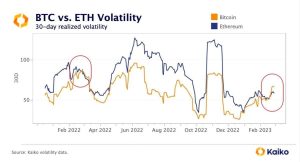

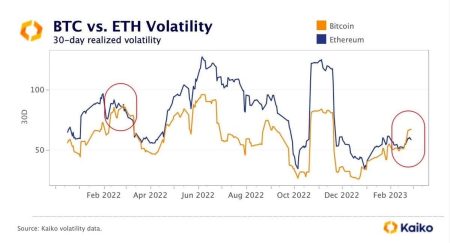

Bitcoin ETFs have emerged as a revolutionary financial instrument, bringing the world of cryptocurrency closer to traditional investing. As Eric Balchunas, a senior ETF analyst at Bloomberg, analyzes the Bitcoin market volatility, his insights suggest that investor structures within Bitcoin ETFs may be more robust than previously anticipated. However, he warns of inherent Bitcoin price risks, highlighting the unpredictable nature of this digital currency. Initially, Balchunas believed that these funds would mitigate market volatility by replacing speculative investors post-FTX incident. Yet, the selling pressure from early holders underscores the persistent high-risk profile associated with Bitcoin, keeping potential investors on high alert.

Exchange-traded funds (ETFs) linked to Bitcoin are gaining traction as a viable option for both seasoned and novice investors, drawing attention to their unique characteristics. Analysts like Eric Balchunas are scrutinizing the impact of these funds on the overall cryptocurrency ecosystem, particularly concerning the fluctuations in Bitcoin markets. The discourse surrounding the dynamics of Bitcoin investor demographics sheds light on how these platforms aim to stabilize a highly volatile asset class. However, the inherent price risks associated with Bitcoin continue to pose challenges, revealing the complexities involved in these investment vehicles. As interest in Bitcoin-linked ETFs grows, so does the need for careful consideration of the market forces at play.

| Key Point | Details |

|---|---|

| Investor Structure | Strong than expected; Balchunas maintains this view. |

| Market Volatility | Previous expectations that Bitcoin ETFs would reduce volatility were incorrect. |

| Retail Investors | Balchunas expected retail funds to stabilize the market after the FTX incident. |

| Selling Pressure | Established investors (OGs) sold at high prices, creating volatility. |

| Price Increase | Recent 450% increase highlights potential risk and volatility. |

| High-Risk Characteristic | Bitcoin is expected to remain a high-volatility, high-risk asset. |

Summary

Bitcoin ETFs continue to be a focal point of discussion as they present an intriguing investment opportunity for both retail and institutional investors. Despite initial optimism about their potential to stabilize Bitcoin’s market volatility, recent assessments reveal that the impact may be less pronounced due to significant selling pressures from early holders. As Bitcoin’s value surged dramatically, warning signs of continued volatility emerge, suggesting that the characteristics of Bitcoin as a high-risk asset are likely to endure in the near future.

Understanding Bitcoin ETFs

Bitcoin ETFs (Exchange-Traded Funds) have become a hot topic in the financial world, particularly among investors looking for exposure to cryptocurrency without the complexities of directly holding digital assets. The appeal of a Bitcoin ETF lies in its ability to provide a regulated, traditional investment vehicle for those hesitant to dive into the volatile waters of cryptocurrency trading. However, the structure of these ETFs, as pointed out by Eric Balchunas, involves a complex dynamic between retail and institutional investors, which can significantly influence the market.

The investor structure of Bitcoin ETFs plays a crucial role in shaping market dynamics. Balchunas emphasized that he initially underestimated the impact of retail investors, who expected a safer investment alternative post-FTX collapse. This leads to a paradox: While Bitcoin ETFs are designed to stabilize investment in cryptocurrencies, the sheer volume of selling pressure from early holders can exacerbate Bitcoin market volatility. Understanding this structure is essential for investors looking to navigate the potential risks associated with Bitcoin price fluctuations.

Eric Balchunas Insights on Bitcoin Market Volatility

Eric Balchunas, a prominent voice in the ETF analysis space, has provided insights that underline the unpredictable nature of Bitcoin and its associated ETFs. He pointed out that while Bitcoin ETFs might theoretically reduce volatility by attracting a more stable investor base, the reality has shown a different outcome. He acknowledges that his previous expectations were overly optimistic, given the relentless selling pressure from OG (original) Bitcoin holders who are cashing out at peak prices, thereby contributing to rapid price swings.

