In this analysis of Bitcoin price trends, we dive into the latest developments surrounding BTC as it surges past $90,000, marking a near three-week high. Despite this impressive rise, recent market observations signal a cautious outlook among traders regarding future price movements. The Bitcoin futures market presents a subtle picture, where the current annualized premium remains at just 4%, hinting at a lack of overwhelming confidence. Furthermore, with over $900 million in net outflows from Bitcoin ETFs since mid-December, these Bitcoin market trends reflect a significant hesitance among investors, raising questions about sustainable gains. For those exploring BTC trading strategies, it’s crucial to interpret these signals and adapt to potential market shifts, keeping in mind BTC price predictions and their implications for long-term investment.

When inspecting the financial landscape of digital currencies, particularly the performance of the flagship cryptocurrency, Bitcoin, we uncover vital insights that shape investors’ decisions. The recent spike in BTC’s value showcases intriguing patterns that can be dissected through various lenses, including valuation forecasts and trading practices. As the cryptocurrency ecosystem evolves, understanding the dynamics of Bitcoin’s position and the factors influencing its market trajectory—including ETF inflows and futures trading—becomes essential. A comprehensive review of these elements will illuminate the ongoing shifts in market confidence and risk management techniques employed by seasoned investors. By synthesizing these insights, one can better navigate the complexities of the Bitcoin market and optimize their investment strategies accordingly.

Bitcoin Price Analysis: Current Trends and Market Sentiment

Bitcoin’s recent surge past the $90,000 mark marks a significant shift in the dynamics of BTC price analysis. This uptick, reaching a near three-week high, has stirred interest among traders and investors who closely monitor Bitcoin market trends. Despite hitting this psychological resistance level, there remains an undercurrent of caution among market participants. The data suggests that while some bullish sentiment is present, traders are wary of overextending their positions, indicated by the steady demand for leveraged long positions.

The current market sentiment can be encapsulated in the observed capital flow, particularly in the derivatives and spot ETF sectors. Specifically, the Bitcoin ETF flow reflects a concerning trend with over $900 million in net outflows since mid-December, which may indicate a lack of confidence in sustained price increases. Furthermore, with the Bitcoin futures market showing a basis below the neutral threshold and put options trading at a premium, many seasoned traders are opting to hedge against potential downturns rather than chase after inflated prices.

Bitcoin Market Trends: Understanding Recent Movements

The latest Bitcoin market trends reveal a complex interplay between price recovery and trader psychology. As BTC inches closer to previous highs, there’s a noticeable hesitation among investors, leading to a mixed sentiment in the market. The recent rebound in price has not been matched by a corresponding rise in investment in Bitcoin futures. The current premium of 4% in the futures market suggests that traders are skeptical about the sustainability of the rally, leading to a strategic focus on preserving capital during volatile periods.

This cautious approach is further emphasized by the performance of Bitcoin put options, which lately have been traded at a premium. Such demand indicates that traders are increasingly prioritizing downside risk protection amidst uncertainty. As many analysts delve into BTC price prediction, they urge caution, advising investors to watch how external factors like regulatory news and macroeconomic conditions could influence market trajectories in the near term.

Strategies for Trading Bitcoin: Navigating Market Risks

In the context of Bitcoin’s current price action, developing effective BTC trading strategies is more vital than ever. Market volatility often presents both risks and opportunities, compelling traders to adapt their approaches quickly. Successful traders typically emphasize a balanced mix of technical analysis and sentiment monitoring. By employing methods such as stop-loss orders and position sizing tailored to their risk tolerance, traders can protect themselves against adverse market movements while positioning themselves to capitalize on potential gains.

Additionally, an understanding of the Bitcoin futures market is crucial for constructing robust trading strategies. Given the flow of Bitcoin ETF and the latest sentiment within futures trading, market participants are encouraged to incorporate a strategy that takes into account the unique characteristics of leveraged trading. This might include deploying strategies that exploit arbitrage opportunities between spot and futures prices, thereby enabling traders to maximize their performance regardless of short-term fluctuations.

Impact of Bitcoin ETF Flow on Market Dynamics

The influence of Bitcoin ETF flow on market dynamics is becoming increasingly evident as recent trends highlight significant net outflows. The outflow of over $900 million from Bitcoin spot ETFs since mid-December raises questions about institutional confidence in Bitcoin’s long-term value proposition. These dynamics can create pressure on BTC prices, especially if institutional players continue to withdraw support. As a result, market watchers are closely observing how this could impact future trading volumes and overall liquidity.

Moreover, the flow of Bitcoin ETFs may also correlate with the demand seen in the futures market. If larger investors retreat from ETFs, they might seek other avenues for exposure, such as futures contracts. This shift could lead to an adjustment in how BTC trading strategies are formulated going forward. Understanding these correlations will be essential for traders looking to navigate the evolving cryptocurrency landscape efficiently.

