Bitcoin ETFs have captured significant attention in the financial world, especially with the recent surge in ETF inflows marking a new era for cryptocurrency investments. On the very first trading day of 2026, US-based spot Bitcoin exchange-traded funds experienced an impressive $471.3 million in net inflows, signaling a robust start despite fluctuating crypto market sentiment. Additionally, the combined interest in both Bitcoin and Ether ETFs, totaling approximately $646 million, demonstrates the growing appetite among mainstream investors for these digital assets. As institutional investors begin to re-enter the market, the impact of ETF inflows on price movements and overall cryptocurrency market health cannot be overlooked. With Bitcoin and Ether ETFs leading the charge, the future of crypto investments looks increasingly promising, setting the stage for further growth in this dynamic sector.

The rising wave of cryptocurrency exchange-traded funds (ETFs), including spot Bitcoin and Ether options, represents a pivotal shift in how investors approach digital currencies. This financial product not only provides a simplified route for capitalizing on Bitcoin’s price movements but also reflects a broader trend in the acceptance of cryptocurrencies within traditional finance. With a notable influx of investment capital reported at the start of the year, the enthusiasm surrounding crypto ETFs emphasizes their role as barometers for market sentiment. Observing the inflow trends can reveal insights about investor confidence and the potential for future price appreciation in the ever-evolving crypto landscape. Therefore, as the industry navigates through periods of volatility, the performance of these ETFs will be crucial in shaping investor strategies and market dynamics.

The Surge in Spot Bitcoin ETFs: A New Beginning

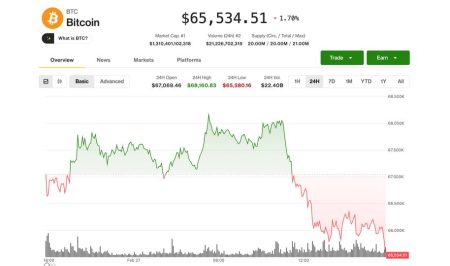

The launch of spot Bitcoin ETFs at the beginning of 2026 has garnered significant attention, particularly after they recorded net inflows of approximately $471.3 million on their first day. This marked the largest inflow in over a month, suggesting a resurgence in investor interest despite a mixed sentiment prevailing in the cryptocurrency market. As Bitcoin continues to be seen as a primary asset among institutional investors, the performance of these ETFs could signal a turning point that could influence crypto market sentiment moving forward.

Investors are now cautiously optimistic, as the response to spot Bitcoin ETFs could foreshadow broader trends in the cryptocurrency market. The inflow numbers indicate a potential reconnection of retail and institutional interests that were somewhat stifled during the downturn experienced in late 2025. With the gravity of ongoing market conditions, large-scale investments might encourage a more stable environment for crypto assets, eventually reflecting positively on the price movements of Bitcoin.

Ether ETFs: Capitalizing on Growing Crypto Market Interest

Alongside spot Bitcoin ETFs, Ether ETFs have displayed impressive growth, securing $174.5 million in net inflows on the same day. This noteworthy figure underscores the increasing acceptance and utilization of Ethereum within the cryptocurrency market. As Ether continues to develop its network through smart contracts and decentralized applications, the inflows into Ether ETFs highlight a burgeoning confidence amongst investors towards Ethereum as a viable investment opportunity.

Moreover, the rising popularity of Ether ETFs mirrors the evolving narrative in the crypto market where Ethereum is placing itself as the second-most valuable cryptocurrency after Bitcoin. This trend suggests that as institutional and retail investors explore diversified portfolios, Ether is set to become a significant player in the broader landscape of crypto assets. The inflow metrics also drive a consequential dialogue about the future regulatory landscape for cryptocurrencies and how it aligns with mainstream financial products.

Understanding ETF Inflows and Market Sentiment

ETF inflows serve as crucial indicators of market sentiment towards the cryptocurrency realm. As observed with the striking $646 million influx in spot Bitcoin and Ether ETFs within a single trading day, these inflows can often reflect broader investor confidence, or a quick adaptation to market dynamics. The connection between ETF inflows and market sentiment is particularly vital during periods of price volatility, where a robust inflow can suggest optimism amidst challenging conditions for cryptocurrencies.

