The Bitcoin four-year cycle has emerged as a focal point of discussion among investors, especially as we approach January 2026, a date that may herald a pivotal moment in cryptocurrency trends. Historical analysis suggests that Bitcoin’s price movements may adhere to this cycle, revealing unique structural patterns that can inform market predictions. Recent developments, such as the massive $57 billion capital inflow from ETFs, have sparked debates regarding their impact on Bitcoin and whether the cycle is being extended. Meanwhile, Bitcoin price analysis indicates strikingly similar timestamps for market lows, notably November 21, which occurred consecutively in both 2022 and 2025. As the cryptocurrency landscape shifts, all eyes will be on the upcoming legislative discussions that could further influence the Bitcoin cycle analysis and overall market dynamics.

Within the cryptocurrency market, the Bitcoin four-year cycle is often a term that encapsulates the rhythm of Bitcoin’s price movements over a set period. This cyclical pattern has historically provided critical insights into investment timing and market behavior, prompting analysts to delve deeper into Bitcoin market predictions. Recent discussions surrounding the ETF impact on Bitcoin highlight the complexities of this cycle, as sizable capital inflows can distort conventional trends. As we look towards significant upcoming events, particularly legislative hearings, the potential implications for Bitcoin’s trajectory cannot be overstated. Understanding this cyclical nature is essential for anyone navigating the evolving landscape of digital currencies.

