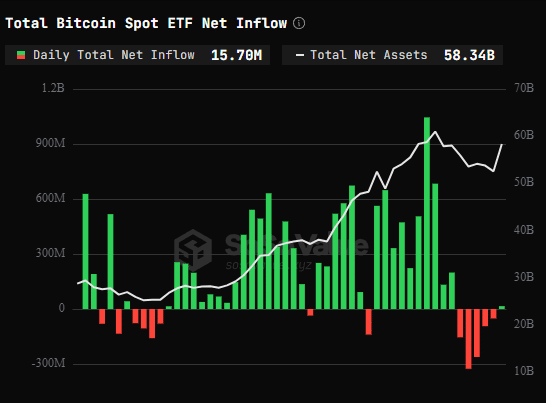

This week, Bitcoin ETFs net outflow made headlines as the U.S. spot Bitcoin ETFs experienced a staggering total outflow of $1.3241 billion, marking a concerning trend for investors. Notably, this was the first trading week recorded without any net inflows, raising alarms about Bitcoin investment trends. Major players like IBIT and FBTC contributed significantly, with net outflows of $537.5 million and $451.5 million, respectively. This unprecedented negativity in Bitcoin ETF performance highlights the underlying challenges facing the cryptocurrency market, and it invites closer scrutiny and Bitcoin market analysis. With the increasing attention on cryptocurrency net outflow, investors are left to wonder what implications this may have for the future of Bitcoin and its ETFs.

In recent developments, the outflow of capital from Bitcoin exchange-traded funds has caught the attention of market analysts and investors alike. The consequences of this significant withdrawal from Bitcoin funds can be likened to broader shifts in cryptocurrency investment dynamics. As transaction volumes drop and the market faces increased scrutiny, investors are evaluating their options in light of current conditions. The lack of inflow into these financial products suggests an urgent need for a deeper understanding of Bitcoin’s current market position. With the implications for Bitcoin’s future hanging in the balance, many stakeholders are keenly analyzing these investment patterns.

| ETF Name | Net Outflow (in million $) |

|---|---|

| IBIT | 537.5 |

| FBTC | 451.5 |

| BITB | 66.3 |

| ARKB | 76.2 |

| EZBC | 10.4 |

| BRRR | 3.8 |

| HODL | 6.3 |

| GBTC | 172.1 |

Summary

This week marked a significant downturn in the cryptocurrency market, as Bitcoin ETFs experienced a net outflow of $1.3241 billion, signaling investor concern and market volatility. Notably, major ETFs such as IBIT and FBTC led the outflows, indicating a shift in investment strategies among crypto investors. Understanding the dynamics of Bitcoin ETFs net outflow can provide valuable insights into market trends and investor behavior, making it crucial for stakeholders and traders to monitor these developments closely.

Understanding Bitcoin ETFs Net Outflow Trends

The recent trend of net outflows from U.S. spot Bitcoin ETFs signifies a growing investor caution in the cryptocurrency market. This week alone, these ETFs saw a staggering net outflow totaling $1.3241 billion, a stark indicator of shifting sentiment among cryptocurrency investors. Such outflows raise questions regarding future Bitcoin ETF performance and the overall health of Bitcoin investment trends, particularly amid the evolving landscape of regulation and market acceptance.

Key players in the Bitcoin ETF space, such as IBIT, FBTC, and GBTC, reported significant individual net outflows ranging from hundreds of millions to tens of millions. For instance, IBIT alone experienced a net outflow of $537.5 million, underscoring the fragility of investor confidence in these financial instruments. This net outflow trend is essential not only for assessing the performance of individual ETFs but also for understanding broader cryptocurrency net outflow dynamics that could shape market analysis going forward.

Impact of U.S. Bitcoin ETFs on Cryptocurrency Market Dynamics

The activity surrounding U.S. Bitcoin ETFs plays a crucial role in shaping cryptocurrency market dynamics. With the latest figures showcasing a comprehensive net outflow, investors are increasingly turning cautious. Analyzing the performance of U.S. Bitcoin ETFs can provide insights into Bitcoin market analysis and identify prevailing investment trends. The lack of inflow on any trading day this week suggests a potential liquidity issue that may further compound market volatility.

Moreover, the consistent net outflows observed among various Bitcoin ETFs indicate a significant shift in investor behavior. As major ETFs like FBTC and GBTC report substantial withdrawals, the overall sentiment towards Bitcoin investments is plagued with uncertainty. Understanding these trends is vital for both current and prospective investors looking to navigate the complex Bitcoin investment landscape.

Analyzing Recent Bitcoin Investment Trends

In light of the recent net outflows observed in Bitcoin ETFs, it is essential to analyze current investment trends among cryptocurrency investors. The $1.3241 billion net outflow highlights a need for close scrutiny of factors influencing investor sentiment. Factors such as regulatory changes, market performance, and potential economic headwinds play significant roles in shaping how investors view Bitcoin as a viable asset.

Furthermore, these investment trends hark back to earlier episodes in cryptocurrency history, where abrupt shifts in outflow patterns have triggered broader market corrections. This week’s data serves as a crucial reminder of the volatility inherent in Bitcoin investments. While ETFs are designed to provide a streamlined investment experience, the reality is that investor psychology and broader market trends can drastically alter their fortunes.

The Role of Bitcoin Market Analysis in Investment Decisions

Market analysis is a fundamental tool for investors navigating the ever-changing landscape of Bitcoin and cryptocurrencies. In light of the recent comprehensive net outflows from Bitcoin ETFs, in-depth market analysis can help potential investors make informed decisions. This analysis not only focuses on numerical data, like the $1.3241 billion outflow this week, but also examines trends over time and the implications of such movements.

