| Key Points |

|---|

| Bitcoin institutional demand remains strong with $53 billion accumulated by large wallets in 12 months. |

| Institutional investors, especially wallets holding 100-1,000 BTC, continue to show inflows. |

| 577,000 BTC added to custody wallets, indicating strong institutional demand and excluding exchange/miner influence. |

| Accumulation increased by approximately 33% in two years, correlating with first spot Bitcoin ETFs launch. |

| ETFs have seen inflows of $1.2 billion this year despite a modest Bitcoin price gain of around 6%. |

| Future investments in Bitcoin and Ethereum are expected to rise as suggested by political economist ‘Crypto Seth’. |

| Companies like Michael Saylor’s DAT purchased 260,000 BTC ($24 billion), holding over 1.1 million BTC total. |

| Retail sentiment is cautious with a ‘fear’ rating of 32 on the Bitcoin Fear and Greed Index. |

| Recent price retreat from $97,000 to below $92,000, influenced by rising global trade tensions. |

| Rising institutional accumulation contrasts with falling retail sentiment in the crypto market. |

Summary

Bitcoin institutional demand remains robust, signaling a strong commitment from large investors in the cryptocurrency market. With significant accumulation by large wallets and institutional investors, there is a clear indication that interest in Bitcoin remains high, despite the fluctuating sentiment among retail traders. This trend suggests a deeper integration of Bitcoin into the financial landscape, as institutions diversify their assets amidst global economic uncertainties.

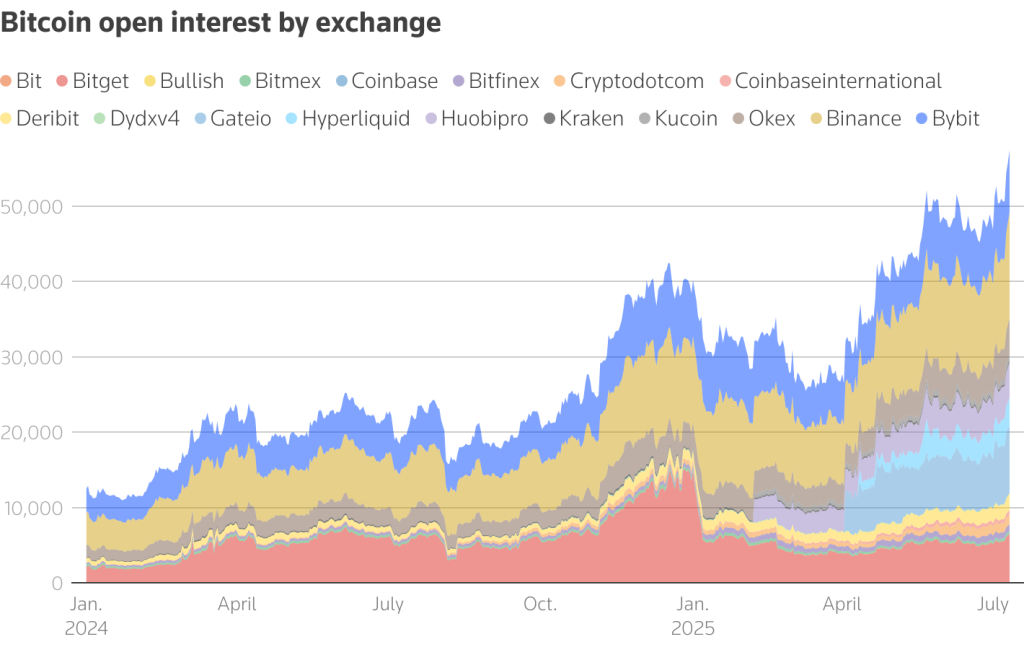

Bitcoin institutional demand is becoming increasingly prominent, with large wallets accumulating a staggering $53 billion in Bitcoin over the past twelve months, according to CryptoQuant. This substantial investment indicates a steadfast interest from major institutions, particularly in light of the ongoing Bitcoin investment trends. In particular, wallets holding between 100 and 1,000 BTC are witnessing consistent inflows, further showcasing the commitment to Bitcoin by institutional investors across the United States. Notably, the inflow from Bitcoin ETFs has reached approximately $1.2 billion this year alone, reinforcing the narrative of institutional Bitcoin accumulation. As the crypto market sentiments fluctuate, the analysis of Bitcoin wallets continues to reveal a strong undercurrent of support from these large players, highlighting a robust demand environment that could shape the future of this digital asset.

