As Bitcoin faces a monumental $40 trillion test amid rising US debt, the implications for the crypto market are profound. The alarming increase in the US national debt not only challenges traditional financial structures but also shapes Bitcoin’s price prediction and investment strategies. With the pressure of escalating interest rates and Bitcoin’s potential vulnerability as a risk asset, traders must navigate complex crypto market trends. Interestingly, as the national debt continues to balloon, discussions surrounding Bitcoin’s resilience as a hedge against inflation and dollar devaluation become increasingly relevant. This confluence of factors necessitates an examination of how US debt dynamics influence both Bitcoin’s market behavior and investor confidence.

In this economic climate, the interplay between digital currency and national liabilities is drawing significant scrutiny. The towering federal obligations are spurring anxiety among investors, prompting a reevaluation of Bitcoin’s role in a diversifying portfolio amidst soaring US financial commitments. As market analysts delve into alternative investment avenues, the continuing burden of national debts raises questions about future asset valuations, particularly in the realm of cryptocurrencies. An exploration of how interest liabilities influence digital currencies highlights a shift in financial paradigms, as traders adapt strategies to incorporate Bitcoin as a potential refuge amidst fiscal turbulence. Hence, understanding the broader ramifications of government debt on Bitcoin’s trajectory becomes crucial for stakeholders in the evolving financial landscape.

Understanding the Impact of US National Debt on Bitcoin

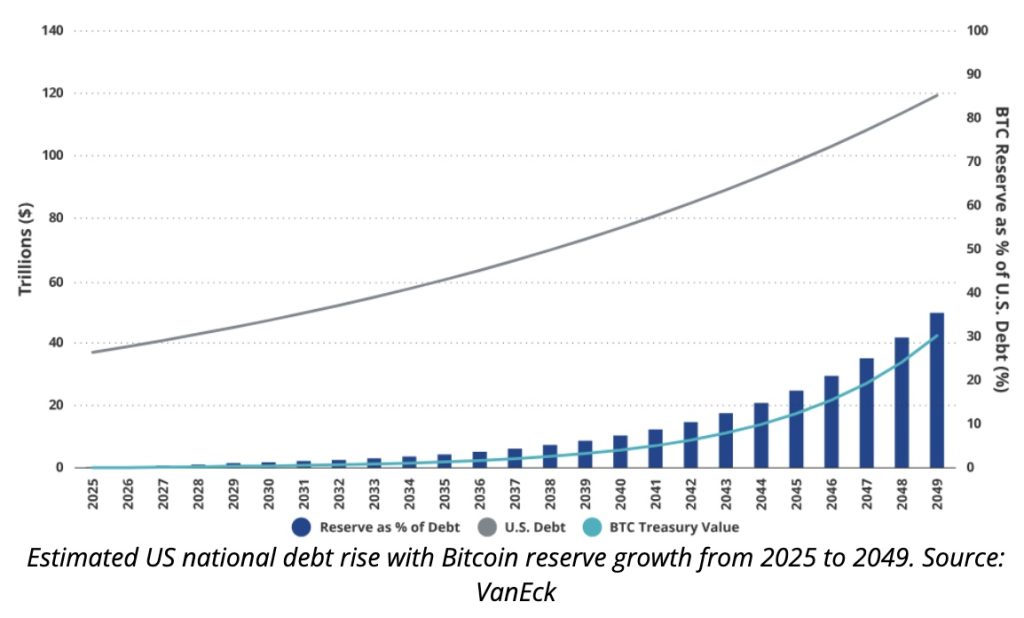

The ever-increasing U.S. national debt, which is projected to surpass $40 trillion, presents both challenges and opportunities for Bitcoin investors. As the burden of debt grows, the connection between traditional finance and the crypto market becomes increasingly pronounced. With the rising national debt, there are heightened concerns about long-term dollar value diminishment, leading many investors to seek alternative assets like Bitcoin. This shift highlights Bitcoin’s appeal as a hedge against inflation, contrasting it with the depreciating purchasing power of fiat currencies.