Investors often look at such inflows as a measure of the appetite for risk in the cryptocurrency market. A significant rise in ETF investments typically points to a hearty recovery from general market decline, indicating a shift towards favorable perceptions of digital assets. Understanding these movements can provide key insights into potential future trends, helping investors make more informed decisions in an increasingly unpredictable landscape.

The Importance of Institutional Investment in Crypto ETFs

Institutional investors are pivotal to the success of cryptocurrency ETFs, as they bring substantial capital and long-term stability into the market. The recent inflow of $21.4 billion into US crypto ETFs, primarily steered by institutional players, demonstrates the significant role these entities play in legitimizing digital assets as an investment class. Such involvement not only enhances market liquidity but also fosters a more robust regulatory framework that may benefit cryptocurrency ecosystems in the long run.

As institutions adapt to evolving market conditions, their willingness to invest in spot Bitcoin and Ether ETFs reflects a strategic shift towards incorporating cryptocurrencies into mainstream financial strategies. This trend could stimulate further innovation within the crypto space, encouraging the development of new investment vehicles tailored to institutional needs, ensuring that the growth trajectory of cryptocurrency ETFs remains upward.

Crypto Market Sentiment: Evaluating the Fear and Greed Index

The fluctuating scores of the Crypto Fear & Greed Index provide a unique lens into market sentiment, reflecting how influencers perceive the crypto landscape. Currently, the Index indicates a return to ‘Extreme Fear’ based on consistent trends of pessimism following price declines in major cryptocurrencies. Understanding these sentiment markers can be beneficial for investors seeking to navigate the complex emotional and irrational behaviors often present in market cycles.

Given the volatile nature of cryptocurrencies, the Fear & Greed Index serves as a reminder of the need for prudent investment practices. Investors must weigh market sentiment alongside their long-term financial goals, especially in environments marred by uncertainty. Current trends show that while some investors may feel cautious, others are starting to position themselves for potential rebounds as authorities and market constructs continue to evolve.

2025: A Breakthrough Year for US Crypto ETFs

The year 2025 marked a watershed moment for US crypto ETFs, which collectively drew over $31.77 billion in investments. This figure includes a staggering $21.4 billion specifically funneled into US spot Bitcoin ETFs, indicating the depth and resilience of institutional capital within the crypto space. This influx signifies that despite market corrections, large investors maintained a forward-looking perspective, which is essential for sustaining overall market health.

Furthermore, the capital inflow dynamics reveal interesting patterns about investor behaviors—while some may have retreated amidst fear during downturns, a considerable portion of investors capitalized on the opportunity provided by lower prices. As we allude to the recent inflows, it becomes clear that recognition of Bitcoin and Ether as essential components of a diversified portfolio is strengthening among investors, laying the groundwork for continued growth in the cryptocurrency market.

The Role of Market Dynamics in ETF Pricing

Understanding the market dynamics that affect ETF pricing is crucial for investors aiming to navigate the cryptocurrency landscape effectively. Factors such as supply and demand, investor sentiment, and macroeconomic influences play a significant role in determining how ETFs react to market fluctuations. The recent surge in inflows into spot Bitcoin and Ether ETFs illustrates how positive sentiment can drive prices up, even in a bearish environment for cryptocurrencies.

Market analysts often suggest that as the popularity and visibility of crypto ETFs increase, they hold the potential to serve as a barometer for broader market trends. Tracking these price movements alongside main digital assets like Bitcoin and Ether can guide investors in making strategic decisions about their portfolios. The interplay between ETF performance and crypto market dynamics thus becomes a critical area of focus for anyone looking to capitalize on potential growth in the digital asset sector.

Future Trends: Predicting the Next Wave of Crypto ETFs

As the cryptocurrency market matures, predictions about future trends in ETF offerings begin to emerge. With the recent success of spot Bitcoin and Ether ETFs, we may soon see more specialized ETFs catering to various digital assets, such as stablecoins or decentralized finance (DeFi) tokens. The diversification of ETF products can help broaden investor access to different segments of the cryptocurrency landscape while also allowing for varied investment strategies.

