Bitcoin order books play a crucial role in the cryptocurrency trading landscape by revealing the intricate balance of market dynamics at play. Recent analyses highlight how these order books expose the “wild” mechanics that have been suppressing Bitcoin’s rallies, unveiling a market scenario where heavy sell-side liquidity dominates. Investors seeking insight into Bitcoin market analysis can observe the thick layers of order book pressure that are actively neutralizing volatility and squeezing traders into a tight range. With buy-side support becoming more selective, Bitcoin’s price movement appears tame, lacking any significant upward momentum. As sell-side liquidity continues to cap rallies, understanding Bitcoin order books becomes essential for navigating the current cryptocurrency trading trends effectively.

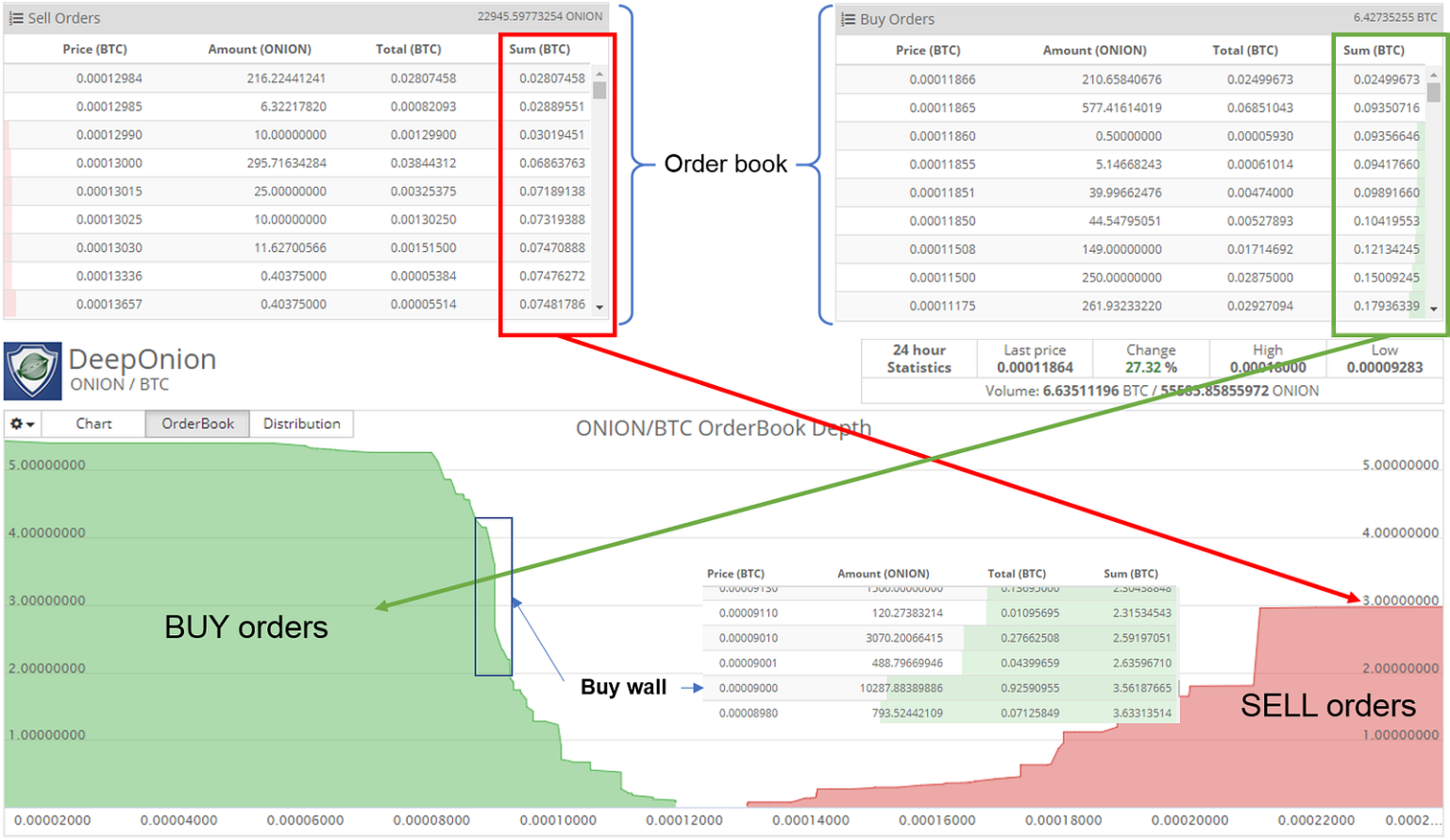

In essence, Bitcoin order books can be seen as the comprehensive ledger detailing the buy and sell transactions that underpin the market’s movements. These dynamic tools display the standing orders for Bitcoin, allowing traders to gauge the pressure from both buyers and sellers. Analysts focus on elements like order book pressure and liquidity layers to discern trading patterns and market sentiment. The balance between buy and sell sides provides critical insights into the current liquidity situation, offering fresh perspectives on how these factors influence price stability. By assessing the depth of order books, traders can better anticipate the potential fluctuations in the cryptocurrency market.

Understanding Bitcoin Order Books and Their Impact on Price Movement

Bitcoin order books play a crucial role in the cryptocurrency market, serving as a real-time display of buy and sell orders. They provide insight into where significant liquidity exists, showcasing the intentions of traders who are poised to enter or exit positions. By analyzing order book data, traders can gauge market sentiment and identify zones of support and resistance. Recent observations indicate that substantial sell-side liquidity has entrenched itself just above current Bitcoin levels, creating an environment where price movements are restrained. This layered sell pressure effectively neutralizes bullish momentum, suggesting that any rallies will face significant barriers before gaining traction.

Additionally, understanding the dynamics of buy and sell orders in the order book can inform trading strategies. For instance, robust buy-side support near lower price levels can indicate that traders anticipate a bounce, thereby absorbing selling pressure. However, the equilibrium created by both buy and sell orders can also signal a lack of conviction in the market, resulting in a sideways price action. As Bitcoin sits within this tightly controlled range, traders may need to exercise patience, recognizing that until a clear breakout occurs, volatility is likely to remain muted.

