Recent activity in the Bitcoin market has raised eyebrows, particularly concerning the rising Bitcoin ETF outflow which has seen over $2.9 billion exit these exchange-traded funds in just 12 days. This significant withdrawal highlights a bearish sentiment emerging as traders react to broader cryptocurrency trends and pressures from the futures market. The ongoing decline in BTC prices, combined with bearish futures data, presents a worrying outlook for investors, triggering a reassessment of BTC price predictions. As investors navigate this tumultuous landscape, many are reconsidering their strategies around investing in Bitcoin. With heavy liquidations and strategic hedging now becoming the norm, understanding these market dynamics is crucial for anyone looking to engage with Bitcoin’s rapidly evolving environment.

The recent surge in capital leaving Bitcoin exchange-traded funds signals a cautious sentiment among investors, hinting at a potential watershed moment for the cryptocurrency’s valuation. As the market grapples with shifting dynamics and bearish sentiments, the volatility within the Bitcoin space raises questions about future trends and market stability. Liquidation events and fluctuating interest in BTC are not just indicators of market health, but they also reflect broader investor behavior that can influence Bitcoin’s trajectory. Amid the uncertainty, professionals analyzing the crypto landscape are keen on deciphering signs that may reveal the sentiment behind these massive ETF withdrawals. A close examination of these factors is essential for understanding the broader repercussions on Bitcoin trading and investment directions.

| Key Points |

|---|

| $2.9 billion in Bitcoin ETF outflows was recorded over 12 trading days, signaling a bearish trend in the market. |

| Heavy liquidations specifically affected leveraged buyers, demonstrating a market purging effect due to the high level of risky positions. |

| Professional traders are hedging against further price drops, indicated by a rise in demand for put options and an increase in delta skew metrics. |

| The downturn in Bitcoin’s price was influenced by a decline in the Nasdaq Index and disappointing tech sector performance, including news from AMD. |

| Amidst the uncertainty, cryptocurrencies are generally expected to recover over time despite significant sell-offs and liquidations. |

| Concerns over Binance’s solvency and the stability of its operations have fueled additional anxiety among investors, compounding the effect of the ETF outflows. |

Summary

The recent $2.9 billion Bitcoin ETF outflow highlights a significant bearish trend in the cryptocurrency market, primarily fueled by heavy liquidations and a lack of confidence among investors. As the market experiences pressure from both ETF withdraws and a declining tech sector, traders are hedging their positions, indicating skepticism about Bitcoin’s price recovery. The current atmosphere suggests that unless the market regains strength, Bitcoin’s value may continue to face downside risks.