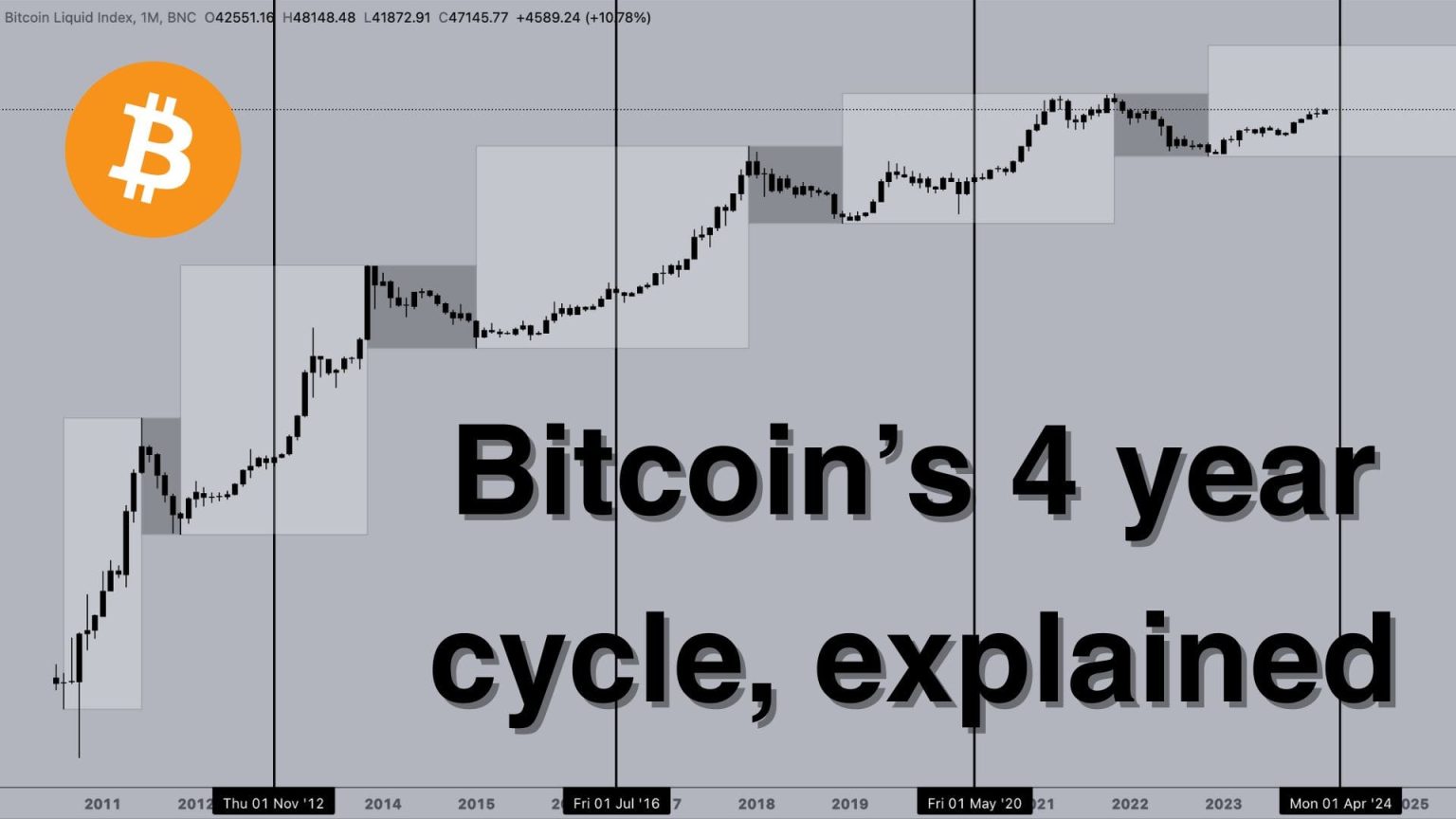

Understanding Bitcoin’s Four-Year Cycle

Bitcoin’s four-year cycle is a significant aspect of its price analysis and historical trends. This model suggests that the cryptocurrency experiences dramatic price shifts approximately every four years, often aligned with Bitcoin’s halving events. The most recent cycle began after the halving in May 2020, which set the stage for the explosive price gains observed through 2021. As we approach January 2026, various analysts are questioning whether the historical patterns of this cycle will hold true in light of recent developments, particularly with capital inflows from ETFs.

In 2026, markets are abuzz with predictions regarding Bitcoin’s potential price movements. Some experts affirm that the four-year cycle should remain largely intact, despite recent ETF inflows absorbing substantial financial capital. The structural divergences noted in the historical patterns, particularly around pivotal dates like January 15, 2026, suggest that the cycle might repeat itself. This upcoming market structure hearing may act as a catalyst, determining whether Bitcoin’s price trajectory remains consistent with past cycles or takes a new direction, influenced by external regulatory factors.

The Impact of ETF Inflows on Bitcoin’s Price Dynamics

The rise of Exchange-Traded Funds (ETFs) has dramatically reshaped the cryptocurrency landscape, injecting over $57 billion into Bitcoin. This influx not only heightens liquidity in the market but also encourages institutional investment, a key driver in altering Bitcoin price predictions. Analysts have started to explore how these ETF inflows might influence Bitcoin’s historic price cycle. Some express concern that such a shift could obscure traditional cycle patterns, particularly if these assets stabilize Bitcoin prices against the typical volatility associated with its four-year cycle.

Conversely, many experts argue that the influx of funds through ETFs represents a natural evolution in Bitcoin’s market presence, leading to more sustained price growth rather than the sharp fluctuations familiar to traders. They predict that the additional liquidity from ETFs could support price levels that align with the historical four-year cycle, demanding closer scrutiny in the coming months. As we look ahead to 2026, both the market’s structural changes due to ETF investments and their impact on historical patterns will be essential to understand Bitcoin’s future price mechanisms.

Analyzing Bitcoin Market Predictions for 2026

Amid debates about the potential turn in Bitcoin’s four-year cycle, market predictions for 2026 are increasingly being informed by historical performance data. Many analysts are revisiting past cycles to predict future price behaviors, assessing factors such as macroeconomic trends and technological advancements. The historical parallel between the local bottoms in recent cycles, both occurring on November 21, strengthens the idea that patterns might repeat, providing a tactical advantage for traders looking to optimize their engagement with Bitcoin in the coming year.

With the ongoing developments in regulations and the anticipated hearing on the U.S. crypto market structure on January 15, experts believe 2026 could become pivotal in defining Bitcoin’s trajectory within its cycle analysis. The convergence of these events suggests a ripe environment for new investors and seasoned traders alike, fortifying the need for in-depth Bitcoin price analysis. Success hinges not only on understanding Bitcoin’s intrinsic value metrics but also on monitoring legislative changes that could significantly influence market dynamics.

Exploring Cryptocurrency Trends Leading to January 2026

As the crypto market evolves, numerous trends are emerging that could set the tone for Bitcoin’s performance leading into 2026. Key indicators, including trading volume and institutional adoption rates, suggest that Bitcoin is at the forefront of a transformative phase in its lifecycle. Analysts point to these trends as essential elements in gauging sentiment and predicting future price movements, noting that the timing of events, such as the upcoming U.S. hearing, could be instrumental in shaping market perceptions and trading behavior.

