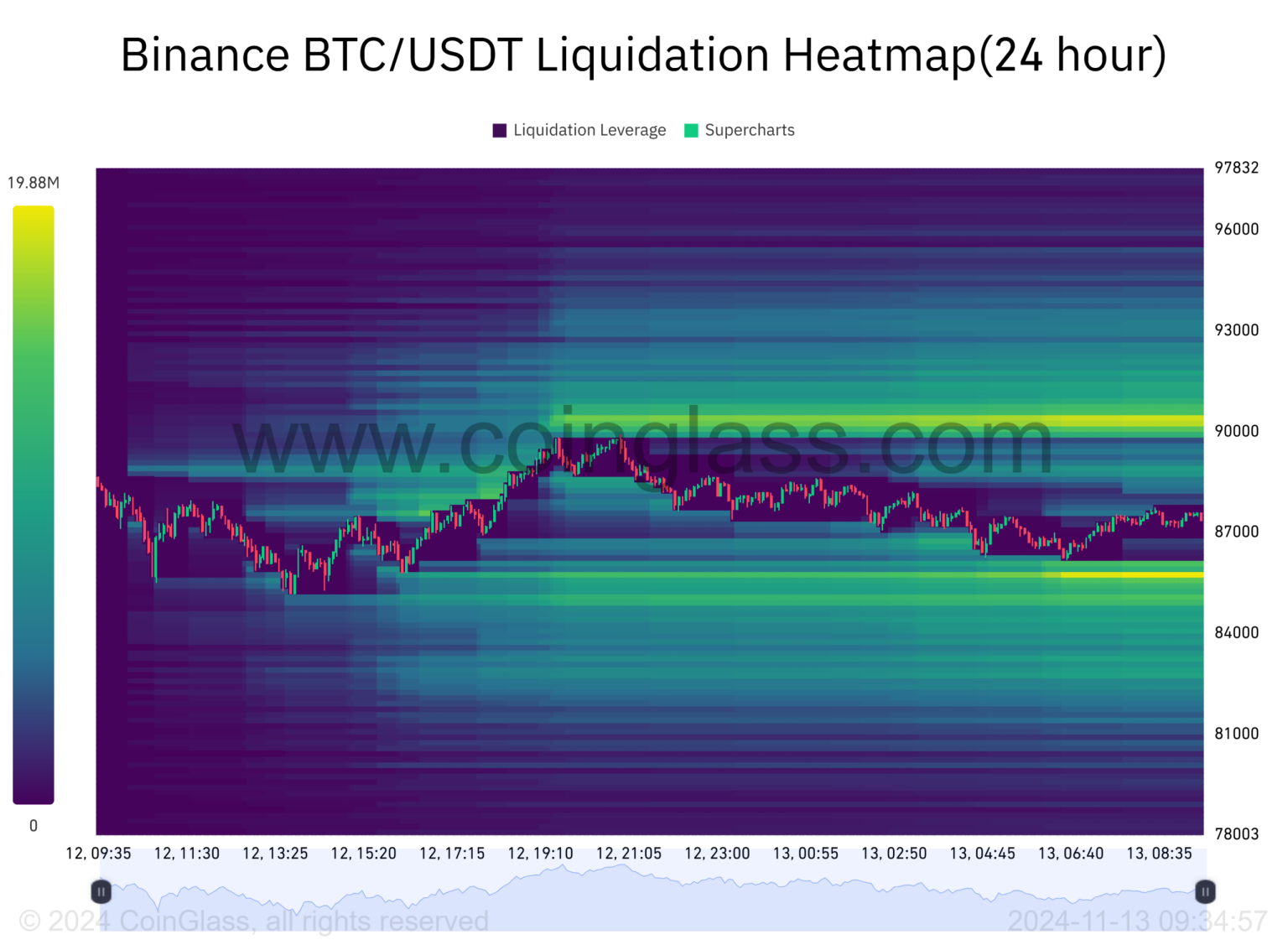

Bitcoin liquidations continue to be a significant trend within the volatile crypto market, reflecting the intense market dynamics at play. In just the past hour, over $80 million was liquidated from various positions, with BTC liquidations alone accounting for a staggering $48.34 million. According to Coinglass data, these liquidations reveal how traders are responding to rapid price shifts, highlighting critical patterns in BTC price analysis. Moreover, the predominance of long position liquidations, totaling approximately $65.08 million, illustrates the current bearish sentiment gripping the crypto landscape. As we delve deeper into liquidation trends, understanding the implications of these numbers becomes essential for navigating the complexities of Bitcoin and Ethereum liquidations effectively.

