Bitcoin all-time high 2026 is rapidly becoming a focal point for investors and enthusiasts alike, as Grayscale Research’s predictions suggest a historic peak in the next couple of years. The company challenges the traditional four-year cycle theory, asserting that the dynamics of the cryptocurrency market have evolved significantly. With institutional investment directed toward Bitcoin ETFs and diversified digital asset pools, the landscape appears ripe for growth. Additionally, favorable macroeconomic conditions, including potential interest rate cuts and bipartisan crypto legislation, could bolster Bitcoin prices even further. The optimism surrounding Bitcoin price prediction 2026 reflects a broader confidence in the crypto market’s resilience despite recent fluctuations.

As the anticipation builds around Bitcoin’s ascension in the coming years, discussions surrounding its future surge are intensifying. Investors are eager to analyze insights from reports such as the Grayscale Bitcoin report, which outlines the potential for unprecedented market highs. By exploring alternative theories and examining factors like the influence of Bitcoin ETFs and evolving regulatory landscapes, stakeholders can gain a comprehensive understanding of where the leading cryptocurrency might be headed. Many analysts are now focusing on shifts in market sentiment and institutional strategies, moving beyond conventional narratives to better predict Bitcoin’s trajectory. With so much volatility and potential for growth, the conversation around reaching a peak in Bitcoin value is more relevant than ever.

Bitcoin All-Time High 2026: A New Era for Cryptocurrency

Grayscale’s recent analysis projects that Bitcoin will achieve an all-time high in 2026, a claim that has stirred discussions across the crypto community. This prediction suggests a significant paradigm shift in the market dynamics, highlighting the diminishing relevance of the long-standing four-year cycle theory, which posited that Bitcoin prices undergo predictable cyclical peaks. Rather than relying on historical price patterns, current analyses consider factors such as institutional investment and macroeconomic indicators, making the prediction more robust. Indeed, if Bitcoin maintains its bullish momentum, the forecasts could translate into substantial gains for investors.

The optimism surrounding Bitcoin’s price trajectory in 2026 is largely buoyed by favorable conditions in today’s market. The adoption of Bitcoin ETFs is capitalized upon as a game-changer, attracting institutional funds and liquidity into the market like never before. Furthermore, legislative advancements aimed at enhancing the regulatory framework for cryptocurrencies are gaining traction in the United States. As bipartisan support for crypto legislation grows, the security and legitimacy of Bitcoin as an investment tool seem poised for improvement, potentially influencing a surge in demand by 2026.

Understanding the Grayscale Bitcoin Report and Its Implications

The Grayscale Bitcoin report serves as a pivotal resource for understanding future market predictions for Bitcoin. In its latest findings, Grayscale emphasizes the transformative impact of institutional investment in Bitcoin, particularly through instruments such as ETFs. By concentrating capital from large-scale investors rather than traditional retail methods, this shift not only stabilizes Bitcoin’s price but also mitigates volatility, anchoring it into mainstream finance. This nuanced understanding provides investors with insights into the underlying factors that could drive Bitcoin toward new heights in the foreseeable future.

Moreover, the emerging data from Grayscale challenges the traditional four-year cycle theory, which traditionally suggested that Bitcoin’s price peaked every four years following its halving events. By asserting that the market’s current structure—characterized by increased institutional investment and regulatory clarity—deviates from these historical norms, Grayscale opens the door for a new interpretation of Bitcoin’s price behavior. Investors might need to reassess their strategies, taking into account these novel dynamics instead of relying solely on past patterns.

The Four-Year Cycle Theory: Rethinking Its Relevance

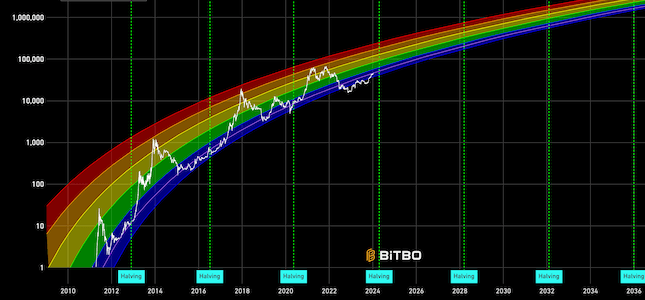

The four-year cycle theory has long been a foundational concept in Bitcoin market analysis, positing a consistent rhythm of price peaks and troughs aligned with halving events. However, as highlighted by the recent Grayscale report, this theory may not hold water in a rapidly evolving cryptocurrency landscape. Current market conditions, marked by significant institutional involvement and the emergence of financial products like Bitcoin ETFs, suggest that price movements could be driven more by external economic factors than by predictable timing associated with these cycles.