The Pressure of Sell-Side Liquidity in the Bitcoin Market

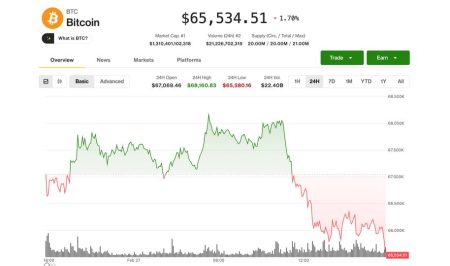

Sell-side liquidity has been a defining characteristic in the Bitcoin market’s recent performance. Thick layers of sell orders positioned above the current price not only create resistance but also instill a sense of caution among traders. The persistent presence of these orders indicates a lack of urgency on the part of sellers to push the market higher, instead opting to safeguard their positions. As Bitcoin’s price hovers in the high $80,000s, the dominance of sell-side liquidity becomes evident, effectively stifling any attempts at significant upward movement. This phenomenon illustrates how the pressure exerted by sellers can shape market dynamics, forcing buyers to either adapt their strategies or risk getting caught in a detrimental price range.

Moreover, the sell-side pressure has implications for overall market confidence. As traders witness repeated failures to break through resistance levels, it can breed despair and caution in the bullish sentiment. The inability of Bitcoin to rally sustainably serves as a reminder of the influential forces at play within the market. Consequently, this environment has led to a tempered trading approach, where volatility is supplanted by a more cautious sentiment. As sellers maintain their defenses, they continue to dictate the market’s short-term movement, emphasizing the importance of understanding order book structures in assessing future price trajectories.

Buy-Side Support: A Vital Element in Bitcoin’s Stability

In the face of overwhelming sell-side liquidity, the persistence of buy-side support is a beacon for Bitcoin’s stability. The recent analysis indicates that while sellers dominate the order book, buyers have not entirely retreated; instead, they have strategically positioned themselves at lower price levels to cushion potential downturns. This presence plays a critical role in absorbing selling pressure and preventing sharp declines in price. The strategic placement of buy orders reflects buyers’ commitment to the market, showing an intent to accumulate Bitcoin even amid challenging trading conditions.

Furthermore, buy-side support acts as a psychological anchor for traders. The existence of dense buy orders generates a sense of confidence among market participants, as it suggests that there is a robust demand willing to step in during price dips. This incentivizes traders to adopt a more risk-averse approach, often leading them to reconsider short positions or aggressive selling strategies. As a result, the interplay between buy-side support and sell-side resistance will continue to define Bitcoin’s price action, establishing a range-bound market where both sides are merely waiting for a significant catalyst to prompt decisive movement.

