Bitcoin dominance plays a pivotal role in understanding the overall landscape of the cryptocurrency market. As of early November, Bitcoin’s market share has impressively surpassed 60%, demonstrating its resilience amidst the ebb and flow of cryptocurrency trends. Currently stabilized around 59%, Bitcoin’s dominance indicates a consolidation of funds into Bitcoin, particularly during recent market pullbacks. This ongoing Bitcoin analysis provides critical insights for investors seeking to navigate the BTC market update and recognize the factors influencing cryptocurrency valuations. By examining Bitcoin dominance, stakeholders can better assess future market movements and investment opportunities in the digital currency sphere.

The prominence of Bitcoin within the cryptocurrency ecosystem is often reflected in its market authority and influence over altcoins. Recognized as a leading digital asset, its robust market share sheds light on the prevailing trends that shape the entire sector. The fluctuations in Bitcoin’s market position often contrast with the performances of alternative cryptocurrencies, highlighting its unique role as a bellwether for market sentiment. Investors keen on understanding the dynamics of crypto investments may benefit from exploring related metrics that illuminate Bitcoin’s standing in the market arena. Delving deeper into these themes can uncover valuable insights into the movements of digital currencies and help predict future shifts in the crypto landscape.

Understanding Bitcoin Dominance in Today’s Market

As of early November, Bitcoin’s market dominance has crossed the crucial 60% threshold, showcasing its significant presence in the cryptocurrency landscape. Such dominance indicates that Bitcoin holds a substantial share of the entire cryptocurrency market, which is currently experiencing fluctuations and pullbacks. In times of market consolidation, investors often turn to Bitcoin as a reliable asset, thereby increasing its market share. This trend not only underscores Bitcoin’s role as a digital gold but also reflects investors’ confidence in BTC amidst broader market uncertainties.

At present, Bitcoin’s dominance remains steady at around 59%. This stability can be attributed to various factors, including an increase in institutional investments and adoption among mainstream financial institutions. As regulatory frameworks become clearer, and new investors enter the market, Bitcoin’s role in cryptocurrency trends is likely to solidify further. Continuous analysis of Bitcoin’s market trends and its position relative to other altcoins is critical for investors seeking to understand the dynamics that influence Bitcoin’s market share.

Bitcoin Market Share: Trends and Insights

Bitcoin’s market share trends have shown a remarkable ability to weather volatility compared to its altcoin counterparts. Insights drawn from recent analyses indicate that as market conditions fluctuate, Bitcoin often retains investor interest, leading to increased BTC market updates reflecting its consolidated share. This behavior is indicative of a more risk-averse approach by investors who are reassessing their portfolios during market pullbacks. Moreover, analysts predict that as Ethereum and other cryptocurrencies fluctuate, Bitcoin’s stability will likely continue to attract both retail and institutional investors.

With Bitcoin maintaining a dominant stance in the cryptocurrency ecosystem, its market share serves as a barometer for overall market sentiment. This dominance often impacts trading decisions and can lead to shifts in the investment strategies employed by hedge funds and retail traders. Understanding these trends is paramount, as they not only depict Bitcoin’s resilience but also its pivotal role in shaping the future of the cryptocurrency market. As BTC continues to lead, monitoring these market share dynamics will be essential for predicting future movements and trends.

Frequently Asked Questions

What is Bitcoin dominance and why is it important in cryptocurrency trends?

Bitcoin dominance refers to the percentage of the total cryptocurrency market capitalization that is attributed to Bitcoin. This metric is crucial in cryptocurrency trends as it indicates Bitcoin’s market share relative to other cryptocurrencies. A higher dominance suggests that Bitcoin is leading the market, while a lower dominance indicates a more diversified market with other cryptocurrencies gaining influence. For example, at the beginning of November, Bitcoin’s dominance exceeded 60% and has recently stabilized around 59%, reflecting its continued significance in the crypto landscape.

How does Bitcoin market share impact the overall cryptocurrency market?

Bitcoin market share, or dominance, plays a pivotal role in the overall cryptocurrency market ecosystem. When Bitcoin’s market share rises, it often leads to increased investor confidence and can have a stabilizing effect on the broader market. Conversely, a drop in Bitcoin’s market share can signal a shift towards altcoins, indicating changes in investor sentiment and market trends. For instance, the recent stability of Bitcoin’s dominance around 59% suggests a consolidation phase where investors are weighing the performance of BTC against other cryptocurrencies.

