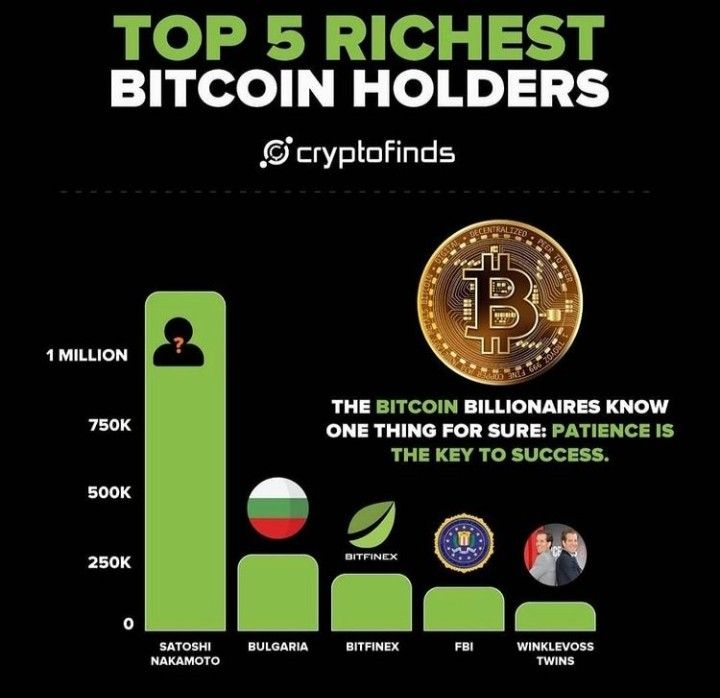

Bitcoin holders are currently facing a tumultuous phase in the crypto landscape, especially as recent sell-offs have put significant pressure on the market. In the past week alone, whale addresses—those possessing substantial amounts of Bitcoin—have sold off a staggering 81,068 BTC, pushing their total holdings to a nine-month low. This massive movement in Bitcoin dynamics is accompanied by emerging trends within the retail sector, where smaller investors are seizing opportunities by buying on price dips. As analysts conduct Bitcoin price analysis, the growing influence of these retail investors amidst major market shifts becomes evident, highlighting their role in shaping current and future crypto market trends. Understanding these dynamics could provide Bitcoin holders with valuable insights into potential market recovery or further fluctuations as the balance between whales and retail investors continues to evolve.

Currently, those invested in Bitcoin are navigating a complex environment marked by significant shifts and sell-offs within the cryptocurrency domain. The behavior of large holders, often referred to as ‘whales’, exhibits patterns that can dramatically influence market conditions and investor sentiment. At the same time, smaller crypto enthusiasts and traders—sometimes known as retail investors—are taking steps to capitalize on favorable pricing opportunities, particularly given the current market adjustments. Insights gathered from Bitcoin price analysis can shed light on these trends, revealing how the actions of both large-scale and individual investors are intertwined and impactful. As this narrative unfolds, the cryptocurrencies’ viability and the strategies employed by different investor brackets will determine the future trajectory of this digital asset.

| Key Points |

|---|

| Bitcoin price has dropped to $60,001, the lowest since October 2024. |

| Whale and shark addresses sold 81,068 BTC in just 8 days. |

| Whales and sharks now hold only 68.04% of the total Bitcoin supply, a 9-month low. |

| Shrimp addresses (holding |

| Retail investors are buying on dips, which may indicate their potential capitulation. |

| Historical patterns suggest whale sell-offs with retail purchases could lead to bear market cycles. |

Summary

Bitcoin holders should be aware of the recent market developments as whale and shark addresses sold a significant amount of Bitcoin, which has led to a drop in the total Bitcoin supply held by these entities. The market’s current condition indicates potential bearish trends, yet retail investors seem to be taking advantage of the price dip. It’s crucial for Bitcoin holders to stay informed and consider closely how these trends may impact their investments moving forward.

Understanding Whale Sell-Offs in the Bitcoin Market

In recent weeks, the Bitcoin market has seen significant activity from whale and shark addresses, which has had a pronounced impact on Bitcoin price dynamics. According to recent reports, these entities offloaded a staggering 81,068 BTC in just eight days, pushing their total holdings down to a nine-month low. This selling pressure is significant, as it represents a substantial portion of Bitcoin’s circulating supply, typically indicating shifts in market sentiment among large holders. The behavior of these whales can be directly correlated to the current crypto market trends, reflecting broader investor concerns about market stability and potential price declines.

Whale sell-offs can create waves of volatility within the crypto market, as their large-scale transactions often instigate responses from retail investors and other market players. When whales divest from Bitcoin, it tends to initiate fear and uncertainty among smaller investors, which can lead to further sell-offs across the board. Understanding the actions of these large holders is crucial for predicting market movements and analyzing Bitcoin price fluctuations. As current trends suggest an increasing divergence between whale activities and retail investor purchases, many analysts caution that the market may face additional pressure until a clearer buying signal emerges from both institutional and retail fronts.

