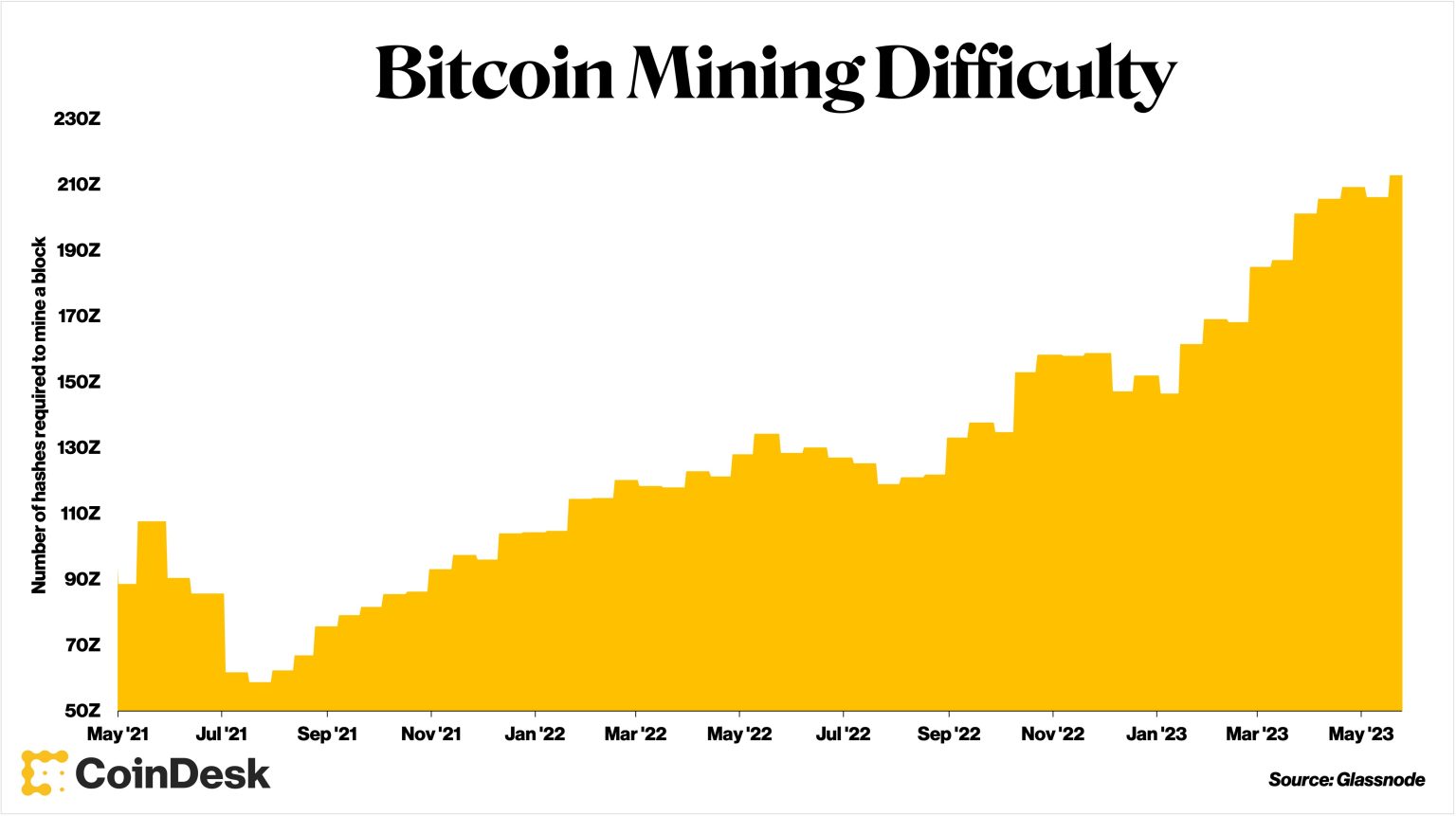

Bitcoin mining difficulty has recently seen a notable decrease, dropping to 125.86 trillion hashes, which represents an 11.16% decline. This adjustment, reported by CloverPool, highlights the dynamic nature of the Bitcoin network and its hash rate, currently standing at an impressive 948.13 EH/s. Understanding changes in cryptocurrency difficulty is crucial for miners and investors alike, as it directly affects the profitability and viability of blockchain mining operations. Moreover, such fluctuations offer key insights into the overall health and security of the Bitcoin network. Keeping abreast of Bitcoin mining news is essential for anyone involved in the cryptocurrency space, especially in light of larger shifts and trends in mining activity.

