Bitcoin long-term holders play a crucial role in the cryptocurrency market by holding their assets through the ups and downs of price fluctuations. Recently, the perception has shifted, suggesting that these steadfast investors are stepping back from selling, a trend that could signify a potential stabilization in the market. This dynamic is vital for Bitcoin investing, as long-term holders often dictate market sentiment and price movements. With an eye on long-term Bitcoin strategy, investors and analysts alike are closely monitoring these trends in an effort to understand the future trajectory of Bitcoin prices. As we delve into Bitcoin market analysis, it becomes clear that the behavior of long-term holders is integral to deciphering current cryptocurrency trends and the influence of ETF flows in Bitcoin.

The cohort of Bitcoin investors committed to holding their assets for an extended period has found themselves at the center of recent market discussions. These dedicated holders, often referred to as HODLers, have remained undeterred despite market volatility and are now being analyzed for their selling patterns, or lack thereof. Understanding the actions of these steadfast individuals is essential for grasping the broader implications of an effective long-term cryptocurrency strategy. As the cryptocurrency landscape evolves, the behaviors observed among these holders contribute significantly to Bitcoin price dynamics and trends, especially in the context of recent ETF developments. Tracking their movements offers valuable insights into market sentiment and helps investors navigate the unpredictable waters of Bitcoin trading.

Understanding the Role of Bitcoin Long-Term Holders in Market Dynamics

Bitcoin long-term holders play a crucial role in stabilizing the market, particularly in times of volatility. These holders, often referred to as ‘HODLers’, have a tendency to withstand market fluctuations without succumbing to the panic selling that can characterize the behavior of shorter-term investors. Their long-term strategy emphasizes patience, allowing them to weather downturns while maintaining their holdings. As the cryptocurrency market fluctuates, the actions of these individuals can serve as a barometer for broader investor confidence. When long-term holders reduce selling pressure, it can signal an emerging sense of stability and optimism for future price movements.

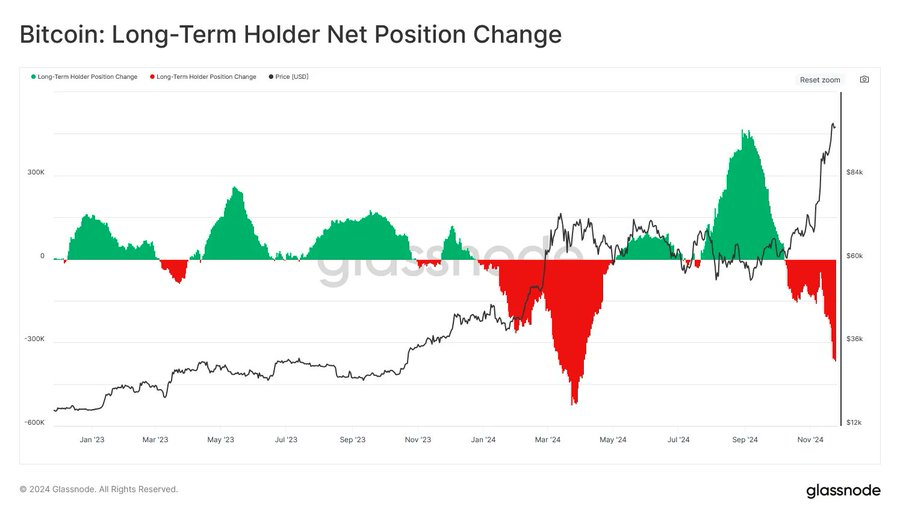

Recent analyses reveal that long-term holders have begun to refrain from selling. Such behavior could indicate a shift in market sentiment where these investors choose to accumulate rather than distribute their assets. This re-accumulation phase typically heralds the onset of a recovery in the market. Moreover, the presence of long-term holders can significantly influence Bitcoin’s price trends, particularly when combined with increasing institutional interest and positive cryptocurrency trends.

The Impact of Bitcoin ETF Flows on Short-Term Price Movements

Exchange-Traded Funds (ETFs) have substantially influenced the way Bitcoin behaves in response to market changes. Unlike the actions of long-term holders, ETF flows are characterized by rapid liquidity, making the market react swiftly to large inflows or outflows. For instance, a significant outflow from Bitcoin ETFs, such as BlackRock’s iShares Bitcoin Trust, can create immediate price adjustments that may overshadow the sales activity of long-term holders. This dynamic often results in discrepancies between on-chain data and actual market price movements, leading to the perception of increased volatility.

Investors must remain aware of how ETF flows interact with the behavior of Bitcoin long-term holders. While the latter may be holding their positions for extended periods, ETFs can introduce a layer of complexity that impacts daily trading volumes and sentiment. Therefore, tracking both on-chain movements and ETF flows provides a more comprehensive view of Bitcoin’s market landscape, allowing investors to make more informed decisions based on prevailing risks and opportunities.

