In the volatile landscape of cryptocurrency, the Bitcoin liquidity signal stands out as a crucial indicator of market conditions, offering insights into potential price trajectories. As Bitcoin approaches the Federal Reserve’s impending policy decisions, its price movement has shown signs of underlying strain despite appearing relatively stable. Recent on-chain data has illuminated that investors are grappling with significant losses, while the market consolidation phase seems to mask a deeper liquidity transition at play. This shift, driven by the Fed’s actions, could have profound implications for Bitcoin’s future as the relationship between monetary policy and cryptocurrency becomes increasingly intertwined. Understanding this liquidity signal is essential for investors looking to navigate the complexities of Bitcoin’s evolving market dynamics.

The concept of liquidity in the financial realm often refers to how easily an asset can be converted into cash without affecting its market price. In the Bitcoin ecosystem, the liquidity signal serves as an essential gauge, indicating how the interplay between supply and demand influences market sentiment and price stability. As the Fed approaches a pivotal moment in its monetary policy, the intricacies of Bitcoin market consolidation reveal crucial insights into investor behavior and asset performance. A close examination of these liquidity dynamics highlights how shifts in Federal Reserve policies can trigger significant movements in the cryptocurrency landscape. By leveraging on-chain data analysis, market participants can better understand the implications of liquidity transitions for Bitcoin’s trajectory.

Understanding Bitcoin Liquidity Signals

Bitcoin has consistently demonstrated a strong relationship with liquidity signals, particularly those stemming from the Federal Reserve’s monetary policy. As we approach the end of the year, it’s clear that the Fed’s decisions will significantly impact Bitcoin’s market dynamics. The enormous $400 billion liquidity signal indicates a transition that Bitcoin traders must consider, as it has historically affected price movements, often more than anticipated interest rate cuts. Assessing on-chain data analysis, we can see how market participants are reacting to these liquidity shifts, ultimately affecting the broader Bitcoin ecosystem.

In more turbulent market conditions, such as those currently reflected in the significant unrealized losses across the board, the market appears to be heading into an important liquidity transition period. This transition not only offers an insight into investor confidence but also into potential Bitcoin market consolidation phases as the Fed’s policies adapt to changing economic conditions. Understanding these liquidity signals is crucial for predicting upcoming price movements and market stability.

Frequently Asked Questions

What is the Bitcoin liquidity signal and why is it important for Bitcoin price movement?

The Bitcoin liquidity signal refers to the underlying monetary conditions, such as those influenced by Federal Reserve policies, that affect the liquidity available in the market. It is crucial for Bitcoin price movement because changes in liquidity can lead to significant fluctuations in Bitcoin’s value, as the asset tends to follow liquidity cycles rather than just interest rate adjustments.

How does Federal Reserve policy impact Bitcoin liquidity signals?

Federal Reserve policy directly impacts Bitcoin liquidity signals by dictating monetary supply and interest rates. For example, when the Fed transitions from Quantitative Tightening to liquidity expansion, it often leads to increased investments in Bitcoin, as seen in previous cycles, thereby enhancing its price.

What role does on-chain data analysis play in understanding Bitcoin liquidity signals?

On-chain data analysis plays a vital role in understanding Bitcoin liquidity signals by providing insights into market behavior, such as investor losses, coin distribution, and supply tightness. This data helps in assessing the underlying market structure and potential price movements during liquidity transitions.

How can Bitcoin market consolidation indicate a shift in liquidity conditions?

Bitcoin market consolidation can indicate a shift in liquidity conditions by reflecting a period of indecision among traders. When consolidation occurs with low volatility, it may mask underlying market stress, suggesting an imminent liquidity transition as investors prepare for potential price movements.

What is liquidity transition and its significance for Bitcoin investors?

Liquidity transition refers to a shift in the availability of liquidity in the market, often influenced by monetary policy changes. For Bitcoin investors, understanding liquidity transitions is significant because they can lead to substantial price changes; an expansion of liquidity typically favors price increases, while contraction can result in downward price pressures.

How does Bitcoin respond to changes in the Federal Reserve’s balance sheet strategy?

