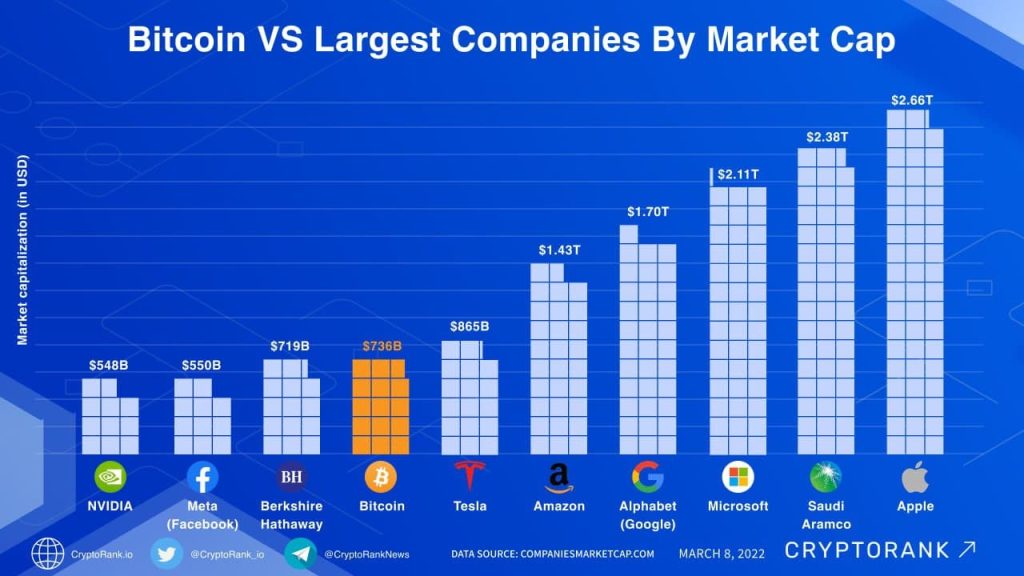

The Bitcoin market capitalization ranking has seen a significant decline, now sitting at 15th place in the global asset market. This drop highlights Bitcoin’s current market challenges as it competes against giants like Saudi Aramco and Tesla. Currently valued at approximately $1.28 trillion, Bitcoin has suffered a 24-hour decline of 11.41%, which raises questions about its future against other prominent cryptocurrencies, especially in a Bitcoin Ethereum comparison context. Meanwhile, Ethereum has plummeted to 88th place, with a market value of about $228.47 billion, trailing behind traditional brands such as McDonald’s. This shift in cryptocurrency rankings emphasizes the volatile nature of the market and the ever-changing dynamics of digital currencies.

In the world of digital currencies, the position of Bitcoin within the broader financial landscape has quickly shifted, now ranking 15th among global assets. This metric showcases the volatility present in cryptocurrency markets as Bitcoin faces stiff competition from well-established companies and other cryptocurrencies. Additionally, Ethereum, now ranked 88th, illustrates the drastic changes occurring in this sector, with its market value dwindling significantly. Such fluctuations in market standings not only affect investors but also influence the overall perception of cryptocurrencies within the global financial ecosystem. Understanding these shifts is crucial for anyone interested in the cryptocurrency space.

| Asset | Current Market Capitalization (in Trillions) | Ranking | 24-hour Decline (%) | 7-day Decrease (%) |

|---|---|---|---|---|

| Bitcoin | 1.28 | 15th | 11.41 | 23.40 |

| Ethereum | 0.228 | 88th | 11.49 | 32.33 |

Summary

The Bitcoin market capitalization ranking has seen a significant decline, now positioned at 15th in the global asset market. This drop reflects a broader trend as Bitcoin is outperformed by well-established companies, highlighting the challenges faced in the current economic climate. Similarly, Ethereum’s ranking plummets to 88th, indicating a fierce competitive landscape. These changes in market capitalization showcase the volatility and unpredictability inherent in cryptocurrency investments.

Bitcoin’s Market Capitalization Ranking: Current Status

Bitcoin has recently experienced a significant shift in its market capitalization ranking, now sitting at 15th place in the global asset market. This notable change reflects the volatility that characterizes the cryptocurrency landscape, where market fluctuations can dramatically alter a digital asset’s standing. With a current market value of approximately $1.28 trillion, Bitcoin remains a dominant player in the crypto space, but it faces tough competition from established companies such as Saudi Aramco and Tesla, which are leading the global market with higher capitalizations.

