The performance of Bitcoin ETFs has become a hot topic as investors look for effective ways to diversify their portfolios. Recently, Bloomberg’s senior ETF analyst Eric Balchunas released performance data highlighting the exceptional growth of ETF assets, which are projected to reach $1.48 trillion in 2025. Among the offerings, the BlackRock Bitcoin ETF stands out with approximately $248.44 billion in assets under management, placing it as a significant player despite its challenging performance last year. In fact, BlackRock’s IBIT was the only one among the top 15 ETFs to report a negative return of -6.41%, reflecting the broader struggles in Bitcoin investment trends. As the market evolves, understanding these dynamics and analyzing ETF performance data becomes vital for investors aiming to navigate this complex landscape.

The exploration of Bitcoin-based exchange-traded funds (ETFs) has gained traction in the financial markets, particularly as savvy investors scrutinize their options. With intriguing developments like the BlackRock Bitcoin ETF making headlines, many are curious about how such instruments are adapting amid fluctuating cryptocurrency values. Analysts, including Eric Balchunas, provide essential insights into the trajectory of ETF assets, projected to hit unprecedented highs by 2025. However, potential investors must remain aware that attaining solid returns from Bitcoin ETFs can be unpredictable, especially considering the recent trends in market performance. As discussions around cryptocurrency investments surge, evaluating the characteristics and implications of ETF mechanisms will become increasingly essential to achieving success.

Understanding the Rise of Bitcoin ETFs

The surge in popularity of Bitcoin ETFs has transformed the investment landscape, providing investors with an accessible entry point into the cryptocurrency market. With products like BlackRock’s Bitcoin ETF (IBIT), investors have the opportunity to benefit from the price fluctuations of Bitcoin without holding the digital asset directly. This growth has contributed to the substantial increase in ETF assets, which are expected to soar, hitting around $2 trillion by 2025 according to current investment trends.

As more institutional investors flock to Bitcoin ETFs, the momentum around this asset class continues to gain traction. Analyst Eric Balchunas has noted that these funds are appealing for their regulatory clarity and ease of trading, making them a preferred choice for many investors seeking exposure to Bitcoin. This indicates a shift in investor preferences, with traditional and new investors alike showing increased interest in diversified ETF options, signifying a broader acceptance of cryptocurrencies within the investment community.

BlackRock Bitcoin ETF: Analyzing Performance Data

As of 2025, BlackRock’s Bitcoin ETF (IBIT) has accumulated approximately $248.44 billion in assets under management. This positions it as a significant player in the ETF market, yet its annual performance has raised eyebrows. Last year, despite a growing trend in Bitcoin investment, IBIT reported a staggering negative return of -6.41%. This performance stands in stark contrast to the broader market, which experienced a healthy increase in total ETF assets, averaging nearly $60 billion in daily trades.

Such performance data showcases the volatility inherent in Bitcoin investments. While the overall ETF market flourished, attributing a record $1.48 trillion in assets, BlackRock’s IBIT revealed the impact of Bitcoin’s market challenges. Investors should carefully analyze these performance metrics and consider both historical data and future projections when deciding whether to include Bitcoin ETFs in their portfolios, especially with the anticipated growth in ETF assets expected through 2025.

Future Outlook for ETF Assets in 2025

The projected growth of ETF assets to approximately $2 trillion by 2025 reflects a robust future for various investment vehicles, including specialized ETFs like those focused on Bitcoin. BlackRock’s developments in Bitcoin ETFs are particularly noteworthy, as they represent a melding of traditional finance with innovative cryptocurrency offerings. This forecast suggests increasing investor confidence and a trend towards diversifying portfolios with a blend of traditional stocks and Bitcoin ETFs.

Factors influencing this positive outlook for ETF growth include regulatory clarity around cryptocurrencies, increased acceptance by institutional investors, and the growing importance of ETFs as investment vehicles. Investors today are more educated and equipped to understand the implications of market trends, which helps bolster the attractiveness of new financial products entering the market. As Bitcoin investment trends evolve, so too will the range and features of ETFs available to investors.

