Bitcoin ETFs have become a pivotal development in the cryptocurrency landscape, revolutionizing the way investors engage with Bitcoin. As more people look to diversify their portfolios with Bitcoin investments, these exchange-traded funds offer a seamless gateway into the world of cryptocurrencies. The approval and trading of Bitcoin ETFs represent a significant milestone for the integration of digital assets into traditional financial markets—it’s a marriage of old and new finance. Furthermore, the growing Bitcoin trading volume indicates a rising interest beyond just tech-savvy investors, capturing the attention of institutional players as well. With Bitcoin ETFs, both seasoned investors and newcomers alike can tap into Bitcoin’s potential with reduced complexities and enhanced market accessibility.

The emergence of cryptocurrency ETFs is reshaping the investment fabric of digital assets, allowing for broader market participation and exposure. Rather than purchasing Bitcoin directly, investors can opt for these financial products that operate within familiar frameworks, thereby easing their entry into the crypto realm. This shift not only elevates Bitcoin trading to a new level but also signifies how traditional finance is embracing digital currencies. With growing interest from mainstream financial channels, the introduction of market-friendly structures like Bitcoin ETFs fosters a conducive environment for both seasoned asset managers and everyday investors looking to allocate capital in a burgeoning sector. As this trend continues, it challenges the dichotomy between traditional finance and the innovative landscape of crypto.

The Rise of Bitcoin ETFs in Traditional Finance

The approval of Bitcoin exchange-traded funds (ETFs) marked a significant turning point for cryptocurrency in the landscape of traditional finance. For many years, Bitcoin was seen as a speculative asset limited to enthusiasts and seasoned investors well-versed in the crypto space. However, the introduction of Bitcoin ETFs streamlined the entry for mainstream investors, creating an easy and familiar way to gain exposure to the leading cryptocurrency. This transformation has fundamentally shaped how Bitcoin is perceived within the established financial markets, allowing it to be incorporated into standard investment portfolios alongside traditional assets.

As Bitcoin ETFs began trading, they quickly attracted considerable capital flows, totaling billions in the initial days alone. This inflow represents not only a growing acceptance of Bitcoin as a legitimate asset but also a major shift in the type of investors now entering the market. Institutional investors, financial advisors, and retail investors alike can now invest in Bitcoin with the comfort of utilizing familiar financial instruments, bridging the gap between classic investment strategies and new digital assets.

Frequently Asked Questions

What are Bitcoin ETFs and how do they influence Bitcoin investment?

Bitcoin ETFs, or exchange-traded funds, are investment vehicles that allow investors to gain exposure to Bitcoin without holding the asset directly. They have significantly influenced Bitcoin investment by integrating it into traditional finance systems, making it accessible to a broader range of investors, including institutional players, thereby shifting the dynamics of the cryptocurrency markets.

How have Bitcoin ETFs changed the landscape of cryptocurrency ETFs?

Bitcoin ETFs have revolutionized cryptocurrency ETFs by providing a regulated, easy-to-access product that appeals to institutional and retail investors alike. This transition has increased trading volume and liquidity for Bitcoin, establishing it as a staple in financial markets and contributing to the maturation of the cryptocurrency sector.

What impact did the approval of Bitcoin ETFs have on Bitcoin trading volume?

The approval of Bitcoin ETFs led to a significant increase in Bitcoin trading volume, with the first day of trading seeing approximately $4.6 billion in transactions. This surge illustrates how Bitcoin ETFs have created a familiar trading environment, attracting more investors and enhancing liquidity in the Bitcoin market.

In what ways have Bitcoin ETFs integrated with traditional finance?

Bitcoin ETFs have integrated with traditional finance by allowing investors to include Bitcoin in their portfolios through established brokerage platforms, retirement accounts, and investment funds. This integration has enabled Bitcoin to be viewed as a legitimate asset class, aligning it closer to traditional securities.