Analyzing Cryptocurrency Trends and Their Implications for Investors

Cryptocurrency trends often indicate broader market behavior, influencing how investors approach Bitcoin investing. One current trend is the cautious optimism observed among longer-term investors, suggesting that they are shifting from distribution to accumulation phases. As seasoned investors adapt their strategies, they may rely more on market analysis rather than emotional responses to price fluctuations, indicating a maturation of the market as a whole. This shift may signal a readiness for a longer-term market recovery, setting the stage for new price patterns that could be more sustainable.

Moreover, in assessing cryptocurrency trends, market analysts emphasize the importance of understanding the correlation between Bitcoin’s performance and macroeconomic factors. The Fed’s monetary policies, such as interest rate adjustments, can significantly affect investor sentiment. As the market begins to recover from past declines, astute investors paying attention to both technical analysis and macroeconomic indicators stand a better chance of capitalizing on emerging opportunities.

Bitcoin Market Analysis: Current Conditions and Future Predictions

Current Bitcoin market analysis reveals a delicate balance between long-term holders and speculative traders. As selling pressure from long-term holders has diminished, it opens up opportunities for gradual upward movements in price, albeit at a cautious rate. Analysts are examining patterns in trader sentiment and position sizing, considering how these factors will shape future price action. Overall market conditions remain tenuous, but with a cautious outlook, Bitcoin could stabilize if the collective behavior of long-term holders aligns positively with increasing institutional adoption.

Future predictions regarding Bitcoin’s price trajectory hinge on multiple factors, including the actions of long-term holders and institutional flows. If LTHs continue to accumulate while ETF flows remain steady or positive, there may be a strong case for potential bullish movements in the coming months. Conversely, excessive distribution from long-term holders or erratic ETF flows could pose significant risks. Investors should remain alert to market signals and incorporate a long-term Bitcoin strategy into their investment frameworks, as calculated approaches tend to yield the best results in a fluctuating marketplace.

Deciphering the ‘Phantom’ Wallet Movement Phenomenon

One of the most confusing aspects of the current Bitcoin market is the phenomenon of ‘phantom’ wallet movements, which can mislead investors about actual selling pressure. Such movements often occur due to exchanges like Coinbase transferring large amounts of cryptocurrency between their internal wallets for security reasons. These movements lead to a temporary spike in blockchain activity, creating an illusion of increased selling or trading pressure when, in fact, there is no change in ownership. For long-term holders, understanding this distinction is crucial in interpreting market signals.

The misinterpretation of wallet movements can impact trading strategies significantly. When panic sellers react to phantom movements, it can provoke unnecessary market volatility, potentially discouraging long-term holders from staying the course. Thus, to navigate the current environment effectively, investors must develop an awareness around these phenomena and rely on accurate analyses that differentiate between actual market behaviors and mere operational adjustments by exchanges.

The Macro Economic Context: How it Influences Bitcoin Pricing

The macroeconomic context is a fundamental pillar to consider when analyzing Bitcoin pricing. Central bank policies, interest rates, and inflation trends these elements evidence the broader economic landscape, which invariably influences investor sentiment in cryptocurrency markets. Recently, with shifts in the Federal Reserve’s approach toward monetary policy, markets are recalibrating their expectations. Lowering interest rates can lead to increased liquidity, providing a conducive environment for Bitcoin’s resurgence, making market participants pay close attention to these large-scale economic signals.

Understanding the macro backdrop offers many strategic insights for Bitcoin investors. A keen awareness of anticipated economic trends allows long-term holders to adjust their strategies accordingly, positioning themselves better for potential market shifts. As the economic conditions evolve, the alignment of Bitcoin investment strategies with emerging macro trends could prove essential in maximizing returns while mitigating risks associated with unpredictable market fluctuations.

The Emotional Journey of Long-Term Bitcoin Investors

The emotional aspects of investing in Bitcoin, especially among long-term holders, play a significant role in determining market conditions. Investors who withstand the test of time often experience a series of psychological battles, from the euphoria of surging prices to the despair following sharp drops. This emotional journey can impact decision-making processes greatly, with each swing affecting their readiness to buy, hold, or sell. Recognizing these emotional trends helps delineate market behavior and can inform better strategic investment approaches.

Moreover, as the market landscape continues to change, the emotional resilience developed by long-term holders could shape the market’s future. If more investors adopt a steady mindset, focusing on accumulation instead of panic selling, this sentiment can lead to a less volatile market environment. Thus, cherishing the human aspect of investing is as critical as understanding analytics, since the psychological disposition of market participants often dictates substantial price movements in the Bitcoin ecosystem.

Examining Potential Market Outcomes for Bitcoin

As the Bitcoin market evolves, various potential outcomes emerge that depend on the interaction between long-term holders and external market factors. One possibility is that long-term holders cease distribution, allowing prices to stabilize, combined with positive ETF flows and a reduction in volatility. This would signal that the market has found a firm bottom and can begin the slow climb back to previous highs. Understanding this potential outcome requires monitoring both the psychological behavior of investors and the technical data that suggests where Bitcoin might be headed.

Conversely, if long-term holders begin to distribute significantly while ETF flows remain unpredictable, the market may find itself in a range of prolonged frustration or downside pressure. This uncertainty can deter new speculative investments, complicating recovery efforts. Awareness of these potential scenarios equips investors with the insights needed to navigate their strategies, whether it’s maintaining a steady hand in turbulent waters or adjusting to new market conditions as they unfold.

