The Bitcoin mining profit cycle is currently facing unprecedented challenges, as highlighted by recent reports indicating that the industry is experiencing its worst profit contraction in 15 years. With hash rate prices declining to around $35 per petahash per second, many Bitcoin mining companies find it difficult to maintain profitability amidst such unfavorable market conditions. Furthermore, the payback period for new mining machines has dramatically increased to over 1000 days, exacerbating concerns as we approach the next Bitcoin halving event. As profits dwindle, major players in the sector, including CleanSpark and Riot, are taking significant steps to deleverage, resulting in a notable decline in mining stocks. This alarming trend raises important questions about the future of cryptocurrency mining and the sustainability of Bitcoin mining profits in today’s volatile environment.

The dynamics of cryptocurrency mining are in a state of flux, particularly with respect to Bitcoin extraction and profits. This sector, often referred to as the Bitcoin mining industry, is grappling with intense economic pressures as companies experience a significant downturn in revenue. The operational hurdles that these mining companies face, including soaring costs and an elongated return on investment for new equipment, are becoming increasingly evident. Moreover, the imminent Bitcoin halving effect is anticipated to further influence mining profitability, compelling operators to reevaluate their business strategies. As mining stocks decline and the market remains in turmoil, understanding this profit cycle has never been more crucial for stakeholders.

The Current Bitcoin Mining Profit Cycle

The Bitcoin mining profit cycle is undergoing unprecedented challenges, described by many in the industry as the “worst profit cycle in history.” With a significant drop in hash rate pricing to approximately $35 per petahash per second (PH/s), miners are struggling to maintain profitability. This decline can largely be attributed to rising energy costs and increasing competition among mining operations. As the market pushes towards sustainability, many mining companies are facing stark realities in their operations and financial viability.

The extended payback period for new mining equipment, now exceeding 1000 days, further complicates the situation. Miners are required to consider their capital investments carefully, especially with the looming Bitcoin halving in 2025, which could further impact future profit margins. As the industry copes with these economic pressures, many companies are forced into strategic pivots, including debt repayments and operational restructurings, to adapt to the changing market dynamics.

Impact of Bitcoin Halving on Mining Profits

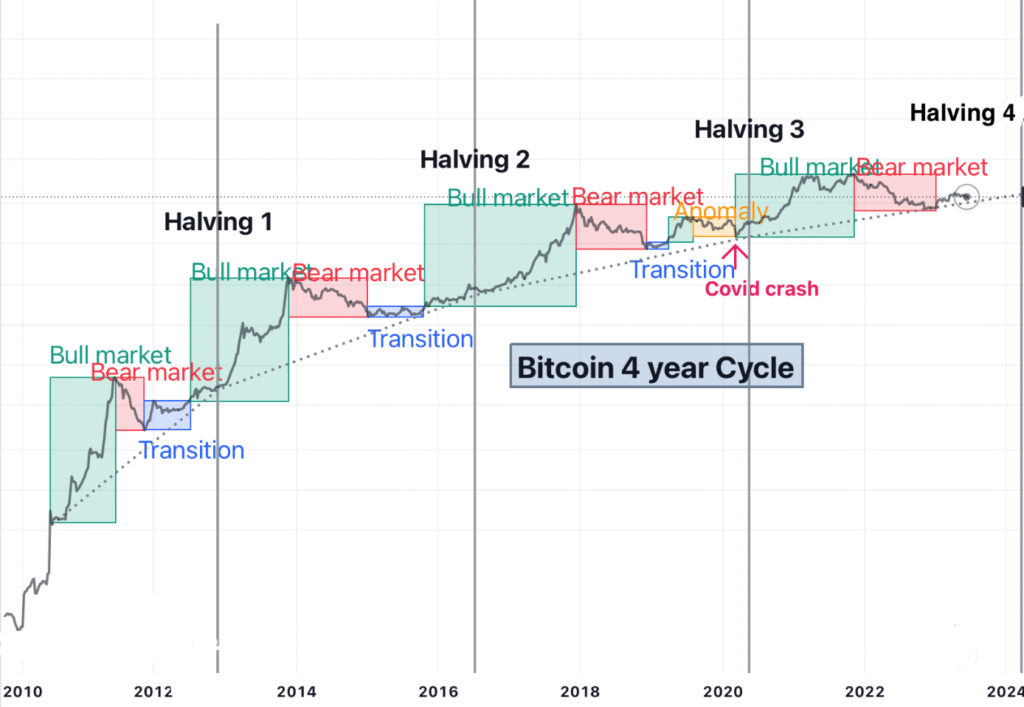

The upcoming Bitcoin halving is a pivotal event that historically influences mining profits significantly. Occurring every four years, this event reduces the reward for mining a block by half, which directly impacts miners’ revenues. As the payback periods lengthen, the halving adds an additional layer of uncertainty for Bitcoin mining companies, who must navigate these cycles while maximizing their operational efficiency. Miners are beginning to reassess their cost structures and operational strategies in anticipation of the changes that halving will bring.