The recent adjustment in Bitcoin’s mining parameters reflects a significant transformation in the hashing landscape, directly impacting the competitive environment for digital currency extraction. With the current metrics indicating a falling threshold for mining difficulty, stakeholders are keenly observing how this will influence mining strategies and profitability in the near term. In the realm of cryptocurrency, the term ‘mining fluctuation’ often describes these alterations in the operational challenges faced by miners. As the blockchain ecosystem evolves, understanding the implications of such changes becomes increasingly vital for all participants in the digital economy. Thus, the vital interplay between the network hash rate and mining difficulty should not only engage miners but also attract potential investors looking to navigate this intriguing market.

| Key Points |

|---|

| Bitcoin mining difficulty adjusted to 125.86 T |

| Decrease of 11.16% |

| Largest drop since May 2021 |

| Current total network hash rate at 948.13 EH/s |

| Expected further decrease in next Bitcoin mining difficulty |

Summary

Bitcoin mining difficulty has recently seen a significant drop to 125.86 T, marking an important moment in the cryptocurrency landscape. This 11.16% decrease is particularly noteworthy as it represents the largest reduction since May 2021, illustrating shifts in the mining ecosystem. With the total network hash rate currently at 948.13 EH/s, analysts predict that the Bitcoin mining difficulty may continue to decline in subsequent adjustments. Understanding these changes is crucial for miners and investors navigating the volatile market.

Understanding Bitcoin Mining Difficulty

Bitcoin mining difficulty is a crucial metric that determines how challenging it is to validate transactions and add new blocks to the Bitcoin blockchain. Specifically, it represents the amount of computational power that miners must expend to successfully mine a block. Recently, Bitcoin mining difficulty was adjusted down to 125.86 trillion (T), which is a significant decrease of 11.16%. This adjustment reflects the dynamics of the Bitcoin ecosystem, particularly in response to fluctuations in the network hash rate, which currently stands at an impressive 948.13 exahashes per second (EH/s).

The concept of mining difficulty plays a vital role in ensuring that the Bitcoin network maintains a target block time of approximately every ten minutes. When more miners join the network, the difficulty increases, making it harder to mine blocks. Conversely, a decrease in miners can trigger a reduction in difficulty, as seen in the latest data. The recent significant drop, the largest since May 2021, indicates a shift in the mining landscape, where miners might be facing increased operational costs or declining profitability, prompting some to exit the market.

Impact of Network Hash Rate on Bitcoin Mining

The network hash rate is a crucial indicator of the Bitcoin mining environment, as it represents the total computational power being used to mine and process Bitcoin transactions. With the current network hash rate at 948.13 EH/s, it reflects a robust and active mining sector, despite the recent decrease in mining difficulty. This hash rate can significantly influence the time it takes to confirm transactions and the overall security of the Bitcoin network. As hash rate and mining difficulty were both high, blocks would typically be mined faster, but the recent downturn in difficulty suggests an adjustment to accommodate current mining conditions.

Miners are constantly adapting to changes in the environment, including shifts in the network hash rate. When hash rates are high, more miners can compete, leading to increased mining difficulty. However, when difficulties arise—be it due to energy costs, regulatory changes, or market conditions—miners may have to make tough decisions about their operations. The interplay between hash rate and mining difficulty not only impacts profitability for miners but also affects the stability and reliability of the Bitcoin network, emphasizing the importance of these metrics in the cryptocurrency ecosystem.

Current Trends in Bitcoin Mining News

In the fast-evolving world of cryptocurrency, staying updated with Bitcoin mining news is critical for miners and investors alike. Recently, the news surrounding Bitcoin mining difficulty has garnered significant attention, especially with the recent adjustment to 125.86 T. Such changes are closely monitored, as they can have considerable effects on the profitability and operation of mining facilities. In addition, understanding the reasons behind these fluctuations can provide insights into future trends and help stakeholders make informed decisions.

