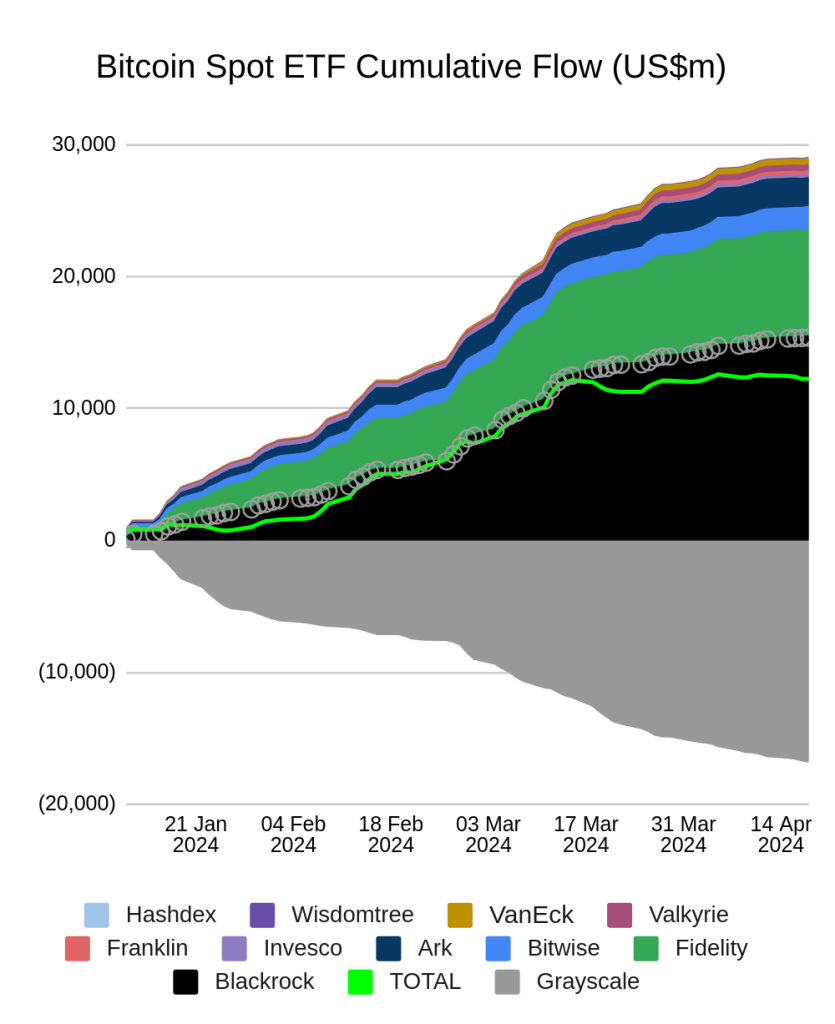

Bitcoin ETF outflows have captured the market’s attention amid ongoing macroeconomic and geopolitical uncertainties, leading to a significant exit of funds from these investment vehicles. On Tuesday alone, spot Bitcoin ETFs recorded outflows totaling $483.4 million, with key players like the Grayscale Bitcoin Trust ETF (GBTC) and Fidelity Wise Origin Bitcoin Fund (FBTC) accounting for major portions of this withdrawal. Coupled with a staggering $230 million in outflows from spot Ether ETFs, these movements are indicative of shifting dynamics within the crypto market trends, reflecting institutional investors’ cautious stance. As Bitcoin struggles to maintain momentum—slipping below the $89,000 mark after previously soaring past $97,000—a critical examination of these ETF outflows sheds light on the interplay between Bitcoin price movement and broader economic pressures. Investors are increasingly concerned about how ongoing concerns, such as trade tensions and global liquidity squeeze, are shaping their strategies and impacting overall market sentiment.

