Bitcoin Cash Price Prediction: Eyes on the $460 Demand Zone if Support Gives Way

Key Takeaways

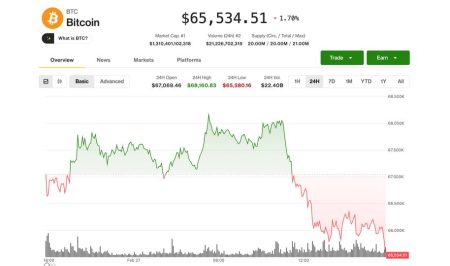

Bitcoin Cash (BCH), a spin-off of Bitcoin created in 2017, is currently captivating the attention of the cryptocurrency market with a critical price juncture that could set the tone for its future movements. As observed by CoinJournal and other market analysts, BCH is flirting with a significant price level, and a drop could see it reaching the $460 demand zone.

A Historical Perspective

Bitcoin Cash was conceived to address the scalability issues of Bitcoin by increasing the block size limit, thereby allowing more transactions to be processed per block. The premise was to make Bitcoin Cash a more viable tool for daily transactions, thereby complementing the position of Bitcoin as a store of value. This ideological and technical fork of Bitcoin was one of the high-profile splits in the crypto world, sparking debate and diversity in the blockchain ecosystem.

Despite the initial optimism surrounding Bitcoin Cash, its journey has been fraught with high volatility and competition, both from its progenitor and other altcoins. Bitcoin Cash started at a price close to $240 in 2017 and surged to an all-time high above $4000 in December of the same year, according to historical data from CoinMarketCap. Since those dizzying heights, BCH has seen substantial fluctuations, bearing the brunt of market cycles.

Current Market Dynamics

As of now, Bitcoin Cash trades around the critical $500 mark, hovering close to support levels that have been tested multiple times over the past months. A keen observation from CoinJournal suggests that the persistence of current market pressures could potentially push BCH down towards the $460 region, a demand zone that could either revitalize buying interest or pave the way for further declines.

This viewpoint aligns with a broader technical analysis wherein the $460 level signifies a confluence of historical support and Fibonacci retracement levels. Such technical zones often act as battlegrounds where bulls and bears vie for market supremacy, potentially resulting in high volatility.

Factors Influencing The Price

Several factors could be influencing Bitcoin Cash’s trajectory towards the $460 zone. Macro-economic conditions, such as inflation rates, interest rate changes, and economic downturns, significantly impact cryptocurrency markets. Moreover, the overall sentiment in the crypto market, driven by developments around regulations, adoption, and technological advancements, plays a crucial role.

Furthermore, Bitcoin Cash’s adherence to its original goal of everyday utility might be affecting its perception. As newer blockchain solutions offer faster and cheaper transactions, BCH must continuously innovate and solidify its position as a practical payment mechanism.

Forward-Looking Predictions

Looking ahead, the market’s sentiment on Bitcoin Cash remains cautiously optimistic. Experts from CoinJournal and other analytical platforms believe that if the $460 support holds, it could signal a strong buying opportunity for investors. This scenario banks on the presumption that at such a valuation, BCH would be undervalued, thereby attracting both short-term traders and long-term investors.

However, if the downward pressure breaks this critical support level, it might trigger a sell-off, pushing prices lower. In such a case, market watchers might reevaluate the foundational metrics and potential of BCH in a rapidly evolving digital currency landscape.

Conclusions

Cryptocurrency markets are notably unpredictable, and Bitcoin Cash is no exception. Investors should keep a close eye on the $460 demand zone. Conducting thorough research and staying updated with global economic trends, alongside specific developments in the crypto sector, is advisable before making any investment decisions. As ever in the cryptocurrency world, volatility is the only certainty.