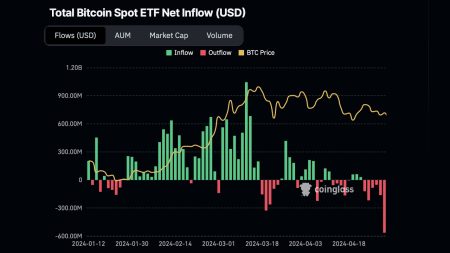

The recent decline in Bitcoin has sent shockwaves through the cryptocurrency market, as investors react to a stark Bitcoin price drop. According to a Deutsche Bank report, this downturn is driven more by a gradual erosion of confidence among institutions and regulators than any single macroeconomic shock. This report highlights the impact on Bitcoin, revealing that significant outflows are stressing its performance, particularly with over $7 billion exiting the U.S. Bitcoin spot ETF in recent months. Furthermore, Bitcoin’s correlation with traditional assets like stocks and gold has faltered, complicating its narrative as “digital gold”; while gold surged, Bitcoin plummeted by 6.5%. With cryptocurrency adoption trends also showing a decline, the unexpected downturn has sparked urgent Bitcoin market analysis among stakeholders.

The recent struggles of Bitcoin signify a broader trend impacting the entire digital currency landscape. The ongoing downturn illustrates shifting dynamics in the asset’s perception and value, as institutional confidence wanes. Analysts are now scrutinizing potential implications for Bitcoin within the larger framework of cryptocurrency investment. Reports, such as those from Deutsche Bank and Citi, reveal troubling signs of a weakening appetite for digital assets. As the market grapples with these challenges, understanding how these factors interplay becomes critical for both current investors and those considering entering the cryptocurrency space.

| Key Point | Details |

|---|---|

| Erosion of Confidence | The decline in Bitcoin is attributed to a gradual loss of confidence among institutional investors and regulators. |

| Institutional Outflows | Substantial outflows from the U.S. Bitcoin spot ETF: $7 billion in November, $2 billion in December, and over $3 billion in January. |

| Market Dynamics | Traditional market relations for Bitcoin are breaking down, contributing to its price decline. |

| Regulatory Issues | Weakening regulatory support and stalled legislative discussions, such as the Digital Asset Market CLARITY Act. |

| Price Correlation | The correlation between Bitcoin, stocks, and gold has weakened, impacting its status as ‘digital gold’. |

| Consumer Adoption | Adoption rate of cryptocurrency among U.S. consumers decreased from 17% in mid-2025 to 12%. |

| Current Market Position | Bitcoin’s trading price is near critical ETF cost levels, reflecting a decline towards pre-election price bottoms. |

Summary

The Bitcoin decline has been significantly influenced by a range of factors, including a steady drop in institutional confidence and an outflow of funds from key investment vehicles. As market dependencies shift and regulatory frameworks become less favorable, Bitcoin’s narrative as a resilient asset akin to gold is increasingly challenged. This decline calls attention to the critical need for renewed strategies to restore investor trust and promote sustainable market growth.

Understanding the Factors Behind the Bitcoin Decline

The decline of Bitcoin can be attributed to a mix of institutional disillusionment and regulatory uncertainties. Deutsche Bank’s report indicates that confidence among institutional investors is waning, which has resulted in a significant outflow of funds from Bitcoin markets. This gradual erosion of trust stems largely from three main forces: the diminishing flow of institutional investments that once provided necessary liquidity, a breakdown in traditional market relationships, and a weakening regulatory framework that has historically supported Bitcoin’s liquidity. As a result, we are witnessing a series of consequences in the Bitcoin price drop that has left many market analysts concerned about its future stability.

