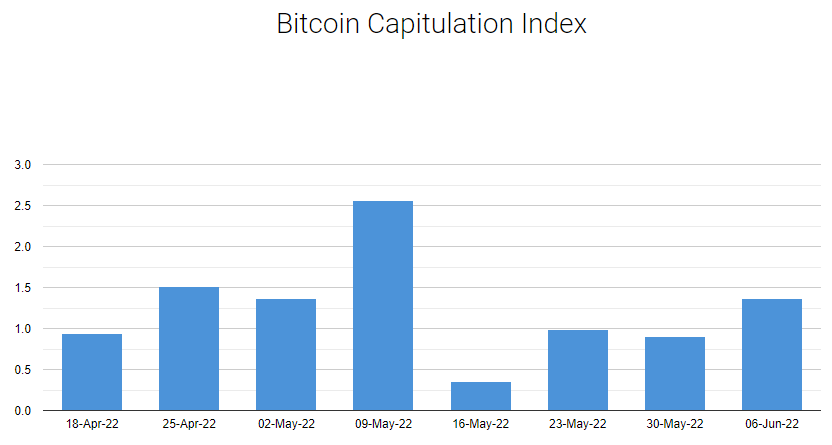

Bitcoin capitulation is a pivotal event in the crypto world, marking a significant decline in the market as investors panic and exit their positions. Recent Bitcoin price analysis suggests that we have yet to see the typical capitulation depth of -70% to -80% as recorded in previous cycles. Interestingly, current BTC market trends indicate a troubling drop, with the price hovering around 50% lower than its historical peak. This situation has many looking to CryptoQuant data for insights and predictions about the future of Bitcoin. Understanding the dynamics of cryptocurrency capitulation can help investors navigate these turbulent times and make informed decisions.

The phenomenon of Bitcoin capitulation, often characterized by a drastic downturn and mass sell-offs, is a crucial indicator for many cryptocurrency enthusiasts and traders alike. Often referred to as market capitulation or crypto sell-offs, this stage reflects the psychological strain of investors as they confront significant losses. Current data on BTC trends reveal that we are still a distance away from experiencing typical capitulation markers that have historically pointed to potential market reversals. As Bitcoin prices remain dramatically lower than past highs, analyzing related metrics becomes essential for anticipating future movements. Sustainable recovery in the crypto markets relies heavily on understanding these capitulation trends and historical patterns.

| Key Point | Details |

|---|---|

| Current Bitcoin Price | Approximately 50% lower than its historical peak |

| Capitulation Depth | BTC has not reached -70% to -80% typical capitulation depths |

| Data Source | CryptoQuant |

Summary

Bitcoin capitulation refers to a significant decline in the market where investors sell off their holdings, often leading to a bottoming out of prices. Based on recent data, Bitcoin appears to be in a phase where it has not yet entered typical capitulation depths of -70% to -80% compared to previous market cycles, indicating that further price declines may occur before a true bottom is reached. This situation creates both challenges and opportunities for investors watching the market.

Understanding Bitcoin Capitulation in Market Cycles

Bitcoin capitulation refers to a phase in the cryptocurrency market where investors sell off their holdings in large quantities, leading to a steep decline in prices. According to recent CryptoQuant data, Bitcoin has not yet dipped to the typical capitulation depths of -70% to -80% that characterize previous market cycles. This suggests that the current level of market panic may not have fully matured, impacting Bitcoin price analysis and anticipations regarding the future of the BTC market.

Historically, Bitcoin has experienced significant capitulation phases during bear markets, where the panic selling results in prolonged downturns. Each capitulation event carries lessons for investors, as it often precedes recovery and eventual price surges. The current market situation indicates that Bitcoin’s price is still approximately 50% lower than its historical peak, hinting at potential turbulence ahead unless the market conditions shift drastically.

