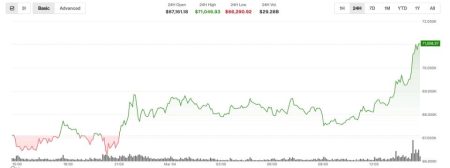

Bitcoin snaps back above key averages, bulls eye $93K as risk appetite stabilizes Bitcoin rebounded sharply after a bruising selloff, climbing about 4.5% to roughly $90,200 and reclaiming short-term momentum indicators. Traders are watching whether the move holds above key hourly moving averages as the market targets the $93,000 area next.

Market snapshot

Bitcoin recovered from an intraday low near

$86,190

, reversing part of yesterday’s nearly 5% decline that briefly pushed prices down to

$83,814

. The rebound accelerated into a session high around

$90,873

before consolidating. The broader tone across risk assets remains cautious but improved, with crypto volatility elevated and liquidity pockets amplifying intraday swings.

Technical picture: bulls retake control—for now

On the hourly chart—where momentum shifts fastest—Bitcoin pushed back above the converged

100-hour

and

200-hour

moving averages at

$89,108

and

$89,253

, respectively. Sustaining trade above those levels keeps the near-term bias tilted to the upside. – Immediate resistance sits in a “swing area” defined by the November 20 and November 28 highs near

$93,091

. – A clean break of that zone would expose the

$94,229

region, which aligns with the

38.2% retracement

of the decline from October 27. – On the downside, a move back below the 100/200-hour cluster would weaken the bullish case and refocus attention on

$86,190

, and then

$83,814

if pressure builds.

What traders are watching

– Momentum continuity: The close relative to the hourly moving averages will guide intraday positioning as trend-followers lean into strength above the cluster. – Reaction at $93K: Sellers previously defended this zone; a decisive topside break could spark follow-through buying and short-covering. – Macro risk tone: Crypto has been trading as a high-beta expression of risk sentiment. A steadier backdrop tends to support BTC, while renewed risk-off can quickly unwind gains.

Key points

- Bitcoin rebounds ~4.5% to around $90,200 after a near 5% drop the day before.

- Price retakes the 100-hour ($89,108) and 200-hour ($89,253) moving averages, improving near-term momentum.

- First major resistance: $93,091 (November swing area).

- Next upside level: $94,229 (38.2% retracement of the October 27 decline).

- Support to watch: $86,190 intraday low; deeper support near $83,814.

Why it matters for broader markets

Bitcoin’s quick snapback underscores ongoing two-way volatility that has implications for risk appetite across assets. A sustained push higher could buoy sentiment in high-beta equities and risk-sensitive FX, while a failure back below the hourly averages might reanimate defensive flows. For day traders, the intraday moving-average cluster is the pivot; for swing traders, the $93K–$94K band is the key test.

Frequently Asked Questions

Why did Bitcoin rebound today?

The bounce coincided with buyers defending the mid-$80Ks and a reclaim of the 100- and 200-hour moving averages. That technical shift often attracts momentum and systematic flows, helping extend the recovery.

What levels are most important right now?

On the upside, watch $93,091 and then $94,229. On the downside, a drop back below $89,108–$89,253 weakens the bullish bias, putting $86,190 and $83,814 back in focus.

How could this move affect FX and stocks?

A steady Bitcoin rally can support broader risk appetite, often lifting high-beta equities and risk-sensitive currencies. Conversely, a sharp reversal in BTC tends to reinforce risk-off behavior.

Is this a trend change or just a bounce?

It’s a short-term momentum shift. A sustained break above the $93K–$94K band would strengthen the case for a broader recovery; failure there could keep price action choppy within the recent range.

What should traders watch next?

Monitor intraday closes relative to the hourly moving averages and the reaction at $93K. Liquidity conditions and volatility remain pivotal—thin books can amplify moves in either direction.

Reporting by BPayNews.

Related: More from Bitcoin News | JPMorgan: New Legis. Could Spark Bitcoin Growth | Bitcoin Fork Proposal Fails to Gain Support