Bitcoin Futures Market: Current Insights and Predictions

The Bitcoin futures market is currently at a pivotal junction, highlighted by a premium just below the neutral threshold. This situation reflects a market grappling with uncertainty, where traders are keenly aware of potential price fluctuations. Observations from recent futures trades indicate a broader apprehension concerning the future trajectory of Bitcoin prices, making it imperative for participants to remain informed about shifting market conditions.

As predictions about BTC’s performance evolve, market participants are encouraged to analyze indicators such as open interest and volume trends in the futures market. These metrics provide insights into how confidently traders are engaging with Bitcoin amidst ongoing volatility. By maintaining an adaptable posture based on market insights, traders can better position themselves to navigate shifts in momentum, whether they are bullish or bearish.

Caution in Bitcoin Trading: Protecting Yourself from Market Volatility

The recent behavior in the Bitcoin market serves as a sobering reminder of the volatility that characterizes cryptocurrencies. With traders facing both significant price surges and corresponding uncertainty, cautious trading becomes the name of the game. Implementing protective measures such as setting stop-loss orders and diversifying portfolios can help mitigate risks amid sharp price movements, ultimately safeguarding capital.

It’s essential for both novice and experienced traders to develop an understanding of market signals that indicate potential reversals. Data surrounding leveraged long positions and the overall sentiment can provide clues for adjusting trading strategies. For instance, with the current market landscape influenced by substantial BTC movements, traders might consider staying informed about macroeconomic trends that historically correlate with price declines or recoveries.

Navigating the Professional Trading Landscape of Bitcoin

Professional traders are increasingly adapting their strategies to navigate the complex Bitcoin trading landscape, positioned between caution and opportunity. The real-time data analysis and research underpinning professional trading strategies allow for decisive actions that can capitalize on short-term gains while managing risk exposure. For such traders, the fluctuations resulting from Bitcoin’s price movements are not just challenges but opportunities to refine their methods.

Moreover, the willingness to utilize tools like options trading for hedging against risks has become a staple in the toolkit of many professional Bitcoin traders. The increase in demand for downside protection points to a heightened awareness towards market stability. As new strategies emerge to leverage the volatility, understanding the nuances within BTC trading becomes essential, marking the differentiator between novice and professional engagement in the cryptocurrency sector.

The Future of Bitcoin: Speculating on Market Developments

Looking ahead, speculating on the future of Bitcoin necessitates an understanding of both historical and current market developments. Traders remain divided on whether the recent price uptick signifies the beginning of a new bullish cycle or a temporary rebound. Analysts who specialize in BTC price prediction often weigh various factors—from macroeconomic trends to technological advancements—as these elements could drastically impact Bitcoin’s value moving forward.

Furthermore, the evolution of Bitcoin ETFs and the interplay with market sentiment will be crucial to watch. As regulatory frameworks become clearer and institutional adoption continues to evolve, traders will need to adapt their strategies in response to these dynamics. Some market observers maintain an optimistic outlook, believing that increased mainstream acceptance of Bitcoin could catalyze substantial growth, while others advocate for a cautious approach given the inherent volatility of cryptocurrencies.

