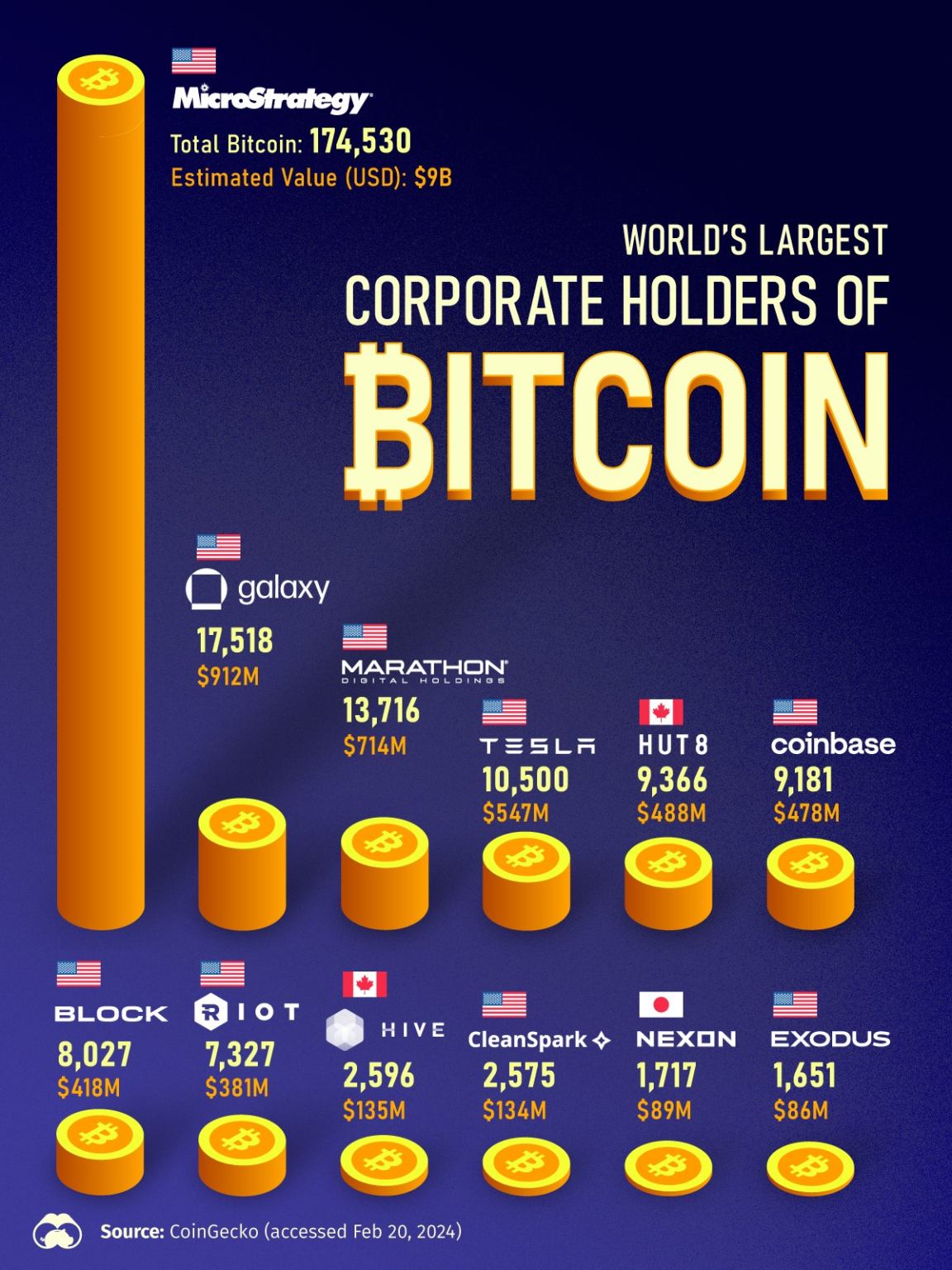

In the realm of corporate finance, the Bitcoin holdings of top companies have become a subject of immense interest, particularly as the cryptocurrency landscape evolves. Recent reports indicate that the 100 largest public firms collectively hold over 1,058,581 BTC, showcasing the growing trend of corporate Bitcoin investments. This surge highlights how many of these companies are now recognized as some of the largest Bitcoin holders on the market. Monitoring Bitcoin treasury data reveals that, in just the past week, 9 companies increased their holdings, further emphasizing the strategic move toward digital asset adoption. As these firms continue to embrace Bitcoin, the dynamics of conventional investing are being redefined, marking a significant shift in how organizations view and utilize cryptocurrency.