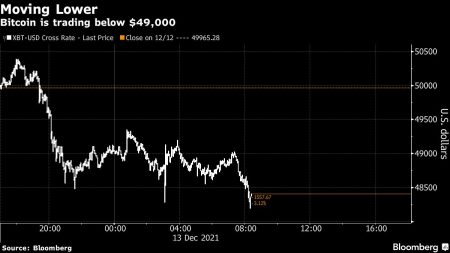

The drop in Bitcoin’s market cap ranking is alarming, especially when looking at the numbers. Over the last week, the digital currency has seen a decline of 23.40%. Such fluctuations can be attributed to various factors, including regulatory concerns, market sentiment, and macroeconomic variables. This decline serves as a reminder of the inherent risks associated with investing in cryptocurrencies, prompting investors to reconsider their portfolios and potentially pivot towards more stable assets in the global asset market.

Comparative Analysis: Bitcoin and Ethereum Market Value

In the ever-evolving world of cryptocurrencies, the comparison between Bitcoin and Ethereum is essential for investors. Currently, Bitcoin’s market value is significantly higher than that of Ethereum, which has fallen to 88th place in the global asset market rankings with a value of around $228.47 billion. The stark contrast in rankings emphasizes the challenges Ethereum faces as it struggles to maintain its position amidst increasing competition from emerging technologies and other cryptocurrencies. The differences in their trajectories highlight divergent use cases; while Bitcoin is often viewed as a store of value, Ethereum is seen as a platform for decentralized applications.

The recent decline in Ethereum’s market position, alongside a 7-day drop of 32.33%, raises critical questions about its future in the cryptocurrency rankings. Factors influencing this downtrend include network congestion, scalability issues, and a general bearish sentiment within the crypto market. This scenario creates an opportunity for potential investors to assess Ethereum’s long-term value proposition. Understanding the underlying principles of both Bitcoin and Ethereum can provide clarity on their roles within the broader global asset market and help in making informed investment decisions.

Impact of Market Fluctuations on Cryptocurrency Rankings

Market fluctuations can have profound impacts on cryptocurrency rankings, as evidenced by Bitcoin and Ethereum’s recent declines. The cryptocurrency market is notoriously volatile, with prices reacting sharply to news events, regulatory changes, and shifts in investor sentiment. These factors have contributed to Bitcoin’s fall to the 15th position in global asset rankings and a substantial dip for Ethereum. The rapid pace of these changes highlights the need for investors to stay informed and nimble to navigate the tumultuous waters of cryptocurrency investments effectively.

As cryptocurrencies continue to capture the attention of both retail and institutional investors, understanding the mechanisms behind market fluctuations becomes even more critical. The effects of a single announcement or market trend can ripple through the entire digital asset ecosystem, influencing rankings and valuations. Investors should collectively observe these trends to mitigate risks and identify opportunities within the vast global asset market.

The Role of Institutional Investors in Cryptocurrency Rankings

The entry of institutional investors into the cryptocurrency market has undeniably shaped the dynamics of asset valuation and market ranking. As Bitcoin drops to 15th place, there is a growing concern about the influence of corporate players and investment firms that now invest in cryptocurrencies like Bitcoin and Ethereum. These institutions often bring substantial capital and can impact price movements, further solidifying or undermining the positions of digital currencies within the global asset market.

Institutional involvement has added a layer of complexity to cryptocurrency rankings. For instance, Bitcoin has traditionally been the darling of institutional investors due to its scarcity and recognition as digital gold. However, Ethereum is now receiving more attention for its utility in facilitating decentralized finance (DeFi) applications. This evolution could lead to shifts in market valuations, demonstrating how institutional strategies can redefine the landscape of cryptocurrency rankings.

Understanding the Factors Behind Bitcoin’s Fluctuating Market Value

Bitcoin’s fluctuating market value is influenced by multiple interconnected factors. From macroeconomic trends to investor behaviors, various elements contribute to its current ranking of 15th in the global asset market. Economic indicators, such as inflation rates, interest rates, and market liquidity, can heavily sway Bitcoin’s price, while news about regulatory actions or technological advancements also play a crucial role. The cumulative impact of these factors shapes investor confidence and market sentiment.

As Bitcoin navigates through these fluctuations, understanding the underlying contributors to its market value becomes imperative for anyone interested in cryptocurrency investments. It becomes evident that a comprehensive view of financial systems, market dynamics, and global events is essential for making informed decisions regarding Bitcoin’s position compared to other assets within the global market.

Prospects for Bitcoin and Ethereum in the Upcoming Market Trends

Given their recent rankings, Bitcoin and Ethereum find themselves at a crucial crossroads. As the cryptocurrency ecosystem continues to evolve, both digital assets must adapt to market trends to regain and fortify their positions in the global asset market. With Bitcoin sitting at 15th, it must contend with emerging projects and compliance frameworks that could reshape the future of cryptocurrencies. This ability to innovate and address contemporary challenges will be key for Bitcoin to maintain or improve its market ranking.

