The relationship between Bitcoin correlation with Nvidia has increasingly garnered attention as both the cryptocurrency and tech stocks navigate volatile market conditions. As institutional investors react to Bitcoin price volatility, the performance of Nvidia’s stock emerges as a significant impact factor, intertwining these assets more than ever. Notably, shifts in AI infrastructure effects, driven by Nvidia innovations, can catalyze Bitcoin’s price movements, revealing its status as a risk asset alongside tech stocks. Investors must remain vigilant of Bitcoin sell-off risk as geopolitical tensions and supply chain disruptions heavily influence investor sentiment across these markets. This link underscores the growing complexity of cryptocurrency dynamics in relation to tech equities, where every fluctuation in Nvidia’s stock could echo through Bitcoin’s valuation.

Examining the dynamics of Bitcoin’s relationship with Nvidia reveals an intricate web of interdependencies that define the modern investment landscape. The evolving interplay between cryptocurrency and semiconductor giants signals a deeper convergence, where technological advancements impact Bitcoin’s market behavior. As fluctuations in the value of Nvidia shares ripple through investor sentiment, they simultaneously affect Bitcoin’s price stability, illustrating the significance of tech stocks in the crypto sphere. This interaction emphasizes the potential risks associated with Bitcoin investments, particularly amid heightened market volatility influenced by AI developments. Such correlations suggest that understanding the financial mechanisms at play is crucial for investors looking to navigate the complexities of Bitcoin and its performance amidst the shifting tech landscape.