What are the current trends in Bitcoin analysis regarding its market dominance?

Current trends in Bitcoin analysis reveal that despite fluctuations in price, Bitcoin’s market dominance remains a key focal point for investors. Analysts observe that following market pullbacks, there tends to be a consolidation of funds into Bitcoin, which can drive its dominance up. As of early November, Bitcoin’s dominance increased above 60% but has since stabilized near 59%. This stability is crucial for understanding the market dynamics and forecasting future movements within the cryptocurrency space.

Why is monitoring BTC market updates essential for cryptocurrency investors?

Monitoring BTC market updates is essential for cryptocurrency investors because Bitcoin often sets the tone for the entire market. As Bitcoin’s dominance fluctuates, it can influence the valuation of altcoins and the sentiment of the broader cryptocurrency market. Recent updates indicating a stabilization of Bitcoin’s dominance around 59% after peaking above 60% provide insights into market trends and investor behavior, enabling investors to make informed decisions regarding their crypto holdings.

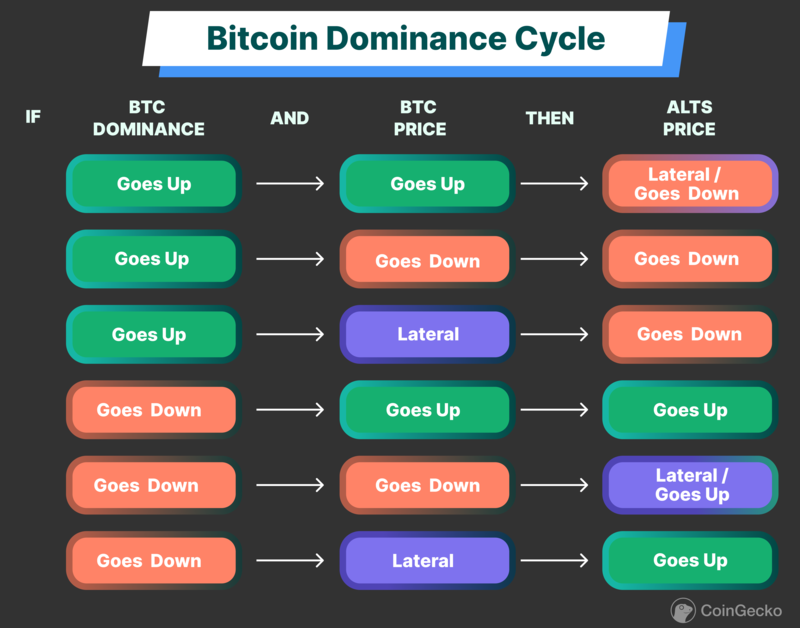

How does Bitcoin dominance affect investment strategies in cryptocurrencies?

Bitcoin dominance significantly affects investment strategies in cryptocurrencies as it serves as a barometer for market sentiment. A rising dominance can encourage investors to focus on Bitcoin, while a declining dominance may lead them to explore altcoins. Understanding Bitcoin’s position in the market helps investors to strategize their portfolios effectively. For example, the recent stabilization of Bitcoin’s dominance around 59% suggests that investors might anticipate better short-term performance from BTC, leading to potential shifts in their investment approaches.

| Key Point | Details |

|---|---|

| Bitcoin’s Market Dominance | Bitcoin’s market dominance rose to over 60% at the beginning of November and is currently stable at approximately 59%. |

| Market Consolidation | Funds have been consolidating into Bitcoin during a market pullback, which contributed to its dominance increase. |

| Current Status | As of now, Bitcoin’s dominance remains around 59%, illustrating its strong position in the cryptocurrency market. |

Summary

Bitcoin dominance has become a critical indicator of its strength within the cryptocurrency market. With its market dominance exceeding 60% in early November and stabilizing at around 59%, Bitcoin continues to lead as the preferred cryptocurrency. This trend suggests that despite market fluctuations, Bitcoin remains a strong asset with substantial investor confidence.