Bitcoin historically responds to changes in the Federal Reserve’s balance sheet strategy, as shifts towards reserve rebuilding often lead to increased demand for Bitcoin. Such policy changes can provide a favorable environment for Bitcoin price appreciation, particularly during liquidity expansion phases.

What indicators suggest we are experiencing a Bitcoin liquidity pivot?

Indicators such as a decrease in leverage in futures markets, rising long-term wallet accumulations, and reducing exchange balances suggest we may be experiencing a Bitcoin liquidity pivot. These signals indicate a tightening supply environment and potential upward price momentum as liquidity sends positive signals.

Why is monitoring labor market data essential for analyzing Bitcoin liquidity signals?

Monitoring labor market data is essential for analyzing Bitcoin liquidity signals because changes in employment trends can influence Federal Reserve policy decisions. A weaker labor market may prompt the Fed to adopt more liquidity-friendly policies, which could positively influence Bitcoin prices.

What strategies can Bitcoin traders implement during periods of market consolidation?

During periods of market consolidation, Bitcoin traders can implement strategies like setting clear price levels for entry and exit, using on-chain metrics for insights on supply and demand, and monitoring Federal Reserve signals to anticipate potential liquidity transitions that could impact price movements.

How does a strong correlation between Bitcoin and traditional assets like gold reflect liquidity conditions?

A strong correlation between Bitcoin and traditional assets such as gold often reflects liquidity conditions, as both assets may react similarly during periods of monetary policy shifts. When investors anticipate increased liquidity, capital flows may favor both Bitcoin and gold, indicating shared market dynamics.

| Key Aspect | Details |

|---|---|

| Bitcoin and the Federal Reserve | Bitcoin follows a $400 billion liquidity signal from the Federal Reserve, which holds greater significance than rate cuts. |

| Current Market Conditions | Investors are facing daily losses nearing $500 million while ultra-low volatility masks underlying stress. |

| Liquidity Transition | The end of Quantitative Tightening on December 1 marks a pivotal shift towards potential Reserve Management Purchases (RMP), anticipated to be detailed in the Fed’s upcoming announcements. |

| Impact on Bitcoin | Upcoming policy shifts and the labor market’s condition could significantly influence Bitcoin’s price, making it sensitive to liquidity expectations rather than interest rate changes. |

| Technical Analysis | A breakthrough above $93,500 could signal bullish momentum while resistance at $82,000-$75,000 suggests strong structural support for price. |

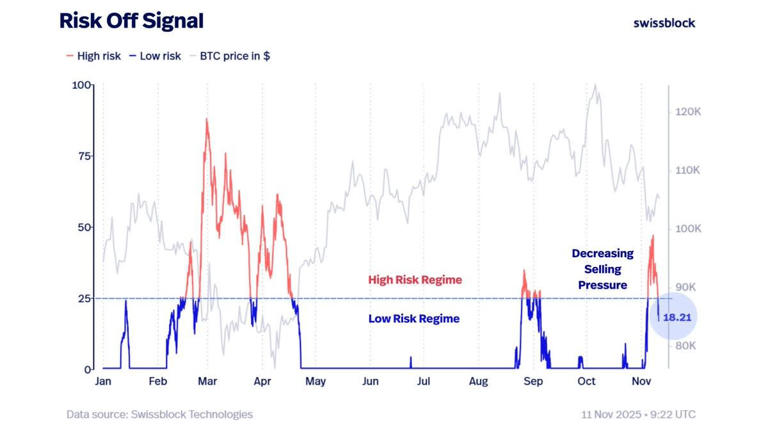

| Market Dynamics | While some selling pressure exists, evidence of accumulation shows a potential bottom forming as capital flows cautiously respond to market conditions. |

Summary

Bitcoin liquidity signal plays a crucial role in the current market landscape, as Bitcoin navigates through decreased volatility amidst underlying financial strains. The liquidity conditions tied to the Federal Reserve’s policy changes are impacting investor sentiment and Bitcoin’s price direction. Understanding this liquidity signal is essential for anticipating future price movements, as Bitcoin’s responsiveness to upcoming Federal Reserve developments will likely shape its market trajectory going forward.