Bitcoin Forecast: Price Set to Surge Past This Key Threshold

Bitcoin, the digital currency that has become a bellwether for the cryptocurrency market, is poised for a potential surge that could see it break past a crucial financial threshold. This forecast hinges on several convergent factors including historical data trends, market sentiment, and recent technological advancements. Experts predict that if Bitcoin can successfully break this threshold, it could trigger a new bull market phase for the digital currency.

The Threshold at Stake

The critical level in focus for Bitcoin is the $50,000 mark, a psychological barrier that has acted both as support and resistance since Bitcoin first reached this price point in early 2021. Breaking past this level with conviction is seen by many as a key indicator of sustained upward momentum.

Factors Fueling the Surge

Several key factors contribute to the optimistic forecast for Bitcoin’s price:

Increased Institutional Adoption

In recent years, Bitcoin has seen a growing interest from institutional investors. Companies like Tesla and MicroStrategy have significantly invested in Bitcoin, adding legitimacy and stability to its value. As more corporations consider adding Bitcoin to their balance sheets or adopting it as a payment method, demand is expected to increase, pushing the price upwards.

Inflation and Economic Uncertainty

With global economies experiencing increased inflation rates, more investors are turning to Bitcoin as a potential hedge against inflation. This shift is reminiscent of the perception of Bitcoin as ‘digital gold’, an asset that can hold value during times of economic uncertainty.

Technological Innovations

The continuous improvement and adoption of the Bitcoin network also contribute to its positive outlook. Innovations such as the Lightning Network enhance Bitcoin’s scalability and usability, making it more attractive not only as a store of value but also for everyday transactions.

Regulatory Clarity

As regulatory frameworks for cryptocurrencies become clearer and more standardized, investor confidence grows. Recent movements towards cryptocurrency regulation in major economies can provide a more stable environment for Bitcoin’s growth.

Technical Analysis

From a technical standpoint, Bitcoin has shown strong resilience. After bottoming out at around $17,000 in the previous year, Bitcoin has managed to maintain a steady uptrend. According to technical analysts, should Bitcoin hold above the $45,000 mark steadily; it could indicate strength and potential to break through the $50,000 resistance.

Market Sentiment

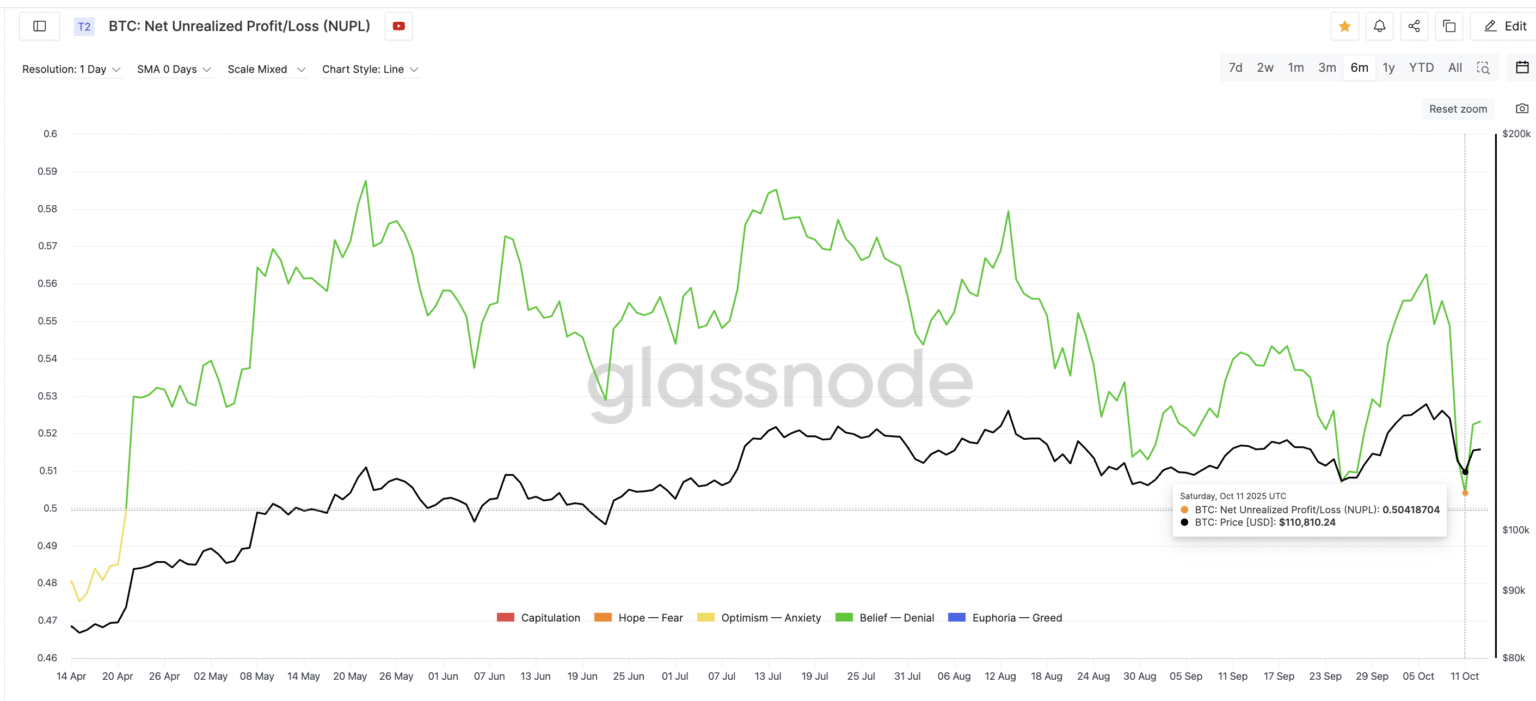

The market sentiment is notably bullish. The Fear and Greed Index, which analyzes emotions and sentiments from different sources and crunches them into one simple number, is currently indicating ‘Greed.’ This suggests that investors are confident about potential market gains, which could propel Bitcoin past the anticipated threshold.

Expert Opinions

Cryptocurrency analysts and financial experts are cautiously optimistic. While acknowledging the volatile nature of Bitcoin, they point out the alignment of various indicators suggesting a strong potential for an upward movement. “All eyes are on the $50,000 mark,” says one leading financial analyst. “A clear break above this point could usher in a wave of fresh investments.”

Conclusion

While predicting the precise movements of Bitcoin’s price is notoriously challenging, the convergence of favorable factors paints a promising picture. Should the current support levels hold firm and external market forces remain favorable, Bitcoin could be set to break past the $50,000 threshold. As always, investors should keep in mind the high volatility and unpredictability inherent in cryptocurrency investments and proceed with caution.