Bitcoin miners sell pressure is a pivotal factor influencing the cryptocurrency‘s market dynamics. As Bitcoin’s price surged to approximately $91,056 in early January, a substantial 60,000 BTC was absorbed by accumulation addresses amidst growing concerns about miners offloading assets. This influx of BTC into accumulator wallets highlights a strong demand even as miners transferred around 33,000 BTC to exchanges, raising questions about the sustainability of the current rally. Analyzing Bitcoin price trends reveals that despite this miner sell pressure, the demand remains robust, which is essential for maintaining upward momentum. Understanding how miner distributions interact with market trends can provide insights into future Bitcoin accumulation and overall market health.

The phenomenon of miner sell-off activity plays a significant role in shaping the cryptocurrency landscape. As Bitcoin experiences tumultuous price movements and gains traction with new highs, the behavior of miners—those who validate transactions on the blockchain—can directly impact market stability. When these miners decide to convert a portion of their mining rewards into fiat or other currencies, it creates additional sell pressure in the market. Notably, this correlation between mining rewards and market dynamics must be analyzed in the context of broader Bitcoin market trends and the ongoing demand from accumulation addresses. Insights into miner distributions provide key information for predicting potential shifts in Bitcoin price analysis and future market behavior.

Understanding Bitcoin’s Accumulation Trend

In early January, Bitcoin accumulator addresses displayed a notable surge in holdings, transitioning from approximately 249,000 BTC to 310,000 BTC within just a week. This aggressive accumulation indicates a strong bullish sentiment among long-term investors, who appear keen to capitalize on the rebound in Bitcoin’s price, now hovering around the low-$90,000 mark. The increase in these addresses marks the end of a prolonged consolidation phase, during which the holdings were largely stagnant between 200,000 and 230,000 BTC from September to December.

Such a dramatic shift in accumulation suggests that investor confidence is returning, as many buyers seem eager to absorb available supply rather than await potentially deeper corrections. This behavior aligns with broader Bitcoin market trends, where increased accumulation often coincides with rising prices, reinforcing the idea that a solid foundation of demand exists to support future price movements.