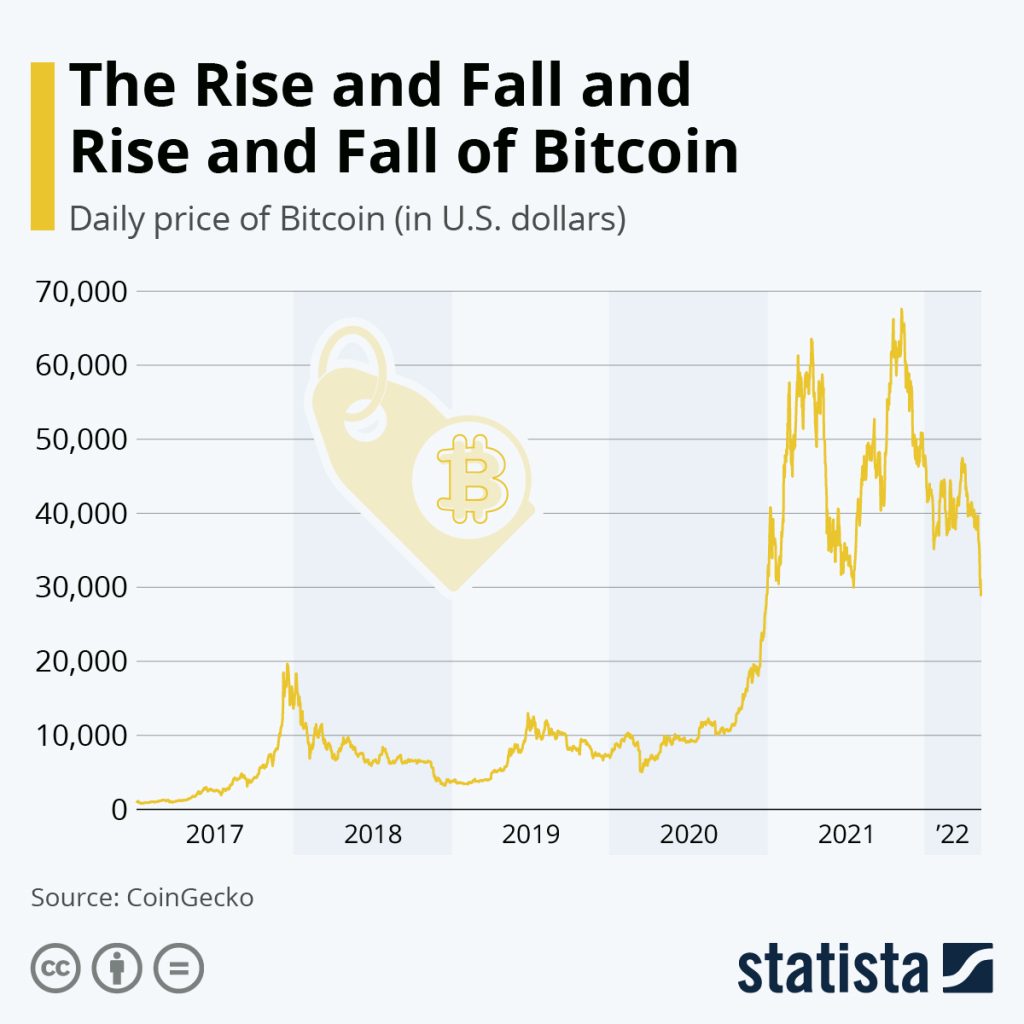

Historically, Bitcoin has been viewed as a safe-haven asset akin to gold, often dubbed “digital gold” due to its limited supply and perceived security. However, the recent correlation with both equity markets and gold has weakened, calling this status into question. With gold prices soaring over 60% this year while Bitcoin has experienced a notable drop of 6.5%, it raises the question of whether investors still view Bitcoin as a viable alternative for traditional asset classes amidst current market volatility. The implications of these trends are significant for cryptocurrency adoption moving forward.

Frequently Asked Questions

What are the reasons behind the recent Bitcoin decline?

The recent decline in Bitcoin is attributed to a gradual erosion of confidence among institutions and regulators, instead of a singular macroeconomic shock. Factors like continuous outflows of institutional funds, a breakdown of traditional market relations, and weakening regulatory support have contributed to the drop.

How has the Bitcoin price drop affected institutional investment?

The Bitcoin price drop has led to a significant outflow of institutional funds, with over $7 billion leaving the U.S. Bitcoin spot ETF in November alone. This continuous outflow reveals diminishing confidence among institutional investors, impacting the overall stability of Bitcoin.

What is the current impact on Bitcoin due to market relations?

The decline in Bitcoin is closely linked to the breakdown of traditional market relations. As its correlation with other assets, such as stocks and gold, weakens, Bitcoin’s narrative as ‘digital gold’ is challenged, resulting in decreased trust and investment in the cryptocurrency.

What insights does the Deutsche Bank Bitcoin report provide on cryptocurrency adoption trends?

The Deutsche Bank report indicates that cryptocurrency adoption trends are declining, with U.S. consumer adoption rates falling from approximately 17% in mid-2025 to about 12%. This decline reflects growing challenges in the cryptocurrency market and waning interest among investors.

How is the recent Bitcoin decline reflecting on its valuation compared to gold?

Bitcoin’s recent price drop contrasts sharply with gold’s performance, which has risen over 60% this year. This divergence highlights Bitcoin’s struggle to maintain its status as ‘digital gold,’ further influencing investor sentiment and market dynamics.

What warnings are given regarding the future of Bitcoin in the Deutsche Bank report?

The Deutsche Bank report warns that as capital inflows slow and resistance builds, Bitcoin’s trading price may fall below critical ETF cost levels, approaching its pre-election price bottom. Such trends highlight the precarious nature of Bitcoin’s current market position.

What effects has legislative stagnation had on the Bitcoin market?

Legislative stagnation, particularly concerning the stablecoin provisions in Congress, has contributed to the uncertainty in the Bitcoin market. The stalled bipartisan Digital Asset Market CLARITY Act is likely exacerbating the challenges faced by Bitcoin and other cryptocurrencies.

Is there a correlation between Bitcoin’s performance and stock market dynamics?

Yes, the correlation between Bitcoin and stock market dynamics has weakened in recent months. This diminished relationship suggests that Bitcoin is no longer reacting to stock market movements as it once did, which has implications for its price behavior.