In recent trading sessions, Bitcoin liquidations have surged dramatically, capturing the attention of crypto enthusiasts and investors alike. In just one hour, over 20 million dollars worth of liquidations swept through the markets, with BTC liquidations alone tallying up to an astounding 12.78 million dollars. This trend highlights critical liquidation analysis in the volatile world of crypto, where drastic price fluctuations can lead to significant market shifts. Coinglass market data indicates that of the total 20.28 million dollars in liquidated positions, a staggering 19.5 million dollars came from short positions, raising important discussions around BTC market trends. As traders seek to interpret these crypto liquidation news, understanding the implications of Bitcoin and Ethereum liquidations statistics becomes more crucial than ever.

In the ever-changing landscape of cryptocurrencies, a notable trend is the frequency of margin calls and forced liquidation events. These occurrences, often referred to as crypto sell-offs, reflect how swiftly traders’ bets can unravel, especially in a high-stakes environment like Bitcoin. Recent reports emphasize the importance of analyzing liquidation volumes within the digital currency markets, showcasing the significance of Ethereum’s liquidation figures in comparison to Bitcoin’s. By tapping into robust datasets like those provided by Coinglass, market participants can glean insights into trading behavior and the overall health of the crypto ecosystem. Understanding these liquidation patterns not only aids in minimizing risk but also informs strategies in responding to market upheavals.

Understanding Recent Bitcoin Liquidations

In the world of cryptocurrency, liquidations are a critical aspect to monitor, especially with Bitcoin (BTC) liquidations often leading the pack. Recently, over $12.78 million in BTC liquidations were reported within a single hour, contributing significantly to the cryptocurrency market’s volatility. This surge in liquidations serves as a stark reminder of how swiftly market conditions can change, often triggered by price movements that catch traders off guard. Understanding the underlying factors that contribute to these substantial liquidations helps investors better navigate the turbulent waters of the cryptocurrency market.

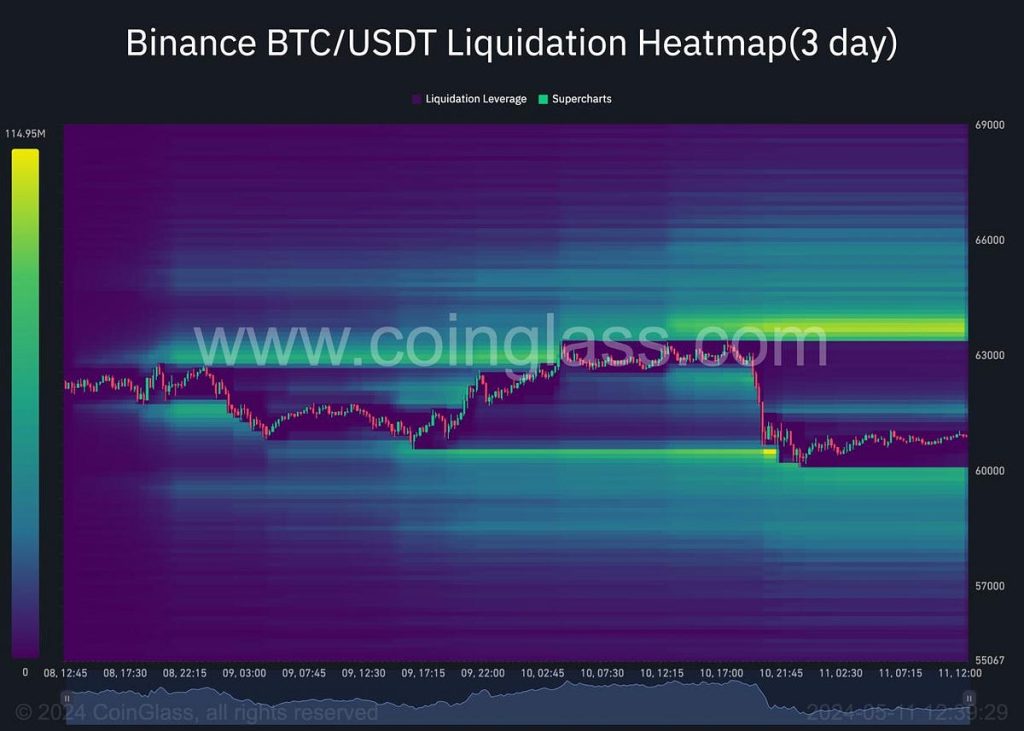

Liquidations occur when leveraged positions are closed automatically due to the asset’s price slipping beyond a certain threshold. The recent snapshot provided by Coinglass market data indicates a broader trend where BTC and ETH are both experiencing significant liquidations, with total market liquidations reaching a staggering $20.28 million. This trend highlights the increasing risk appetite in the crypto space and the ever-present potential for sudden market corrections that can lead to widespread liquidation activity.

