Bitcoin mining data provides critical insights into the ever-evolving landscape of cryptocurrency. This week, the mining sector has experienced significant fluctuations, with the Bitcoin hash rate peaking at 1000 EH/s, reflecting both increased competition and heightened operational costs. As the Bitcoin price trends indicate a robust but volatile market, miners are feeling the pressure, particularly as the mining cost line has been breached, suggesting tighter margins for profitability. Additionally, the recent spikes in Bitcoin miners selling pressure could signal a pivotal moment for the crypto market analysis, impacting both short-term prices and long-term investment strategies. Staying updated with Bitcoin mining data is essential for anyone looking to navigate the complexities of this digital gold rush.

The collection of data concerning Bitcoin mining sheds light on the operational dynamics of cryptocurrency generation. With the latest developments indicating that the energy expenditure line for miners has been surpassed, stakeholders are adjusting their strategies amid fluctuating returns. Moreover, analyzing the activity levels, or hash rates, within the network shows notable trends that could influence overall market sentiment. Miners are currently experiencing a tug-of-war between rising costs and shifting Bitcoin price activities, which may affect their decision to hold or liquidate assets in these unpredictable times. Understanding this nuanced ecosystem of Bitcoin mining not only informs investment choices but also reveals the intricacies behind the digital currency’s market behavior.

| Key Point | Details |

|---|---|

| Average Hash Rate | 912 EH/s, with a peak of 1000 EH/s and a low of 831 EH/s, a 9.28% increase from last week. |

| Average Bitcoin Price | $78,781, with a max of $84,599 and a min of $62,182, an 11.22% decrease from last week. |

| Mining Cost Line | Breached, leading to potential short-term selling pressure among miners. |

| Cango Inc. Holdings | Reported total Bitcoin holdings of 7,474.6 coins as of January. |

Summary

Bitcoin mining data has revealed significant trends this week, indicating a complex landscape for miners. With the average hash rate experiencing a notable increase and crucial price adjustments, the market is responding to fluctuations in miner costs. As the cost line has been breached, this could lead to increased selling pressure, impacting the sustainability of mining operations in the short term. Investors and stakeholders should monitor these trends closely to understand their implications on the Bitcoin ecosystem.

Understanding Bitcoin Mining Costs and Selling Pressure

The week of February 6, 2026, has brought significant changes to the landscape of Bitcoin mining. The data shows that the Bitcoin miners’ cost line has been broken, indicating a shift in operational economics for miners. This breach could potentially lead to increased selling pressure as miners rush to liquidate their assets to cover their costs. Historical trends suggest that when Bitcoin prices dip significantly, miners may resort to selling their holdings to maintain liquidity, which could exacerbate market volatility. Understanding these dynamics is crucial for anyone analyzing the crypto market.

Moreover, the implications of this selling pressure can extend beyond just miners. As the cost line breaks and miners find themselves in a precarious position, it can trigger a chain reaction that affects Bitcoin price trends and overall market sentiment. Analysts suggest that during such times, potential investors should be wary of increased volatility, as the crypto market tends to react sharply to any sign of distress from miners.