Recent withdrawals from cryptocurrency exchange-traded funds (ETFs) highlight a cautious exit by institutional investors from the digital asset space. The dynamics surrounding crypto investment are currently being influenced by various factors, including geopolitical developments and economic pressures that are causing investors to reassess their exposure to volatile assets. Notably, the substantial outflows from both Bitcoin and Ethereum ETFs suggest a shift in investor sentiment, moving towards risk-averse strategies in the face of uncertainty. As the cryptocurrency landscape evolves, trends such as these withdrawals may serve as critical signals of underlying market conditions and investor attitudes towards large-scale digital currencies. Understanding the ramifications of these trends is essential for stakeholders looking to navigate this complex and rapidly changing financial environment.

| Category | Outflows (in millions) | Comments | |

|---|---|---|---|

| Spot Bitcoin ETFs | $483.4 | Grayscale Bitcoin Trust (GBTC) leads with $160.8M outflow, followed by Fidelity Wise Origin Bitcoin Fund (FBTC) at $152M. | |

| Spot Ether ETFs | $230 | After five days of inflows, BlackRock’s ETHA saw $92.3M in exits. | |

| Spot XRP ETFs | $53.3 | Notable largest single-day outflow to date. | |

| Solana ETFs | $3 | Contrary to the trend, showed net inflows. | |

| General Market Trends | |||

Summary

Bitcoin ETF outflows have significantly impacted the broader cryptocurrency market, reflecting institutional caution amidst ongoing macroeconomic instabilities. As millions were pulled from prominent Bitcoin and Ether ETFs, analysts noted a shift in market dynamics, particularly revealing control transitioning towards short-term holders. This behavior, coupled with a decline in Bitcoin’s value, highlights the necessity for traders to closely monitor economic indicators and geopolitical tensions that influence the crypto landscape.

Understanding Bitcoin ETF Outflows and Market Dynamics

The recent significant outflows from Bitcoin exchange-traded funds (ETFs) are a telling indicator of the current sentiment in the cryptocurrency market. On Tuesday, Bitcoin ETFs experienced a staggering $483.4 million in outflows, with the Grayscale Bitcoin Trust leading at $160.8 million and Fidelity’s Wise Origin Bitcoin FundSee also joined the trend with $152 million in withdrawals. These movements reflect a growing caution among institutional investors, who are adjusting their strategies in response to ongoing macroeconomic challenges and geopolitical uncertainties.

As institutional investments play a pivotal role in establishing market stability, the recent ETF outflows suggest a pullback from higher risk assets. The data from SoSoValue highlights that these withdrawals are distinct, not just in magnitude but also in their implications. Investors are not only reacting to price movements but also to external pressures, including rising trade tensions and liquidity constraints caused by shifts in global economic conditions.

The Impact of Macroeconomic Trends on Cryptocurrency Investments

Macroeconomic conditions and geopolitical issues have historically impacted investor behavior in the cryptocurrency landscape. Over the past week, the market has seen Bitcoin prices dip significantly, with the cryptocurrency falling below the $89,000 mark after reaching highs above $97,000. This volatility can be linked to various factors, such as rising yields in Japan and concerns related to U.S.-EU trade relationships that exacerbate market fears. Investors tend to be prudent when observing these macro indicators, which often signals a risk-off sentiment.

Beyond the immediate price impacts, these macro trends resonate with broader market movements, often resulting in shifts in how investors allocate their resources. Traders are acutely aware of the connection between macroeconomic announcements and crypto market performance; hence, they keep an eye on upcoming figures, such as the U.S. Initial Jobless Claims. If these indicators reflect weaker economic conditions, they could further fuel market apprehension among both institutional and retail investors.

Institutional Investment Strategies in a Turbulent Market

In the face of recent challenges, institutional investment strategies are evolving to reflect a more cautious approach. The current landscape, marked by declining prices and heightened uncertainty, has prompted larger holders to accumulate additional Bitcoin. Notably, wallets holding between 10 and 10,000 BTC added approximately 36,300 coins in just over a week. This indicates that while the market may be retracting, some investors are seeking to capitalize on perceived lower valuations.