Historically, Bitcoin halvings have been associated with market price rallies, which could offset some of the immediate profit pressures miners face today. However, as profits have already contracted sharply, the extent to which miners can benefit from price increases post-halving remains uncertain. This situation places added stress on Bitcoin mining companies, further exacerbating the trend of declining mining stocks as they navigate both operational and market volatility.

Challenges Facing Cryptocurrency Mining Operations

The challenges confronting cryptocurrency mining operations today extend beyond mere profitability. With the Bitcoin network experiencing record hash rates, competition among miners has intensified, making it increasingly difficult for operations to remain lucrative. Factors such as energy costs, regulatory landscapes, and environmental concerns have set the stage for a challenging operational environment, resulting in a significant number of mining companies adopting a more conservative approach to expansion and investment.

Additionally, the increasing complexity of mining technologies places further strain on smaller mining operations. Companies that once thrived amidst favorable market conditions now find themselves struggling with outdated equipment as larger operations invest in more advanced technologies. This disparity between established mining giants and smaller newcomers is widening, creating a landscape where only the most efficient miners may survive in the long run.

Strategic Responses from Bitcoin Mining Companies

In light of the current profit crisis, Bitcoin mining companies are deploying a variety of strategic responses to ensure their longevity in a volatile market. Many organizations are prioritizing debt reduction, as evidenced by CleanSpark’s recent full repayment of its Bitcoin collateralized credit line. This move exemplifies a trend toward deleveraging, with firms looking to stabilize their balance sheets and reduce financial risks amid declining Bitcoin prices and mining profitability.

Moreover, companies are embracing innovation and technological advancements as part of their response mechanisms. By optimizing their operations and exploring renewable energy sources, miners aim to mitigate spiraling energy costs. This shift not only addresses immediate profitability challenges but also aligns with growing environmental concerns in the industry, enhancing their reputations and positioning them better for future market recovery.

The Role of Mining Stocks in the Cryptocurrency Market

The decline of mining stocks is a critical aspect of the current challenges faced by Bitcoin miners. Companies such as Marathon Digital Holdings (MARA), CleanSpark, Riot Blockchain, and HIVE have seen their stock prices plummet by 32% to 54% since mid-October. This downturn highlights the vulnerability of mining operations to broader market sentiments and underscores the need for companies to demonstrate resilience and adaptability to investors in such turbulent times.

Investor confidence in mining stocks often mirrors the health of the Bitcoin market and the profitability of mining efforts. As supply pressures and uncertainty increase, potential investors may hesitate to commit capital to mining companies, further exacerbating the cycle of decline. Hence, improving operational performance and transparency is vital for mining firms to attract investments and navigate through the bleak profit waters they are currently facing.

Examining the Future of Bitcoin Mining

The future of Bitcoin mining is shrouded in uncertainty, yet ripe with potential opportunities for those willing to innovate. As the market adapts to the realities of lower profits and intense competition, there may emerge new business models and technologies that enable miners to operate profitably. The historical cyclicality of Bitcoin prices suggests that the current downturn may be temporary, giving rise to a possible resurgence in mining profits as conditions align in favor of the sector.

Additionally, advancements in technology and efficiency measures could transform the mining landscape significantly. By harnessing artificial intelligence and machine learning to optimize resource use and operational performance, companies may recapture lost margins. Furthermore, as the emphasis shifts towards sustainable practices, miners who adopt green initiatives will likely command a premium, positioning themselves favorably in the next phase of the Bitcoin mining cycle.

Navigating Regulatory Landscapes in Cryptocurrency Mining

As Bitcoin mining faces unprecedented challenges, navigating the regulatory landscape has become increasingly complex. Governments around the world are scrutinizing cryptocurrency operations more closely, with policies evolving to address environmental concerns and energy consumption. Mining companies must adapt to these regulations or risk facing penalties that could further erode their profit margins.

