Bitcoin liquidity has become a key topic of discussion in the wake of significant shifts in the cryptocurrency market. Recently, Bitcoin has lost an estimated $2 trillion in its liquidity safety net, leaving the asset vulnerable to unprecedented volatility. Analysts conducting Bitcoin price analysis are closely monitoring how these changes will affect future price predictions and overall market trends. The impact of global liquidity levels, influenced by decisions from the Federal Reserve, may create new challenges for investors as they navigate through these turbulent times. As we delve deeper into the complexities of Bitcoin’s liquidity, understanding its implications on crypto market trends and price trajectories becomes essential.

The liquidity of Bitcoin is often discussed in relation to its overall market health and investor confidence. In financial circles, this concept—often referred to as market depth or cash flow—has critical implications for pricing movements and trends in the broader cryptocurrency ecosystem. As market participants analyze recent shifts in global cash availability and the potential influence of central banks, discussions around Bitcoin’s viability intensify. The ramifications of decreasing liquidity, especially in light of the Federal Reserve’s changing monetary stance, are of particular interest to those predicting future price movements. Exploring these dynamics offers valuable insights into the evolving nature of digital currencies.

Analyzing Bitcoin Liquidity: Impacts on Price Stability

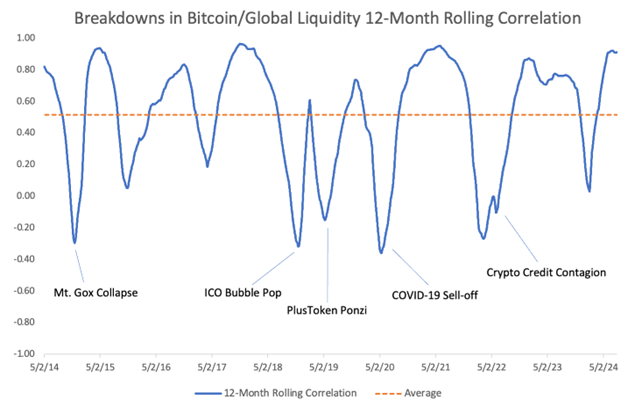

Bitcoin liquidity has become a topic of intense discussion, particularly in light of its significant recent shifts. The loss of a $2 trillion liquidity safety net has left Bitcoin vulnerable, exposing it to potential price volatility. As the Federal Reserve’s mechanisms, which previously supported the crypto market, face a downturn, investors are left questioning the sustainability of Bitcoin’s rally in 2025. With key liquidity metrics fluctuating, the analysis of Bitcoin’s liquidity levels is crucial for understanding future price stability.

Market trends indicate that liquidity plays a pivotal role in Bitcoin’s price behavior, and the impact is felt across the broader crypto market. The juxtaposition of high liquidity indices at the beginning of 2025 against the current tightening situation necessitates a closer look at how these changes influence Bitcoin price predictions. If liquidity drains further, Bitcoin’s resilience and its ability to maintain price support may diminish, leading to potential bearish trends that investors should be wary of.

Global Liquidity: Its Role in Shaping Crypto Market Trends

The concept of global liquidity has a profound influence on the crypto market and specifically on Bitcoin’s performance. In early 2025, global liquidity was thriving, buoyed by record levels of cross-border bank credit, which provided a robust foundation for price increases. However, as the quarter progressed and reports from institutions like the Bank for International Settlements began to highlight a decline in liquidity, concerns arose over the sustainability of these market conditions, leading to calls for a reassessment of Bitcoin’s upcoming trajectory.

Recent data suggests that while liquidity levels reached impressive heights early in the year, the subsequent downturn hints at a precarious future for Bitcoin and its counterparts. This shift shifts attention to the Federal Reserve’s decisions, which are crucial in determining liquidity extensions for the crypto sector. The interplay between these global liquidity cycles and Bitcoin performance underscores the need for investors to remain vigilant regarding monetary policy changes and how they might directly affect market dynamics.

Federal Reserve’s Impact on Bitcoin: A Crucial Analysis

The Federal Reserve has been a decisive player in shaping the crypto landscape, manifesting effects that ripple through Bitcoin pricing and investor behavior. The recent depletion of the Fed’s reverse repo facility indicates a significant shift, as this mechanism had long acted as a safety net for cryptocurrencies. As liquidity begins to tighten, understanding the implications of the Fed’s policies becomes vital for predicting Bitcoin’s future, particularly as monetary policies can swiftly alter market conditions.