The rising trend of institutional engagement in cryptocurrencies, particularly Bitcoin, has garnered significant attention recently. Institutional players, characterized by their strategic and long-term investment approach, are increasingly recognizing the value of Bitcoin as a digital asset. Notably, the accumulation of Bitcoin by these entities paints a picture of a growing acceptance and confidence in the asset class. Alongside these developments, the inflow into exchange-traded funds (ETFs) further exemplifies the shift in investment paradigms. Furthermore, a close examination of digital asset treasury allocations reveals substantial commitments from various corporations, indicating a vibrant landscape for institutional investors in the realm of cryptocurrency.

Understanding Bitcoin Institutional Demand

Bitcoin institutional demand has been a topic of increasing interest among investors and analysts alike. With large wallets accumulating a staggering $53 billion in Bitcoin over the past 12 months, it’s evident that institutional interest in Bitcoin has remained robust. These transactions are major indicators of confidence in the cryptocurrency’s long-term viability, showcasing a commitment that extends beyond casual trading. According to data from CryptoQuant, wallets that hold between 100 and 1,000 BTC have increasingly seen inflows, highlighting that entities with significant capital are confident in their investments against market fluctuations.

Continuing on this trend, recent insights from CryptoQuant’s founder, Ki Young Ju, reveal that approximately 577,000 Bitcoin have been funneled into larger custody wallets, including ETFs. This sustained accumulation signifies a departure from prevailing sentiments among retail investors, and presents a more optimistic picture for entities capable of weathering the market’s volatility. By excluding influences from exchanges and miners, it becomes clear that institutional players are driving the narrative about Bitcoin’s stability and long-term growth potential.

Frequently Asked Questions

What is driving Bitcoin institutional demand in 2023?

Bitcoin institutional demand in 2023 is primarily driven by large-scale accumulation by institutional investors, with wallets holding between 100 and 1,000 BTC witnessing significant inflows. Over the past year, approximately $53 billion has been added to these large custody wallets, highlighting robust institutional interest in Bitcoin.

How have Bitcoin ETFs influenced institutional Bitcoin accumulation?

Bitcoin ETFs have played a crucial role in enhancing institutional Bitcoin accumulation, with reported inflows totaling $1.2 billion this year alone. The launch of spot Bitcoin ETFs aligns with a 33% increase in institutional demand over the last two years, attracting significant investments from large wallets.

What is the current trend in Bitcoin investment for institutions?

The current trend in Bitcoin investment for institutions shows a persistent increase in demand, with institutions like Michael Saylor’s Digital Asset Treasuries purchasing huge amounts of Bitcoin. This trend suggests that institutional investors are increasingly viewing Bitcoin as a viable asset class for the future.

How does crypto market sentiment affect Bitcoin institutional demand?

While institutional demand for Bitcoin remains strong, retail market sentiment has turned cautious, as reflected in the Bitcoin Fear and Greed Index. Despite retail fears, institutional investors continue to accumulate Bitcoin, creating a disparity in market sentiment that underscores growing confidence among institutions.

Can we expect more institutional investment in Bitcoin in the future?

Yes, experts indicate that we can expect more institutional investment in Bitcoin as many institutions are still in the early stages of their investment journey. Analysts like ‘Crypto Seth’ predict that as institutional confidence grows, larger investments in Bitcoin will follow, further driving institutional demand.

How are Bitcoin wallets analyzed to track institutional demand?

Bitcoin wallets are analyzed by monitoring the inflows and balances of large wallets, particularly those holding between 100 and 1,000 BTC. This analysis helps to track trends in institutional Bitcoin accumulation, revealing significant investments and overall demand in the ecosystem.

What challenges does Bitcoin face despite growing institutional demand?

Despite growing institutional demand, Bitcoin faces challenges such as fluctuating retail sentiment and geopolitical tensions, which can influence market reactions. Recent declines in the Bitcoin Fear and Greed Index indicate that while institutions are accumulating Bitcoin, retail investors may remain skeptical in the current climate.