Bitcoin cycle analysis has emerged as a focal point for investors navigating the cryptocurrency market trends, particularly as Bitcoin trades around $87,661. This innovative approach not only scrutinizes historical price movements but also combines insights from the Bitcoin Quantile Model and Plan C analysis to predict future trajectories. As business cycle indicators show signs of weakness, understanding these cycles becomes crucial in avoiding significant financial pitfalls. Analysts like Plan C argue that mistakenly assuming the current Bitcoin cycle will mirror previous patterns could mark one of the biggest financial mistakes of the decade. With such critical insights, Bitcoin cycle analysis becomes an essential tool for anyone looking to make informed decisions in the ever-evolving crypto landscape.

The examination of cryptocurrency cycles provides valuable insights into market behavior, helping investors assess potential risks and rewards. Many experts, including those employing the Bitcoin Quantile Model and business cycle indicators, emphasize the importance of recognizing unique market conditions during each Bitcoin cycle. It’s essential to adopt a flexible perspective that moves beyond traditional analysis, adapting to evolving economic contexts. By exploring alternative predictive methods such as Plan C analysis, investors can better navigate future Bitcoin price dynamics and align their strategies with ongoing cryptocurrency market trends. Understanding these nuanced cycles represents a key step towards informed trading and investment decisions.

Understanding Bitcoin Cycle Analysis

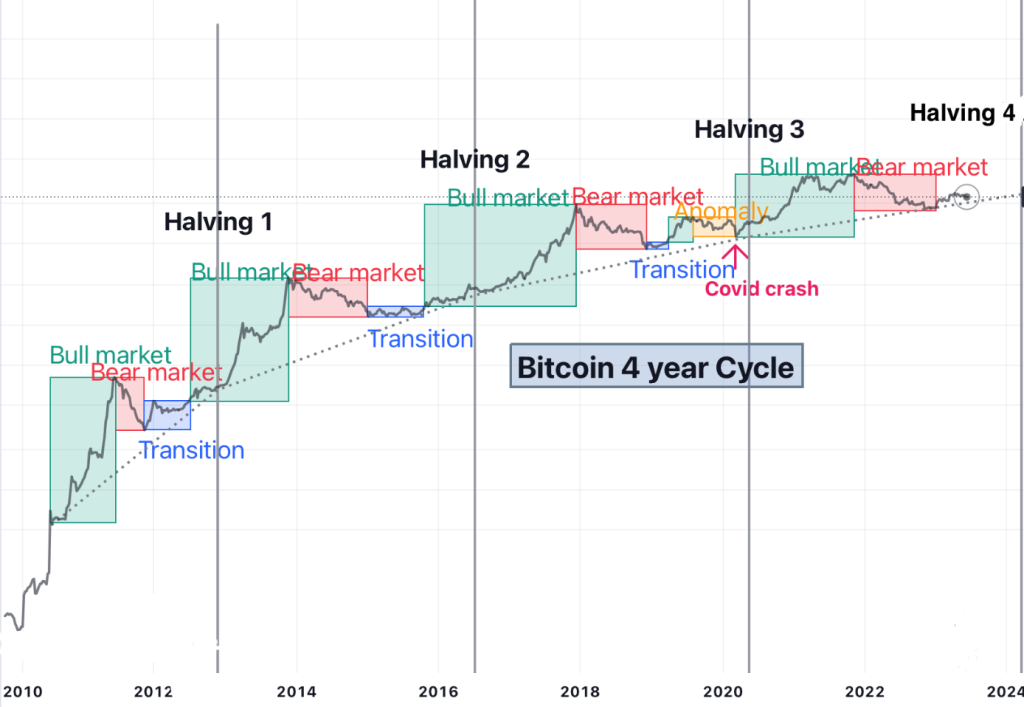

Bitcoin cycle analysis involves examining the historical price movements of Bitcoin and identifying patterns that can potentially predict future trends. Analysts like Plan C utilize this method to highlight deviations from expected cycles and challenge common assumptions held by investors. By recognizing that each Bitcoin cycle may differ due to external market influences, as indicated by current business-cycle indicators, it becomes clear that rigid adherence to past trends could lead to significant financial miscalculations.

The importance of Bitcoin cycle analysis lies in its ability to provide a broader perspective on market dynamics. As Bitcoin approaches critical price points, it’s essential to assess how economic indicators—like the PMI—affect investor sentiment and liquidity. For example, if traditional business cycle metrics indicate contraction while Bitcoin appears resilient, it suggests that investors might treat Bitcoin as a liquidity-sensitive asset rather than purely a growth asset. This nuanced understanding is critical for formulating effective Bitcoin price predictions and navigating the cryptocurrency market.