The Strategic Intersection of Bitcoin and Nvidia

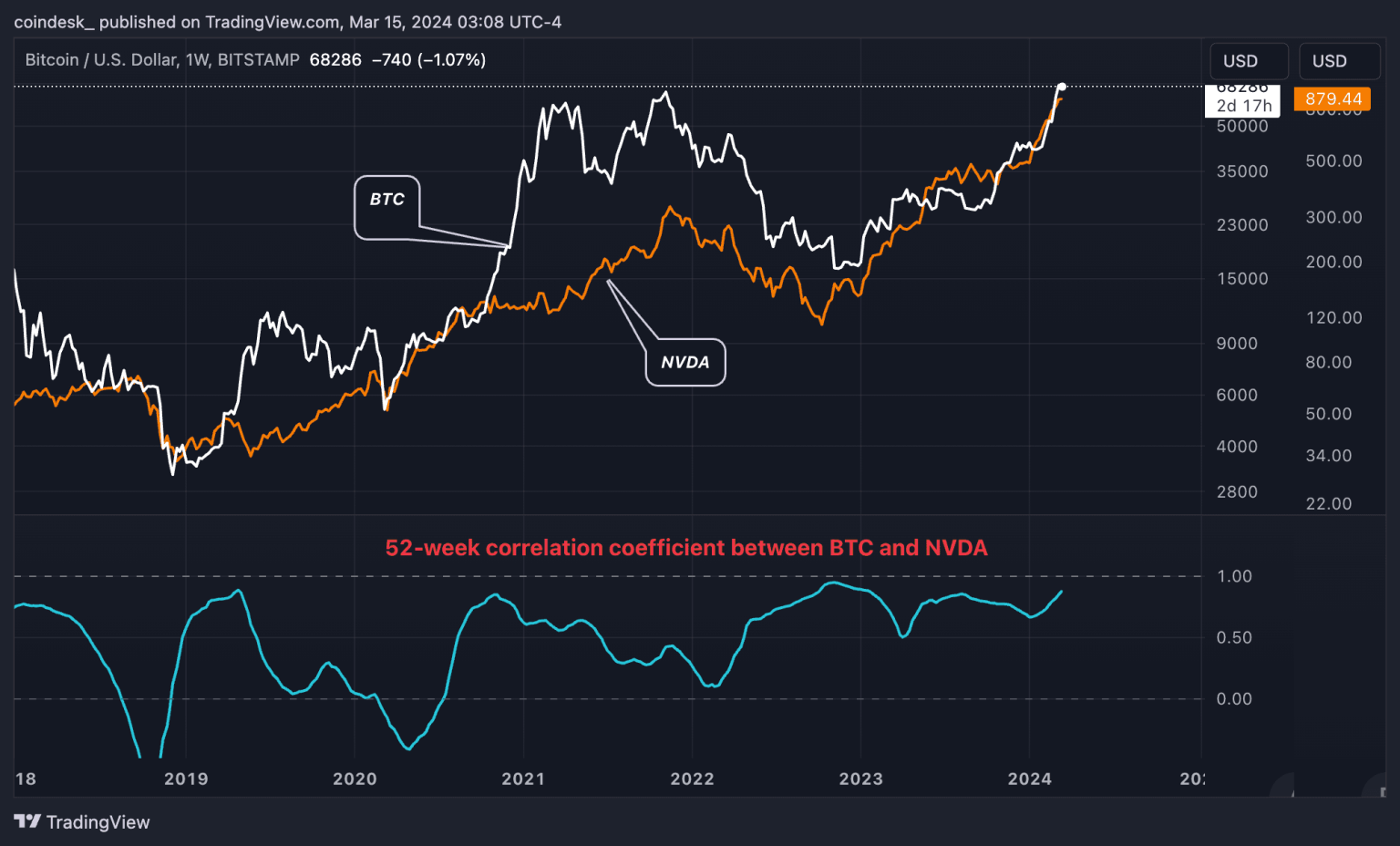

Bitcoin’s increasing correlation with Nvidia stock indicates a significant strategic intersection between cryptocurrency and artificial intelligence. As Nvidia continues to dominate the AI hardware market, Bitcoin has found itself closely linked to the stock’s performance. Institutional investors often view Bitcoin as a high-risk asset class that parallels the volatility of tech stocks, including those like Nvidia. This correlation suggests that shifts in Nvidia’s fortunes can directly influence Bitcoin prices, especially during periods of market uncertainty.

The current dynamics show that as Nvidia stocks fluctuate due to factors such as regulatory news or supply chain constraints, Bitcoin tends to follow suit. This is particularly evident during pivotal moments in the tech market where institutional investors re-evaluate their risk portfolios, opting to sell off high-risk assets like Bitcoin in response to declines in Nvidia’s stock value. Thus, this strategic intersection emphasizes the importance of closely monitoring Nvidia’s performance for anyone invested in Bitcoin.

Frequently Asked Questions

How does Bitcoin’s correlation with Nvidia impact Bitcoin price volatility?

Bitcoin’s correlation with Nvidia impacts its price volatility significantly. When Nvidia’s stock experiences fluctuations—often due to regulatory news or supply-chain issues—Bitcoin tends to react in the same direction. This relationship suggests that as institutional investors reallocate assets between tech stocks and cryptocurrencies, Bitcoin can either rise or fall alongside Nvidia’s performance, making it a risk asset within the tech-driven market.

What role does Nvidia stock impact play in Bitcoin’s market movements?

The impact of Nvidia stock on Bitcoin’s market movements is crucial due to the high correlation between the two. When Nvidia’s shares drop, often due to negative news or supply constraints, institutional investors often sell off Bitcoin as well. This risk-off behavior leads to increased Bitcoin price volatility, as market sentiments extend from AI equities to cryptocurrencies.

Can fluctuations in AI infrastructure affect Bitcoin’s correlation with tech stocks like Nvidia?

Yes, fluctuations in AI infrastructure significantly affect Bitcoin’s correlation with tech stocks like Nvidia. As Bitcoin mining companies increasingly pivot towards AI hosting, any disruptions in AI supply chains, such as GPU shortages or regulatory challenges, can prompt a sell-off in both sectors. Consequently, this amplifies Bitcoin’s price movements in relation to the tech market.

What is the Bitcoin sell-off risk associated with Nvidia’s stock volatility?