Analyzing Current Bitcoin Market Trends

Current trends in the Bitcoin market reveal a complex interplay between investor sentiment and broader economic factors. With Bitcoin currently sitting around 50% below its historical peak, many market analysts are closely monitoring indicators such as trading volumes and investor behavior. These trends are indicative of whether the market is gearing up for a potential capitulation or a recovery, making thorough Bitcoin price analysis imperative for traders.

In addition to market sentiment, technological advancements and regulatory news significantly influence Bitcoin’s performance. As institutional adoption increases and innovations in blockchain technology continue, the resilience of the cryptocurrency in a turbulent market becomes a focal point for observers. These dynamics, coupled with data from sources like CryptoQuant, underscore the intricate factors driving BTC market trends today.

The Impact of Historical Peaks on Bitcoin Pricing

Bitcoin’s historical peaks have a profound effect on its current pricing dynamics and investor perceptions. Looking back at earlier cycles, we notice that each peak has been followed by intense periods of retraction and sometimes severe capitulation as traders recalibrate their expectations. With the current price being significantly lower than its previous highs, many investors are left questioning whether we are nearing a bottom or just at the beginning of another downturn.

Understanding how these historical peaks influence Bitcoin’s trajectory requires careful examination of market cycles. The data from CryptoQuant shows that liquidity conditions and macroeconomic trends play crucial roles in determining how investors react to price movements. As traders analyze these factors, they must consider historical patterns to inform their decision-making processes regarding BTC market investments.

CryptoQuant Data Insights on Bitcoin’s Future

Utilizing data from CryptoQuant, analysts can glean valuable insights into Bitcoin’s future performance. This platform provides metrics surrounding market activity, such as total exchange balances and miner behavior, offering a clearer picture of potential capitulation points. By analyzing trends over time, investors can better anticipate shifts in Bitcoin’s valuation and identify optimal entry or exit points within the market.

One significant takeaway from CryptoQuant’s data is the current lack of capitulation among crypto investors. Despite Bitcoin’s notable price decline, many holders are choosing to remain invested rather than liquidate their assets. This behavior suggests a potential buoyancy in the market, indicating that a recovery might be on the horizon if confidence in Bitcoin’s fundamentals remains steadfast.

Crypto Investment Strategies During Capitulation

Investing in Bitcoin during periods of capitulation can be remarkably challenging yet rewarding if approached strategically. During capitulation, emotions often drive market movements, leading to erratic pricing and heightened volatility. Savvy investors look for opportunities to accumulate BTC at lower prices, betting on the cryptocurrency’s long-term growth despite short-term declines. Developing investment strategies that leverage this volatility can lead to significant returns when the market stabilizes.

Moreover, during capitulation, it’s critical for investors to employ sound risk management practices. Diversification of assets and setting stop-loss limits can help mitigate potential losses during steep declines. These strategies, combined with a solid understanding of the current market indicators provided by tools such as CryptoQuant, empower investors to navigate the complexities of Bitcoin trading during turbulent times.

The Role of Market Sentiment in Bitcoin Price Fluctuations

Market sentiment plays an essential role in the fluctuation of Bitcoin prices, often propelling rapid changes that may seem irrational at times. When fear dominates the crypto space—often during capitulation—the price of Bitcoin can plummet, leading to widespread panic among investors. Conversely, positive news or investor optimism can drive prices back up, illustrating the direct correlation between sentiment and Bitcoin’s market performance.

Understanding sentiment can aid investors in making data-informed decisions, particularly during uncertain times. Using platforms like CryptoQuant, traders can measure sentiment indicators that provide insights into community behavior, helping to predict future price movements based on current trends. By correlating sentiment analysis with traditional Bitcoin price analysis, investors can develop a more nuanced understanding of market dynamics.

Potential Recovery Patterns Post-Capitulation

Historically, post-capitulation recovery patterns in Bitcoin have exhibited unique characteristics that investors can learn from. After severe downturns, Bitcoin generally builds a base that sets the stage for future growth. Traders monitor these recovery patterns closely, searching for bullish signs that signal an impending reversal from bearish trends. Understanding these historical behaviors shapes expectations for potential Bitcoin price stabilization and growth after capitulation.