Moreover, the dynamics of Bitcoin in response to U.S. debt are further compounded by interest rates. As debt levels rise, so too do the costs of servicing this debt. This reality affects market liquidity and the overall environment in which Bitcoin operates. For crypto traders, understanding how shifts in interest rates may dictate Bitcoin price movements is critical. A tightening monetary policy could lead to increased volatility in crypto markets as investors reevaluate risk, especially given Bitcoin’s reputation as a volatile asset.

Analyzing Bitcoin Price Predictions Amidst Growing US Debt

In the context of escalating U.S. national debt, Bitcoin price predictions become more intricate due to economic uncertainties. Financial analysts are wrestling with how rising geopolitical tensions and domestic policies surrounding debt management might shape the future trajectory of Bitcoin prices. Numerous experts suggest that as debt escalates, Bitcoin could experience upward pricing trends due to its established status as a limited supply asset. This commodity-like nature of Bitcoin makes it an attractive option amid fear of currency devaluation.

Conversely, analysts also warn of potential downside risks that could emerge from rising interest rates linked to increasing debt levels. If yields on U.S. Treasuries continue to climb, capital might flow back towards traditional safe-haven assets, thus leading to decreased demand for riskier investments like Bitcoin. This duality of predictions makes it imperative for investors to stay vigilant and informed about both Bitcoin and broader economic indicators.

The Relationship Between Interest Rates and Bitcoin

Interest rates play a crucial role in shaping the market landscape for Bitcoin. As the U.S. government grapples with rising debt and concurrently manages the implications on interest rates, Bitcoin investors must consider how changes in the financial environment could impact their investment strategies. When interest rates are high, the cost of borrowing increases, making crypto investments less appealing in the immediate term due to the alternative of earning predictable yields from bonds.

On the other hand, lower interest rates can spur investment into risky assets, including Bitcoin. If the Federal Reserve’s approach to managing liquidity remains accommodative despite the expanding debt, Bitcoin could appreciate significantly. The intricate balance between these varying interest rates and the economic backdrop defined by U.S. debt levels requires continuous scrutiny from investors to anticipate market shifts accurately.

Exploring Crypto Market Trends in Light of US Debt

The evolving crypto market landscape is increasingly intertwined with traditional economic metrics such as the U.S. national debt. Observing crypto market trends amidst rising debt levels reveals a pattern where market sentiment tends to sway based on government fiscal actions and interest rate policies. As traders find reassurance in Bitcoin as a safeguard against the instability associated with national debt, its price trends often align inversely with fluctuations in stock markets and bond yields.

As market dynamics progress, other cryptocurrencies are also impacted. The overall health of the crypto ecosystem can reflect investor confidence—or lack thereof—in relation to the broader financial landscape dictated by U.S. debt levels. Keeping abreast of these connections is essential for anyone looking to navigate the complexities of investing in cryptocurrencies during times of fiscal uncertainty.

Investment Strategies for Bitcoin in a Rising Debt Environment

Crafting a Bitcoin investment strategy requires astute acknowledgment of the macroeconomic variables at play, particularly in light of the U.S. national debt trajectory. Strategic asset allocation becomes paramount as investors must decide the proportion of their portfolio allocated to Bitcoin, especially as traditional assets are affected by rising debt and interest rates. This consideration leads to developing a balanced approach involving both Bitcoin and safer investments like treasury securities.

Additionally, dollar-cost averaging emerges as a favored strategy amidst volatility generated by debt dynamics. By regularly investing a fixed amount in Bitcoin regardless of price fluctuations, investors can mitigate risk and take advantage of the long-term upward potential many analysts predict for Bitcoin as an inflation hedge. The challenge lies in maintaining this strategy while staying informed about macroeconomic shifts that can influence Bitcoin’s market performance.