Understanding Bitcoin ETF Outflows

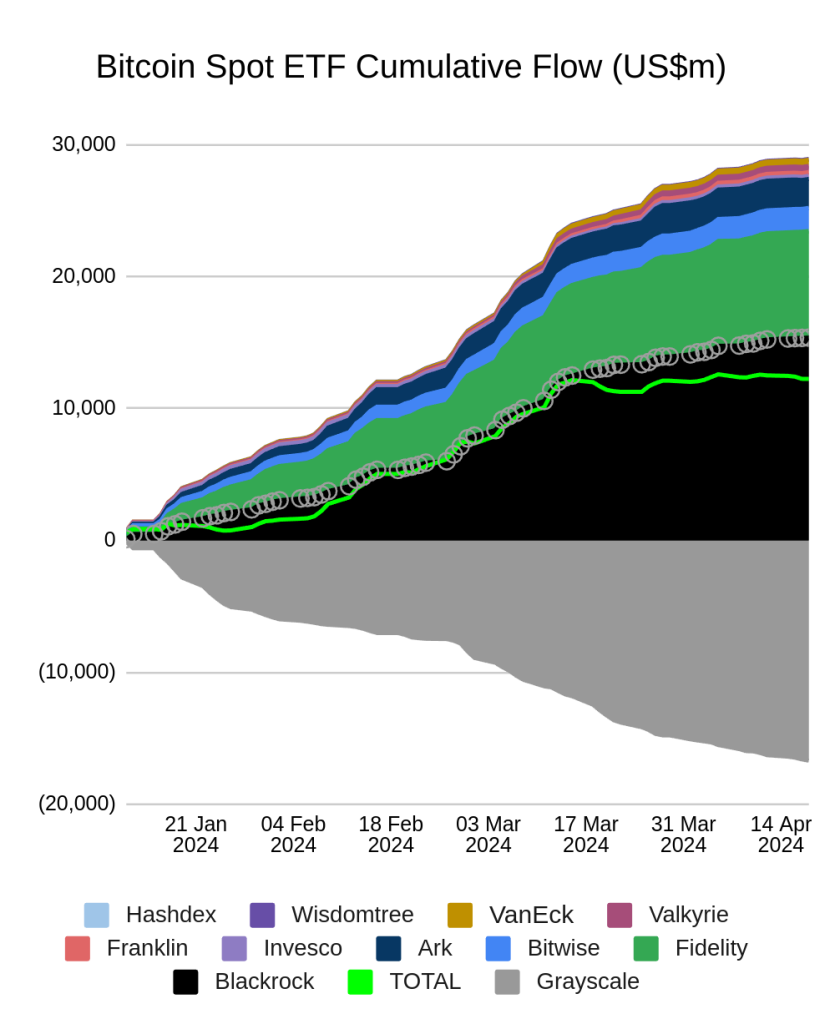

In recent weeks, Bitcoin has witnessed a remarkable exodus from exchange-traded funds (ETFs), amounting to over $2.9 billion in outflows. This trend indicates a shifting sentiment in the cryptocurrency market as investors reassess their positions amidst slumping prices and bearish futures data. The significant outflows from Bitcoin ETFs reflect a broader trend where institutional investors and everyday traders are increasingly cautious, opting to liquidate their holdings rather than risk further losses. Market analysts suggest that this pattern could intensify the downward pressure on Bitcoin’s price as the selling continues.

Understanding the impact of Bitcoin ETF outflows on the market is vital for assessing the future price trajectories of BTC. As investors flee from these funds, it raises concerns about overall market confidence and the liquidity available for Bitcoin trading. The historical data shows that such outflows often correlate with price declines, as seen in prior bearish trends. Investors need to closely watch ETF flows alongside other metrics, such as spot price movements and leverage ratios in the futures market, which together paint a clearer picture of forthcoming market conditions.

Analyzing Cryptocurrency Trends Amidst Market Volatility

The current cryptocurrency landscape is dominated by increased volatility and uncertainty, as indicated by the mass liquidation of leveraged long positions. Over $3.25 billion in liquidations has occurred in the futures markets, signifying that traders are adapting to the quick pace of change within the Bitcoin market. Volatility, while daunting, often creates unique opportunities for seasoned investors to capitalize on price swings. By closely monitoring these fluctuations and understanding their causes, market participants can make more informed decisions regarding their trading strategies.

Additionally, liquidity conditions in the cryptocurrency ecosystem are increasingly being scrutinized. Traders are now faced with the challenge of deciphering whether to exit or strategically invest during this turbulent period. With major technical issues reported by exchanges like Binance, and rumors about potential liquidity crises, scepticism has grown. Yet, it is important to remember that historically, the cryptocurrency market has shown resilience, bouncing back from corrections when investor confidence returns, which can potentially drive BTC price recoveries.

Futures Market News: Impacts on BTC Price Prediction

To accurately predict Bitcoin’s price movements, keeping an eye on futures market data is essential. Recently, the futures market has displayed bearish indicators, including rising options skew metrics that suggest a prevailing doubt amongst traders regarding a bounce-back from Bitcoin’s recent lows. As pro traders hedge their bets with put options, there lies an implicit acknowledgment of potential further declines beneath the critical support levels, indicating a downturn might not only be temporary but part of a larger trend.