In addition, as regulatory environments become clearer, it is likely that additional institutional funds will flow into crypto ETFs, potentially resulting in enhanced market stability and growth. The future of cryptocurrency ETFs appears promising, with increasing institutional participation serving as a foundation for innovative financial products that can attract a wider range of investors seeking exposure to digital assets.

Impact of Regulatory Developments on Crypto ETFs

Regulatory developments significantly shape the cryptocurrency landscape, particularly for ETFs. The recent influx of institutional capital into crypto ETFs reflects a growing acceptance of these products in mainstream finance, partly driven by regulators recognizing the need for clearer frameworks. Understanding how ongoing regulations evolve can provide insight into future investment flows in this sector, especially as the spotlight on investor protection intensifies.

As regulatory bodies continue to refine their approaches to cryptocurrency, the adaptability of ETFs may set the tone for broader acceptance among investors. With institutional confidence rising in response to regulatory clarity, we can anticipate that crypto ETFs will play a pivotal role in shaping the acceptance and integration of cryptocurrencies within the wider financial ecosystem.

Frequently Asked Questions

What are spot Bitcoin ETFs and how do they impact the cryptocurrency market?

Spot Bitcoin ETFs are exchange-traded funds that allow investors to gain exposure to Bitcoin without directly owning the cryptocurrency. These ETFs hold actual Bitcoin, making them directly reflective of Bitcoin’s market price. Their impact on the cryptocurrency market is significant, as notable inflows, such as the recent $471.3 million on the first trading day of 2026, signal rising institutional interest and can influence market sentiment positively.

How did spot Bitcoin and Ether ETFs perform on their first trading day of 2026?

On their first trading day of 2026, spot Bitcoin and Ether ETFs attracted a remarkable combined net inflow of approximately $646 million. Spot Bitcoin ETFs recorded net inflows of $471.3 million, while spot Ether ETFs gained $174.5 million, indicating strong investor interest despite a mixed crypto market sentiment.

What can ETF inflows indicate about crypto market sentiment?

ETF inflows can serve as a barometer for crypto market sentiment. When significant inflows occur, like the $646 million seen with Bitcoin and Ether ETFs, it often indicates positive investor confidence and attraction towards cryptocurrencies. Conversely, continuous outflows may reflect caution or negative sentiment among market participants.

Why are spot Bitcoin ETFs considered a good investment during bearish trends in the crypto market?

Spot Bitcoin ETFs are appealing during bearish trends because they provide a regulated and simplified method for institutional and retail investors to gain exposure to Bitcoin. In turbulent markets, these ETFs can showcase resilience; the recent surge in inflows underscores their potential as instruments for mainstream adoption even amid a wider cryptocurrency market downturn.

How do Bitcoin and Ether ETFs differ in terms of market performance?

Bitcoin and Ether ETFs differ in their underlying assets and market performance metrics. For instance, while spot Bitcoin ETFs saw inflows of $471.3 million on the first day of 2026, spot Ether ETFs garnered $174.5 million. These differences can reflect varying investor interest levels and market conditions for each cryptocurrency within the broader cryptocurrency market.

What influenced the substantial ETF inflows seen at the start of 2026?

The substantial ETF inflows at the start of 2026, totaling approximately $646 million, were influenced by several factors, including renewed institutional interest after a tax-loss harvesting phase in Q4 2025 and the broader recovery signs within the cryptocurrency market, even amid fluctuating investor sentiment.

How have US investors responded to Bitcoin ETFs compared to previous years?

In 2025, US investors invested over $31.77 billion into US crypto ETFs, with Bitcoin ETFs receiving the largest share at $21.4 billion. This reflects a decrease in interest from the previous year (2024), but the ongoing inflows indicate sustained confidence in Bitcoin ETFs as critical vehicles for cryptocurrency investment.

What role do Bitcoin ETFs play in gauging market trends?

Bitcoin ETFs play a crucial role in gauging market trends as they provide insights into institutional interest and investor sentiment. The recent net inflows demonstrate how these ETFs can signal potential price movements and reflect broader crypto market dynamics, particularly during periods of volatility.