The Impact of Retail Investors on Bitcoin Supply

While whale sell-offs dominate headlines, the role of retail investors is equally significant in shaping Bitcoin’s market landscape. Recently, reports indicate that shrimp addresses—wallets holding less than 0.01 BTC—have reached a new 20-month high, now making up 0.249% of the total Bitcoin supply. This surge reflects an increased interest and buying activity among retail investors, particularly during dips in the market. As these smaller investors actively acquire Bitcoin, their collective purchasing power can contribute to long-term price support, even amid substantial sell-offs from larger entities.

The interaction between retail investors and major holders like whales creates a complex dynamic in the cryptocurrency market. As retail participants buy into dips, they help cushion Bitcoin’s price against drastic drops, albeit temporarily. However, if whale sell-offs outpace retail accumulation, the market sentiment can tilt towards bearish, driving prices further down. Therefore, monitoring the balance between institutional sell-offs and retail purchases is essential for stakeholders looking to navigate the uncertainties of the crypto market effectively.

A cautionary tale emerges as retail investors should remain aware of the potential risks associated with following market trends originated from whale activities. Historically, when institutions begin to retreat, it often catalyzes wider market sell-offs as fear significantly impacts retail trading behavior. Thus, understanding the psychology behind these market movements is vital for investors looking to time their entries and exits efficiently.

Bitcoin Price Analysis: Navigating Recent Trends

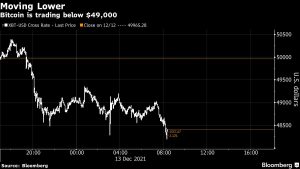

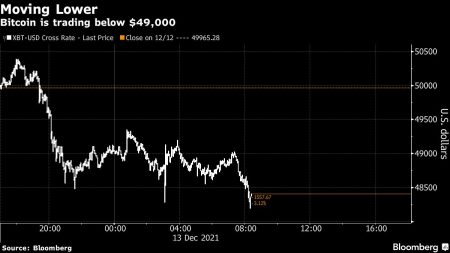

In light of recent sell-offs by whales, Bitcoin’s market price has declined to $60,001, which is the lowest recorded since October 2024. This decline raises pressing questions about the sustainability of Bitcoin’s growth trajectory amid bearish indicators. Price analysis reveals that such drastic movements often precede significant market corrections, and given the current circumstances where whale and shark addresses are liquidating their holdings, further drops could be anticipated unless buying pressure from retail investors steps in.

Market analysts suggest that the timing and magnitude of these sell-offs serve as a litmus test for overall market health. As more retail investors enter the market, their buying decisions can lead Bitcoin on a potentially bullish resurgence, but until whales show signs of capitulation, skepticism remains. The critical challenge lies in balance: if whales continue to offload their assets while retail buys, we may see heightened volatility that typifies bear market behavior. Therefore, tracking these movements in conjunction with price analysis is imperative for anyone looking to offer insights into future Bitcoin valuations.

Whale Addresses: What They Mean for the Future of Bitcoin

Whale addresses, defined as wallets holding significant quantities of Bitcoin, have a tremendous impact on market dynamics and future price movements. Their behaviors can signal broader trends within the cryptocurrency ecosystem. As these large holders recently sold off over 81,000 BTC, it raises concerns about market confidence and the potential for future price corrections. Analysts highlight that movements by whales not only reflect individual strategies but also provide insights into potential shifts in market sentiment and investor psychology.

The dominance of whale holdings remains a double-edged sword; while their activities can amplify market movements, they can also offer opportunities for contrast with retail investment behavior. Often, when whales sell, they do so on the premise of anticipated downturns or market corrections, leaving retail investors to either ride the wave or mitigate losses. Future scenarios will rely heavily on the actions of these whale addresses; their decision to re-enter the market could signal a new bullish phase, while continued liquidation may confirm lingering bearish sentiments. Understanding the intentions behind whale transactions is crucial for making educated investment decisions.

Retail Investors’ Buying Spree Amidst Market Uncertainty

As whale addresses have been liquidating their holdings, retail investors have demonstrated resilience and a unique purchasing strategy. With current market sentiments leaning bearish due to significant whale sell-offs, retail investors are taking advantage of low-price opportunities by buying Bitcoin during market dips. This increasing accumulation among smaller wallets, often termed ‘shrimp’ addresses, signifies a growing community of retail holders contrary to the large-scale movements from whales. It showcases a divergence in market strategies, where retail investors find value despite prevailing uncertainties.

These retail purchases could play a critical role in stabilizing Bitcoin’s price amidst whale-driven volatility. With the current rise in shrimp addresses, it is clear that there is a growing belief in Bitcoin’s long-term potential among the retail investing community. This dynamic also presents a counterbalance to the market manipulation often associated with whale address sell-offs. As retail investors continue to buy into the market, their increasing presence could deter further aggressive sell-offs and pave the way for Bitcoin price recovery in the coming months.