The recent wave of liquidations in the cryptocurrency sector showcases the precarious nature of trading in digital assets like Bitcoin and Ethereum. As volatility sweeps through the markets, many investors find themselves forced to liquidate their positions, leading to significant losses and an overall decline in market confidence. Coincidentally, analyzing BTC price movements as well as the broader landscape of crypto market liquidations can provide valuable insights into trading strategies. Beyond that, monitoring data from tools like Coinglass can enhance one’s understanding of liquidation behavior and market trends. In this environment, grasping alternative terms such as forced sales or asset liquidations becomes crucial for those keen to make sense of the ongoing upheaval.

| Aspect | Value |

|---|---|

| Total Liquidations (Last Hour) | $80.26 million |

| BTC Liquidations | $48.34 million |

| ETH Liquidations | $16.23 million |

| Long Position Liquidations | $65.08 million |

| Short Position Liquidations | $15.18 million |

Summary

Bitcoin liquidations have surged beyond $80 million in recent trading sessions, indicating significant volatility in the market. In just the past hour, the total liquidated amount reached approximately $80.26 million, with a notable focus on long positions. Specifically, Bitcoin liquidations alone accounted for $48.34 million, highlighting the substantial impact on BTC traders. Monitoring these fluctuations is essential for understanding market dynamics and investor behavior.

Understanding Bitcoin Liquidations in the Crypto Market

In the ever-volatile landscape of cryptocurrency, Bitcoin liquidations play a pivotal role in shaping market dynamics. Today’s events reveal a staggering $48.34 million in BTC liquidations, highlighting the intense pressure that long positions face within the crypto market. These liquidations typically occur when traders fail to meet margin calls, resulting in their positions being forcibly closed. As liquidations surge, they can significantly impact BTC price analysis, often leading to sharp price fluctuations that echo throughout the entire market.

Liquidations are not just restricted to Bitcoin; they reflect broader trends in the crypto market. The current data from Coinglass indicates a total liquidation of $80.26 million, with long positions dominating the figures. Understanding this aspect of trading can provide critical insights for investors and traders alike. As liquidation pressures mount, particularly around major trading pairs, prices can behave unpredictably, further complicating BTC price analysis.

Recent Liquidation Trends in Ethereum

Alongside Bitcoin, Ethereum also witnessed significant liquidations, amounting to $16.23 million in the last hour. This growing trend points to the increasing volatility and risk associated with Ethereum trading. The emergence of such liquidation events can be attributed to factors like market sentiment shifts, regulatory news, and broader economic indicators that sway investor confidence. Analyzing these trends is crucial as they can offer predictive insights for potential market movements.

Ethereum liquidations reveal how interconnected the crypto markets have become, with fluctuations in Bitcoin’s price often affecting Ethereum and other altcoins. As traders react to liquidation pressures, the interconnected market may see rapid sell-offs across multiple currencies. Keeping a keen eye on liquidation trends can arm cryptocurrency enthusiasts with valuable information, allowing them to strategize and react proactively to impending market developments.

The Role of Coinglass Data in Liquidation Analysis

Coinglass has become an essential data provider for traders monitoring crypto market liquidations. By offering real-time data on liquidation volumes, the platform equips traders with insights necessary for making informed decisions. Recently, the data showcased a remarkable $80.26 million in total liquidations, which includes significant contributions from Bitcoin and Ethereum. The granular data points provided by Coinglass help in understanding market sentiments and volatility, making it a valuable tool for anyone operating within the crypto trading space.

Moreover, understanding how to interpret Coinglass data can significantly enhance BTC price analysis. Traders can utilize this platform to identify patterns in liquidation trends and predict some of the potential market shifts. By analyzing historical data in conjunction with real-time updates, investors can better gauge their risk and position management strategies in a market characterized by rapid changes.

Impact of Market Liquidations on Cryptocurrency Prices

Market liquidations have a profound effect on cryptocurrency prices, often resulting in sharp downward trends that can shake trader confidence. In the recent events, the market saw liquidations surpassing $80 million, with a substantial part from long positions, which typically indicates that traders were overly optimistic. Such mass liquidations can trigger further sell-offs, pushing prices down and creating a cycle of panic in the market.

Conversely, when short positions face liquidations, particularly during a bullish reversal, it can lead to a significant price uptick as those positions are closed out at market prices. This double-edged nature of liquidations makes understanding their implications for BTC price analysis essential for predicting market movements. Savvy traders can leverage these insights to time their entry and exit points more strategically.

The Importance of Monitoring Liquidation Events for Traders

For traders in the crypto space, staying attuned to liquidation events is crucial for risk management and strategy formulation. With the market experiencing rapid fluctuations, ongoing monitoring can help traders mitigate losses and capitalize on potential rebounds. Given that around $80 million was liquidated in recent hours, understanding the factors leading to such drastic changes can provide insights into future market behavior.

Furthermore, setting stop-loss limits and employing risk management strategies can help traders navigate the tumultuous environment that often accompanies high liquidation levels. Developing a keen sense of market movements—especially during periods of heightened liquidation—will empower traders to make more strategic decisions, minimizing risk while potentially capitalizing on price recovery.

Navigating the Volatility of Crypto Market Liquidations

The liquidation landscape in the cryptocurrency market is often fraught with volatility and unpredictability. Recent data indicates that across the market, liquidations surged, amounting to over $80 million in just an hour. As traders react to the market’s rapid shifts—whether up or down—understanding how to navigate these fluctuations is essential for retaining profitability.