Beyond just mining difficulty, current Bitcoin mining news highlights various trends in the industry, including advancements in mining technology, power resource challenges, and regulatory developments. These factors are interconnected; for instance, as technology improves, more efficient mining operations can help sustain profitability even in challenging environments. Furthermore, discussing the implications of these changes within the broader context of the cryptocurrency market enables miners and investors to strategize effectively in anticipation of future cycles.

Future Predictions for Bitcoin Mining Difficulty

Looking ahead, the future of Bitcoin mining difficulty is subject to various influencing factors that could lead to further adjustments. Analysts are already predicting that the next difficulty adjustment may result in a further decrease. This outlook stems from the substantial drop experienced recently and the prevailing trends within the cryptocurrency market. Miners are closely estimating their operational costs against the backdrop of fluctuating cryptocurrency prices and network dynamics, ultimately determining whether they will continue to invest in mining.

The potential for further decreases in mining difficulty can have mixed implications for the ecosystem. On one hand, lower difficulty may make mining more accessible to smaller operators and enthusiasts, potentially increasing the decentralization of the network. On the other hand, sustained adverse conditions could lead to a consolidation in the industry, where only the most efficient and well-capitalized miners survive. The evolution of Bitcoin mining difficulty remains a key aspect to monitor as it directly correlates with the health of the Bitcoin network and the broader cryptocurrency market.

The Role of Blockchain Mining in Bitcoin Security

Blockchain mining is integral to maintaining the security and integrity of the Bitcoin network. Each time a block is mined, it not only includes transactional data but also serves as a confirmation of the previous block, creating a secure chain. The recent changes in Bitcoin mining difficulty underscore how mining impacts this security model. With lower difficulty, there is a potential risk of malicious attacks if a smaller number of miners can overpower the hash rate, thus emphasizing the need for a robust and balanced mining environment.

Furthermore, the security of the Bitcoin blockchain relies heavily on miners participating honestly. This participation is influenced by economic incentives tied to mining difficulty and rewards. As difficulty decreases, the incentives to mine may draw in a new range of miners, enhancing the security through increased participation. Ensuring a diverse set of participants in the mining process is vital for maintaining the resilience and unchangeable nature of the blockchain, as it deters attempts to manipulate the network.

Analyzing Bitcoin Mining Profitability

Bitcoin mining profitability is a critical factor that miners must assess continuously. Given the recent adjustment in Bitcoin mining difficulty to 125.86 T, it’s imperative for miners to re-evaluate their strategies. The decline in difficulty can lead to improved mining margins for those still operating, as the required computational power to mine has diminished. However, this can also pose a challenge, as it may indicate a shift in the competitive landscape where some miners may exit when prices decline.

Moreover, factors such as electricity costs, hardware efficiency, and overall market price trends of Bitcoin also play significant roles in determining mining profitability. Competitive miners who adapt to these fluctuations with advanced technologies or lower operating costs can enhance their chances of success. Therefore, continuously monitoring Bitcoin mining news, as well as difficulty adjustments, and market trends is essential for miners looking to optimize their operations for ongoing profitability.

The Future of Mining and Cryptocurrency Regulations

The landscape of Bitcoin mining and its future implications are increasingly being shaped by growing regulatory scrutiny around cryptocurrency. As governments worldwide contemplate or implement regulations, they could impact miners’ operations, including the costs of energy, equipment, and legal compliance. The recent fluctuations in Bitcoin mining difficulty highlight the fragility of the mining ecosystem when external factors come into play. These regulations could aim not only to govern mining practices but also to ensure that operations are environmentally sustainable, adding another layer for miners to navigate.

As governments work towards creating a regulatory framework for cryptocurrency, it is essential for miners to stay informed about potential changes that could affect their activities. This knowledge enables miners to proactively adapt their operations to comply with new rules, ensuring continuity in their business models. The complexity of merging the continuous evolution of blockchain technology with regulatory requirements will shape the future of Bitcoin mining significantly, as miners strive to maintain profitability while adhering to the established guidelines.

Technological Innovations in Bitcoin Mining

Technological advancements play a pivotal role in the efficiency and effectiveness of Bitcoin mining operations. Innovations such as ASIC (Application-Specific Integrated Circuit) miners have revolutionized the mining process, allowing for higher hash rates while using lesser energy. With the recent changes to Bitcoin mining difficulty and the network hash rate of 948.13 EH/s, miners look to leverage these technologies to maximize their profitability. As the landscape evolves, those who invest in the latest mining technologies may find themselves in a stronger position to navigate downturns in mining difficulty.