The Role of Stablecoins in the Treasury Market and Bitcoin Dynamics

As the U.S. national debt continues to expand, the role of stablecoins is becoming increasingly significant in bridging the crypto economy with the Treasury market. Stablecoin issuers are increasingly purchasing U.S. debt as part of their asset management strategies, creating a tighter integration between cryptocurrency and traditional financial systems. This trend reinforces the need for Bitcoin investors to track developments within the stablecoin sector closely, as these movements can influence overall market liquidity.

Furthermore, stablecoin growth signifies a vital liquidity source for Bitcoin, especially during turbulent economic periods signified by high U.S. debt levels. Understanding how stablecoin transactions correlate with Bitcoin pricing trends can provide insights into potential future movements in the crypto market. Therefore, investors should remain alert to changes in stablecoin reserves and market sentiment surrounding them as a critical component of their Bitcoin investment strategy.

Liquidity Management: Linking US Debt and Bitcoin

Liquidity management is at the core of understanding the relationship between U.S. national debt levels and Bitcoin market performance. Recent moves by the Federal Reserve to adjust its balance sheet—the cessation of reductions and inclined acquisitions of short-term government bonds—indicate policies that can directly affect liquidity levels in the system. These decisions create ripple effects in various asset markets, including the cryptocurrency space.

For Bitcoin, increased liquidity generally translates to enhanced market activity, which can bolster prices. Conversely, any constraints imposed on liquidity can elicit investor caution, thereby reflecting on Bitcoin’s value. Investors must closely monitor the Federal Reserve’s maneuvers regarding liquidity management as these will signal critical moments that could either support or diminish Bitcoin’s market momentum.

Scenario Analysis for Bitcoin Amid Escalating US Debt

As Bitcoin continues to navigate through the complex landscape created by escalating U.S. debt, several potential scenarios for its future emerge. One possibility, dubbed ‘the slow grind,’ indicates that even as debt rises and yields remain high, Bitcoin’s price may still experience gradual upward trends albeit with increased volatility. A new wave of regulatory scrutiny around cryptocurrencies could also frame this environment, affecting how market participants respond.

Alternatively, the ‘growth scare’ scenario projects yields decreasing faster than rising debt, potentially making Bitcoin a desirable asset as investors seek refuge in lower costs of borrowing. In a contrasting ‘tantrum’ scenario, unforeseen supply pressures could trigger a sharp increase in yields, leading to asset sell-offs across the board, including Bitcoin. Each scenario bears implications for how investors should approach their positions in Bitcoin amidst shifting economic realities.

The Intersection of Faith and Funding for Bitcoin’s Future

In a world of financial complexity characterized by soaring U.S. national debt, Bitcoin stands at the intersection of faith and funding. Investors’ beliefs in Bitcoin as a viable alternative financial system often compete with the tangible realities of debt accumulation, which can lead to fluctuating confidence levels in the asset. Faith in Bitcoin’s potential as a long-term store of value must contend with market responses to financial policy decisions and economic pressures resulting from escalating debt.

Furthermore, as Bitcoin navigates this challenging landscape, its funding mechanisms, underscored by supply and demand dynamics, will determine its capacity for growth. Investors need to cultivate a deep understanding of how intertwined these aspects are—faith in Bitcoin’s unique value proposition coupled with a keen awareness of funding flows from both traditional and emerging financial channels will provide strategic insights into its future trajectory.

Frequently Asked Questions

How does the rising US national debt affect Bitcoin price predictions?

As the US national debt escalates, particularly nearing the $40 trillion mark, Bitcoin price predictions may become increasingly optimistic or pessimistic depending on market reactions to economic indicators. Investors often view Bitcoin as a hedge against inflation and currency devaluation, which can result from high national debt. Consequently, when the debt rises, it may lead to increased interest in Bitcoin as a potential store of value.

What impact do rising interest rates have on Bitcoin and the US national debt?