Traders need to adopt a proactive approach to manage the inherent risks of volatility during liquidation events. By employing techniques such as diversification and active portfolio management, they can cushion themselves against these sudden price swings. The current market conditions underscore the necessity for both new and experienced traders to stay informed and adaptable.

The Psychological Impact of Liquidation on Traders

Liquidation events can lead to a significant psychological impact on traders, often causing panic and fear among those with long positions. When stats reveal over $80 million in liquidations, including substantial BTC and ETH losses, many traders reevaluate their strategies and risk tolerance. The emotional stress can lead to hasty decisions that exacerbate losses, highlighting the need for emotional discipline in trading.

Conversely, some traders may thrive on the volatility, seeing liquidation events as opportunities to capitalize on price retractions. Understanding the psychological landscape of crypto trading can help traders harness their emotions effectively, allowing for more strategic decision-making. Cultivating a well-thought-out trading plan, coupled with strong emotional regulation, is vital for navigating the stormy seas of the crypto market.

Future Predictions: Liquidation Trends and Market Reactions

Future predictions regarding liquidation trends offer insights into how traders might prepare for impending market shifts. As the current data indicates, with $80 million already liquidated, the potential for further dramatic moves looms large. Analysts often look at historical patterns in liquidation events to forecast possible outcomes, keeping in mind that market sentiment and external factors can rapidly alter these predictions.

If trends continue, traders might experience further volatility, especially around key support and resistance levels. Keeping updated with metrics from reliable data sources like Coinglass can be invaluable as traders position themselves for future movements. Adequately interpreting liquidation trends allows savvy investors to hedge their bets and capitalize on bullish or bearish signals in the ever-changing crypto landscape.

Technical Analysis of Bitcoin Liquidations and Market Sentiments

Technical analysis serves as a critical tool for understanding Bitcoin liquidations and their implications on broader market sentiments. With high levels of liquidations reported at $48.34 million, dissecting price charts can reveal valuable insights into potential support and resistance levels that traders should watch. By examining indicators such as moving averages, Relative Strength Index (RSI), and volume analysis, traders can assess the likelihood of price reversals in response to liquidation pressures.

Moreover, technical analysis combined with real-time liquidation data can enhance traders’ understanding of market movements. When BTC liquidations spike, technical indicators might signal overbought conditions, suggesting potential price declines. This analytical approach empowers traders to make informed decisions based on both historical data and current market behavior, enhancing their ability to navigate the uncertainties of the crypto market.

Frequently Asked Questions

What are Bitcoin liquidations and how do they impact the crypto market?

Bitcoin liquidations occur when leveraged positions in BTC are forcibly closed by exchanges due to price fluctuations, impacting market stability. These liquidations can lead to significant volatility in the crypto market, often correlating with sharp price increases or decreases.

What recent trends have been observed in Bitcoin liquidations?

Recent Coinglass data indicates that Bitcoin liquidations have spiked significantly, with over $48 million liquidated in the last hour alone. This trend suggests increased volatility within the BTC price analysis and may signal market shifts affecting both short and long positions.

How do liquidations affect Bitcoin versus Ethereum in the current market?

Currently, Bitcoin liquidations are outpacing Ethereum liquidations, with BTC experiencing $48.34 million in liquidations compared to ETH’s $16.23 million. This disparity could indicate a stronger market interest or leverage in Bitcoin, influencing overall market liquidations.

What can investors learn from the latest liquidation trends in Bitcoin?

Investors can analyze the latest liquidation trends to gauge market sentiment and volatility levels. The recent $80 million liquidations across the market, highlighted in Coinglass data, may provide insights into potential trading strategies and risk management amidst changing conditions.

Where can I find reliable data on Bitcoin liquidations and overall market performance?

For reliable data on Bitcoin liquidations and market performance, sources like Coinglass provide up-to-date statistics on liquidation volumes and trends. This data can be crucial for understanding the dynamics of crypto market liquidations and making informed trading decisions.

How do liquidation events correlate with Bitcoin price fluctuations?

Liquidation events contribute to short-term price fluctuations in Bitcoin. A recent spike of $48.34 million in BTC liquidations reflects sudden market movements that can either exacerbate price drops or create bounce-back opportunities, impacting overall BTC price analysis.

What role do long and short positions play in the context of Bitcoin liquidations?

In the context of Bitcoin liquidations, long positions refer to bets that Bitcoin prices will rise, while short positions anticipate a decline. Recent data shows long positions accounting for $65.08 million of liquidations, highlighting the market’s bullish sentiment before potential downturns.

How can traders mitigate risks associated with Bitcoin liquidations?

Traders can mitigate risks associated with Bitcoin liquidations by implementing strategies like avoiding excessive leverage, setting stop-loss orders, and keeping informed through sources like Coinglass data. Awareness of current liquidation trends helps traders navigate potential market volatility.