analysis and market sentiment. As buying activity fluctuates alongside the general market mood, the interplay between support levels and resistance could catalyze a resurgence or continue to dampen enthusiasm. Traders should also be aware of external influences, such as macroeconomic conditions and regulatory updates, which can affect the broader crypto price predictions and lead to unexpected market shifts.

Frequently Asked Questions

What caused the recent Bitcoin price crash?

The recent Bitcoin price crash was primarily caused by a significant wave of liquidations in leveraged long positions exceeding $840 million. As Bitcoin dipped below major support levels and psychological thresholds, automated liquidation mechanisms exacerbated the decline, turning a routine correction into a sharp downturn.

How has the Bitcoin price crash affected major support levels?

The Bitcoin price crash has dramatically impacted key support levels, with the critical psychological barrier of $70,000 being breached. Traders are now monitoring the next potential support at $65,000. If Bitcoin fails to hold this level, it may extend its decline towards $60,000.

What is the relationship between Bitcoin correction and crypto market decline?

The Bitcoin correction is indicative of a broader crypto market decline, as the recent sell-off has not only affected Bitcoin but also caused major altcoins to follow suit. This suggests that the market is undergoing a period of deleveraging, impacting overall sentiment across crypto assets.

What role did Bitcoin liquidations play in the recent price decline?

Bitcoin liquidations played a crucial role in the price decline, as the forced closure of overleveraged long positions triggered a cascade effect that intensified selling pressure. Many traders were caught off guard, leading to a sharp and rapid decrease in Bitcoin’s value.

How do current Bitcoin support levels influence crypto price forecasts?

Current Bitcoin support levels, particularly the $70,000 and $65,000 ranges, are critical for future crypto price forecasts. Traders are observing these levels closely to gauge Bitcoin’s recovery potential after the recent crash. Stability above these support zones may lead to positive price forecasts, whereas a break below could indicate further declines.

What could be the implications of Bitcoin’s price crash for future market trends?

The implications of Bitcoin’s price crash may include increased volatility and cautious trading behavior as market participants seek clarity on support levels. Additionally, the divergence between long-term holders, who are less panicked, and short-term traders may lead to evolving market dynamics in the coming weeks.

Are there any signs of recovery in Bitcoin following the price crash?

Signs of recovery in Bitcoin following the price crash could emerge if the price convincingly breaks above the resistance level of $72,000. Traders will be looking for sustained movement above this threshold as a positive indication that selling pressure is easing and market sentiment is improving.

What should traders look for in Bitcoin price movements after the crash?

Traders should focus on key price levels, especially the support at $65,000 and resistance at $72,000, while analyzing trade volumes and market trends. Observing the behavior of leveraged positions and overall market sentiment will be crucial in predicting Bitcoin’s short-term trajectory following the crash.

How do Bitcoin’s exchange outflows impact the market amid a price crash?

Bitcoin’s exchange outflows can significantly impact the market, especially during a price crash. Increased outflows, particularly from major exchanges like Binance, may indicate that long-term holders are withdrawing their Bitcoin from exchanges, suggesting confidence in future price appreciation and potentially stabilizing the market.

Will the market recover from the Bitcoin price crash soon?

While it’s uncertain when the market will recover from the Bitcoin price crash, traders are cautiously optimistic if Bitcoin can establish support at critical price levels. Close monitoring of trading patterns and broader market sentiment will be essential in determining the timing and sustainability of any recovery.