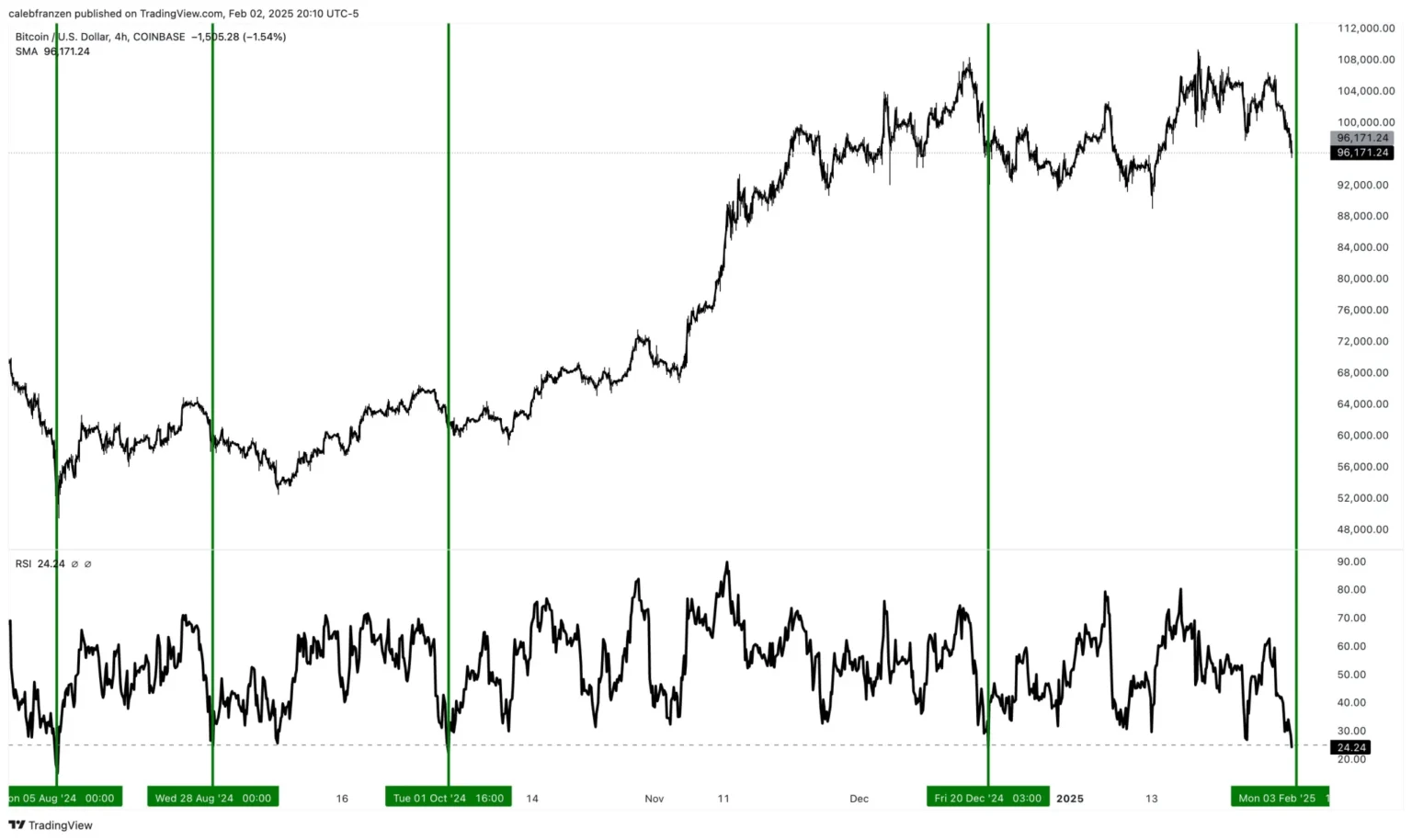

Bitcoin is currently facing uncertainty as the Relative Strength Index (RSI) for $BTC shows an oversold signal. This development raises questions about the future trajectory of Bitcoin. An oversold RSI typically suggests that an asset may be undervalued, potentially leading to a price rebound. However, it can also indicate a continued downtrend if market sentiment remains negative. Traders and investors are closely monitoring these signals to gauge potential market movements. The implications of this oversold condition could influence trading strategies and decisions in the short term. Analysts are divided on whether this signal will lead to a recovery or if further declines are imminent.

This update was auto-syndicated to Bpaynews from real-time sources. It was normalized for clarity, SEO and Google News compatibility.

Related: More from Bitcoin News | Bitcoin Futures Retreat Amid Iran Conflict Escalation | Bitcoin Drops Below $66K Amidst Escalating Iran Conflict