The recent Bitcoin crash has left investors reeling, with the Bitcoin price dropping dramatically over the past month. This sell-off, attributed primarily to leveraged bets made by Hong Kong hedge funds, has seen Bitcoin plummet over 40%, dipping below the $60,000 mark. With concerns over the causes of Bitcoin’s decline gaining traction, many analysts are examining the intricacies of market dynamics and investor behavior. The BTC sell-off not only highlights individual trading strategies but also reflects broader cryptocurrency trends impacting market stability. Understanding the underlying factors behind this drastic Bitcoin crash is crucial for both seasoned investors and newcomers alike.

In the financial landscape, the term ‘Bitcoin crash’ encompasses a significant downturn in the value of the cryptocurrency, raising questions about market health and investor confidence. As we explore the context of this downturn, alternative phrases like ‘BTC decline’ or ‘wallet depreciation’ may come to mind, revealing the multifaceted nature of cryptocurrency valuation. Recent analyses point toward complex interactions between hedge fund strategies, market reactions, and rising costs as potential explanations for the steep Bitcoin price drop. Furthermore, the emerging trends indicate potential shifts in investor sentiment and engagement with Bitcoin and its competitors. Examining these factors will provide a clearer picture of the recent market volatility and its implications for the future.

| Theory | Description |

|---|---|

| Hong Kong Hedge Funds | Hedge funds in Hong Kong made leveraged bets on Bitcoin, financing these through borrowed yen. When prices dropped, they were forced to sell BTC quickly, exacerbating the decline. |

| Morgan Stanley Products | Complex financial products tied to Bitcoin prices led to forced selling by banks as BTC fell below key levels, increasing market volatility. |

| Mining Exodus | Bitcoin miners are shifting focus away from cryptocurrency to AI data centers and selling off BTC, raising concerns about financial stress in the mining sector. |

Summary

The recent Bitcoin crash can be attributed to several key factors impacting market stability. Notably, Hong Kong hedge funds’ leveraged bets have led to significant selling pressure, contributing to Bitcoin’s rapid dip below $60,000. This bearish trend highlights a growing volatility in the crypto market, driven by both institutional trading strategies and a shift among miners. Understanding these dynamics is crucial for investors navigating the uncertain landscape following the Bitcoin crash.

Understanding the Recent Bitcoin Crash

The recent dramatic downturn in Bitcoin’s value has left many investors wondering about the root causes of the Bitcoin crash. One significant factor contributing to this downturn is the actions of Hong Kong hedge funds. Leveraged bets placed on Bitcoin’s price trajectory created a precarious situation where rising costs associated with borrowing negatively impacted these positions, ultimately leading to a massive sell-off. As Bitcoin prices dipped below $60,000, it triggered a chain reaction that forced these hedge funds to liquidate their holdings, further exacerbating the downward momentum.

Understanding the dynamics behind the Bitcoin crash also requires a look into broader market sentiments and trading behaviors. Market analysts have noted a correlation between Bitcoin’s price movements and the activities of institutional investors, particularly those employing complex financial instruments tied to Bitcoin’s performance. This makes the cryptocurrency market particularly vulnerable to volatility, as large sell orders can have a cascading effect, causing panic among retail investors and prompting even more significant markdowns in Bitcoin’s price.

The Impact of Hedge Fund Leverage on Bitcoin Prices

Hedge funds have increasingly turned to leverage as a strategy for amplifying returns in the volatile cryptocurrency market. In the instance of the recent Bitcoin crash, funds engaged in leveraging their positions on Bitcoin ETFs, utilizing borrowed capital to bolster their exposure. Such practices, while potentially lucrative during bullish trends, backfire dramatically when prices begin to decline, as the funds are subsequently pressed to liquidate their positions to meet margin calls. This added pressure contributes to a quicker depreciation in Bitcoin’s market value, creating a significant ripple effect throughout the crypto ecosystem.

The actions of these hedge funds underscore the risks involved with leveraged trading, especially in a market as unpredictable as cryptocurrency. The Bitcoin price drop demonstrates that while leveraged positions can lead to short-term gains, they also heighten the potential for severe losses when market sentiment shifts negatively. This highlights the importance of understanding market dynamics and the role institutional behaviors play in shaping Bitcoin’s price trajectory.

Morgan Stanley’s Role in the Bitcoin Sell-off

The allegations surrounding Morgan Stanley’s involvement in the Bitcoin sell-off highlight the intricate web of financial products that can influence cryptomarket flows. According to Arthur Hayes, the former CEO of BitMEX, complex financial instruments tied to Bitcoin’s performance can create scenarios where banks, rather than providing liquidity, are forced into selling as the value of Bitcoin declines. This situation often leads to ‘negative gamma’ dynamics, where falling prices necessitate hastened sales to hedge against losses, effectively creating a self-reinforcing cycle of price decline.