Understanding Bitcoin market analysis enables investors to gauge the current sentiment towards cryptocurrencies, identify favorable entry points, and measure risks associated with individual ETFs. By monitoring these trends, investors can develop strategies that align with their financial goals, whether it’s through diversifying into other cryptocurrencies or holding onto traditional assets as the market stabilizes.

Evaluating Bitcoin ETF Performance Amidst Market Changes

Evaluating the performance of Bitcoin ETFs during a period of market turbulence allows investors to understand the resilience of these financial products. The stark net outflows displayed this week highlight weaknesses in ETF structures and their correlation with Bitcoin’s underlying market. By examining such performance metrics, investors can discern which ETFs are worth pursuing in the long run versus those that may continue to struggle amidst prevailing circumstances.

Additionally, understanding the context behind Bitcoin ETF performance offers an opportunity for comprehensive risk assessment. As performance varies dramatically, depending on investor sentiment and broader market conditions, analyzing the respective strategies of each ETF can provide insights into their effectiveness. Investors who remain informed of these dynamics can better allocate their resources, whether in Bitcoin ETFs or alternative strategies.

The Future of Bitcoin ETF Investments

The recent net outflow trend observed in Bitcoin ETFs poses critical questions about the future of Bitcoin investments. As institutional investors recalibrate their strategies, the outlook for Bitcoin ETFs becomes increasingly nuanced. Understanding where the market is heading involves not only analyzing current metrics but also predicting how regulatory developments and societal sentiment toward cryptocurrency will evolve.

As the cryptocurrency landscape continues to mature, it’s likely that the market will experience further shifts in investment strategies. New trends may emerge as investors seek safer alternatives or innovative products within the cryptocurrency space. By staying attuned to changes and understanding the implications of these net outflows, investors can navigate the future of Bitcoin ETF investments with a clearer lens.

Investor Sentiment and Market Challenges

The recent spike in net outflows from Bitcoin ETFs illustrates a crisis of investor confidence, reflecting broader market challenges that cryptocurrencies face today. As various Bitcoin ETFs report substantial withdrawals, it indicates a significant shift in sentiment—investors are becoming increasingly wary about future valuations and market stability. Understanding these emotional and psychological barriers that influence decision-making is essential for any serious cryptocurrency investor.

Market challenges extend beyond individual ETF performances; they encompass regulatory scrutiny, global economic factors, and competition from traditional financial assets. As the market grapples with these variables, understanding risk tolerance becomes paramount. Investors must analyze how their strategies align with their risk appetite amidst the shifting sentiment triggered by significant net outflows.

Navigating Regulatory Developments Impacting Bitcoin ETFs

The rapid pace of regulatory developments can significantly impact the operational landscape of Bitcoin ETFs. Investors must stay informed about updates that can affect their portfolios and drive shifts in investment trends. Current net outflows can be partly attributed to heightened anticipation surrounding potential regulations that may affect compliance and access to Bitcoin ETFs, influencing investor behavior and market dynamics.

By navigating these regulations, investors can make more strategic decisions that may buffer them against adverse market movements. While regulatory clarity may often instill confidence, uncertainty often leads to net outflows, as seen this week. Keeping abreast of these changes will help investors connect the dots between regulatory landscapes and Bitcoin’s market performance.

The Broader Implications of Cryptocurrency Net Outflows

Cryptocurrency net outflows are telling indicators of market sentiment and investor behavior. The $1.3241 billion net outflow observed this past week underscores a critical juncture in investor confidence, raising alarms about potential bear markets or extended downturns. The implications of such movements extend beyond individual ETFs and can foreshadow broader market corrections, shifting the way investors approach their strategies.

Understanding the causes and consequences of cryptocurrency net outflows involves analyzing market psychology and trends. These outflows serve as reflections of uncertainty and risk aversion that investors must contend with. By comprehensively analyzing these patterns, investors can make decisions that either mitigate losses or capitalize on favorable market conditions as they arise.

Frequently Asked Questions

What are the recent Bitcoin ETF performance trends related to net outflow?

This week, the performance of U.S. Bitcoin ETFs saw a staggering total net outflow of $1.3241 billion, highlighting significant declines across various funds, with no trading day recording net inflows.

How did the Bitcoin ETFs net outflow specifically impact individual funds?

Individual U.S. Bitcoin ETFs experienced notable net outflows: IBIT saw a $537.5 million outflow, FBTC $451.5 million, and other funds like BITB and ARKB also reflected substantial losses, indicating widespread investor withdrawal.

What factors contribute to Bitcoin investment trends in light of ETF net outflow?

Factors influencing the current Bitcoin investment trends include market sentiment, regulatory developments, and investor reactions to the significant net outflows from Bitcoin ETFs, which may signal cautious market attitudes toward cryptocurrency.

What does the current Bitcoin market analysis reveal about net outflow from U.S. Bitcoin ETFs?

The latest Bitcoin market analysis reveals that the overall $1.3241 billion net outflow from U.S. Bitcoin ETFs suggests a bearish trend among investors, as they pull back their investments during uncertain market conditions.

How do cryptocurrency net outflows from Bitcoin ETFs affect overall market confidence?

Cryptocurrency net outflows, especially from Bitcoin ETFs, can negatively impact overall market confidence, as large withdrawals may indicate reduced investor trust and speculation about future price declines.

What implications do substantial Bitcoin ETF net outflows have for future ETF performance?

Substantial Bitcoin ETF net outflows could lead to decreased liquidity and volatility within the market, potentially affecting future ETF performance as investors reassess their positions and market strategies.