Analyzing Market Trends Post Whales’ Liquidation

The recent sell-off by whale and shark addresses indeed raises questions regarding long-term trends within the cryptocurrency market. The last recorded Bitcoin price drop to $60,001 could trigger various potential reactions across different investor groups. When significant liquidity exits the market due to large holders liquidating their assets, it results in moments of panic and uncertainty among smaller investors; however, it also provides insightful signals about market direction. Observations indicate that prices could either stabilize as retail investors step in or descend further as fear grips the market.

The twists and turns of the Bitcoin market are significantly shaped by these large institutional players, thus making it essential for emerging investors to closely monitor whale activities and market responses. Future market trends will likely hinge on the ability of retail investors to absorb the pressure from whale sell-offs and maintain bullish momentum. It creates an important point of analysis for market watchers trying to navigate Bitcoin’s price trajectory amidst the backdrop of both whale and retail investor behaviors.

Factors Influencing Bitcoin’s Price Movements

Market sentiment is a powerful driver of Bitcoin’s price, influenced by various factors including whale activities, macroeconomic indicators, and retail investor behavior. In particular, the recent information from Santiment reveals that a decrease in whale holdings can cause a ripple effect, leading to price declines as larger holders set the market tone. Understanding these factors is crucial for anyone looking to engage in Bitcoin investments, as they contribute to the multifaceted nature of the crypto market.

Additionally, external headlines and regulatory changes can amplify or mitigate these influences, making Bitcoin’s trajectory even more unpredictable. Retail investors looking to navigate these trends must consider how whale actions, combined with significant shifts in market narrative, will impact their investments. Staying informed about the latest developments and market analysis provides valuable perspective on making sound investment decisions.

The Future of Bitcoin: Predictions and Insights

With the recent sell-offs from whales and the consequent increase in retail investment, the future of Bitcoin holds varied predictions. Many experts contend that for Bitcoin to regain bullish momentum, it will require a collaborative effort between institutional and retail investors. If whales can stabilize their holdings or re-enter the market at strategic points, this could reinvigorate enthusiasm and drive price improvements. Conversely, if selling pressure continues without significant retail support, Bitcoin risks entering a protracted bear market.

Looking ahead, it becomes increasingly important for both individual and institutional investors to strategize their responses based on the interplay between whales and retail investors. The actions of whale addresses will remain a pivotal component of Bitcoin’s narrative as market participants seek to gather insights that could influence their buying and selling strategies. By understanding the market dynamics shaped by these contrasting groups, investors can better position themselves to capitalize on future opportunities.

Frequently Asked Questions

What impact do Bitcoin sell-offs by whales have on the market for Bitcoin holders?

Bitcoin sell-offs by whale addresses significantly affect market dynamics, often leading to price declines that impact Bitcoin holders adversely. When whales, who hold substantial amounts of Bitcoin, liquidate their positions, it typically signals bearish sentiments, creating increased volatility and discouraging retail investors.

How can Bitcoin holders analyze crypto market trends and the behavior of retail investors?

Bitcoin holders can analyze crypto market trends by monitoring activities of whale addresses alongside retail investors. Tools like Santiment’s market insight can provide data on whale sell-offs, Bitcoin price analysis, and shifts in retail purchasing, helping holders make informed decisions based on the flow of Bitcoin in the market.

Are Bitcoin holders affected when whale addresses sell large amounts of Bitcoin?

Yes, when whale addresses sell large amounts of Bitcoin, it can lead to downward pressure on Bitcoin prices, impacting all Bitcoin holders. This can cause panic selling among retail investors and may contribute to overall market downturns.

What does the increase in retail investors’ purchases indicate for Bitcoin holders?

An increase in retail investors purchasing Bitcoin, especially during dips, indicates bullish sentiment among smaller investors, which can provide a counterbalance to whale sell-offs. This trend provides Bitcoin holders with a glimmer of hope for price stabilization or growth, despite potential bearish moves from large holders.

What should Bitcoin holders know about whale addresses and their influence on Bitcoin price analysis?

Bitcoin holders should recognize that whale addresses control a significant portion of the Bitcoin supply, and their selling patterns greatly influence Bitcoin price analysis. Monitoring their activities can offer insights into potential market trends and assist holders in making strategic decisions.

How do Bitcoin sell-offs by whales correlate with the actions of retail investors for Bitcoin holders?

Bitcoin sell-offs by whales often lead to increased selling pressure in the market, which can trigger price drops. Conversely, if retail investors begin buying on dips, as seen in recent trends, it can counteract the whales’ influence, signaling an opportunity for Bitcoin holders to reassess their positions and strategies.

What strategies can Bitcoin holders employ during major sell-offs in the market?

During major Bitcoin sell-offs, Bitcoin holders may consider strategies such as dollar-cost averaging to accumulate more Bitcoin at lower prices, or they might choose to hold through volatility, relying on market recovery trends among retail investors to restore prices.