Additionally, these relationships between traditional financial institutions and cryptocurrency can introduce significant external pressures that impact Bitcoin’s stability. As the market observes sudden shifts caused by financial engineering, it raises important questions regarding the transparency and regulatory oversight of these derivatives. The intricate dance between banks and cryptocurrency values suggests a significant area of vulnerability for Bitcoin, particularly as the market matures and traditional finance continues to seep into the crypto space.

Shifts in Mining Strategies Amidst Bitcoin Price Decline

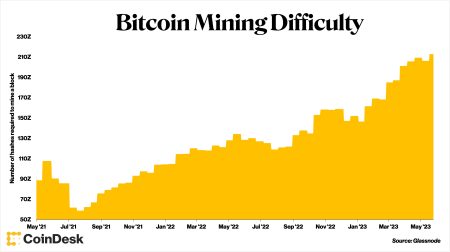

Amid the recent Bitcoin crash, some miners are recalibrating their strategies, with reports indicating a trend of moving away from Bitcoin mining to focus on alternative technologies like artificial intelligence data centers. Companies such as Riot Platforms are not only shifting operational focus but also liquidating considerable amounts of Bitcoin holdings. This pivot reflects broader concerns regarding profitability in Bitcoin mining, especially as production costs climb amid declining BTC prices, adding another layer of complexity to the cryptocurrency landscape.

The changing narratives around mining practices pose fundamental questions regarding the sustainability of Bitcoin’s mining ecosystem. With a growing emphasis on transitioning to AI and other data-centric industries, the long-term viability of Bitcoin mining might be jeopardized, especially if profit margins remain strained. As more miners consider diversifying away from Bitcoin, this transition could further impact the cryptocurrency’s market value, resulting in a cascading effect on supply-demand dynamics that could stretch the Bitcoin market’s resilience.

Long-term Holders’ Behavior During Market Downturns

The behavior of long-term Bitcoin holders during market downturns plays a critical role in price stabilization. As demonstrated by recent data, wallets holding significant amounts of Bitcoin have noticeably decreased their active participation in trading, preferring instead to hold onto their assets amid the current price decline. This cautious approach signals a lack of confidence in the market’s immediate recovery prospects, contributing to downward pressure as fewer coins change hands at potentially stabilizing prices.

Notably, the decrease in supply controlled by long-term holders echoes broader fears about the Bitcoin market’s capacity to rebound quickly from significant dips. When large holders retreat from active trading, it not only indicates a bearish sentiment but also raises anxiety among smaller investors. Their hesitation to enter the market amidst uncertainty could further exacerbate Bitcoin’s volatility, as decreasing liquidity might prevent a natural stabilization in price that typically follows a sell-off.

Analyzing Cryptocurrency Trends in the Context of Bitcoin’s Decline

The recent Bitcoin crash serves as a stark reminder of the volatility that defines the cryptocurrency market. Market analysts are diligently observing current trends, noting that Bitcoin’s decline has echoes of previous bear markets. Trends such as increased regulatory scrutiny, shifting investor sentiment, and operational changes among miners all feature prominently in contemporary analyses, suggesting that the overall health of the cryptocurrency sector remains precarious.

Moreover, the implications of Bitcoin’s price drop extend beyond its immediate market, influencing the behavior of alternative cryptocurrencies as well. As the largest cryptocurrency by market capitalization, Bitcoin’s fortune often predetermines the trajectory of the broader market, eliciting trends in price movements across altcoins. Observing these trends provides critical insights for investors looking to navigate the current environment while addressing the underlying causes of Bitcoin’s decline.

The Interplay of Market Sentiment and Price Movements

Market sentiment significantly influences Bitcoin’s price movements. Following the recent crash, sentiment among investors has drastically shifted, creating a climate of fear and uncertainty. Analysts have noted how market psychology, driven by amplified news regarding sell-offs and major losses, can dictate the trading patterns of cryptocurrencies, not just Bitcoin. As retail investors react to market developments, the resulting behavior can often lead to intensified bull or bear trends.

At times like this, negative sentiment can become a self-fulfilling prophecy, where fear leads to selling and selling suppresses prices, thereby encouraging more selling. Understanding the interplay between market sentiment and price movements is essential for stakeholders aiming to make informed investment decisions. As they navigate through the volatility, recognizing the emotional psychology of the crypto market may lead to strategic investments that counteract the prevailing trend.