Analyzing Liquidation Trends in the Crypto Market

Liquidation trends provide valuable insight into the overall sentiment of the crypto market. In the past hour, the marketplace witnessed a remarkable shift with long positions totaling $770 thousand being liquidated, while short positions dominated with $19.5 million. This disparity indicates that traders might be overly optimistic about a price rebound, which, when unanchored by tangible market catalysts, results in a harsh correction and a wave of liquidations. Analyzing this data with respect to BTC market trends gives investors an edge in decision-making.

Moreover, keeping an eye on liquidation statistics from various cryptocurrency assets like Ethereum (ETH) is equally crucial. With ETH liquidations hitting $2.31 million, it is evident that the sentiment around both leading cryptocurrencies is interlinked. The interplay between Bitcoin and Ethereum liquidations serves as a barometer for market trends and can often predict future price movements. Traders must remain updated on crypto liquidation news to stay ahead, given the direct link between liquidations and market volatility.

Impact of Liquidations on Bitcoin Market Performance

The impact of liquidations on Bitcoin’s performance extends beyond immediate price fluctuations. When significant amounts are liquidated, it can lead to heightened volatility, causing prices to spiral quickly in either direction. This was seen recently when BTC liquidations alone accounted for over 12 million dollars, which can significantly affect retail and institutional investor sentiment alike. Consequently, such movements may prompt traders to reassess their strategies and risk management approaches to remain viable in this unpredictable environment.

Furthermore, patterns observed in liquidation data also reflect broader market psychology. Traders often react to significant liquidation events by pulling back or adjusting their strategies, as evident from BTC and ETH market performance fluctuations following these data points. Understanding how these dynamics play out across different market segments—including derivatives and spot markets—can provide investors with a more comprehensive picture of where opportunities may arise amidst the chaos of liquidations.

Exploring the Correlation Between BTC and ETH Liquidations

BTC and ETH, the two largest cryptocurrencies by market capitalization, often influence each other’s liquidation outcomes. The recent data suggests a significant connection, as both assets witnessed considerable liquidation amounts within the same time frame. This correlation highlights the interconnected nature of the cryptocurrency markets where Bitcoin liquidations could set off a chain reaction impacting Ethereum and vice versa. Understanding this co-dependency is essential for traders looking to optimize their strategies during volatile periods.

Additionally, analyzing liquidity within these blockchain networks reveals critical insights. For instance, a big wave of BTC liquidations can create ripple effects that impact Ethereum liquidation statistics as traders shift their capital between these digital assets. They may be influenced by performance expectations or hedging strategies that involve switching between BTC and ETH based on the prevailing market mood. By monitoring these interrelated liquidation patterns, traders can better position themselves for potential gains or minimize losses.

Leveraging Coinglass Data for Liquidation Insights

Utilizing Coinglass market data offers traders and investors an advantageous edge in understanding liquidation trends within the cryptocurrency landscape. Coinglass provides real-time insights into not just the aggregate liquidation amounts, but also the composition of these liquidations—detailing how much comes from long versus short positions. Such detailed information helps traders identify prevailing trends and market sentiment which are crucial for crafting informed trading strategies.

Moreover, the availability of high-quality liquidation analysis on platforms like Coinglass empowers crypto investors to react swiftly to changing market conditions. When $20.28 million total liquidations occurred in just one hour, the implications could be far-reaching, and timely data can inform decisions around entering or exiting positions shortly thereafter. The precise tracking of liquidation data allows investors not only to make reactions but also to anticipate market movements based on historical trends.

Strategies to Mitigate Liquidation Risks in Trading

Developing effective strategies to mitigate liquidation risks is imperative for any trader in the cryptocurrency landscape. With the intense fluctuations in Bitcoin and Ethereum prices, a comprehensive risk management strategy is crucial. This involves setting strict stop-loss levels to prevent positions from being automatically liquidated due to adverse market movements. By employing a disciplined approach to trading, especially during high volatility periods, investors can safeguard their assets against the adverse effects of mass liquidations.

In addition, diversifying investment portfolios across multiple cryptocurrencies can also help mitigate risks associated with BTC liquidations. By spreading investments, traders can reduce their exposure to sudden price drops in a single asset, thus balancing their overall risk. Furthermore, using advanced charting tools and analytics platforms can assist traders in identifying potential liquidation zones, thus enabling them to make data-driven decisions that align with market movements.

The Role of Speculation in Crypto Liquidations

Speculation plays a significant role in the occurrence of liquidations within the crypto marketplace. Traders often take on high leverage when speculating on short-term price movements, increasing the total liquidations when market sentiment shifts abruptly. The charged atmosphere around key events or announcements can result in a volatility spike, leading traders to liquidate positions en masse. The recent statistics indicate how speculative trading can lead to a rapid series of liquidations, particularly in highly leveraged positions.