Current State of Bitcoin Trading Trends

The current state of Bitcoin trading trends is characterized by a noticeable lack of momentum, largely due to the intricate dynamics present within the order book. Recent data reveals that Bitcoin has been trapped in a narrow trading range, primarily dictated by the opposing forces of buy and sell orders. This precarious balance has led to subdued volatility, making it challenging for traders to establish directional positions. Instead of experiencing explosive rallies, market participants have found themselves caught in a repetitive cycle of minor fluctuations, reflecting the underlying order book pressures at play.

Traders and analysts alike are closely monitoring these conditions to anticipate potential shifts in market sentiment. With both sellers and buyers seemingly hesitant to commit to larger moves, the trend has leaned towards caution rather than aggression. This is indicative of a broader market sentiment that values measured tactics over impulsive behaviors. As the Bitcoin landscape evolves, traders must be adaptable, employing strategies that account for the current trading trends while remaining vigilant for signs of volatility that could disrupt the existing equilibrium.

Navigating Bitcoin’s Controlled Market Environment

Navigating Bitcoin’s controlled market environment requires an adept understanding of the forces shaping price movement. The recent observations of thick sell-side liquidity reveal a marketplace where uncertainty reigns. With sellers keen to maintain their positions and reluctant to support further upward movement, traders must exercise caution. This is a market where aggressive trading may lead to losses, as breakouts often falter against the stacked sell orders overhead. As such, successfully navigating this landscape revolves around a measured approach, prioritizing the analysis of order books to inform trading decisions.

Moreover, cultivating a comprehensive strategy entails recognizing when to step back rather than force a trade. The sideways movement of Bitcoin suggests that now is the time for traders to wait patiently, observing how the market evolves before committing capital. With the order book acting as a valuable tool for detecting shifts in order flow, those willing to bide their time may find opportunities emerge as the sell-side pressure begins to relent. Ultimately, understanding and respecting the controlled nature of Bitcoin’s market will be crucial for sustained success in cryptocurrency trading.

Signs of Market Maker Control in Bitcoin Pricing

Market maker control in Bitcoin pricing can be observed through the structured formation of liquidity around key price levels. Recent analysis highlights that order book pressure reflects a tentative balance where trades are neither aggressively supported nor resisted. This signaling, often unnoticed by the casual observer, is indicative of sophisticated market-making strategies aimed at stabilizing prices while managing risk. With sell walls overhead and buy support below, market makers effectively control the oscillation of Bitcoin’s price, ensuring that volatility remains contained.

The implications of this controlled pricing environment are profound for traders. Understanding how market makers influence price movements is essential for formulating effective trading strategies. Traders must remain cognizant of the potential for rapid price changes, particularly when liquidity shifts occur. In essence, the ability to read and interpret order book developments provides traders with a critical edge, allowing them to anticipate market movements and adjust their positions accordingly. Recognizing signs of market maker control can empower traders to make informed decisions, particularly in an increasingly volatile trading landscape.

The Importance of Patience in Bitcoin Trading

In the context of Bitcoin trading, patience is not just a virtue; it is a necessity. As the market remains ensnared in its tightly wound structure, characterized by competing buy and sell orders in the order book, the prevailing sentiment favors a cautious approach. Traders who act impulsively may find themselves on the wrong side of market moves, especially in environments dominated by order book pressure. Maintaining a disciplined mindset today can yield fruitful trades in the future when clearer opportunities arise.

Furthermore, the slow grind of Bitcoin’s price action serves as a learning experience for traders. Observing how resistance and support interact within the order book can provide valuable insights into market psychology. It is through patience that traders develop a deeper understanding of market dynamics, empowering them to identify potential breakouts or breakdowns when they occur. In a world where instant gratification is often sought, Bitcoin trading demands a nuanced approach that values strategic observation over hastily executed transactions.

The Role of Catalysts in Shifting Bitcoin Market Dynamics

Catalysts play a pivotal role in shifting market dynamics, especially in a controlled environment like Bitcoin’s current state. The underlying order book pressure suggests that prices are poised for movement, but without an external catalyst, the status quo is likely to persist. Catalysts can vary from regulatory announcements and macroeconomic news to technological advancements and shifts in trading sentiment. When these events occur, they can disrupt the existing balance between buy and sell orders, creating opportunities for traders who are prepared to act.