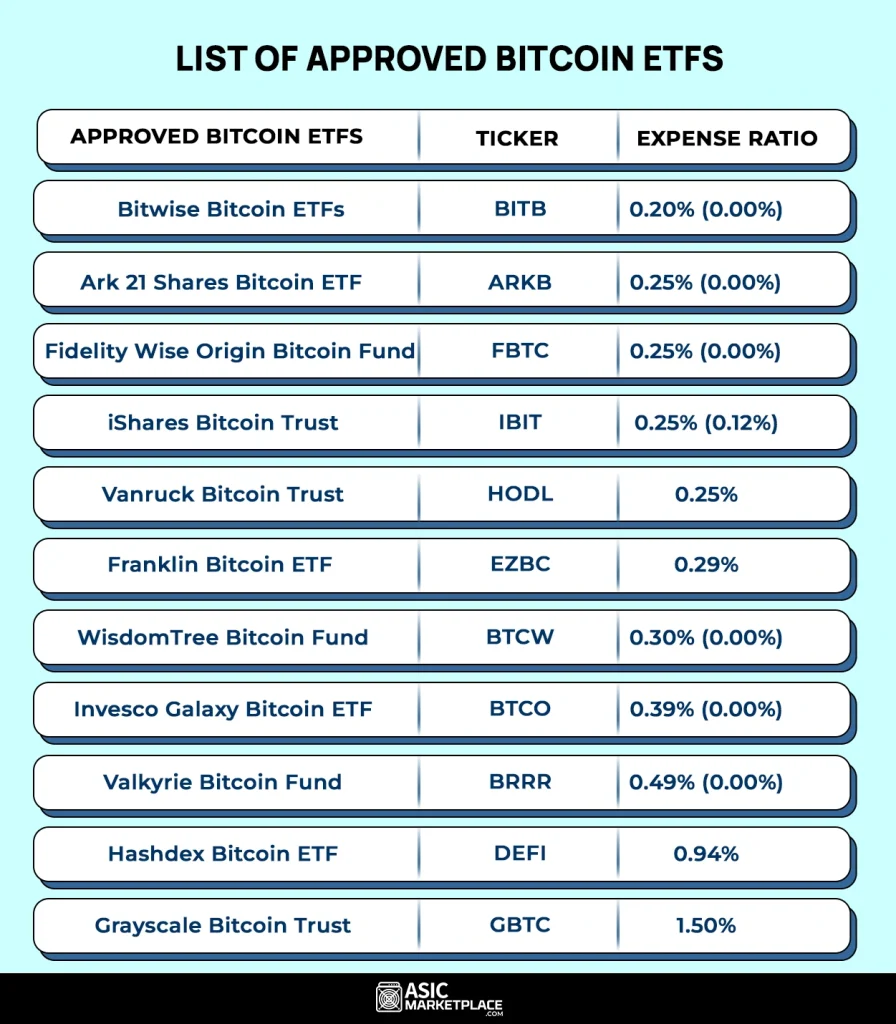

| ETF Type | Net Inflows (Millions) | Notable Insights | |

|---|---|---|---|

| Spot Bitcoin ETFs | $471.3 | Largest net inflow since November 11, 2025. | |

| Spot Ether ETFs | $174.5 | Significant single-day inflow since December 9, 2025. | |

| Total Inflows | $645.8 | Combined inflows representing strong investor interest despite market fears. | |

| Market Sentiment | Crypto market had been in ‘Extreme Fear’, fluctuating sentiment amidst downtrend. | ||

Summary

Bitcoin ETFs have shown a remarkable resurgence, attracting a combined net inflow of approximately $646 million on the first trading day of 2026. Despite the prevailing volatility in the cryptocurrency market, the impressive performance of Bitcoin and Ether ETFs indicates a renewed interest from institutional investors. This significant inflow signifies a possible shift in market dynamics, suggesting that investors may be regaining confidence in these crypto assets. With the growing prominence of Bitcoin ETFs, it will be crucial to monitor subsequent inflows as they can serve as an important barometer for overall market sentiment and price direction in the crypto space.

Related: More from Bitcoin News | Bitcoin Miner MARA Surges 17% with Starwood Deal | Gold, AI, Tech Stocks Lead as Bitcoin Fades