Additionally, the impact of broader economic conditions cannot be underestimated. Trends like inflation rates and stock market performance play a significant role in influencing cryptocurrency prices, particularly Bitcoin. Market participants are increasingly aware that these broader economic factors could either fortify Bitcoin’s position as a safe haven or contribute to its volatility, potentially disrupting the anticipated four-year cycle. Keeping an eye on these dynamics will be crucial for stakeholders aiming to navigate the evolving landscape effectively.

The Role of Market Structure in Shaping Bitcoin’s Future

Market structure plays a critical role in influencing Bitcoin’s price behavior. The structural shifts brought about by increasing regulatory frameworks and institutional acceptance of cryptocurrencies could lead to a re-evaluation of Bitcoin’s traditional cycle patterns. With a bill focused on the U.S. crypto market structure set to be discussed on January 15, 2026, traders are anticipating significant changes that could redefine how Bitcoin is traded and valued in the coming months. Such developments could either reinforce the existing cycle patterns or lead to entirely new market dynamics.

Furthermore, the relationship between market structure and Bitcoin price analysis emphasizes the need for adaptive strategies among investors. Historical data can provide a roadmap, but the uniqueness of the current market conditions—amplified by the influence of ETFs and regulatory oversight—illustrates that previous cycles may not necessarily dictate future outcomes. As analysts continue to dissect these changes, understanding the implications of market structure on Bitcoin’s trajectory will be essential for making informed investment decisions.

Comparing Bitcoin’s Current Cycle to Historical Patterns

Comparative analysis of Bitcoin’s current cycle against its historical patterns reveals intriguing insights into the cryptocurrency’s price performance. Observers note several key similarities and divergences in cycle lengths, with the recurring lows occurring on the same date across two cycles being particularly striking. This phenomenon raises the question of whether Bitcoin’s four-year cycle is a statistical fluke or a genuine reflection of investor behavior and market maturation. By examining these cycles, analysts can develop strategies that capitalize on predictable timelines associated with Bitcoin’s price fluctuations.

However, the volatility introduced by external factors, such as ETF inflows and regulatory developments, poses a challenge to strict adherence to historical models. Analysts urge caution, particularly as we transition into 2026; while historical parallels provide valuable insights, the modern cryptocurrency market is replete with unpredictable elements that could skew traditional cycle analysis. Maintaining a flexible approach will be key to adjusting predictions as new data and trends emerge in this dynamic environment.

Market Sentiment and Bitcoin Price Fluctuations

Market sentiment is a driving force behind Bitcoin price fluctuations, and as January 2026 approaches, sentiment is showing a mix of optimism and skepticism. Recent shifts in regulatory discussions, especially regarding the potential crypto market structure bill, could either boost or dampen investor confidence. Positive sentiment stemming from institutional investments and ETF inflows may contribute to a more stable outlook for Bitcoin. In contrast, negative sentiments triggered by regulatory clampdowns could lead to increased volatility, making careful monitoring of market sentiment essential for traders planning their next moves.

Moreover, the current macroeconomic environment, which includes interest rates and inflation rates, further complicates market sentiment towards Bitcoin. Analysts believe that as economic conditions shift, so will investor attitudes towards cryptocurrencies. Understandably, periods of economic uncertainty tend to heighten volatility as traders react to fears and opportunities alike, often resulting in impulsive market behavior. Thus, understanding the sentiment surrounding Bitcoin is imperative for making informed predictions regarding price movements in early 2026.

Future Predictions: Bitcoin’s Path Forward

As predictions mount for Bitcoin’s price trajectory in 2026, analysts are taking a multifaceted approach to determine its path forward. With the four-year cycle being a cornerstone of Bitcoin price analysis, many experts believe that a continued adherence to these historical patterns could lead to significant upsides for Bitcoin investors. This optimistic outlook is often bolstered by expected institutional adoption and regulatory clarity arising from legislative discussions. Analysts suggest that those investing in anticipation of historical cycles might experience favorable outcomes as market structure evolves.

Conversely, some analysts warn that the unprecedented influx from ETFs and ever-changing regulatory landscapes could disrupt traditional cycle predictions. The unique interplay of these influences necessitates an adaptable mindset for investors. As Bitcoin’s market dynamics shift, future predictions could hinge more on the interplay between external economic conditions and market sentiment than on historical cycles. Therefore, preparing for both bullish and bearish trends will be vital for navigating the Bitcoin landscape ahead.