Moreover, recognizing the factors contributing to recovery is crucial for formulating investment strategies. Elements like increased buying from institutional investors, changes in legislation, and technological advancements can all impact the speed and efficacy of Bitcoin’s rebound. As data from CryptoQuant suggests, close observation of market trends can inform predictions about the timing and scale of potential recoveries, providing traders with critical insights into navigating Bitcoin’s market cycles.

Influence of Institutional Investors on Bitcoin Stability

Institutional investors have increasingly influenced Bitcoin’s market stability, particularly during periods of volatility and potential capitulation. Their investments provide liquidity and reassurance to retail investors, often stabilizing prices after steep declines. With significant financial backing, these institutions can help prevent extensive downturns and promote recovery phases that are critical following moments of capitulation.

Furthermore, the entrance of institutional players has led to more structured market activity, resembling that seen in traditional financial markets. This institutional adoption lends a level of credibility to Bitcoin, which may help mitigate the panic typically associated with capitulation. As such, analyzing the behavior and strategies of large-scale investors becomes pivotal in understanding Bitcoin’s valuation and potential future price movements.

Monitoring Bitcoin Volatility and Strategic Responses

Bitcoin’s inherent volatility poses both risks and opportunities for investors, especially during capitulation phases. This volatility is shaped by a range of factors, including market speculation, macroeconomic trends, and regulatory announcements. Traders must stay attuned to these influences as they can prompt swift price changes necessitating agile responses in trading strategies.

In navigating this volatility, investors are encouraged to develop frameworks for their trading operations, integrating tools for risk assessment and decision-making. By closely monitoring price patterns and utilizing analytics from platforms like CryptoQuant, traders can adopt responsive strategies that optimize their positions during times of significant market fluctuation, particularly during moments of capitulation where rapid price shifts are common.

Frequently Asked Questions

What does Bitcoin capitulation mean in terms of cryptocurrency market trends?

Bitcoin capitulation refers to a significant decline in BTC prices where many investors sell their holdings, often triggering a further drop. It reflects a critical phase in cryptocurrency market trends, where panic selling occurs after a prolonged downturn.

How can I analyze the Bitcoin price to identify signs of capitulation?

To identify signs of Bitcoin capitulation, you can analyze Bitcoin price data alongside critical indicators, including the depth of price drops, trading volume, and behavioral metrics from tools like CryptoQuant. Historically, capitulation occurs when BTC price declines by 70% to 80% from its peak.

What insights does CryptoQuant data provide regarding Bitcoin capitulation?

CryptoQuant data is instrumental in assessing Bitcoin capitulation, revealing that BTC has not yet displayed the typical capitulation signals seen in previous cycles. Current metrics indicate Bitcoin is approximately 50% below its historical peak, suggesting further market movements must occur before significant capitulation is realized.

What are the typical signs of cryptocurrency capitulation that investors should watch for?

Typical signs of cryptocurrency capitulation include rapid price declines, increased selling pressure, high trading volumes, and a stark shift in market sentiment. Observing these indicators can help you anticipate Bitcoin capitulation stages.

How does Bitcoin’s historical peak affect current capitulation analysis?

Bitcoin’s historical peak serves as a reference point for measuring current price levels. As BTC remains nearly 50% lower than its all-time high, analysts can compare recent price drops to understand if we are approaching a capitulation phase based on historical behaviors.

Why is the understanding of Bitcoin market trends important during potential capitulation?

Understanding Bitcoin market trends is crucial during potential capitulation as it provides insights into price direction, investor sentiment, and possible recovery signals. A comprehensive analysis can help determine whether the market is nearing a low point or preparing for a rebound.

How can past Bitcoin capitulation events inform future market predictions?

Past Bitcoin capitulation events help inform future market predictions by establishing patterns in price behavior, investor reactions, and recovery timelines. Analyzing these historical patterns allows investors to make more informed decisions about buying opportunities during downturns.