Moreover, Bitcoin cycle analysis is not merely about spotting ups and downs; it’s also about recognizing the subtleties of market behavior. Given that Bitcoin operates within a complex ecosystem influenced by both macroeconomic factors and investor psychology, an in-depth analysis can reveal potential turning points in price trends. This is crucial for traders looking to capitalize on fluctuations, especially when the business cycle indicators point towards a cooling market.

Investors leveraging Bitcoin cycle analysis must adapt to changing economic landscapes, as evidenced by the mixed signals currently present in the market. By incorporating cycle analysis into their investment strategies, they can better anticipate future movements and allocate resources wisely. As digital assets continue to evolve alongside traditional financial systems, understanding these cycles will play a pivotal role in Bitcoin’s trajectory in the coming years.

The Bitcoin Quantile Model’s Impact on Price Predictions

The Bitcoin Quantile Model, developed by Plan C, revolutionizes how we interpret Bitcoin’s position within its long-term price distribution. By mapping Bitcoin’s price across quantiles, this model provides investors with a statistical framework to assess current and future price targets based on historical data. The model’s approach emphasizes that instead of fixating on a specific price point, one should consider a range of potential outcomes based on quantile bands.

At present, Bitcoin trading around $87,661 places it within the 30th quantile, suggesting that it is below the average price range historically observed. This means that the market may have room for significant appreciation, particularly if external factors—such as improved business-cycle indicators and liquidity support—come into play. By understanding where Bitcoin sits within this quantile distribution, investors can make more informed decisions rather than relying on outdated analogies with past market cycles.

Interestingly, the model also signals that while Bitcoin is experienced significant volatility, the longer-term perspective painted by quantile analysis offers hope for sustained growth. When pivotal economic reports, such as PMI readings, are released, they will greatly influence investor sentiment and Bitcoin’s price trajectory. The interplay between such reports and quantile positioning could serve as a crucial indicator for when to enter or exit positions.

Ultimately, the Bitcoin Quantile Model promotes a more adaptive investment strategy that accounts for the inherent complexities of the cryptocurrency landscape. By framing price predictions within a broader distribution, traders and long-term investors can buffer themselves against market unpredictability and develop a resilient portfolio strategy.

Business Cycle Indicators and Their Influence on Bitcoin

Business cycle indicators, such as the PMI, provide valuable insights into the overall economic health and can significantly impact Bitcoin’s price movements. Currently, the decline below the 50-mark suggests economic contraction, which generally leads to increased caution among investors. Understanding this relationship between economic conditions and Bitcoin’s performance is crucial, especially during periods of uncertainty when investor sentiment can shift rapidly.

For Bitcoin to maintain momentum despite weak business cycle indicators, it must demonstrate its value proposition as a safe haven or liquidity-sensitive asset. As institutions evaluate their positions in light of economic downturns, those who view Bitcoin as a viable alternative to traditional hard assets, like gold, may drive demand even amidst broader economic challenges. Therefore, the analysis of business cycle data becomes essential for predicting Bitcoin’s price trends in conjunction with economic shifts.

Examining historical contexts where Bitcoin thrived during economic adversity also provides educators with more profound insights into potential future behavior. During previous downturns in traditional markets, Bitcoin has often seen its value appreciated as investors seek alternatives. Consequently, monitoring business cycle indicators continuously allows for strategic positioning in anticipation of such movements.

In summary, the correlation between Bitcoin and business cycle indicators is a two-way street. As economic conditions evolve, their impact on Bitcoin’s price trajectory will likely shift investor behavior, necessitating a thorough understanding of these indicators. Bitcoin’s adaptability in response to economic cycles will be a key theme as the market navigates through continued fluctuations.

Navigating Cryptocurrency Market Trends with Plan C Analysis

Understanding cryptocurrency market trends requires a multifaceted approach, particularly one that includes insights from analysts like Plan C. As emphasized in his recent discussions, the disconnect between Bitcoin’s current performance and the prevailing economic conditions highlights the importance of adopting a more analytical perspective. By moving beyond conventional market narratives, investors can gain a clearer picture of potential market movements and outcomes.

Notably, the cryptocurrency market tends to behave independently during critical economic shifts, often mirroring the demand for hard assets like gold. As economic indicators such as PMI signal contraction, traders should not overlook Bitcoin’s role as a liquidity-sensitive investment. This understanding allows investors to align their strategies accordingly, potentially capitalizing on Bitcoin’s resilience even when broader market conditions are unfavorable.

Plan C’s analysis also underscores the importance of assessing macroeconomic conditions in conjunction with cryptocurrency trends. The rise of Bitcoin cannot be isolated from larger economic developments—ratios comparing Bitcoin against gold could reveal shifts in investor preferences during times of ongoing uncertainty. The potential for Bitcoin to outperform traditional safe havens hinges on the overall liquidity in the markets, reinforcing the notion that cryptocurrency trends cannot be viewed in a vacuum.