The confluence of disappointing economic signals from the tech sector and ongoing ETF outflows exacerbates the situation for Bitcoin price predictions. Futures market indicators, including open interest and volume, indicate a cautious stance among traders. As the futures market often foreshadows price action within the spot market, continuous monitoring of these developments is crucial for investors who are keen on buying during dips or who are trying to mitigate risks from prolonged downturns.

Investor Sentiment: The Role of Economic Indicators

Investor sentiment plays a significant role in shaping cryptocurrency prices, and recent economic indicators have painted a grim picture for many traders. Weak employment data in the U.S., coupled with dismal forecasts in technology sectors, has fed into a pervasive pessimism surrounding BTC and general market conditions. Engaging with these economic facets provides insight into how external factors contribute to fluctuations in Bitcoin prices, pushing traders to adapt their strategies in alignment with market realities.

In these uncertain times, it’s important for investors to gauge how broader economic trends could influence Bitcoin’s price trajectory. Increased regulatory scrutiny, potential shifts in market liquidity, and macroeconomic pressures all contribute to an atmosphere of trepidation. Understanding how these elements intersect can help traders navigate their positions more effectively and potentially exploit temporary dips for better investment opportunities.

Exploring BTC Price Predictions: Strategies for Long-term Investing

As traders grapple with the latest market shifts, understanding potential BTC price predictions becomes essential for crafting long-term investment strategies. While recent bearish indicators may deter some investors, those with a long-term perspective often look to underlying fundamentals, like Bitcoin’s scarcity and increased institutional adoption, as pillars for future growth. Analytics and forecasting models that take broader economic factors into account can provide a structured approach to investment, allowing individuals to persist in their strategies despite short-term fluctuations.

Long-term investing requires a strategic outlook that incorporates the lessons learned from past market behavior. By observing trends in liquidity, ETF flows, and the overall sentiment surrounding cryptocurrencies, investors can better position themselves to benefit when the market stabilizes. Successful long-term strategies often emphasize patience and a willingness to endure market volatility, all while setting realistic BTC price targets based on researched insights and trend analyses.

The Impact of Liquidation Events on Market Stability

Liquidation events are pivotal moments that can dramatically alter the landscape for Bitcoin and other cryptocurrencies. The ongoing sell-off leading to over $3.25 billion in liquidations highlights the fragility of heavily leveraged positions within the market. For investors, these events serve as critical reminders of the risks tied to high-leverage trading, especially when market conditions turn against them. The quicker the positions are liquidated, the more volatility can ensue, which could lead to cascading effects across the crypto landscape.

Moreover, examining the aftermath of large liquidation events can present valuable lessons for future trading strategies. Market recovery often requires time, as the liquidity vacuum created during sell-offs can take time to normalize. Investors must consider not just the immediate fallout but also the broader implications these events have on market mechanics and investor psychology. Developing adaptive strategies to weather such storms can help sustain investor resilience in unpredictable markets.

Technological Innovations and Their Influence on Bitcoin Price

Technological advancements are continuously reshaping the cryptocurrency landscape, influencing investor behavior and market dynamics. As firms like Google and AMD make strides in artificial intelligence, the competition within the tech sector has potential implications for Bitcoin adoption and its price trajectory. On an instrumental level, innovations can enhance transaction efficiency and security, attracting new investors to the cryptocurrency ecosystem and amplifying interest in Bitcoin trading.

However, amidst these innovations lies the uncertainty surrounding cybersecurity risks and operational disruptions that may arise from new technologies. Investors must stay informed about both the positive and negative implications of these disruptive trends when developing their Bitcoin investment strategies. By balancing awareness of technological risks with an optimistic outlook on innovation, traders can navigate the intricacies of the evolving crypto environment more effectively.