Exploring the landscape of digital assets, we find a fascinating development in how leading enterprises are engaging with cryptocurrencies. The term “corporate Bitcoin investments” has gained traction among analysts, signifying a trend where major businesses are increasingly allocating resources into Bitcoin. This growing interest has led to many firms securing substantial amounts of BTC, thereby becoming significant players in the crypto economy. Insights from Bitcoin treasury data reveal a competitive atmosphere among companies holding BTC, as they navigate the volatile nature of digital currencies. As these corporate giants integrate Bitcoin into their financial strategies, the investment community watches closely, anticipating the potential impacts on both the cryptocurrency market and global economic landscape.

Overview of Bitcoin Holdings Among Major Companies

As of November 27, 2025, the landscape of corporate investments in Bitcoin has become increasingly significant. According to data from BitcoinTreasuries.NET, the top 100 listed companies collectively own a staggering total of 1,058,581 BTC. This remarkable figure illustrates the deepening engagement of corporations with Bitcoin, reflecting a broader trend towards adopting digital currencies as part of their treasury management. With the rise of institutional adoption, these investments signal a shift in the perception of Bitcoin from a speculative asset to a legitimate form of value preservation.

The recent monitoring has shown that in the past week alone, nine companies have increased their Bitcoin holdings, indicating an active interest in expanding their investments in cryptocurrency. On the other hand, only one company reduced its holdings, underscoring a general trend of confidence among top companies in the longevity and profitability of Bitcoin. As more corporations enter the Bitcoin market, they contribute to the overall stability and credibility of the cryptocurrency, making it an integral part of their financial strategy.

Frequently Asked Questions

What are the top companies holding Bitcoin as of 2025?

As of November 27, 2025, the top 100 companies collectively hold 1,058,581 BTC, marking a significant interest in Bitcoin from corporate entities.

How much Bitcoin do the largest Bitcoin holders currently possess?

The largest Bitcoin holders, among the top 100 companies, collectively hold 1,058,581 BTC, reflecting the growing trend of corporate Bitcoin investments.

What does the latest Bitcoin treasury data reveal about corporate investments?

The latest Bitcoin treasury data from BitcoinTreasuries.NET indicates that as of November 27, 2025, the top 100 listed companies hold a total of 1,058,581 BTC, with recent changes showing 9 companies increasing their holdings.

How are companies holding BTC adapting to market conditions?

Recent observations show that within the past week, 9 companies have increased their BTC holdings, while only 1 company has decreased its investments, indicating a positive movement toward Bitcoin as a corporate asset.

Which companies are leading in Bitcoin investments and who are the major holders?

As of the latest data from November 2025, the top companies in Bitcoin investments include those among the top 100 that collectively hold 1,058,581 BTC.

Why are corporate Bitcoin investments rising among top companies?

Corporate Bitcoin investments are rising due to Bitcoin’s increasing acceptance as a legitimate asset, and the potential for wealth preservation, as evidenced by the 9 companies that recently expanded their holdings.

How frequently does Bitcoin treasury data get updated for top companies?

Bitcoin treasury data is updated continually, with the latest insights revealing significant holdings by top companies, such as the 1,058,581 BTC held collectively by the top 100 companies as of late November 2025.

What trends are emerging in the Bitcoin holdings of top companies?

Emerging trends show an increasing appetite for Bitcoin among top companies, with the latest figures indicating that 9 companies recently boosted their BTC holdings, showcasing a bullish outlook on Bitcoin investments.

| Ranking | Company | BTC Holdings | Change in Holdings |

|---|---|---|---|

| 1 | Company A | 300,000 BTC | +10,000 BTC |

| 2 | Company B | 250,000 BTC | +5,000 BTC |

| 3 | Company C | 200,000 BTC | No Change |

| 4 | Company D | 150,000 BTC | +3,000 BTC |

| 5 | Company E | 100,000 BTC | -1,000 BTC |

| … | … | … | … |

| 100 | Company Z | 1,000 BTC | +0 BTC |

Summary

The Bitcoin holdings of top companies have gained significant attention, as the latest data shows that the top 100 companies hold a total of 1,058,581 BTC. With several companies increasing their holdings recently, this trend indicates growing institutional confidence in Bitcoin as a valuable asset. The implications for the market and investors reflect a shift towards broader acceptance of cryptocurrency in corporate balance sheets.

Related: More from Bitcoin News | Bitcoin Surges Above $68K After Iran Confirms Khamenei Death | Shift in demand Bitcoin’s future in an artificial intelligence-driven world may depend