As the cryptocurrency landscape continues to evolve, adopting Plan C’s analytical method becomes increasingly crucial for navigating complex market dynamics. By remaining cognizant of the interconnected nature of traditional finance and digital assets, investors can refine their strategies to make informed decisions in the face of changing market conditions.

Frequently Asked Questions

What is Bitcoin cycle analysis and how does it affect Bitcoin price predictions?

Bitcoin cycle analysis involves examining historical price data and trends to identify patterns in Bitcoin’s price movements. By understanding these cycles, analysts can make informed Bitcoin price predictions. The ‘Bitcoin Quantile Model’ proposed by Plan C is a key tool in this analysis, providing statistical insights that challenge traditional cyclic playbooks.

How does the Bitcoin Quantile Model help in understanding cryptocurrency market trends?

The Bitcoin Quantile Model, developed by Plan C, shifts the focus from historical analogies of past Bitcoin cycles to a statistical framework. It positions Bitcoin’s current price within its long-term distribution, allowing for better interpretation of cryptocurrency market trends and potential future price movements.

What role do business cycle indicators play in Bitcoin cycle analysis?

Business cycle indicators, such as the PMI, are crucial in Bitcoin cycle analysis as they provide insight into the overall economic environment. Weak indicators can signal potential shifts in Bitcoin’s behavior, influencing its performance relative to traditional assets like gold. This relationship highlights Bitcoin’s sensitivity to liquidity conditions rather than pure growth metrics.

Can Bitcoin’s resilience continue despite weak business-cycle indicators?

Yes, Bitcoin’s resilience can persist even when business-cycle indicators remain weak. If liquidity conditions improve, Bitcoin may act more like a liquidity-sensitive asset rather than a growth-sensitive one, allowing it to maintain strength in challenging economic environments.

What are the potential outcomes of the relationship between Bitcoin and PMI in cycle analysis?

The relationship between Bitcoin and PMI can yield three potential outcomes in cycle analysis: 1) PMI rebounds and aligns with Bitcoin’s strength; 2) PMI remains weak while Bitcoin maintains demand due to liquidity; or 3) PMI weakens further, resulting in a Bitcoin pullback as investors shift to reduce risk.

How does Plan C’s analysis suggest approaching Bitcoin’s long-term price movements?

Plan C’s analysis emphasizes understanding Bitcoin’s price within the context of quantile bands rather than seeking fixed targets. This approach allows for a more dynamic discussion of potential price paths based on changing economic indicators, positioning Bitcoin effectively within its historical cycles.

What implications does the BTC-gold ratio have for Bitcoin cycle analysis?

The BTC-gold ratio is significant in Bitcoin cycle analysis as it compares Bitcoin’s performance against gold, a traditional safe-haven asset. A strong BTC-gold ratio indicates Bitcoin’s relative strength, while changes in this ratio can reflect shifts in investor preferences and market dynamics, impacting future Bitcoin price trends.

When will the next ISM Manufacturing PMI report impact Bitcoin cycle analysis?

The next ISM Manufacturing PMI report, expected in early January, will be a key short-term checkpoint in Bitcoin cycle analysis. This report will provide insights on business conditions and potential liquidity trends that could directly influence Bitcoin’s price action and its resilience in the current economic environment.

| Key Point | Details |

|---|---|

| Bitcoin Analyst’s Warning | Plan C warns against assuming Bitcoin’s current cycle will mirror the last bull market, identifying this as potentially the biggest financial mistake of the decade. |

| Current Bitcoin Price and PMIs | As Bitcoin trades around $87,661, the latest U.S. ISM Manufacturing PMI reading indicates contraction at 48.2, suggesting weaker demand and broader manufacturing issues. |

| Bitcoin Quantile Model | Plan C’s model positions Bitcoin’s price within historical quantile distributions, indicating it is below the median despite being near previous cycle highs. |

| Future Scenarios | Three potential paths for Bitcoin over the next 6-12 months based on PMI reports: improvement aligning with Bitcoin, weakness under support, or a deeper contraction favoring gold. |

| Gold as a Safe Haven | Spot gold’s price translates to approximately 19.7 ounces per Bitcoin, indicating that a rally in Bitcoin can occur alongside gold’s price growth. |

| Implications for Investors | Market observers need to assess the upcoming PMI reports and their potential impacts on Bitcoin’s position relative to hard assets like gold. |

Summary

Bitcoin cycle analysis plays a crucial role in understanding market trends and price movements in the cryptocurrency space. Recent insights from Bitcoin analyst Plan C emphasize the potential risks of adhering to outdated cycle theories, especially as prevailing economic conditions suggest a divergence from past trends. The upcoming PMI reports will be significant indicators for future Bitcoin performance, and investors should remain vigilant as these dynamics evolve.