Miners Sell Pressure: A Double-Edged Sword

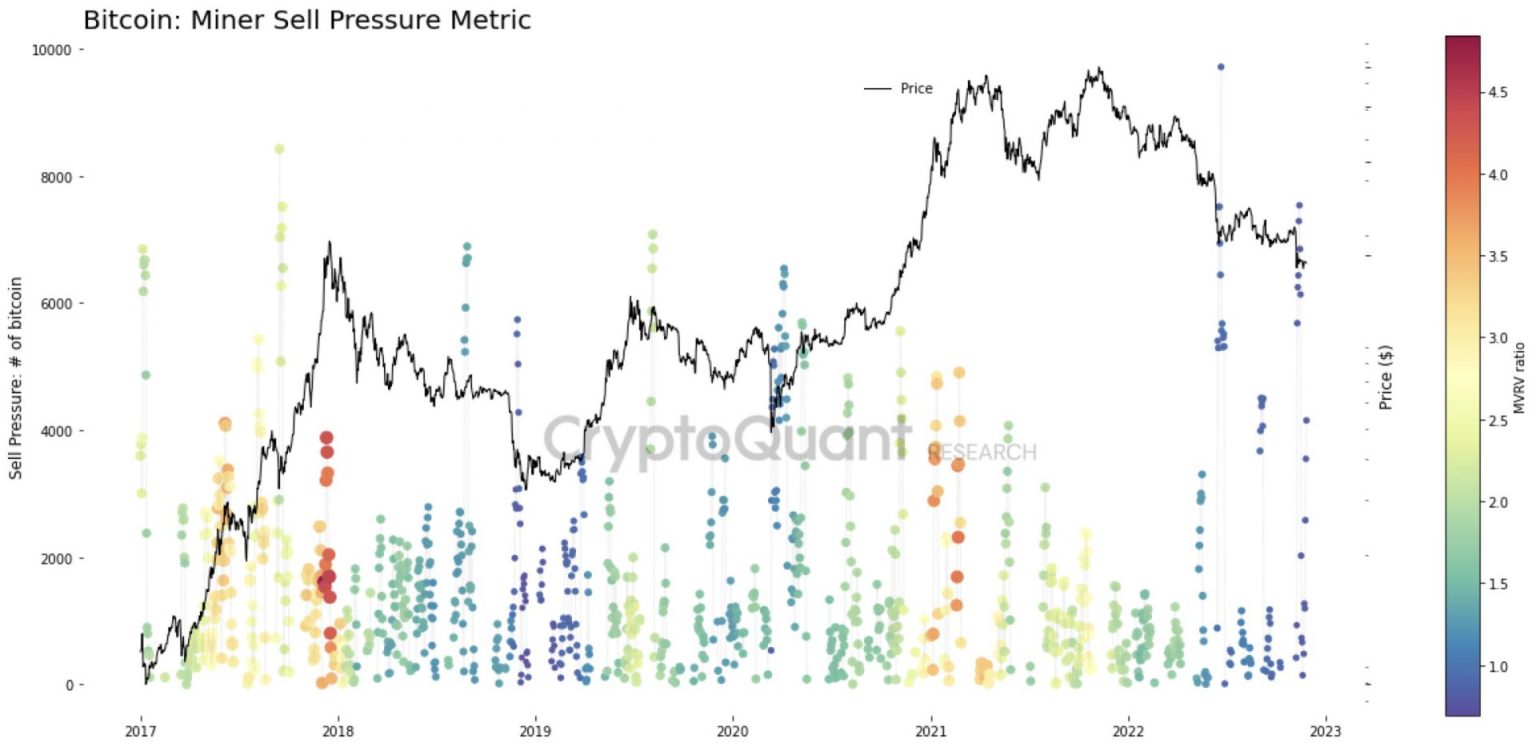

While accumulation has surged, it’s critical to note the countervailing sell pressure from miners. Data indicates that around 33,000 BTC was transferred from miner wallets to exchanges like Binance during the same period, a significant volume that must be considered in Bitcoin price analysis. This miner activity can often introduce instability, as increased distributions may lead to higher sell-side pressure in the market, challenging the price rally’s sustainability.

However, the implications of miner sell pressure are not straightforward. Although it heightens supply in the short term, the long-term impact on Bitcoin’s price largely hinges on market demand. If accumulators can absorb the newly introduced supply, the potential for a bullish trajectory remains intact. Conversely, if this sell pressure overwhelms demand, it could trigger corrections in Bitcoin’s rally.

Analyzing Bitcoin Market Sentiment

Current market sentiment surrounding Bitcoin has showcased a notable transformation following a period of pessimism. As December transitioned to January, data illustrating the net taker flow suggests recovery is underway, with a reported average of $410 million in net buying over seven days. This marks a significant uptick in demand contrasted with the prior weeks of sell pressure that averaged about $2.3 billion.

This shift in sentiment aligns with advancements in Bitcoin’s Unified Sentiment Index, which has recently returned to neutral territory. Such a stabilization indicates that while inherent fear in the market is dissipating, optimism remains restrained. The recent accumulation trends alongside miner sell pressure create a complex landscape that investors need to navigate with caution.

The Role of Spot Demand in Bitcoin’s Rally

For Bitcoin to maintain its current rally, the role of spot demand cannot be overstated. Strong buy-side activity is essential in offsetting the miners’ sell pressure, especially in light of recent distributions. As Bitcoin accumulators increase their holdings, the market’s ability to absorb additional supply directly influences price trajectories.

Should demand falter amid ongoing miner sell transactions, the risk of a price drop looms large. Investors must monitor key signs of demand resilience, as this will be crucial in determining if the upward price momentum can endure or if it will yield to the selling pressure imposed by miners.

Evaluating Long-Term Holding Strategies

The dynamics of long-term holding strategies among Bitcoin investors play a pivotal role in the cryptocurrency market’s overall health. As miners exhibit tendencies to sell their rewards, many long-term investors choose to retain their assets rather than engage in immediate selling. This strategy affects market trends as the reduction in available supply from committed holders can help stabilize or even propel prices during periods of volatility.

The contrast between short-term sell pressure from miners and long-term holding strategies by accumulators illustrates the battle within the market. If the balance tips towards stronger holding patterns, it may provide the resilience needed against the fluctuations caused by increased miner distributions, thereby fostering more robust price movements.

Future Implications of Bitcoin’s Price Movement

Looking ahead, the current interplay between miner sell pressure and accumulating demand sets the stage for crucial implications for Bitcoin’s price trajectory. While the recent rally has captured attention and enthusiasm, the sustainability of this movement rests on maintaining a delicate balance between ongoing accumulation and any subsequent sell-off from miners’ distributions.

As investors and analysts monitor these developments closely, it’s essential to keep track of market trends and sentiment shifts that can signal impending changes in Bitcoin’s price landscape. Ultimately, the ability to absorb incoming supply from miners will likely dictate the duration and strength of this rally.

Impact of Miner Distributions on Market Stability

Miner distributions can significantly impact the stability of the cryptocurrency market. When miners convert their rewards into fiat or other assets, as seen recently with 33,000 BTC transferred to exchanges, it can create a surge in available supply. Without an equivalent buy-side response, such actions may destabilize the short-term price and create anxiety among investors.

Investors must thus remain vigilant, recognizing that while miner sell-offs may provide short-term opportunities for traders, they also introduce complexities that can affect market confidence. Ensuring that there is sufficient buying pressure to counteract miner sell-offs will be pivotal in maintaining a positive price outlook moving forward.

The Future of Bitcoin’s Accumulation Patterns

The current acceleration in Bitcoin accumulation patterns may indicate a shift towards increased long-term investment strategies among market participants. As investors adapt to the potential implications of miner sell pressure and fluctuating prices, the trend of growing holdings could signal continued confidence in Bitcoin’s future value.

