Bitcoin market volatility has become a focal point for investors observing its price fluctuations in tandem with economic shifts, particularly as the US dollar experiences a sharp decline. Recent market movements have spotlighted Bitcoin’s potential as a hedge against fiat currencies, drawing parallels with the rises of traditional assets like gold and silver amid geopolitical tensions. The interconnectedness of these markets has left traders questioning the true drivers behind these fluctuations, especially as Bitcoin struggles to maintain a price above $92,000. Compounding this volatility is the reaction to Federal Reserve announcements, which have been perceived more as political maneuvers than indicators of monetary policy clarity. As the crypto market outlook continues to evolve, understanding Bitcoin’s resilience and susceptibility to external pressures becomes crucial for navigating these turbulent times.

In the dynamic landscape of cryptocurrency, the fluctuations within the Bitcoin market reflect a broader economic narrative that captures keen attention from financial analysts and casual investors alike. As the value of the US dollar wanes, observers look towards Bitcoin not merely as a digital asset, but as a viable alternative relatively resistant to traditional banking vulnerabilities. This intriguing interplay suggests that Bitcoin’s role may increasingly align with those of precious metals like gold and silver, especially during economic uncertainty. Ongoing discussions about the crypto market’s future paint a complex picture of resilience and risk, underscoring the importance of keeping an eye on global economic indicators. With rising volatility dominating recent headlines, the question of Bitcoin’s ability to uphold its stature within the financial world remains an engaging topic of debate.

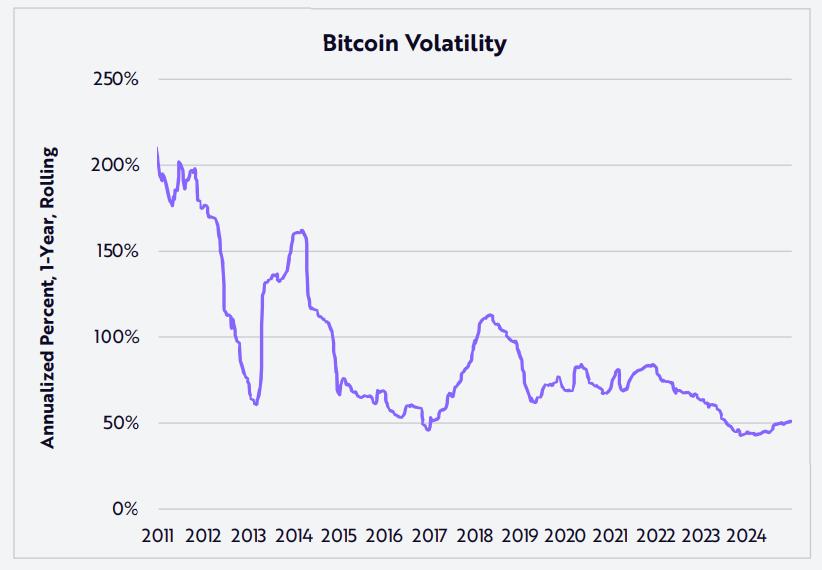

Analyzing Bitcoin Market Volatility

Bitcoin market volatility has become an essential topic among investors and analysts alike, primarily due to its unpredictable price fluctuations. In recent trading sessions, Bitcoin’s performance has been closely tied to movements in the US dollar, with instances of simultaneous upward trends in both Bitcoin and traditional assets like gold and silver. Such instances suggest that market participants are increasingly seeing Bitcoin as a viable hedge against fiat currency erosion, particularly amid concerns over inflation and fiscal policies. This relationship illustrates the intricate dynamics of crypto assets in reaction to macroeconomic conditions.

However, despite occasional spikes in price that make Bitcoin appear resilient, its underlying structural weaknesses have led to moments of sharp declines. For example, just after reaching above $92,000, Bitcoin’s value dropped substantially once the European markets opened, signaling strong selling pressure and a potential cooling sentiment among buyers. This pattern raises questions about Bitcoin’s capacity to serve as a genuine hedge against market uncertainties. With the US dollar showing signs of decline, the ongoing volatility in the Bitcoin market is unlikely to settle until there are clear indicators of stability or renewed investor confidence.

Frequently Asked Questions

How does Bitcoin market volatility relate to Bitcoin price fluctuations?

Bitcoin market volatility is characterized by rapid and unpredictable changes in Bitcoin price fluctuations. Factors such as regulatory news, market sentiment, and macroeconomic indicators can trigger significant price movements, making Bitcoin a highly volatile asset.

What impact does the US dollar decline have on Bitcoin market volatility?

The decline of the US dollar often leads to increased Bitcoin market volatility, as investors seek alternative hedges against fiat currency devaluation. This dynamic can result in upward price movements for Bitcoin, as seen during times when the dollar weakens significantly.

Can Bitcoin act as a hedge against fiat systems amid increasing market volatility?

Yes, Bitcoin has emerged as a potential hedge against fiat systems, especially during periods of economic uncertainty and high market volatility. Investors often turn to Bitcoin when traditional currencies face instability, viewing it as a store of value.

Why do gold and silver prices rise alongside Bitcoin during periods of market volatility?

Gold and silver often rise alongside Bitcoin during periods of market volatility due to a shared perception as safe-haven assets. When investor confidence in fiat currencies wanes, all three assets can benefit from increased demand.

What is the current crypto market outlook concerning Bitcoin market volatility?

The current crypto market outlook is cautious, as high levels of Bitcoin market volatility persist. Factors such as impending U.S. economic data releases and potential regulatory developments may influence market sentiment and price movements in the near term.

| Key Points | Details |

|---|---|

| QCP Capital’s Statement | The U.S. dollar’s decline led to a rise in Bitcoin, gold, and silver. |

| Powell’s Comments | Comments linked to DOJ subpoenas against the Federal Reserve are seen as political retaliation. |

| Market Positioning | Initial volatility suggested Bitcoin might serve as a hedge against fiat risks, but its ability to maintain highs has weakened. |

| Price Movement | Bitcoin could not sustain above $92,000, leading to a decline post-European market opening. |

| Market Sentiment | Optimistic market sentiment for a breakout is dwindling as structural resistance remains. |

| Future Volatility Risks | High volatility is expected around upcoming U.S. economic data releases that may influence risk across markets. |

Summary

Bitcoin market volatility is a significant aspect of the current financial landscape, influenced by various economic and political factors. Recent events, such as the sharp decline of the U.S. dollar and comments from Federal Reserve Chairman Jerome Powell regarding potential legal actions against the Fed, have greatly affected investor sentiment. Despite an initial rise in Bitcoin, its failure to maintain strong price levels highlights ongoing structural challenges. As key economic indicators approach, including U.S. CPI data and Supreme Court rulings on tariffs, the market is poised for continued fluctuations, making it essential for investors to remain vigilant.

Related: More from Bitcoin News | AI, BTC Miners Issue High | Bitcoin Above $69K? Glassnode Weighs In