Additionally, the Fed’s approach towards increasing or maintaining liquidity will directly influence Bitcoin price predictions, as any sign of contraction can lead to market apprehension. If the Federal Reserve continues on its path of diminishing liquidity, cryptocurrency investors could face considerable challenges, including potential price drops. Thus, the relationship between the Fed’s policy decisions and Bitcoin is a crucial area for ongoing observation, especially as we head into an uncertain economic climate.

Bitcoin Price Predictions: Evaluating Technological and Economic Factors

Amidst the shifting landscape of liquidity, Bitcoin price predictions must take into account both technological advancements and macroeconomic variables. The interplay of these elements determines how Bitcoin performs in the broader financial context. As innovations in blockchain technology and shifts in market psychology unfold, expectations surrounding Bitcoin’s valuation must adapt accordingly. The fusion of these elements forms a complex narrative that reflects both the cryptocurrency’s potential and the risks inherent in investing.

With analysts citing both the capabilities of tech advancements and the shadows cast by economic downturns, price predictions for Bitcoin promise to be a balance of cautious optimism and realistic challenges. Evolving market dynamics necessitate that investors remain educated on both the emerging technologies in blockchain and the economic principles that dictate liquidity flows. With the current liquidity landscape in flux, only time will reveal where Bitcoin stands in the evolving price forecasts.

Cross-Border Capital Data: Navigating Bitcoin’s Market Momentum

CrossBorder Capital’s high-frequency data has provided invaluable insights into the current state of Bitcoin’s market momentum, revealing a slowing trend amidst prior highs. Their assessment highlights the global liquidity shift that became apparent by the end of 2025, indicating that Bitcoin may have reached its peak momentum earlier in the year. This data serves as both a warning and a guide for investors, emphasizing the importance of monitoring real-time indicators that can affect potential market shifts.

As the global economic cycle indicates a downward trend, the importance of cross-border capital flows cannot be overstated. Understanding these data points becomes essential for investors looking to predict Bitcoin’s next moves, particularly as liquidity conditions evolve. By keeping a keen eye on such analyses, traders can better navigate the complexities of the crypto landscape and make informed decisions about their investments in or around Bitcoin.

Exploring the Future of Bitcoin: Risks and Opportunities Ahead

The future of Bitcoin is fraught with both risks and opportunities as it navigates through shifting liquidity channels and economic headwinds. The loss of a significant liquidity cushion may trigger volatility, but it could also prompt essential adaptations in investment strategies. When considering potential scenarios for Bitcoin’s price movement, investors must weigh the implications of macroeconomic indicators alongside technological advancements in the cryptocurrency sector.

Investing in Bitcoin and cryptocurrencies at large will require a nuanced understanding of the emerging trends, particularly as central banks globally respond to changing economic situations. Investors should not only focus on immediate price analysis but also consider the broader context encompassing international liquidity dynamics. The ongoing fluctuations could very well identify new investment strategies and opportunities for growth in the assets in the years to come.

The Role of Investor Sentiment in Bitcoin’s Market Performance

Investor sentiment plays a critical role in determining Bitcoin’s market performance, often serving as an influencer during phases of both bullish and bearish momentum. In times of high liquidity, positive investor sentiment can propel Bitcoin prices higher, leading to increased trading volumes and market activity. Conversely, negative sentiment amid liquidity constriction can result in swift price declines and heightened market fears. Understanding these psychological triggers helps investors better predict market movements.

As Bitcoin navigates through its current challenges, investor sentiment will be shaped by external economic pressures, regulatory changes, and technological advancements. Managing psychological factors in investing will be just as crucial as considering market metrics. The ongoing interplay between investor emotions and market realities underscores the need for a comprehensive approach to cryptocurrency investing, especially as Bitcoin faces uncharted territories.

Market Volatility: Understanding Bitcoin’s Corrections and Bounces

Market volatility is an intrinsic part of Bitcoin’s existence, with the cryptocurrency characterized by its rapid price corrections and occasional rebounds. Following the significant liquidity withdrawal, Bitcoin is expected to experience sharper corrections, which are common in cyclical patterns. Understanding the causes behind these fluctuations, from macroeconomic news to market sentiment, can help investors prepare for potential price corrections that are part of the trading landscape.

Investors must remain flexible and reactive to sudden market changes while utilizing sound strategies to capitalize on dips and upswings. Recognizing patterns and adopting a disciplined approach could afford investors ample opportunities in an otherwise volatile environment. By doing so, traders can navigate the choppy waters and potentially secure gains, all while remaining cognizant of the risks associated with market volatility.