Learning from Historical Bitcoin Price Movements and Trends

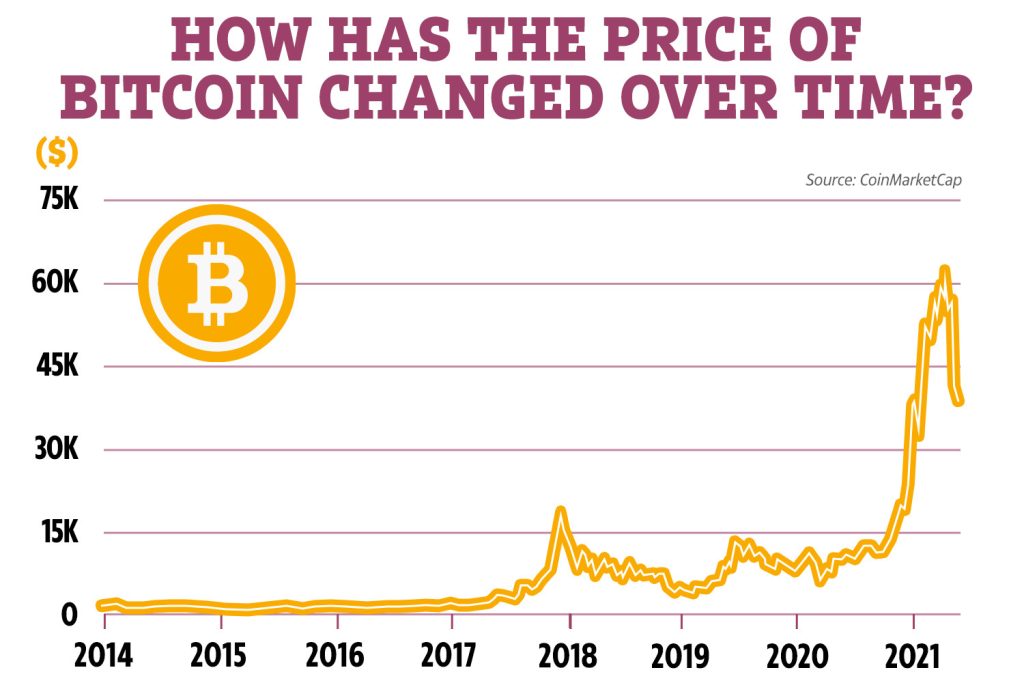

Historical Bitcoin price movements provide invaluable lessons for current and prospective investors. Analysis of previous bull and bear cycles allows traders to identify patterns that can be beneficial for making informed decisions. Learning from historical reactions to market triggers—such as regulatory announcements or macroeconomic changes—can shape contemporary BTC trading strategies, allowing participants to better predict potential outcomes.

Moreover, understanding how past market trends influence current investor behavior plays a pivotal role in shaping future predictions. By interpreting historical data alongside recent market conditions, traders can discover insights that inform long-term strategies, enabling them to navigate potential fluctuations in the Bitcoin landscape. This holistic approach is integral for those seeking to thrive within the evolving ecosystem of cryptocurrencies.

Frequently Asked Questions

What are the current trends in Bitcoin price analysis for January 2026?

As of January 3, 2026, Bitcoin’s price has surpassed $90,000, marking a near three-week high. However, Bitcoin price analysis indicates limited market confidence in further upward movement, as evidenced by cautious capital flow in derivatives and spot ETFs. Despite this rebound, demand for leveraged long positions remains steady, reflecting a mixed sentiment among traders.

How do Bitcoin market trends affect BTC price predictions?

Bitcoin market trends play a crucial role in shaping BTC price predictions. Currently, the trends indicate that, although Bitcoin has achieved short-term gains above $90,000, the overall market confidence for continued growth is faltering due to significant net outflows from Bitcoin spot ETFs, totaling over $900 million since December 15. This scenario suggests analysts may predict a more stabilized or cautious price outlook in the near future.

What impact does Bitcoin ETF flow have on Bitcoin price analysis?

Bitcoin ETF flow significantly impacts Bitcoin price analysis as it reflects investor sentiment and market demand. Recent data shows over $900 million in net outflows from Bitcoin spot ETFs, suggesting a lack of confidence in sustained price hikes. This cautious stance among investors tends to dampen bullish sentiment and influences price volatility, making BTC price analysis critical for understanding potential short-term movements.

How does the Bitcoin futures market shape BTC trading strategies?

The Bitcoin futures market affects BTC trading strategies by providing insights into trader sentiment and market expectations. Currently, the Bitcoin futures basis is below the neutral threshold, with an annualized premium of 4%. This indicates a preference for short trading strategies among some traders, while others may opt for long positions based on current price rebounds. Analyzing the futures market is essential for developing effective BTC trading strategies.

What does the demand for Bitcoin put options signal in terms of price analysis?

The demand for Bitcoin put options serves as an important indicator in price analysis. Recently, put options traded at a premium, suggesting that professional traders are actively seeking downside risk protection due to uncertainties in the market. This behavior typically reflects a cautious outlook on BTC price trends, indicating that while there may be short-term rallies, long-term confidence may be lacking.

| Key Point | Details |

|---|---|

| Current Bitcoin Price | Above $90,000, approaching a three-week high. |

| Market Confidence | Limited confidence in further price increases as indicated by capital flow in derivatives and ETFs. |

| Demand for Long Positions | Demand for leveraged long positions remains steady despite price rebound. |

| Futures Basis | Bitcoin futures basis is below the neutral threshold, with an annualized premium at 4%. |

| ETF Outflows | Spot ETFs have recorded over $900 million in net outflows since December 15. |

| Put Options Demand | Put options trading at a premium indicates increased demand for downside risk protection. |

Summary

Bitcoin price analysis indicates that while Bitcoin has surpassed $90,000, the overall market sentiment suggests caution among traders. The observed limited confidence in further price growth is reflected in capital flows and trading behaviors. Despite the bullish price movement, substantial net outflows from Bitcoin spot ETFs and a steady demand for downside protection via put options highlight a conflicted market perspective. As traders navigate through this complex landscape, it will be essential to monitor these trends for deeper insights into Bitcoin’s future performance.