The Role of Eric Balchunas in ETF Analysis

Eric Balchunas, as Bloomberg’s senior ETF analyst, plays a pivotal role in shaping investor perspectives regarding market trends and performance data. His expertise offers insights into the mechanics of ETF investments, analyzing various funds and trends that influence investor behavior. Notably, Balchunas’s analysis of BlackRock’s Bitcoin ETF has drawn attention to how external factors affect its performance, helping investors navigate their investment decisions.

Through his comprehensive breakdown of ETF performance data, Balchunas provides a framework for understanding how funds like the Bitcoin ETF fit within broader market strategies. His insights are invaluable for both seasoned investors and novices, bridging the gap between cryptocurrency and traditional investment paradigms. By focusing on data-driven analysis, he aids investors in making informed choices, thereby shaping the narrative around Bitcoin ETFs and the future of digital asset investment.

Key Trends in Bitcoin Investment

As Bitcoin continues to evolve, several key trends in investment behavior have emerged. One significant trend is the rising interest in Bitcoin ETFs, illustrated by strong performances in ETFs that track cryptocurrency movements. With firms like BlackRock entering the landscape, there is a notable shift towards sophisticated investment strategies that include digital assets, attracting a diverse range of investors looking to capitalize on Bitcoin’s potential.

Another trend is the increasing institutional adoption of Bitcoin as a legitimate asset class. This shift is reflected in the growing assets managed by Bitcoin-focused ETFs and even in general ETF trends. Investors are responding to market signals and data, leading them to favor investments that incorporate cryptocurrencies alongside traditional equities, thus indicating a more diversified investment approach.

Decoding ETF Performance Data

Decoding ETF performance data is critical for investors looking to maximize returns. Performance metrics such as those published by Eric Balchunas give insights into how well a fund is performing relative to its peers and market movements. Investors can analyze these metrics to identify trends, assess risk, and make strategic decisions about their portfolios. Understanding these data points is crucial in influencing future investment actions.

The performance of Bitcoin ETFs can be particularly volatile, reflecting the unpredictable nature of cryptocurrency markets. The stark -6.41% return recorded by BlackRock’s IBIT highlights the risks associated with these investments. However, analyzing performance data against broader ETF trends reveals patterns that investors can leverage to guide their decisions, ensuring they remain informed and prepared for shifts in both the ETF and cryptocurrency landscapes.