Conclusion: Bitcoin’s Evolving Landscape and Future Considerations

As Bitcoin moves into a new phase against the backdrop of changing liquidity conditions and macroeconomic factors, the landscape presents both challenges and prospects for investors. The need for strategic adaptability becomes paramount, especially with the Federal Reserve’s influence looming large over Bitcoin price predictions. Understanding the interplay of technology, investor sentiment, and liquidity flows will be vital for anyone looking to navigate the crypto market successfully.

Going forward, the focus should not only be on historical trends but also on how evolving economic conditions will reshape the future of Bitcoin. As the crypto ecosystem continues to mature, investors should adopt a holistic view that encompasses the broader financial environment, paving the way for informed investment decisions in the ever-evolving crypto marketplace.

Frequently Asked Questions

How does Bitcoin liquidity impact Bitcoin price analysis?

Bitcoin liquidity is crucial for price analysis as it dictates how easily Bitcoin can be bought or sold without significantly affecting its price. A high liquidity environment allows for minimal price fluctuations, enabling investors to make more accurate assessments of market trends.

What are the implications of global liquidity on Bitcoin price prediction?

Global liquidity influences Bitcoin price prediction by altering investor sentiment and market dynamics. When global liquidity is high, it can suggest strong investor confidence and potential upward price momentum for Bitcoin. Conversely, tightening liquidity could forecast a bearish trend in the crypto market.

How does the Federal Reserve’s impact on crypto affect Bitcoin liquidity?

The Federal Reserve plays a pivotal role in Bitcoin liquidity through its monetary policies. When the Fed tightens monetary policy or reduces its balance sheet, it can lead to decreased liquidity in the broader market, which may negatively affect Bitcoin’s liquidity and overall price stability.

What effects do crypto market trends have on Bitcoin liquidity?

Crypto market trends can significantly impact Bitcoin liquidity by shaping investor behavior. For example, a bullish trend may enhance liquidity as more investors enter the market, while a bearish trend could cause liquidity to tighten as investors retreat, making it difficult to execute large trades without affecting prices.

Why is monitoring global liquidity important for Bitcoin investors?

Monitoring global liquidity is essential for Bitcoin investors because it offers insights into market health and potential price movements. Significant changes in global liquidity can foreshadow shifts in Bitcoin’s liquidity and volatility, helping investors make informed decisions.

What role does reverse repo play in Bitcoin liquidity assessment?

Reverse repo facilities, like those of the Federal Reserve, influence Bitcoin liquidity by impacting the amount of cash available in the financial system. When the reverse repo rates drop, it may indicate reduced liquidity support for Bitcoin, influencing market stability.

How can investors prepare for fluctuations in Bitcoin liquidity?

Investors can prepare for fluctuations in Bitcoin liquidity by diversifying their portfolios, setting stop-loss orders, and closely monitoring macroeconomic indicators, including global liquidity trends, which might signal impending changes in Bitcoin’s liquidity landscape.

What are the indicators of a liquidity squeeze for Bitcoin?

Indicators of a liquidity squeeze for Bitcoin include a significant drop in trading volume, a decrease in market depth, and negative trends in global liquidity indices. These factors could signal future challenges for Bitcoin prices.

| Key Point | Explanation |

|---|---|

| Loss of $2 Trillion Liquidity | Bitcoin has lost a significant safety net that previously provided support against market pressures. |

| Empty Reverse Repo Facility | The Federal Reserve’s reverse repo facility is now empty, which previously helped buoy crypto prices. |

| Diverging Perspectives on Liquidity | Analysts are split; one side argues liquidity is still strong, while the other sees signs of a decline. |

| Global Liquidity Index Trends | Global liquidity indices showed record highs until the last quarter of 2025, indicating shifts in the economic landscape. |

| Decrease in Total Assets | Net liquidity has decreased by about $132 billion as formulations from the Fed change, indicating tightening conditions. |

| Impending Uncertainty for Bitcoin | If the Fed does not create new liquidity sources, Bitcoin’s price stability and growth could be jeopardized. |

| Dependence on Central Bank Actions | Future outcomes for Bitcoin largely depend on policies and decisions made by major central banks worldwide. |

Summary

Bitcoin liquidity has recently come under significant pressure following the loss of a $2 trillion safety net. This loss indicates vulnerabilities in Bitcoin’s market structure as the foundational liquidity that supported its price has diminished. Analysts are cautious as the Fed’s actions, particularly concerning the reverse repo facility and overall monetary policy, will largely influence Bitcoin’s future performance. As the global liquidity landscape shifts, the upcoming decisions by central banks will be crucial for determining what lies ahead for Bitcoin.