Similarly, Ethereum, currently ranked at 88th, must harness its potential as a foundational platform for decentralized applications to recover from its recent declines. The continued development of Ethereum 2.0 presents significant opportunities for scalability and efficiency, attracting new investors and validating its market relevance. These shifts will likely influence whether both cryptocurrencies can reclaim or elevate their standings in cryptocurrency rankings amid a competitive landscape.

The Future of Cryptocurrency Rankings: Predictions and Analysis

As the cryptocurrency market matures, predictions about the future of rankings among the leading digital assets offer valuable insights. Experts suggest that innovations in technology and shifts in user preferences will play significant roles in determining the fate of Bitcoin and Ethereum. While Bitcoin has historically led the charge as a store of value, the emergence of DeFi applications and NFTs on platforms like Ethereum may impact future rankings, presenting new avenues for growth and competition.

The direction of these cryptocurrency rankings will likely hinge on regulatory developments, technological advances, and broader economic trends. Investors seeking to stay ahead in this dynamic market must keep a pulse on these trends and developments. Understanding the interconnected landscape of cryptocurrencies will enable more strategic decisions as they navigate the complexities of ranking in an increasingly sophisticated global asset marketplace.

Investor Sentiment: The Driving Force Behind Cryptocurrency Markets

Investor sentiment plays an essential role in dictating the movements of cryptocurrencies, including Bitcoin’s recent decline to 15th in market capitalization. The psychological aspects of market behavior can cause rapid shifts in price and ranking as emotions often overshadow fundamentals. Factors such as fear, uncertainty, and doubt can greatly influence investors’ willingness to buy or sell, thus impacting the overall market dynamics.

In this arena, understanding the trends of public sentiment and media narratives is crucial for investors. When the sentiment surrounding Bitcoin or Ethereum turns bearish, sell-offs can occur swiftly, leading to cascading effects throughout the cryptocurrency rankings. Thus, seasoned investors pay close attention to sentiment analysis in conjunction with traditional financial metrics to better inform their strategies and investment decisions.

Technological Innovations and Their Impact on Cryptocurrency Rankings

Technological innovations are continuously reshaping the landscape of cryptocurrencies, influencing everything from transaction speeds to energy consumption. For Bitcoin and Ethereum, advancements in blockchain technology are essential for their respective adaptions and rankings. Bitcoin, for instance, must confront challenges related to scalability and energy efficiency to maintain its leading position in the global asset market. Such technological enhancements are critical for bringing Bitcoin back into favor within investor circles.

On the other hand, Ethereum’s transition towards Ethereum 2.0 is a promising development that addresses many concerns surrounding its current market evaluation. Enhancements like sharding and the switch to a proof-of-stake consensus mechanism stand to improve the network’s efficiency and user experience. As these technological innovations take root, the rankings of both cryptocurrencies can shift dramatically, highlighting the importance of adapting to the technological advances that characterize the cryptocurrency ecosystem.

Frequently Asked Questions

What is the current Bitcoin market capitalization ranking in the global asset market?

According to 8MarketCap, Bitcoin’s market capitalization has dropped to 15th place in the global asset market rankings, currently valued at approximately $1.28 trillion.

How does Ethereum’s market value compare to Bitcoin’s ranking?

Ethereum has fallen to 88th place in the global asset market capitalization rankings, with a market value of about $228.47 billion, significantly lower than Bitcoin’s current valuation.

Which companies are currently ahead of Bitcoin in the market capitalization ranking?

Bitcoin, now ranked 15th, is trailing behind major companies such as Saudi Aramco, Tesla, Broadcom, and the Vanguard S&P 500 ETF.

What are the recent trading trends affecting Bitcoin and Ethereum market capitalization?

Bitcoin has seen a 24-hour decline of 11.41% and a 7-day decrease of 23.40%, while Ethereum experienced a 24-hour decline of 11.49% and a 7-day decrease of 32.33%.

How do Bitcoin and Ethereum’s rankings impact the cryptocurrency market overall?

The drop in Bitcoin’s and Ethereum’s rankings within the global asset market capitalization can indicate shifting investor confidence and market sentiment, impacting the overall cryptocurrency rankings.

What factors contributed to the decline in Bitcoin’s market capitalization ranking?

The decline in Bitcoin’s market capitalization ranking can be attributed to recent sharp price corrections, persistent market volatility, and competition from substantial traditional companies in the global asset market.

What significance does Bitcoin’s market cap ranking hold for investors?

Bitcoin’s market capitalization ranking is crucial for investors as it reflects its market dominance and investor confidence, influencing market trends and investment decisions in the broader cryptocurrency rankings.

Where can I find updated Bitcoin and Ethereum rankings in the cryptocurrency market?

Updated Bitcoin and Ethereum rankings, along with comprehensive cryptocurrency rankings, can be found on financial data platforms like 8MarketCap or other cryptocurrency market analysis websites.