The Bitcoin sell-off risk linked to Nvidia’s stock volatility stems from the perceived connection between AI equities and cryptocurrencies. When Nvidia faces stock declines, it prompts institutions to reevaluate their risk exposure, often leading to reduced allocations to Bitcoin. This creates a direct risk of a sell-off in Bitcoin, mirroring the downturn in Nvidia’s shares.

How does Bitcoin’s relationship with tech stocks influence its overall market performance?

Bitcoin’s relationship with tech stocks, particularly Nvidia, heavily influences its overall market performance. As Bitcoin is increasingly viewed as a risk asset in tandem with tech equities, market shifts in major tech companies can lead to parallel movements in Bitcoin’s price. The correlation indicates that positive or negative trends in tech stocks directly affect Bitcoin’s trading sentiment and investment flows.

In what ways does Bitcoin’s price react to Nvidia’s earnings announcements?

Bitcoin’s price often reacts to Nvidia’s earnings announcements due to their close correlation. Positive earnings reports from Nvidia may bolster investor confidence in risk assets, including Bitcoin, leading to potential price increases. Conversely, if Nvidia reports disappointing earnings, Bitcoin’s price may suffer, reflecting the broader market’s risk aversion and the interconnectedness of both asset classes.

What are the implications of Bitcoin’s correlation with Nvidia for investors?

The implications of Bitcoin’s correlation with Nvidia for investors are significant, as it highlights the need for monitoring tech market dynamics. Investors should be aware that changes in Nvidia’s stock performance could lead to corresponding volatility in Bitcoin’s price. Understanding this correlation allows investors to make more informed decisions regarding risk management and asset allocation within their portfolios.

How can ETF flows influence Bitcoin’s correlation with Nvidia?

ETF flows can significantly influence Bitcoin’s correlation with Nvidia by affecting short-term price movements. Increased flows into crypto ETFs generally signal positive sentiment and can lead to a price rise in Bitcoin, aligning it with the performance of tech equities like Nvidia. Conversely, if ETF outflows occur due to negative market sentiment, Bitcoin’s price may decline alongside Nvidia, reinforcing their correlation as risk assets.

| Key Points | Explanation |

|---|---|

| Bitcoin’s Correlation with Nvidia | Bitcoin’s price movements are closely tied to Nvidia’s stock performance and broader AI market sentiment, reflected in a correlation above 0.5 in 2025. |

| Impact of AI Supply Chain News | Disruptions in AI chip supply chains can trigger risk-off sell-offs in both AI stocks and Bitcoin as institutions reduce risk exposure. |

| Chinese AI Market Regulations | China’s instructions to halt orders for Nvidia chips could change market dynamics, prompting cells between AI stocks and Bitcoin. |

| ETF Flows and Bitcoin | Institutional ETF investments significantly impact Bitcoin’s price, with reduced inflows during tech downturns closely affecting Bitcoin’s performance. |

| Bitcoin Mining and AI Infrastructure | More Bitcoin miners are transitioning to AI hosting, linking Bitcoin’s value to the economics of AI infrastructure. |

| Geopolitical Influence | Chinese geopolitical moves affect AI investment costs which in turn influence Bitcoin’s pricing dynamics. |

Summary

The Bitcoin correlation with Nvidia is critical, as fluctuations in AI equity, particularly due to supply-chain disruptions, can lead to significant price changes in Bitcoin. Institutional investors sharply respond to news affecting Nvidia, causing Bitcoin’s value to mirror movements in tech equities. This interconnectedness between Bitcoin and AI stocks, driven by futures in AI infrastructure and geopolitical developments, reinforces the importance of monitoring Nvidia’s performance and related regulatory actions. Therefore, the overall stability of Bitcoin may depend heavily on how the AI market evolves and the reaction of institutional investors to these geopolitical and economic signals.

Related: More from Bitcoin News | Stablecoin Strength Pressures Bitcoin Treasury | Analysts: No Evidence of Jane Street Bitcoin Manipulation, ETF Demand Soars