Balchunas also highlights the concerning trend of Bitcoin’s dramatic price increase of about 450% over two years. Such spikes are often indicative of impending volatility; historically, rapid price increases have preceded sharp corrections in the cryptocurrency market. For investors, understanding this relationship between price increases and volatility is essential, as it contributes to the ongoing discussion around the Bitcoin market’s inherent risks and challenges.

Analyzing Bitcoin Price Risks and ETF Structures

The recent performance of Bitcoin raises critical questions about the interplay between price risks and the structural features of Bitcoin ETFs. With a staggering rise in Bitcoin’s value, investors are left pondering whether this growth trajectory will sustain or lead to pronounced market corrections. The high volatility characteristic of Bitcoin makes risk assessment a complex endeavor. Many investors looking to hedge against potential downturns may turn to Bitcoin ETFs, mistakenly believing they offer a buffer from the market’s inherent risks.

By understanding the investor structure of these ETFs, which comprises both retail and institutional investors, one can better gauge potential price movements. The challenge remains that while Bitcoin ETFs might draw more serious investors to the market, they do not eliminate the fundamental nature of Bitcoin as a volatile asset. Thus, those seeking stable returns should remain cautious and consider the overall landscape of Bitcoin price dynamics, particularly in light of the historical trends that continue to shape the market.

The Future of Bitcoin ETFs in a Volatile Market

Looking ahead, the future of Bitcoin ETFs is tightly interwoven with the cryptocurrency’s volatility. As Eric Balchunas asserts, the investor structure remains a vital factor in determining the overall success and stability of Bitcoin ETFs. The anticipated influx of both retail and institutional investors could potentially mitigate some volatility; however, the unpredictability of the crypto market suggests that significant price fluctuations may persist.

Moreover, it’s crucial for prospective Bitcoin ETF investors to stay informed about broader market trends and economic indicators. As the cryptocurrency landscape evolves, Balchunas’s insights remind us that while Bitcoin could become a more integrated asset in traditional investment portfolios, the risks associated with its volatility will likely endure. Investors must adopt a strategic approach, weighing opportunities against the backdrop of price risks and market dynamics.

Market Reactions to Bitcoin ETF Developments

Market reactions to the introduction of Bitcoin ETFs have been mixed, reflecting the complex sentiment surrounding crypto assets. Following the news about potential regulatory approvals, Bitcoin often experiences price surges, as investors speculate on the long-term viability of these funds. However, as indicated by Balchunas, such optimism may be tempered by the realities of market volatility, where rapid price increases can lead to significant sell-offs from early adopters.

Understanding the ebb and flow of market reactions to Bitcoin ETFs requires a nuanced approach. While retail investors hope for a stable environment facilitated by these funds, historical patterns of Bitcoin market volatility serve as a cautionary tale. The balance of power in the investor structure will ultimately dictate the response to future Bitcoin ETF developments and their potential impact on price stability.

Investing in Bitcoin ETFs: Risks and Rewards

Investing in Bitcoin ETFs presents a unique set of risks and rewards that every investor should consider. On one hand, ETFs offer a gateway to the cryptocurrency market, allowing investors to gain exposure without the logistical challenges of buying and storing Bitcoin directly. On the other hand, the underlying volatility of Bitcoin cannot be understated, as price swings can erode profits or amplify losses swiftly, particularly if investors are not adequately prepared for market fluctuations.

Moreover, Eric Balchunas’s analysis indicates that, while Bitcoin ETFs may attract a more stable pool of investors, they still reflect the underlying asset’s speculative nature. Investors must navigate between the appeal of a traditional investment vehicle and the reality of Bitcoin’s unpredictable price movements. Carefully weighing the benefits against the potential risks is essential for making informed investment decisions in this burgeoning space.

The Evolving Landscape of Bitcoin Regulation and ETFs

The regulatory environment surrounding Bitcoin and Bitcoin ETFs is evolving rapidly, with significant implications for investors. As discussions about regulatory frameworks continue, the potential for heightened oversight could either bolster investor confidence or create barriers to entry. Eric Balchunas emphasizes that the investor structure’s strength hinges on regulatory clarity and support, which can influence both market volatility and the overall health of Bitcoin investments.