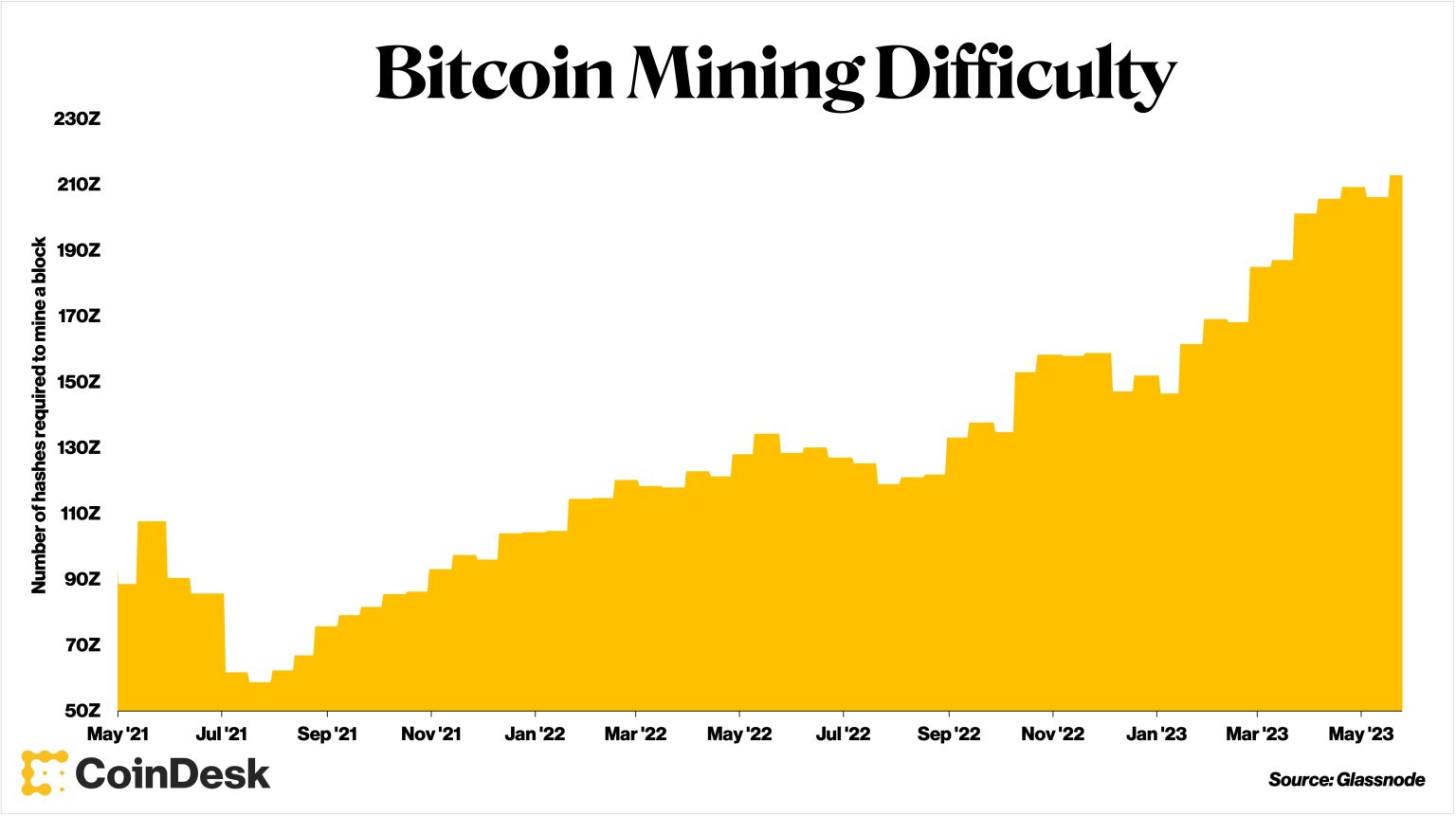

Current Bitcoin Hash Rate Trends and Market Impact

The average Bitcoin hash rate during Week 6 of 2026 has seen a notable uptick, averaging 912 EH/s, with peaks reaching 1000 EH/s. This increase suggests that miners are becoming more competitive, likely motivated by the declining Bitcoin price. A rising hash rate may indicate a robust interest in Bitcoin mining; however, the current economic pressures due to the broken miners’ cost line could shift this trend rapidly. As more miners enter the market, the overall Bitcoin ecosystem can face increased strain, impacting both hash rates and Bitcoin price outcomes.

Crypto market analysis reveals that this fluctuation in the hash rate could lead to a temporary oversupply of Bitcoin, especially if miners begin to sell at higher rates to recover costs associated with operations. Understanding the interplay between the hash rate and resulting mining conditions is essential for predicting price movements and advising potential investors. Technical indicators suggest that current trends could provide buying opportunities, but caution is advised due to potential further drops in Bitcoin prices.

Bitcoin Price Trends: Analysis of Recent Market Movements

The latest data indicates that the average price of Bitcoin has significantly decreased to $78,781, down from $88,735 the prior week. This decline of 11.22% could be tied closely to the selling pressure arising from miners reacting to the broken cost line. Price trends often indicate a consolidation phase after such drops, where traders reassess their positions. For long-term investors and traders alike, this is a critical juncture to evaluate the overall health of their portfolios based on short-term volatility.

Investors must stay informed about how Bitcoin price trends correlate with hash rate movements and miner activities. A decrease in Bitcoin’s price may not just reflect market sentiment but can also impact mining operations and profitability. As the mining environment changes, potential investors should incorporate strategies that account for expected selling pressure from miners, particularly as costs fluctuate. This analysis can lead to more informed decision-making in the volatile landscape of cryptocurrency trading.

Analyzing the Bitcoin Mining Industry: Insights and Forecasts

The Bitcoin mining industry is undergoing significant transformations, influenced heavily by miners’ operational costs and current price fluctuations. As the mining cost line has been breached, companies and individual miners must adapt to the new financial realities. This includes examining mining equipment efficiency, energy costs, and the ability to pivot operations based on market conditions. This adaptability will be crucial for mining companies that aim to thrive despite short-term market pressures.

Market analysts predict that the current challenges faced by Bitcoin miners will lead to an eventual consolidation within the industry, where the most efficient and resilient players will emerge stronger. This points to an anticipated increase in innovation and improvements in mining technologies designed to cut costs and enhance profitability. Keeping a close watch on these industry developments will be essential for stakeholders aiming to capitalize on future market rebounds.