Rising interest rates often correlate with increasing US national debt service costs, which can influence Bitcoin’s appeal. As yields on traditional bonds rise, investors might shift towards safer assets, potentially reducing demand for Bitcoin temporarily. However, if the real yields remain low compared to inflation, Bitcoin may still attract investors seeking to preserve purchasing power.

How are Bitcoin investment strategies changing in light of US debt trends?

With the US national debt on an upward trajectory, Bitcoin investment strategies are adapting to focus on long-term value preservation rather than short-term gains. Investors are increasingly viewing Bitcoin as a hedge against the risks associated with high debt levels, which may lead to a more conservative approach, prioritizing accumulation during market dips.

What are the connections between crypto market trends and US national debt?

Crypto market trends are closely linked to fluctuations in the US national debt as they influence investor sentiment and liquidity conditions. When US debt levels rise dramatically, concerns about inflation and currency stability can drive interest in cryptocurrencies like Bitcoin, which are perceived as alternative assets during economic uncertainty.

Can Bitcoin thrive amid rising US national debt and interest rates?

Yes, Bitcoin can potentially thrive even as US national debt and interest rates rise. In cases where rising debt leads to concerns about dollar depreciation, Bitcoin may gain traction as a non-correlated asset. However, investor sentiment will play a significant role in determining Bitcoin’s performance in such environments, as capital could temporarily flow back into traditional safe havens.

What role do stablecoins play in the interaction between Bitcoin and US debt?

Stablecoins are emerging as critical players in the interaction between Bitcoin and US debt. They have started purchasing short-term US debt as reserves, leading to greater integration between the crypto market and traditional financial systems. This increase in demand for Treasury bills can impact Bitcoin by enhancing liquidity and providing a more stable trading environment.

What scenarios might play out for Bitcoin as the US national debt approaches $40 trillion?

Several scenarios could impact Bitcoin as the US national debt approaches $40 trillion: 1) A slow grind where Bitcoin sees gradual gains despite high yields; 2) A growth scare where yields decrease, positively impacting Bitcoin; or 3) A market tantrum triggered by sudden spikes in yields that could lead to sell-offs in risk assets, including Bitcoin.

| Key Points | Details |

|---|---|

| US National Debt Statistics | The U.S. national debt is projected to reach $40 trillion by August 2025, with a significant increase of approximately $2.3 trillion in one year. |

| Debt and Household Impact | If distributed, the total debt would amount to around $285,000 per household, reflecting personal implications of the national debt. |

| Interest Costs | In FY 2025, interest expenses on U.S. debt reached $1.216 trillion, pressuring traders and influencing market conditions. |

| Bitcoin’s Position | The rising debt and high interest rates challenge Bitcoin’s status as a ‘hard money’ and highlight its behavior as a ‘risk asset’. |

| Role of Stablecoins | Stablecoin issuers are now significant buyers of short-term U.S. debt, linking Bitcoin’s demand dynamics to treasury flows. |

| Federal Reserve’s Actions | The Fed’s decision to halt balance sheet reduction impacts the liquidity environment crucial to Bitcoin price movement. |

| Possible Scenarios for Bitcoin | 1. Slow Growth: Rising debt with sustained high yields. 2. Growth Scare: Decreasing yields with rising debt. 3. Tantrum: Sudden yield spikes causing sell-offs. |

Summary

Bitcoin and US debt present a complex interplay that influences market dynamics significantly. As the national debt escalates towards $40 trillion, the implications for Bitcoin range from increased volatility to potentially higher prices depending on interest yield trends and investor sentiment. The connection between stablecoins purchasing U.S. debt and the Federal Reserve managing liquidity highlights a new dynamic that cryptocurrency traders must navigate. Understanding these evolving relationships will be crucial for assessing Bitcoin’s future in the face of unprecedented fiscal challenges.

Related: More from Bitcoin News | Gold, AI, Tech Stocks Lead as Bitcoin Fades | UBS Slides on US Stocks: Bitcoin’s Fate?