Given the volatile nature of cryptocurrencies, understanding the balance of speculative trading versus fundamental analysis is paramount. While speculation can yield quick profits, reliance solely on this without adequate risk management often leads to the pitfalls of liquidation. Therefore, a well-rounded strategy that incorporates both short-term speculative moves and long-term investments based on market fundamentals can provide a more sustainable path within the crypto ecosystem.

Interpreting Liquidation Data: A Guide for Investors

For investors looking to capitalize on market fluctuations, interpreting liquidation data is essential for making informed decisions. By understanding how and when liquidations occur, traders can gain critical insights into market sentiment and the likelihood of price reversals. Tools like Coinglass provide comprehensive analyses that break down liquidation events and their impact on market momentum, which can give traders a distinct advantage in their trading strategies.

Investors should consider not just the overall liquidation figures, but also the context behind them. For instance, the recent surge in BTC liquidations may indicate over-leveraged positions being punished by market corrections. Recognizing these trends allows traders to engage more strategically, choosing to go against the tide when sentiment is overly pessimistic and capitalizing on potential rebounds. Effective interpretation of liquidity data can turn potential pitfalls into golden opportunities for savvy investors.

Forecasting Market Movements Through Liquidation Patterns

The analysis of liquidation patterns can be an effective tool for forecasting market movements. Observing points at which significant liquidations occur often provides clues about the upcoming price trajectory. If liquidations are heavily weighted toward short positions during a price drop, it could signal a potential reversal, indicating that market participants are squeezing shorts and may lead prices on an upward trajectory. As such, traders who closely monitor these patterns can position themselves advantageously.

Moreover, the timing of liquidations can also broadcast potential changes in market direction. Data showing multiple liquidations in a short period might indicate a panic sell-off, giving informed traders a heads-up on when to capitalize on buying opportunities amid fear-driven markets. By understanding these trends and learning how to read them effectively, traders can greatly enhance their ability to predict market movements, adapting quickly to capitalize on shifting trends.

Frequently Asked Questions

What are the recent Bitcoin liquidations reported in the market?

In the past hour, Bitcoin liquidations reached approximately 12.78 million dollars, indicating a significant shift in market sentiment. These figures are part of a larger total of over 20 million dollars in liquidations across the entire cryptocurrency network.

How does liquidation analysis impact Bitcoin trading strategies?

Liquidation analysis helps traders understand market dynamics by revealing how much capital is being liquidated. For Bitcoin, the recent data shows liquidations of 12.78 million dollars, primarily driven by 19.5 million dollars in short position liquidations. This information can guide traders in adjusting their strategies to manage risk effectively.

What trends can be observed in recent BTC market trends regarding liquidations?

Recent BTC market trends indicate heightened volatility, with significant liquidation events such as the 12.78 million dollars in Bitcoin liquidations reported recently. Analyzing these trends through liquidation analysis can provide crucial insights for traders looking to navigate the fluctuating crypto market.

Where can I find the latest crypto liquidation news including Bitcoin and Ethereum statistics?

The latest crypto liquidation news, including statistics on Bitcoin (BTC) and Ethereum (ETH) liquidations, can be found on platforms like Coinglass. For instance, recent data highlights that ETH liquidations totaled 2.31 million dollars, contributing to a broad understanding of market movements.

How does Coinglass contribute to understanding Bitcoin liquidations?

Coinglass provides essential market data that helps traders analyze Bitcoin liquidations. Their comprehensive reports reveal total liquidations, such as the 20.28 million dollars reported recently, breaking down figures into specific assets, including 12.78 million dollars in Bitcoin and 2.31 million dollars in Ethereum, allowing for informed trading decisions.

What are the implications of short position liquidations for Bitcoin?

The recent spike in Bitcoin liquidations, particularly the 19.5 million dollars in short positions, illustrates a significant market shift that can lead to price volatility. Understanding the implications of such liquidations is crucial for traders, as they can indicate bullish sentiment or a potential price rebound in the BTC market.

Can liquidation statistics predict future Bitcoin market movements?

While liquidation statistics, like the recent 12.78 million dollars in Bitcoin liquidations, can provide insights into market sentiment and potential reversals, they should be used in conjunction with other analytical tools. Traders often combine liquidation analysis with technical indicators and overall market trends to make informed predictions about Bitcoin’s future movements.

| Metric | Value |

|---|---|

| Total Liquidations (in USD) | 20.28 million |

| Liquidations of Long Positions (in USD) | 770 thousand |

| Liquidations of Short Positions (in USD) | 19.5 million |

| BTC Liquidations (in USD) | 12.78 million |

| ETH Liquidations (in USD) | 2.31 million |

Summary

Bitcoin liquidations saw a significant event recently, with over 20 million dollars worth of liquidations occurring swiftly across the market. This indicates not only high volatility but also a keen interest from traders, resulting in major liquidations both for long and short positions. Such shifts in the market can dramatically impact trading strategies and investment outlooks for many participants in the cryptocurrency space.

Related: More from Bitcoin News | AI, BTC Miners Issue High | Bitcoin Above $69K? Glassnode Weighs In