Preparing for the Next Chapter in Bitcoin Investing

As seasoned participants in the Bitcoin market prepare for the next chapter, several strategies become apparent. Long-term holders might choose to adopt a more cohesive strategy involving the careful observation of both chart signals and macroeconomic conditions. To thrive under such conditions, investors should prioritize developing a diversified cryptocurrency portfolio while remaining attentive to emerging trends and technologies within the sector that could provide competitive advantages for sustained growth.

Furthermore, fostering a community around knowledge-sharing and insights can enhance the collective understanding of market dynamics. Bitcoin long-term holders are in a unique position to mentor less experienced investors, guiding them toward successful investment strategies that blend patience with informed decision-making. As the market transitions, the ability to adapt intelligently will dictate who thrives and who falters, effectively shaping the future landscape of cryptocurrency investing.

Frequently Asked Questions

What should Bitcoin long-term holders consider when analyzing market trends?

Bitcoin long-term holders should focus on comprehensive market analysis, examining both on-chain metrics and macroeconomic factors. Understanding trends in ETF flows in Bitcoin can provide insights into potential price movements. Additionally, analyzing long-term Bitcoin strategies in relation to cryptocurrency trends will help holders navigate market volatility effectively.

How do Bitcoin long-term holders impact market sentiment during price fluctuations?

Bitcoin long-term holders significantly influence market sentiment, especially during volatile periods. Their selling patterns can lead to panic among short-term investors, while their tendency to hold can stabilize prices. Recognizing this behavior allows both long-term Bitcoin holders and new investors to make more informed decisions during market shifts.

What role do ETF flows play in the strategy of Bitcoin long-term holders?

ETF flows are crucial for Bitcoin long-term holders, as they can impact liquidity and trading volumes in the market. A significant outflow or inflow into Bitcoin ETFs may overshadow traditional long-term holder behavior, thereby affecting price movements. Understanding these dynamics can help holders adapt their long-term investment strategies accordingly.

How can long-term Bitcoin strategy benefit from tracking on-chain data?

Tracking on-chain data is essential for developing a successful long-term Bitcoin strategy. It provides insights into holder behavior, such as changes in long-term holder supply. By identifying trends and shifts in the market, long-term holders can assess when to accumulate or distribute their assets strategically.

Why is the behavior of Bitcoin long-term holders important during market recoveries?

The behavior of Bitcoin long-term holders is critical during market recoveries because their accumulation phase often precedes significant price increases. When long-term holders stop distributing and start accumulating, it usually indicates a potential bottom, signaling to the market that it may be time to shift focus toward recovery and growth.

What should Bitcoin long-term holders know about the concept of ‘phantom’ wallet movements?

Bitcoin long-term holders should be aware that ‘phantom’ wallet movements, such as internal transfers by exchanges like Coinbase, can create misleading signals about market behavior. These movements may appear to indicate selling pressure, but they do not represent actual changes in ownership, making it important for holders to filter out noise from genuine market trends.

How do long-term Bitcoin holders differentiate themselves from short-term traders?

Long-term Bitcoin holders differentiate themselves from short-term traders by their investment strategy and mindset. While short-term traders react to market fluctuations with rapid buying and selling, long-term holders focus on the fundamental value of Bitcoin and aim to weather market volatility, holding through price swings to achieve their investment goals over time.

What potential outcomes should Bitcoin long-term holders prepare for in shifting market dynamics?

Bitcoin long-term holders should prepare for several potential outcomes, including a market recovery driven by reduced selling pressure, a frustrating range of price stagnation, or a return to distribution that tests market patience. Monitoring ETF flows and macroeconomic indicators will aid holders in adjusting their strategies as conditions evolve.

| Aspect | Details |

|---|---|

| Current Selling Activity | Long-term holders have halted selling, indicating a potential market stabilization. |

| Market Sentiment | Panic sellers react to misleading data, creating a narrative of mass liquidations among long-term holders. |

| Market Analysis Insights | On-chain analysts note a recent small uptick (‘green candle’) in long-term holder supply, suggesting reduced selling pressure. |

| Major Influences | Coinbase’s internal wallet migrations mislead the analysis of long-term holder behavior due to apparent coin movements. |

| ETF Impact | ETF flows can overshadow long-term holder behavior, connoting more volatility in the market despite low selling from holders. |

| Market Recovery Scenarios | Three potential outcomes exist: genuine recovery, frustrating range, or return to distribution – each requiring monitoring. |

| Overall Market Outlook | Long-term holders stepping back indicates reduced market fragility, though macroeconomic factors still play a vital role. |

Summary

Bitcoin long-term holders have found themselves in a position of stability amidst misleading market signals. While recent trends indicate that long-term holders are refraining from selling, the macroeconomic backdrop and ETF flows still hold significant sway over market performance. Understanding this dynamic is crucial for long-term holders as they navigate potential market recoveries or corrections. Moving forward, observing long-term holder behavior will be key to gauging market sentiment and potential price movements.