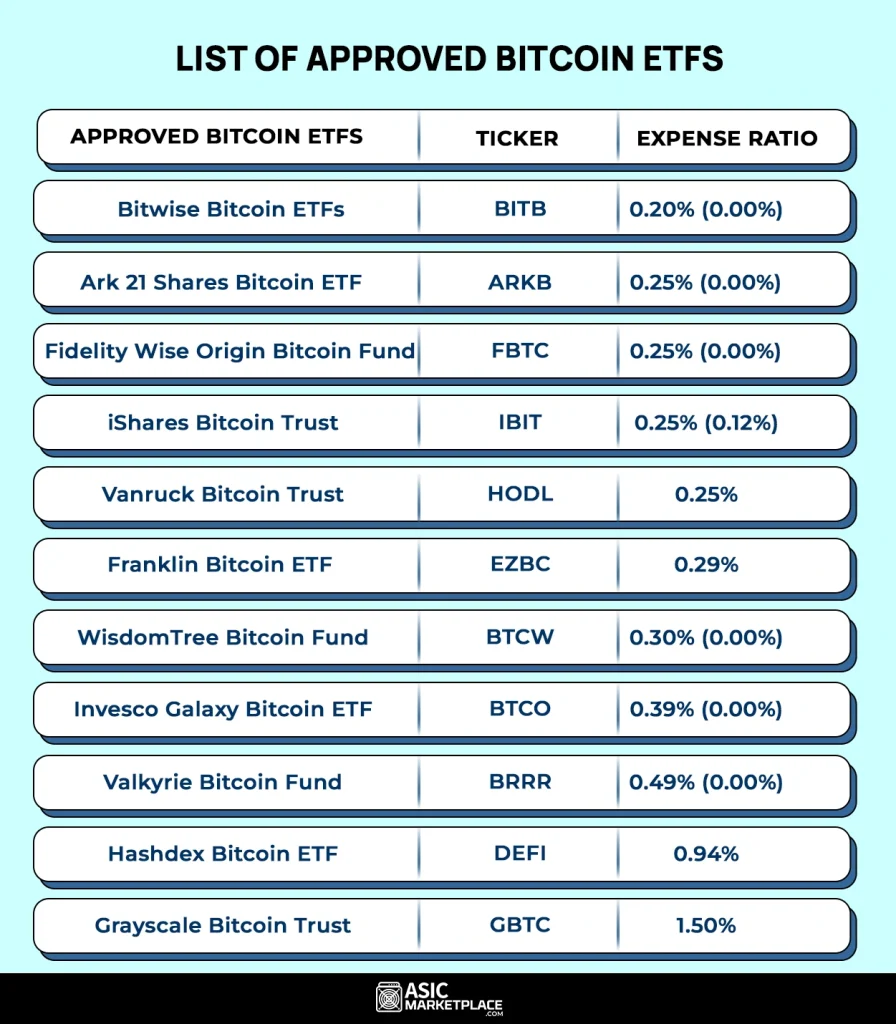

What factors should investors consider before investing in Bitcoin ETFs?

Investors should consider factors such as the fund’s fee structure, the underlying asset management, historical performance, and the liquidity of the Bitcoin ETFs they are interested in. Understanding these elements can help investors make informed decisions and navigate the unique risks associated with Bitcoin investment.

How do Bitcoin ETFs affect volatility in the cryptocurrency markets?

Bitcoin ETFs can influence volatility by consolidating trading activity within regulated frameworks, which often leads to tighter spreads and improved execution. As institutional funds enter through these ETFs, the behavior of Bitcoin prices may become more predictable compared to the more erratic price movements seen in traditional cryptocurrency trading.

What is the significance of Bitcoin ETFs to the future of cryptocurrency regulations?

The success of Bitcoin ETFs may signal a shift toward clearer regulatory frameworks for the entire cryptocurrency market. As regulators become more accustomed to Bitcoin’s integration into traditional finance, further acceptance and regulation for other cryptocurrencies and digital assets are likely to follow, fostering a safer investment environment.

How does the introduction of Bitcoin ETFs impact retail investors?

The introduction of Bitcoin ETFs provides retail investors with a simplified way to invest in Bitcoin without needing to manage digital wallets or custody risk. This convenience allows everyday investors to participate in the Bitcoin market through established investment platforms, reflecting a significant step towards mainstream adoption.

| Key Point | Details |

|---|---|

| Introduction of Bitcoin ETFs | On Jan. 10, 2024, the SEC approved spot Bitcoin ETFs, allowing traditional investors to enter the Bitcoin market. |

| Market Transformation | Bitcoin shifted from a crypto-native trading environment to institutional channels, leading to significant capital inflows. |

| Impact of ETFs | ETFs provided a structured format for Bitcoin investment, attracting new buyers, including advisors and retirement accounts. |

| Net Flows and Statistics | As of Jan. 9, 2026, Bitcoin ETFs have seen a total of $56.63 billion in net inflows, reshaping market dynamics. |

| Market Liquidity | The first day of trading saw $4.6 billion in volume, indicating the capability of Bitcoin ETFs for large transactions. |

| Institutional Adoption | The introduction of ETFs legitimized Bitcoin in traditional finance, creating a link between crypto and mainstream investment. |

Summary

Bitcoin ETFs have significantly transformed the landscape of cryptocurrency investing by providing traditional investors with a structured and accessible way to gain exposure to Bitcoin. With the SEC’s approval in January 2024, the floodgates opened, allowing billions of dollars to flow into these funds and transforming Bitcoin from a niche asset into a core component of many investment portfolios. As Wall Street’s involvement deepens, Bitcoin ETFs are set to continue reshaping market dynamics, providing essential liquidity and attracting a broader base of investors.

Related: More from Bitcoin News | Bitcoin Analysts: BTC Market Bottoming in Q4 2026 | BTC Below $70K, JPN Inflation Under 2%: Monthly Charts