As regulators continue to assess the implications of cryptocurrency on traditional markets, the futures of Bitcoin ETFs will be closely monitored. Understanding these regulatory changes will be crucial for investors aiming to position themselves advantageously in the marketplace. The confidence generated by clear regulations may stabilize Bitcoin’s price in the long run, but investors must remain vigilant to adjust their strategies based on regulatory developments and market responses.

The Role of Institutional Investors in Bitcoin ETFs

Institutional investors have increasingly become a pivotal force in shaping the landscape of Bitcoin ETFs. Their entry into the market is often viewed as a vote of confidence in the cryptocurrency’s future, encouraging widespread adoption. However, as Eric Balchunas points out, institutional involvement doesn’t automatically translate to reduced market volatility. Their trading strategies can vary widely, sometimes amplifying price swings as they respond to market conditions.

Moreover, the presence of institutional investors alters the dynamics of the investor structure in Bitcoin ETFs. While they may bring in substantial capital and sophisticated trading capabilities, their actions can also introduce new risks. The interplay between institutional money and retail sentiment creates a complex narrative for Bitcoin ETFs, making it vital for investors to understand these relationships when assessing their strategies and readiness for market fluctuations.

Strategies for Navigating Bitcoin Market Fluctuations

Navigating the fluctuations of the Bitcoin market requires a keen understanding of both market sentiment and individual investment strategies. Potential investors should familiarize themselves with key indicators that signal shifts in the market. Understanding the characteristics of Bitcoin as a high-volatility asset is essential for devising effective investment strategies, especially in the context of ETFs. Eric Balchunas emphasizes that maintaining an adaptable mindset is crucial as investor structures evolve in tandem with market demands.

Additionally, employing a diversified approach can alleviate some risks associated with Bitcoin price volatility. Investors could explore a combination of direct Bitcoin investments and exposure through ETFs to balance risk and reward. This dual approach enables investors to capture the benefits of ETFs while also capitalizing on the potential upside of direct cryptocurrency holdings, thus positioning themselves more strategically within an inherently volatile market.

Frequently Asked Questions

What is the Bitcoin ETF analysis by Eric Balchunas regarding market volatility?

According to Eric Balchunas, a senior ETF analyst at Bloomberg, his assessment suggested that the investor structure of Bitcoin ETFs would be stronger than previously anticipated. However, he acknowledged that Bitcoin ETFs have not significantly reduced market volatility as he initially believed. This implies that while the investor base may be improving, Bitcoin’s inherent volatility remains a critical factor.

How does Bitcoin market volatility impact Bitcoin ETFs?

Bitcoin market volatility plays a significant role in Bitcoin ETFs as price fluctuations can greatly affect investor sentiment and fund performance. High volatility can lead to rapid gains or losses, which Balchunas points out as a risk, especially with Bitcoin’s 450% price increase over two years. This ongoing volatility signifies continuing high-risk implications for Bitcoin ETF investments.

What insights does Eric Balchunas provide about Bitcoin ETFs and retail investor behavior?

Eric Balchunas indicates that he initially posited that Bitcoin ETFs would attract a more stable retail investor structure, replacing speculative investors post-FTX incident. However, he underestimated the selling pressure from earlier Bitcoin holders, suggesting that the dynamics of retail investor behavior in Bitcoin ETFs may still contribute to existing market volatility.

What are the price risks associated with Bitcoin ETFs as highlighted in analysis?

The analysis of Bitcoin ETFs points out that significant price risks are inherent in the cryptocurrency market. With Bitcoin’s price witnessing a substantial rise of approximately 450% over two years, analysts like Eric Balchunas warn that such rapid price increases may indicate potential for high volatility and risk. Thus, investors in Bitcoin ETFs should remain aware of these fluctuations.

How does ETF investor structure affect Bitcoin ETF performance?

The ETF investor structure, as discussed by Eric Balchunas, suggests that a more robust investor base could enhance the long-term viability of Bitcoin ETFs. However, the anticipated reduction in volatility due to this structure has not fully materialized. This indicates that while a stronger investor profile may stabilize investments, Bitcoin’s high-risk nature and market volatility continue to pose challenges.