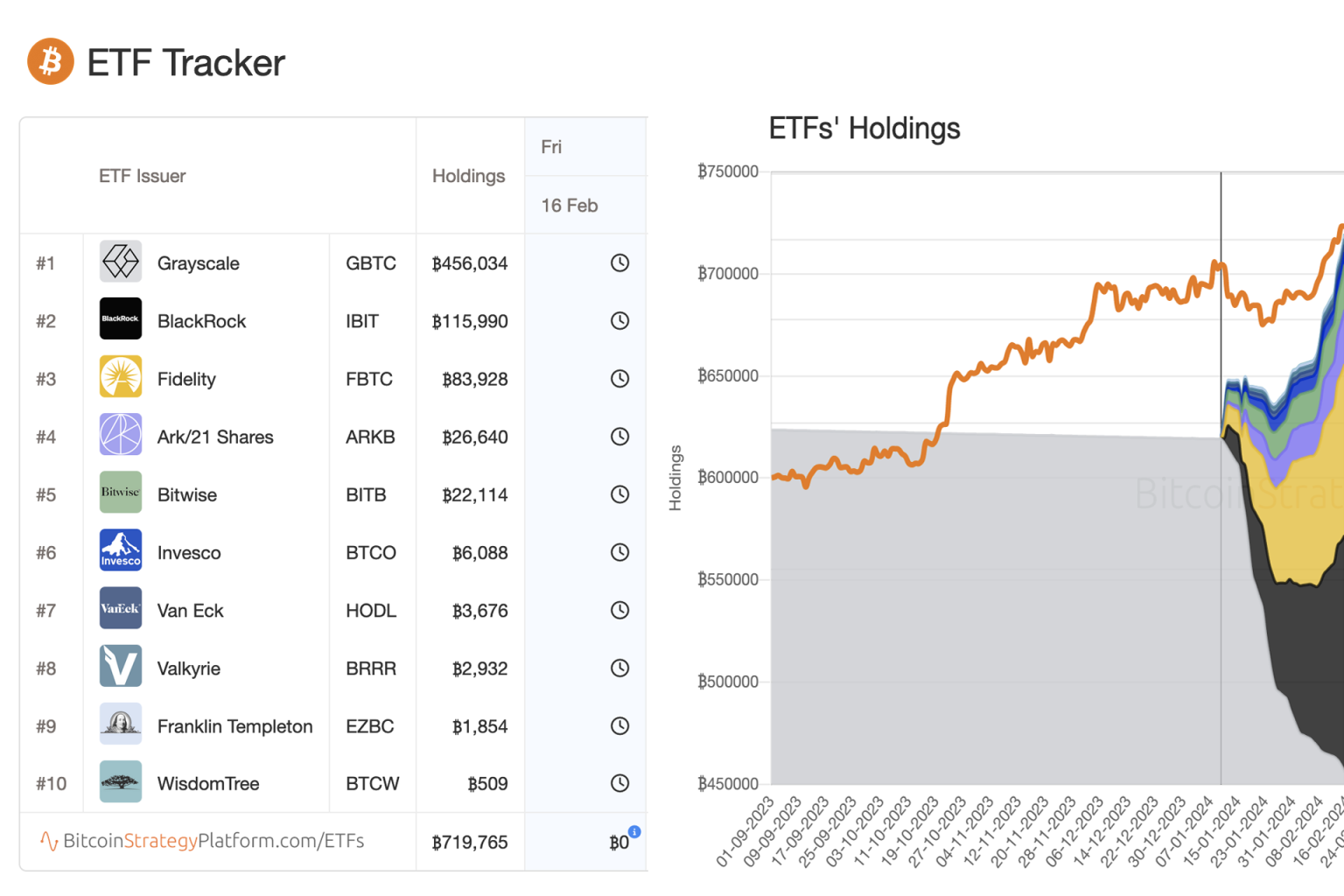

Comparative Analysis of Leading Bitcoin ETFs

Conducting a comparative analysis of leading Bitcoin ETFs provides invaluable insights for investors seeking optimal returns. By examining how BlackRock’s Bitcoin ETF stacks up against competitors in terms of performance, assets under management, and risk factors, investors can make more informed decisions. The fluctuation in performance data, much emphasized by analysts like Eric Balchunas, showcases the importance of evaluating ETFs against one another.

Moreover, such an analysis often reveals how external factors like regulatory changes and Bitcoin market dynamics can impact ETF performance. As the industry evolves, investors should remain vigilant in comparing the offerings of significant players, thereby considering tapes to choose ETFs that align with their investment goals and risk tolerances. This comparative lens sheds light on the potential of Bitcoin ETFs as a stable investment vehicle amid market volatility.

The Impact of Market Trends on Bitcoin ETFs

Market trends significantly influence the performance and acceptance of Bitcoin ETFs. For instance, as cryptocurrency gains traction among a wider audience, factors such as increased regulatory clarity and institutional adoption play a vital role in determining ETF viability. BlackRock’s Bitcoin ETF has experienced firsthand the effects of market fluctuations, showcasing both opportunity and risk in the current financial landscape.

These market dynamics not only affect the perception of Bitcoin as an investment but also impact broader fundraising and asset accumulation in ETFs. As observed with the recent performance data, trends indicate a correlation between increased market activity in cryptocurrency and the resultant impact on ETF assets under management. Understanding these dynamics allows investors to better navigate their investment strategies, accommodating changes and leveraging market trends to their advantage.