The Role of Cango Inc. in Bitcoin Mining Dynamics

Cango Inc. has positioned itself as a significant player in the Bitcoin mining sector, with their recent report highlighting a Bitcoin holding of 7,474.6 coins. As one of the only publicly traded Bitcoin mining companies, Cango’s activities can greatly influence market perceptions and trends. Investors closely monitor their movements, particularly in light of current mining conditions and price pressures, as their decisions can ripple throughout the cryptocurrency market.

The company’s insights and reports provide essential data for crypto market analysis, helping to elucidate broader trends affecting both miners and investors. Cango’s response to the current pressures, including any shifts in operational strategies or asset liquidations, will be crucial to follow for an understanding of how the Bitcoin mining sector adapts. The interplay between their reported data and market actions will serve as a barometer for industry health and investor sentiment moving forward.

Implications of Bitcoin Mining on Market Sentiment

Bitcoin mining activities serve as a significant bellwether for market sentiment, especially during periods of heightened volatility. Recent trends indicate that as miners face increased operational costs and broken cost lines, overall market confidence may wane. Traders often react to miners’ actions, interpreting increased liquidation activities as signs of bearish trends, which can further drive price declines.

Understanding the psychological aspects of mining impacts on market sentiment is vital for investors. As miners sell off Bitcoin to cover rising costs, it could create a feedback loop that precipitates further price drops. Those staying informed on these dynamics will likely have a better chance of making sound investment decisions during turbulent times.

Future of Bitcoin Mining: Challenges and Opportunities

The future of Bitcoin mining is framed by both significant challenges and potential opportunities. As the industry grapples with fluctuating costs and external market pressures, miners are urged to innovate and adopt more sustainable practices. Decisions must be made regarding investments in more efficient hardware or diversification of mining strategies to mitigate risks inherent in price trends.

Simultaneously, the potential for profitability still exists, especially for those who can navigate this evolving landscape effectively. Analysts believe that the integration of new technologies and smarter operational frameworks could lead to a resurgence in efficiency, ultimately benefiting the miners who can adapt swiftly to market dynamics. Keeping abreast of these evolving trends will be critical for any stakeholder in the Bitcoin ecosystem looking to secure long-term gains.

Understanding Crypto Market Analysis in the Context of Bitcoin

Conducting comprehensive crypto market analysis requires a keen understanding of the intricate factors that impact Bitcoin and its surrounding ecosystem. Factors like miners’ cost structures, hash rates, and current price trends all interact to shape market dynamics. Analyzing these components can yield valuable insights into potential future movements, making this framework indispensable for any serious investor.

Being equipped with a thorough knowledge of market analysis methodologies allows investors to predict how shifts in Bitcoin mining activities may influence broader market behavior. As we observe changes in miner behavior, it brings forth critical data points that can forecast investor sentiment, thereby allowing for better-informed positions and strategies in the volatile realm of cryptocurrency.

Frequently Asked Questions

What are the current trends in Bitcoin mining data regarding the hash rate?

As of Week 6 of 2026, the average hash rate for the Bitcoin network is recorded at 912 EH/s, showing a notable 9.28% increase from the previous week, where it was 835 EH/s. This rise reflects the ongoing adjustments within Bitcoin mining data, indicative of growing mining activity.

How does the Bitcoin miners’ cost line impact the mining landscape?

Recently, the Bitcoin miners’ cost line has been breached, indicating a potential shift in profitability for miners. When this cost line is broken, it suggests that many miners could face financial strain, leading to increased selling pressure on Bitcoin, which can affect overall market dynamics.

What are the implications of Bitcoin price trends on mining operations?

This week, the average price of Bitcoin stands at $78,781, down 11.22% from the previous week’s average of $88,735. Such price trends can directly influence Bitcoin mining operations, as lower prices may compel miners to sell holdings more frequently, impacting their ability to cover operational costs.

How does the selling pressure from Bitcoin miners affect the crypto market?

Increases in Bitcoin miners selling pressure can lead to price volatility within the crypto market. When miners sell their coins to offset operational costs, it can create downward price pressure, leading to fluctuations in Bitcoin’s market price and affecting investor sentiment.

What insights does the latest crypto market analysis provide about Bitcoin mining profitability?

Recent crypto market analysis shows that with the average Bitcoin mining cost line being breached and current price fluctuations, profitability for miners might be strained. As some miners reach shutdown prices, it poses significant questions about sustainable mining practices amid changing market conditions.

Can we expect any changes in Bitcoin mining data based on recent market performance?

Yes, as the Bitcoin price trends indicate a recent decline and the miners’ cost line is broken, further adjustments in Bitcoin mining data may occur. Miners might alter their operations or face shutdowns, which can reshape network dynamics and hash rate performance.