Moreover, as the industry progresses, there is a continuous push towards developing more sustainable mining solutions. Environmental concerns regarding Bitcoin mining have led many miners to explore greener energy sources and energy-efficient practices. This not only addresses regulatory pressures but also enhances overall profitability in the long run. By investing in technologies that optimize operations and reduce carbon footprints, miners are positioning themselves for success in an increasingly competitive and scrutinized market.

Community Perspectives on Bitcoin Mining

Community sentiment can significantly impact the Bitcoin mining industry, particularly in light of recent mining difficulty adjustments. Discussions within online forums and social media platforms reveal varying opinions on the long-term viability of Bitcoin mining, especially with the latest decrease in difficulty. Many miners express optimism, viewing the adjustment as an opportunity to increase profitability and operational longevity, while others remain cautious about the overall market conditions and regulatory challenges.

Furthermore, the community plays a vital role in shaping the narrative around mining practices and their sustainability. As awareness of environmental impacts grows, discussions regarding the energy consumption of Bitcoin mining continue to gain traction. This collective consciousness pushes companies and individuals to adopt more sustainable practices, ultimately benefiting the industry. By fostering a supportive community that prioritizes ethical mining, stakeholders can ensure a balanced and responsible approach to Bitcoin mining’s future.

Frequently Asked Questions

What is Bitcoin mining difficulty and why is it important?

Bitcoin mining difficulty refers to how hard it is to find a new block in the Bitcoin blockchain. This metric adjusts approximately every two weeks to ensure that blocks are mined at a consistent rate of one block approximately every ten minutes. Understanding Bitcoin mining difficulty is crucial for miners as it affects their profitability and the overall health of the Bitcoin network.

How does Bitcoin mining difficulty affect the profitability of miners?

Bitcoin mining difficulty directly impacts miners’ profitability. A higher difficulty level means miners need more computational power and electricity to solve cryptographic puzzles. Conversely, when Bitcoin mining difficulty decreases, as seen recently with a drop to 125.86 T, miners can potentially mine more Bitcoin with the same resources, increasing their earnings.

What led to the recent decrease in Bitcoin mining difficulty?

The recent decrease in Bitcoin mining difficulty, which dropped by 11.16% to 125.86 T, can be attributed to a variety of factors including changes in the Bitcoin network hash rate. As the total hash rate reached 948.13 EH/s, fewer miners were competing for rewards, leading to a necessary adjustment in the difficulty level to maintain block production consistency.

What does a decrease in Bitcoin mining difficulty indicate about the Bitcoin network?

A decrease in Bitcoin mining difficulty, like the recent adjustment to 125.86 T, typically indicates a shift in the Bitcoin network’s hash rate or mining competition. Such a significant drop suggests that some miners may have exited the market, leading to reduced competition. This can also be a signal of market conditions, where lower prices make mining less economically viable.

How often does Bitcoin mining difficulty get adjusted?

Bitcoin mining difficulty is adjusted approximately every 2016 blocks, or roughly every two weeks. This adjustment takes into account the total network hash rate to ensure that the average time between blocks remains around ten minutes, keeping the system stable and resilient.

What are the implications of a fluctuating Bitcoin mining difficulty for cryptocurrency investors?

For cryptocurrency investors, fluctuations in Bitcoin mining difficulty can affect the overall market sentiment. A significant drop in difficulty could signal market instability or reduced miner confidence, potentially influencing Bitcoin’s price. Investors should monitor these changes alongside other market indicators to make informed decisions.

Can we expect Bitcoin mining difficulty to decrease further?

Based on recent analyses, there is speculation that Bitcoin mining difficulty may decrease further in the upcoming adjustments. If the current trend of decreasing network hash rate continues, it could lead to additional reductions, benefiting miners in the short term by making mining operations more feasible.

Where can I find the latest Bitcoin mining news regarding difficulty changes?

For the latest Bitcoin mining news, including changes in mining difficulty, you can follow reputable cryptocurrency news outlets, blockchain analytics platforms like CloverPool, and Bitcoin market data aggregators. These sources regularly update information related to Bitcoin mining, network metrics, and market analysis.