Furthermore, the data suggests that control over Bitcoin’s price direction is shifting toward these short-term ‘whale’ holders, indicating a transformation in market dynamics. The emergence of these new whales—crypto investors holding over 1,000 BTC for less than 155 days—highlights a new wave of capital entering the market, which contrasts sharply with traditional long-term holders. This evolution points to a potential change in both trading patterns and market trends, ultimately impacting Bitcoin price movements.

Ethereum ETF Trends and Market Influence

Similar to Bitcoin, Ethereum ETFs have also seen notable movements in recent days, with a reported $230 million in outflows, reversing a previous positive trend. BlackRock’s ETHA ETF recorded net exits of $92.3 million, signifying a broader sentiment that could influence Ethereum’s market performance. The fluctuations in Ethereum ETFs are reflective of broader market dynamics and institutional sentiment, paralleling trends seen in Bitcoin investments.

The implications of these outflows go beyond immediate pricing; they evoke reflections on Ethereum’s adoption and long-term viability within the crypto landscape. As institutions reconsider their stakes amidst market volatility, there’s a critical examination of both Bitcoin and Ethereum as key players in the evolving cryptocurrency ecosystem, especially as we observe rigorous trading behaviors in response to macroeconomic pressures.

Navigating the Crypto Market: Insights for Investors

For investors attempting to navigate through the current turbulence in the cryptocurrency market, it is essential to remain informed about ongoing trends and economic signals influencing price movements. The swift outflows from Bitcoin and Ethereum ETFs exemplify the cautious sentiment among institutional players. Following key macroeconomic announcements can provide crucial insights into potential market shifts, allowing investors to adjust their strategies accordingly.

In a market marked by volatility, the importance of diversification and strategic allocation cannot be overstated. While Bitcoin and Ethereum continue to dominate headlines, investors may also explore alternative assets within the crypto sphere, as exemplified by the modest inflows observed in Solana ETFs. The discerning investor recognizes the need to balance risk and potential reward, taking measured actions as market conditions evolve.

Long-term Investment Perspectives Amid Market Volatility

As market participants react to immediate price fluctuations, the long-term perspective remains crucial. While Bitcoin has seen significant drawbacks, with its price dipping below $89,000 recently, long-term holders are still believed to be consolidating their positions. Understanding the sustained interest from large holders indicates a potential recovery phase, as these investors prepare for future market uptrends when macroeconomic conditions stabilize.

Furthermore, market analysts suggest that the shift toward short-term holders in Bitcoin indicates a new phase in cryptocurrency investment strategies. These new participants are shaping how Bitcoin’s realized cap is evaluated, potentially leading to a revaluation of long-held assumptions. Observing these trends will be essential for understanding the trajectory of Bitcoin and broader market movements, especially as institutional behavior continues to adapt.

The Role of Data Analytics in Bitcoin Market Trends

Data analytics have become increasingly vital in understanding Bitcoin and cryptocurrency market trends. Tracking on-chain movements not only provides insights into holder behavior but also hints at potential market shifts. For example, Santiment’s analysis of Bitcoin wallets reflects significant movement among different holder categories, suggesting that changes in investment strategies are influential in price determinations.

Furthermore, this analytical approach allows for better forecasting regarding institutional investment shifts and expiration of different investment horizons. Data-backed insights cultivate a more profound understanding among investors, driving informed decisions and strategies in a market that often seems erratic. The importance of analytics cannot be overlooked—those who engage in data-driven strategies are likely to adapt more effectively in a volatile crypto landscape.

Embracing New Strategies for Cryptocurrency Trading

In light of the current market dynamics characterized by high volatility and institutional caution, cryptocurrency traders are revisiting and redefining their strategies. The considerable outflows seen in Bitcoin and Ethereum ETFs indicate a necessary shift toward more adaptive trading practices that can withstand macroeconomic pressures. Traders are encouraged to embrace technical analysis and sentiment tracking to make informed decisions during market downturns.