Predictive Insights into Bitcoin’s Market Recovery

As analysts seek to understand Bitcoin’s current downturn, attention also turns toward predictive insights into potential recovery trajectories for the digital currency. While no prediction is entirely accurate or guaranteed, certain indicators suggest that Bitcoin may find support near pivotal price levels. Understanding historical price patterns, along with market-driven factors such as miner health and institutional interest, can offer valuable context in assessing potential recovery constellations.

Moreover, looking ahead, the emerging trends within Bitcoin’s ecosystem can illuminate potential revival strategies. Emerging technologies, changes in investor behavior, and various market dynamics will likely shape Bitcoin’s ability to rebound from significant corrections. Investors must remain vigilant, closely monitoring shifts in market sentiment alongside external financial influences, to gauge how these elements may converge to facilitate a potential recovery for Bitcoin.

Examining the Role of ETF Investments in Bitcoin Volatility

Exchange-Traded Funds (ETFs) tied to Bitcoin have garnered significant interest, often touted as a gateway for mainstream investment into cryptocurrencies. However, this rising popularity also brings with it risks that can amplify Bitcoin’s volatility. As large financial entities create ETFs linked to Bitcoin prices, these products may contribute to rapid movements in Bitcoin’s value, particularly during periods of panic selling or market correction, as seen in the recent crash.

The recent involvement from institutional investors leveraging these ETFs prompts scrutiny regarding their role in Bitcoin’s price dynamics. While ETFs can boost exposure and drive inflows, they can also serve as a catalyst for large-scale sell-offs. As seen with the influence of hedge funds employing Bitcoin-linked ETFs, these financial instruments can transform investor behaviors and impact market stability. Observing how ETF investments interact with Bitcoin valuation will be key for future market assessments.

Frequently Asked Questions

What are the causes of Bitcoin crash recently?

The recent Bitcoin crash can be attributed to several factors. Primarily, leveraged bets by Hong Kong hedge funds led to a significant BTC sell-off. These funds had bet on rising prices using borrowed funds in yen, and when those bets turned negative, they were forced to liquidate their positions. Additionally, financial products offered by banks created a scenario where price drops led to increased selling pressure, while miners shifting their focus to AI investments contributed to the decline. This multifaceted situation showcases the volatility in cryptocurrency trends.

How has the recent Bitcoin price drop affected long-term holders?

The recent Bitcoin price drop has made long-term holders more cautious. Data shows that wallets holding between 10 to 10,000 BTC have been decreasing their exposure, now controlling the smallest share of Bitcoin supply in nine months. This reluctance among long-term investors indicates concerns over potential further declines in Bitcoin’s value amid current cryptocurrency trends.

What impact did hedge fund activities have on the recent BTC sell-off?

Hedge fund activities, particularly from Hong Kong, played a crucial role in the recent BTC sell-off. These funds engaged in leveraged betting on Bitcoin’s price rise using cheap yen, which, when the market turned, forced them to cover losses by selling Bitcoin quickly. This exacerbated the crash, highlighting the connection between hedge fund speculation and sudden declines in Bitcoin’s market price.

Can we expect further declines in Bitcoin following its recent crash?

It’s challenging to predict Bitcoin’s exact trajectory after its recent crash. Analysts suggest that if BTC falls below $60,000, it may lead to financial stress for miners and further exacerbate the decline. Additionally, ongoing market reactions to hedge fund activities and changes in investor sentiment will continue to influence Bitcoin price trends.

What role do miners play in the Bitcoin crash scenario?

Miners have a significant role in the Bitcoin crash scenario. As some miners shift their focus towards AI data centers and sell substantial amounts of BTC, their actions can introduce additional supply pressure in the market. This, compounded by the rising operational costs associated with mining, could further contribute to a downward spiral in Bitcoin prices.

How do cryptocurrency trends forecast future Bitcoin market movements?

Cryptocurrency trends currently indicate heightened volatility and uncertainty in the Bitcoin market. Analysts are closely monitoring factors such as hedge fund activities, miner shifts, and investor behavior. These trends suggest that while recoveries are possible, the risk of further declines remains, especially in the wake of significant sell-offs.

What are the effects of negative gamma on Bitcoin’s price during a crash?

Negative gamma occurs when banks, responding to falling Bitcoin prices, shift from providing liquidity to becoming forced sellers. This accelerates selling pressure in the market, which can exacerbate a Bitcoin price crash. The dynamics of negative gamma are critical, particularly when Bitcoin breaches key support levels, triggering increased liquidations.

Is Bitcoin’s recovery likely after its recent significant decline?

Recovery for Bitcoin post-decline is possible but uncertain. The market’s reaction to ongoing economic conditions, regulatory news, and investor sentiment will play a key role in determining whether Bitcoin can regain its value. Historical performance shows that while Bitcoin can rebound, it remains susceptible to rapid price fluctuations and market dynamics.