Recognizing the potential for catalysts in the cryptocurrency market is an essential part of trading strategy. Traders must remain vigilant, observing the broader landscape for developments that could prompt a change in order book dynamics. By positioning themselves to respond quickly to these events, traders can capitalize on sudden volatility or breakouts that may arise. Ultimately, understanding the role of external catalysts in shaping market behaviors can empower traders to navigate Bitcoin’s intricate ecosystem more effectively.

Frequently Asked Questions

What are Bitcoin order books and how do they impact trading?

Bitcoin order books are digital lists displaying buy and sell orders for Bitcoin on exchanges, influencing trading by revealing sell-side liquidity and buy-side support. Traders analyze these order books to assess pressure and potential price movements.

How does order book pressure affect Bitcoin market analysis?

Order book pressure is crucial in Bitcoin market analysis as it indicates where substantial buy-side support or sell-side liquidity exists. Analyzing this pressure helps traders predict potential price movements and spot trends in cryptocurrency trading.

What role does sell-side liquidity play in Bitcoin trading trends?

Sell-side liquidity represents the volume of Bitcoin available for sale at varying prices. It impacts trading trends by creating resistance levels; thick sell-side liquidity can halt upward momentum and stabilize prices within a narrow range.

Why is understanding buy-side support important for Bitcoin order books?

Understanding buy-side support is key when analyzing Bitcoin order books, as it signifies demand beneath the current price. Strong buy support can absorb price dips, preventing further declines and indicating a potential price floor.

What does it mean when Bitcoin experiences both buy-side support and sell-side pressure?

When Bitcoin exhibits both buy-side support and sell-side pressure, it reflects a balanced market where prices stabilize. This setup can result in prolonged price ranges, as buyers and sellers compete for control without triggering a breakout.

How can traders use cryptocurrency trading trends to navigate Bitcoin order books?

Traders can navigate Bitcoin order books by observing cryptocurrency trading trends and the relationship between order book pressure, which helps them make informed decisions about entering or exiting trades based on market dynamics.

What indicators suggest market maker control in Bitcoin order books?

Indicators of market maker control in Bitcoin order books include the presence of thick layers of sell-side liquidity above the market and buy orders that consistently provide support below, indicating professional management of price action.

Why do Bitcoin price movements often stall or bounce within narrow ranges?

Bitcoin price movements can stall or bounce within narrow ranges due to the balanced order book pressure from sell-side liquidity and buy-side support, which creates resistance and cushioning effects that limit volatility.

What is the significance of trader hesitation observed in Bitcoin order books?

Trader hesitation in Bitcoin order books, indicated by fluctuating liquidity near the price, suggests uncertainty and a lack of conviction for either buying or selling, which can prolong sideways price action.

How do Bitcoin order books reflect market sentiment during calm periods?

During calm periods, Bitcoin order books reveal market sentiment by showing where buy and sell orders are placed. Lower volatility accompanied by a balanced book suggests professional handling, absorbing pressure without drastic price changes.

| Key Point | Details |

|---|---|

| Market Conditions | Bitcoin’s price hovers in the high $80,000s, indicating a lack of drastic market movement. |

| Order Book Analysis | Sell-side liquidity is thick above Bitcoin’s price, while buy-side support is strengthening but cautious. |

| Price Patterns | Resistance levels are consistently tested but hold, while a cushion of buy orders absorbs dips. |

| Market Dynamics | Order book pressure indicates professional market makers controlling liquidity rather than speculative trading. |

| Trading Strategy | Traders should exercise patience; breakouts meet resistance and pullbacks find support in the current range. |

| Long-Term View | Bitcoin’s order book shows no panic; professional management suggests stability until a significant catalyst occurs. |

Summary

Bitcoin order books indicate a tightly controlled market, reflecting the complex dynamics at play. As sell-side liquidity caps potential rallies and buy-side support cushions price drops, traders find themselves in a consolidated range rather than experiencing clear moves. The careful orchestration by market makers demonstrates that while Bitcoin appears stable, significant underlying forces are at work, keeping the price steady and awaiting a potential shift.

Related: More from Bitcoin News | BTC Price Revisits Historic Low: Crypto Daybook Americas in Bitcoin | BTC, ETH, SOL Drop; DECR, AI Tokens Surge in Bitcoin