The Importance of Keeping Up with Bitcoin Trends

Staying informed about current Bitcoin trends is essential for both seasoned traders and new investors as we approach 2026. The cryptocurrency market is notoriously volatile, with sudden price shifts often influenced by market sentiment, regulatory news, or macroeconomic trends. A primary example is the buzz surrounding expected legislative changes and the potential impact of ETF capital flows on Bitcoin’s price dynamics. Understanding these trends will empower investors to make strategic decisions, minimizing risks while maximizing potential for profit.

In addition, the role of market sentiment cannot be undervalued—perceptions can influence buying behaviors, often leading to significant price fluctuations. Awareness of public sentiment around Bitcoin, including excitement triggered by institutional investments or hesitance driven by regulatory uncertainties, will give traders insights into potential price movements. Thus, keeping up to date with Bitcoin trends is not just a matter of academic interest; it is crucial for successful navigation of cryptocurrency investments.

Frequently Asked Questions

What is the Bitcoin four-year cycle and why is it important for Bitcoin price analysis?

The Bitcoin four-year cycle refers to the recurring patterns observed in Bitcoin’s price movements, which often align with the halving events that occur approximately every four years. This cycle is crucial for Bitcoin price analysis as it helps traders and investors predict future price trends based on historical data. Understanding this cycle can provide insights into potential market behaviors and investment opportunities.

How do ETF impacts influence the Bitcoin four-year cycle?

ETFs, or exchange-traded funds, have a significant impact on the Bitcoin four-year cycle by attracting substantial capital inflows into the cryptocurrency market. For instance, a recent report indicated that ETFs absorbed $57 billion, which could alter price dynamics and potentially prolong or shift the cycle. As more institutional investments enter through ETFs, their influence on Bitcoin price trends becomes increasingly noticeable.

Are Bitcoin market predictions based on the four-year cycle accurate?

Bitcoin market predictions that utilize the four-year cycle can be useful but should be taken with caution. While historical patterns, such as identical local bottom dates, suggest a degree of reliability, unforeseen factors like regulatory changes and market sentiment can create deviations. Analyzing these cycles alongside current market conditions helps enhance prediction accuracy.

What should investors know about the upcoming hearing on the U.S. crypto market structure bill in relation to the Bitcoin four-year cycle?

The upcoming hearing on January 15, 2026, regarding the U.S. crypto market structure bill could significantly influence the Bitcoin four-year cycle. Such regulatory developments may create volatility and potentially mark a turning point in the cycle, impacting investor sentiment and market trends. Keeping an eye on this event is essential for anyone tracking the Bitcoin cycle and its implications.

What are the structural divergences in the Bitcoin four-year cycle observed recently?

Recent analysis indicates structural divergences in the Bitcoin four-year cycle, suggesting that patterns observed in past cycles may not hold true indefinitely. For instance, while the latest local bottom occurred on the same date as the previous cycle’s low, ongoing market dynamics and the emergence of ETFs could mean this cycle behaves differently than expected. Investors should consider these divergences when analyzing potential trends.

How does the Bitcoin four-year cycle relate to cryptocurrency trends in 2026?

The Bitcoin four-year cycle is crucial for understanding cryptocurrency trends in 2026. With historical patterns suggesting turning points and the approaching regulatory developments, investors can expect significant movements in Bitcoin’s price as the year unfolds. By analyzing these cycles, market participants can better navigate the potential volatility and establish informed trading strategies.

| Key Point | Details |

|---|---|

| Turning Point | January 2026 could be pivotal for Bitcoin’s cycle. |

| Effectiveness Debates | Experts are debating the continuation of the four-year cycle. |

| ETF Inflows | $57 billion absorbed by ETFs raises questions about the cycle. |

| Historical Patterns | Coincidental overlaps in low points: November 21, 2025 & November 21, 2022. |

| Upcoming Events | U.S. crypto market structure bill hearing on January 15, 2026. |

Summary

The Bitcoin four-year cycle is attracting attention as January 2026 approaches, which may signal a new turning point for Bitcoin. Discussions are heating up around the cycle’s effectiveness and its potential impacts, particularly with significant ETF inflows and upcoming legislative events. As historical patterns reveal, the interplay of market forces and Bitcoin’s cyclical nature continues to intrigue investors and analysts alike.