Macro Trends Driving Bitcoin Market Behavior

Macroeconomic trends have a profound impact on Bitcoin and cryptocurrency markets. Factors such as inflation rates, interest rates, and overall economic health can dictate investor behavior and sentiment towards BTC. For instance, as interest rates rise, traditional assets often gain favor, drawing investment away from riskier assets like Bitcoin. Understanding these macro trends is crucial for framing investment strategies and setting realistic BTC price expectations amidst a fluctuating economic landscape.

Furthermore, the interplay between macroeconomic indicators and Bitcoin price dynamics cannot be overstated. Investors should consider how geopolitical events and fiscal policies can influence cryptocurrency valuations. By integrating macro analysis into their investment approach, traders can better anticipate shifts in market sentiment and effectively navigate the complexities of investing in Bitcoin during turbulent economic times.

Navigating Uncertainty: Strategies for Bitcoin Investors

Navigating market uncertainty requires a multifaceted approach, particularly in the context of Bitcoin’s volatile trading environment. As recent data suggests sustained ETF outflows and bearish market signals, investors must adopt robust risk management strategies to safeguard their portfolios. This could include diversifying investments, setting stop-loss orders to protect against extreme market swings, and maintaining a flexible trading strategy that adapts to changing conditions.

Moreover, it’s crucial for Bitcoin investors to remain proactive in their research efforts, tracking significant market developments, regulatory news, and technological innovations that impact the cryptocurrency ecosystem. By staying informed and considering multiple factors in their decision-making process, traders can mitigate risks while remaining poised to seize opportunities when the market rebounds, ensuring they remain relevant and competitive in a rapidly changing environment.

Frequently Asked Questions

What does the recent Bitcoin ETF outflow imply for cryptocurrency trends?

The recent Bitcoin ETF outflow, totaling over $2.9 billion, suggests a significant shift in investor sentiment, reflecting concerns about the cryptocurrency market amidst bearish futures data. This outflow indicates that many investors are moving away from ETFs in response to declining Bitcoin prices and heightened market volatility.

How are Bitcoin ETF outflows affecting BTC price predictions?

With daily net outflows averaging $243 million from Bitcoin ETFs, analysts may need to adjust BTC price predictions downward as this trend signals weakened demand and potential bearish movement in the market, following a substantial correction in prices post-$98,000 peak.

What factors are contributing to Bitcoin ETF outflow trends?

Key factors contributing to Bitcoin ETF outflows include recent poor performance in the tech sector impacting market confidence, massive liquidations in the futures market, and traders hedging against further price declines. These elements have combined to create a cautious atmosphere among investors.

Will the current Bitcoin ETF outflows continue, and what might that mean for the futures market?

Given the ongoing Bitcoin ETF outflows and the negative sentiment reflected in the futures market, further outflows could persist. Should this trend continue, it could lead to increased downward pressure on BTC prices, potentially triggering additional liquidations in leveraged positions.

How do professional traders interpret Bitcoin ETF outflow amidst bearish market conditions?

Professional traders view recent Bitcoin ETF outflows with skepticism, often interpreting them as a sign of bearish sentiment. The uptick in demand for put options indicates that they foresee more downside risks for Bitcoin prices, implying a lack of confidence in a near-term recovery.

What role do liquidity issues at exchanges play in Bitcoin ETF outflows?

Liquidity issues at exchanges can exacerbate Bitcoin ETF outflows, as delays and problems in processing transactions may deter investors from keeping their funds in ETFs or exchanges. This uncertainty can lead to a quicker withdrawal of investments from Bitcoin ETFs.

Are Bitcoin ETF outflows indicative of a long-term trend in Bitcoin investing?

While Bitcoin ETF outflows currently indicate short-term bearish trends, it’s unclear if this will develop into a long-term trend. Historical market patterns suggest that despite periods of heavy outflows and price corrections, the Bitcoin market has typically recovered over time.

What should investors consider when observing Bitcoin ETF outflows?

Investors should closely monitor Bitcoin ETF outflows as indicators of market sentiment. Additionally, they should analyze broader economic factors, the performance of traditional tech stocks, and developments in the futures market to gauge potential impacts on Bitcoin’s price.