Moreover, the rise of alternative cryptocurrencies offers traders opportunities to diversify their portfolios beyond Bitcoin and Ethereum. ETFs that focus on these emerging assets can provide gateways to potentially lucrative ventures, especially amid prevailing market uncertainties. Investors can leverage diversified holdings to manage risks while potentially capitalizing on varying crypto market trends.

The Future of Institutional Investment in Cryptocurrencies

As the cryptocurrency market evolves, the role of institutional investment is becoming increasingly pivotal. The recent outflows from Bitcoin and Ethereum ETFs reflect a cautious approach, underscoring the importance of adaptability in the face of changing market conditions. Institutions will likely continue to recalibrate their strategies, balancing short-term gains with long-term investment horizons.

Looking ahead, it is essential for institutional investors to maintain a keen awareness of macroeconomic indicators that may impact future cryptocurrency trends. As market conditions shift, factors such as market liquidity and inflationary pressures will continue to shape investment decisions, influencing both the price movements of Bitcoin and Ethereum and the broader crypto market.

Frequently Asked Questions

What are Bitcoin ETF outflows and what do they signify?

Bitcoin ETF outflows refer to the withdrawal of funds from Bitcoin exchange-traded funds (ETFs), indicating a shift in institutional investor sentiment. Significant outflows, like the $483.4 million reported recently, often reflect increased caution among investors due to macroeconomic uncertainties affecting the crypto market.

How do Bitcoin ETF outflows impact Bitcoin price movement?

Bitcoin ETF outflows can negatively influence Bitcoin price movement, as large withdrawals typically signal reduced demand for Bitcoin among institutional investors. This was evident when Bitcoin prices slid below $89,000 amid record ETF outflows, highlighting the interconnectedness of ETF trends and Bitcoin market performance.

What factors are driving Bitcoin ETF outflows in the current market?

Current Bitcoin ETF outflows are driven by geopolitical uncertainties, macroeconomic pressures, and tightening global liquidity, as exemplified by ongoing trade tensions and the recent sell-off of Japanese government bonds. These conditions create a risk-off sentiment, prompting investors to withdraw from Bitcoin ETFs.

Are Ethereum ETF outflows related to Bitcoin ETF outflows?

Yes, Ethereum ETF outflows often correlate with Bitcoin ETF outflows, as both reflect broader trends in institutional investment and market sentiment in the crypto sector. Recently, Ethereum ETFs registered $230 million in outflows, contributing to a combined risk perception that also affected Bitcoin investments.

What is the significance of institutional investment in Bitcoin ETFs?

Institutional investment in Bitcoin ETFs is significant as it indicates mainstream acceptance of cryptocurrency as an asset class. However, when Bitcoin ETF outflows occur, it highlights cautious behavior among institutional investors, suggesting potential volatility in the crypto market that can influence future investment trends.

How do macroeconomic conditions influence Bitcoin ETF outflows?

Macroeconomic conditions heavily influence Bitcoin ETF outflows by affecting investor behavior. Factors such as rising interest rates, trade tariffs, and economic uncertainty can lead to a risk-off sentiment, causing investors to pull back from Bitcoin ETFs, as seen recently with the outflows due to tightening liquidity and geopolitical issues.

What trends are observed among Bitcoin whale holders amid ETF outflows?

Amid significant Bitcoin ETF outflows, trends show that larger Bitcoin holders, or ‘whales’, continue accumulating coins, even as short-term holders are reducing their positions. This shift in control from long-term holders to newer, short-term whales may impact Bitcoin price dynamics and future market behavior.

Can ETF outflows predict future trends in the crypto market?

ETF outflows can serve as a predictive indicator of future trends in the crypto market. High outflows often signal waning confidence among institutional investors and can precede further price declines or increased volatility in cryptocurrencies like Bitcoin and Ethereum.