Moreover, compliance with varying regulations across different jurisdictions necessitates heightened diligence and flexibility from mining operations. Companies that proactively engage with regulatory bodies and embrace transparent practices will be better positioned to thrive in this evolving landscape. By showing a commitment to responsible mining, companies can enhance their reputations and foster trust among investors and communities alike.

The Importance of Sustainable Mining Practices

Sustainability is increasingly becoming a cornerstone of the Bitcoin mining discussion amid rising environmental scrutiny. As energy consumption becomes a central issue, miners are exploring options to utilize renewable energy sources to power their operations. Companies investing in sustainable practices not only reduce their carbon footprints but may also uncover new opportunities for increased profitability by lowering their operational costs.

Furthermore, environmentally responsible mining can yield reputational benefits, enticing conscious investors and improving overall market perception. As the gap between responsible mining and traditional practices narrows, those who prioritize sustainability are likely to possess a competitive edge as the demand for ethical cryptocurrency practices continues to grow.

Bitcoin Mining’s Global Impact and Trends

The global implications of Bitcoin mining extend beyond mere economics; they touch on technological advancements, environmental responsibilities, and socio-political dynamics. As mining operations flourish in regions with low energy costs, such as parts of China and North America, the economic benefits and technological innovations associated with Bitcoin mining are increasingly significant. However, this growth must be balanced with environmental accountability and the responsible use of resources.

Recent trends indicate an accelerated push toward decentralized mining, with smaller operations gaining ground against larger incumbents. As more individuals enter the market, mining could become less concentrated, potentially democratizing the benefits of cryptocurrency. This shift may challenge existing power dynamics while fostering a more diverse and resilient mining ecosystem that can weather economic fluctuations more robustly.

Frequently Asked Questions

What are the current trends in the Bitcoin mining profit cycle?

The current Bitcoin mining profit cycle is facing an unprecedented contraction, described by some as the worst in history. With the hash rate price dropping to around $35/PH/s, mining companies are grappling with a significant decline in profitability and longer payback periods for new equipment.

How does the Bitcoin halving effect impact mining profits?

The Bitcoin halving effect reduces the block rewards for miners, which can exacerbate the challenges faced in the current profit cycle. Given that there are about 850 days until the next halving, miners are under immense pressure to optimize their operations and possibly increase efficiency before rewards are cut.

What challenges are cryptocurrency mining companies facing in this profit cycle?

Cryptocurrency mining challenges in the current profit cycle include sharply declining mining profits, increased operational costs, and a lengthy payback period for new mining machines, which has extended beyond 1000 days. Additionally, mining stocks have seen serious declines, placing further strain on these companies.

Why are mining stocks experiencing decline during the Bitcoin mining profit cycle?

Mining stocks like MARA, CleanSpark, Riot, and HIVE have fallen between 32% and 54% since mid-October due to decreased Bitcoin mining profits and overall market conditions. Investors are reacting to the bleak outlook of the Bitcoin mining profit cycle and the financial strain on mining companies.

What is the average payback period for Bitcoin mining machines in the current market?

In the current Bitcoin mining profit cycle, the payback period for new generation mining machines has extended to over 1000 days, highlighting the significant challenges mining companies face in achieving profitability amidst declining market conditions.

How are mining companies responding to the worsening Bitcoin mining profit cycle?

In response to the worsening Bitcoin mining profit cycle, many mining companies are deleveraging to manage their financial health. For instance, CleanSpark has fully repaid its Bitcoin collateralized credit line, reflecting the need to reassess financial strategies amidst declining profits.

| Key Point | Details |

|---|---|

| Market Condition | Bitcoin mining is facing its worst profit contraction in 15 years. |

| Hash Rate Price | The price has dropped to about $35/PH/s, a structural low. |

| Payback Period | The payback period for new mining machines exceeds 1000 days. |

| Impact of Halving | There are only 850 days left until the next halving event. |

| Company Reactions | Mining companies like CleanSpark are deleveraging; they fully repaid their Bitcoin collateralized credit line. |

| Stock Market Response | Mining stocks have dropped significantly, with declines between 32% and 54% for companies like MARA, CleanSpark, Riot, and HIVE. |

Summary

The Bitcoin mining profit cycle is currently facing unprecedented challenges, marked by severe profit contraction, particularly as prices fall and operational costs rise. The industry’s future depends on how miners adapt to the current conditions, manage their investments, and prepare for the upcoming halving event. The situation calls for strategic adjustments to maintain profitability amidst changing market dynamics.