Looking ahead, the evolving patterns of accumulation will be a fundamental aspect of Bitcoin’s market behavior. Should the trend of accumulation outpace sell pressure from miners, it could establish a bullish scenario that underpins significant price growth, inviting new investors while reinforcing the commitment of existing holders.

Navigating Bitcoin Price Volatility and Opportunities

As Bitcoin navigates its current price volatility, it is essential for investors to identify potential opportunities amidst both miner sell-offs and accumulation increases. Market participants who are attuned to the subtleties of price movements and sentiment trends may find ripe conditions for strategic trading and long-term investment.

However, it’s critical to recognize that Bitcoin’s fluctuations are inherently tied to investor behavior, influenced significantly by miner sell pressure and broader market trends. A well-informed strategy that accounts for these factors will be essential for capitalizing on future opportunities and mitigating risks in the inherently volatile landscape of cryptocurrency.

Frequently Asked Questions

What impact does Bitcoin miners sell pressure have on the Bitcoin price analysis?

Bitcoin miners sell pressure impacts price analysis by introducing sell-side supply to the market, which can challenge upward price movements. When miners offload their rewards, it may create downward pressure unless there is sufficient demand from buyers to absorb the new supply.

How does Bitcoin accumulation relate to miners’ sell pressure?

Bitcoin accumulation refers to the increase in BTC holdings by long-term investors. If accumulation is strong while miners are selling, it can offset the sell pressure. This balance determines if the Bitcoin price rally can continue despite miners distributing their rewards.

What are the Bitcoin market trends linked to miner sell pressure and accumulation?

Current Bitcoin market trends show a mixed scenario where strong accumulation from addresses outweighs miner sell pressure. However, significant selling by miners can impact rally momentum if the demand fails to absorb this additional supply.

Can the recent Bitcoin rally sustain itself despite miners’ sell pressure?

Whether the recent Bitcoin rally can sustain itself amid miners’ sell pressure largely depends on the underlying market demand. If accumulation by investors continues, it may counteract the sells from miners, helping to maintain upward price momentum.

What role do mining rewards sell pressure play in Bitcoin price stability?

Mining rewards sell pressure plays a crucial role in Bitcoin price stability by potentially introducing more BTC into the market. If miners regularly sell a portion of their rewards, this could lead to volatility unless offset by strong buying interest from other market participants.

Are sellers in the Bitcoin market primarily driven by miners’ sell pressure?

While miners’ sell pressure contributes to the overall selling volume in the Bitcoin market, it is not solely driven by them. Various factors, including trader sentiment and external market trends, also influence the selling behavior of other entities.

How can investors respond to Bitcoin miners’ sell pressure?

Investors can monitor Bitcoin miners’ sell pressure as an indicator of market sentiment. By analyzing miners’ selling patterns alongside accumulation trends, investors can make informed decisions about buying, holding, or selling BTC in response to evolving market dynamics.

What are some strategies to mitigate the impact of miners sell pressure on Bitcoin investments?

Strategies to mitigate the impact of miners’ sell pressure include dollar-cost averaging to spread out entry points, diversifying investments, and keeping a close watch on market trends to determine optimal buying or selling opportunities.

How does the trend of miners sending BTC to exchanges influence the broader Bitcoin market?

The trend of miners sending BTC to exchanges tends to heighten sell pressure, which can dampen bullish sentiment in the market. Observing this behavior is essential for anticipating potential corrections or supporting ongoing price rallies.

What signs indicate that Bitcoin miners’ sell pressure is easing?

Signs indicating that Bitcoin miners’ sell pressure is easing include a reduction in the amount of BTC being transferred to exchanges and an increase in the overall net buying sentiment from investors, reflecting stronger market absorption capabilities.

| Key Points |

|---|

| Bitcoin accumulators added approximately 60,000 BTC in six days, ending a consolidation phase. |

| Miners transferred around 33,000 BTC to exchanges, indicating reduced long-term holding. |

| The ability of the market to absorb this new supply will influence future price stability. |

| Accumulation has surged as prices rise, showing eagerness from long-term investors. |

| Market sentiment is stabilizing, with signs of consistent buying amid prior selling pressure. |

Summary

Bitcoin miners sell pressure is a significant factor in the current Bitcoin market dynamics. Recent data shows that while Bitcoin accumulators have confidently added 60,000 BTC, miners concurrently sold about 33,000 BTC to exchanges. This duality presents a challenge for Bitcoin’s rally, as ongoing miner distributions may create sell pressure that impacts market stability. The sustainability of this rally will largely depend on whether the demand can consistently absorb the additional supply from miners. Investors should remain vigilant and consider these market movements as they navigate their strategies.

Related: More from Bitcoin News | Gold, AI, Tech Stocks Lead as Bitcoin Fades | UBS Slides on US Stocks: Bitcoin’s Fate?