Investing in Bitcoin ETFs: Risks and Rewards

Investing in Bitcoin ETFs presents both risks and rewards that investors must carefully assess. The volatility of Bitcoin as a digital asset leads to inherent risks characterized by sharp market swings. BlackRock’s Bitcoin ETF, despite its significant asset base, recorded negative annual returns, illustrating the potential for loss that comes with investing in these funds, particularly in fluctuating markets.

Conversely, the rewards associated with Bitcoin ETFs include accessibility and the potential for substantial returns if structured properly. With firms like BlackRock bringing sophisticated financial products to market, investors are provided with various tools to manage risk while tapping into the burgeoning cryptocurrency sector. By weighing the risks against potential returns, investors can make decisions that align with their financial goals and risk tolerance levels.

Frequently Asked Questions

What were the performance metrics of the BlackRock Bitcoin ETF in 2025?

In 2025, the BlackRock Bitcoin ETF (IBIT) had assets under management of approximately $248.44 billion, placing it sixth among ETFs. However, it experienced a negative annual return of -6.41%, making it the only ETF in the top 15 to report a loss, which underscores the overall poor performance of Bitcoin last year.

How does the performance of Bitcoin ETFs relate to overall investment trends in Bitcoin?

The performance of Bitcoin ETFs, particularly the BlackRock Bitcoin ETF, reflects broader investment trends in Bitcoin. In 2025, while ETF assets surged to a record $1.48 trillion, the BlackRock Bitcoin ETF struggled with a -6.41% return, highlighting the volatility and challenges in the Bitcoin market despite increased interest and investment in ETFs.

What factors influenced the negative performance of the BlackRock Bitcoin ETF last year?

The negative performance of the BlackRock Bitcoin ETF (IBIT), which reported a -6.41% return in 2025, can be attributed to the overall decline in Bitcoin’s performance last year. Despite significant capital inflows, the ETF’s performance was hampered by market volatility and external economic factors affecting Bitcoin investment trends.

What are the implications of Bitcoin ETF performance data for investors?

Investors should analyze Bitcoin ETF performance data, such as that of the BlackRock Bitcoin ETF, to make informed decisions. The negative return of -6.41% indicates potential risks in investing in Bitcoin ETFs, emphasizing the need to consider market conditions and performance history before committing capital to Bitcoin-related assets.

How did the assets under management of Bitcoin ETFs change in 2025 compared to previous years?

In 2025, assets under management for Bitcoin ETFs saw significant growth, reaching approximately $1.48 trillion, a 28% increase from the previous year. This expansion reflects growing interest in Bitcoin as an investment, although the BlackRock Bitcoin ETF specifically faced challenges, returning -6.41%.

What does Eric Balchunas’s analysis reveal about Bitcoin ETF performance trends?

Eric Balchunas’s analysis of Bitcoin ETF performance trends in 2025 highlights a booming market with ETF assets increasing significantly. However, the performance data shows that despite growth in assets, the BlackRock Bitcoin ETF’s -6.41% return indicates that not all cryptocurrencies are experiencing similar performance improvements, presenting a complex picture for investors.

| Key Point | Detail |

|---|---|

| ETFs Assets Under Management | $1.48 trillion, a 28% increase from last year. |

| Average Daily Transactions | Approximately $60 billion. |

| BlackRock’s Bitcoin ETF (IBIT) Assets | $248.44 billion, ranked sixth. |

| IBIT Annual Return | -6.41%, the only negative return among the top 15 ETFs. |

Summary

Bitcoin ETF performance has shown a remarkable growth overall in 2025, yet certain challenges remain for individual ETFs like BlackRock’s IBIT. With a record of $1.48 trillion in total ETF assets and significant daily trading activity, the landscape is robust. However, IBIT’s struggle highlighted the impact of Bitcoin’s overall poor performance last year, indicating that while the market is expanding, specific assets may not perform equally well.