Critically, the shift away from a rigid adherence to the cycle theory shifts investor focus towards macroeconomic stability and policy developments. As the market matures, the impact of regulatory frameworks and institutional adoption will likely create a more unpredictable yet dynamic trading environment. Investors are encouraged to consider these influences, which might shape Bitcoin’s viability more significantly than historical patterns, thus challenging the entrenched assumptions of the four-year cycle.

The Impact of Bitcoin ETFs on Market Dynamics

The rise of Bitcoin ETFs has marked a transformative chapter in cryptocurrency trading, redefining how investment flows into Bitcoin. By facilitating easier access for institutional investors, these financial products increase liquidity and stabilize Bitcoin prices, countering the volatility typically associated with digital currencies. The Grayscale report underscores this transition, revealing that as institutional investment burgeons through ETFs, Bitcoin’s demand could escalate significantly, supporting the price projections for an all-time high in 2026.

Moreover, as ETFs become more commonplace, they also drive adoption among retail investors, who may feel more secure investing in a regulated financial instrument. This growing inclusionary narrative surrounding Bitcoin ETFs not only boosts investor confidence but also acts as a crucial factor in pushing Bitcoin toward its projected peak. As the market starts to perceive Bitcoin as a legitimate component of diversified portfolios, the implications for its price trajectory could be significant, especially by 2026.

Macroeconomic Influences on Bitcoin Price Predictions

Bitcoin’s journey to a potential all-time high in 2026 cannot be divorced from the larger macroeconomic landscape. As analysts note, the current economic indicators, including expectations for interest rate cuts, are poised to catalyze a more favorable investment climate for cryptocurrencies. When traditional investment avenues appear less attractive, Bitcoin becomes increasingly appealing as a hedge against inflation and economic uncertainty, offering potential rewards that many investors seek.

Furthermore, as bipartisan support for cryptocurrency legislation gathers momentum in the U.S., the outlook for Bitcoin becomes substantially more positive. A stable regulatory environment is likely to bolster institutional confidence in the market, leading to increased capital influx and, consequently, higher prices. The interplay of macroeconomic factors paints a promising scenario for what could unfold by 2026, potentially setting the stage for Bitcoin to weather any future economic storms while reaching new altitudes.

Anticipating Bitcoin’s Market Behavior: Insights from Analysts

As Bitcoin finds itself at a pivotal point in history, analysts are predicting various scenarios for its future, particularly as we approach 2026. The prevailing sentiment is tinged with optimism, supported by significant indicators from the Grayscale report. Analysts highlight that, despite recent volatility including a 32% pullback, such corrections are typical in a bull market and do not necessarily signal the onset of a prolonged downturn. This outlook fosters confidence among investors, who may anticipate a return to upward momentum.

Moreover, sentiments echoed by influential figures in the crypto space, including BitMine CEO Tom Lee, reinforce the notion that Bitcoin could reach higher than expected thresholds very soon. As expert forecasts align with impending regulatory advancements and macroeconomic support, the likelihood of a strong bullish trend leading into 2026 seems increasingly viable. Engaging with these insights will equip investors with the necessary perspective as they navigate the exhilarating yet unpredictable Bitcoin landscape.

The Role of Cryptocurrency Legislation in Shaping Market Sentiment

As the crypto industry gains traction, the implications of evolving cryptocurrency legislation are paramount in shaping market sentiment. Analysts suggest that regulatory clarity could significantly enhance institutional confidence, an essential factor for Bitcoin’s price journey towards new highs. With bipartisan support for reforms on the rise, the likelihood of more comprehensive frameworks becoming a reality is palpable, offering a foundation for institutional investors to enter or expand their positions in Bitcoin.

This legislative shift not only aims to protect investors but also establishes clear guidelines that can foster market integrity. An environment with clear regulations invites more participants, diminishing the barriers that have previously deterred institutional investment. Consequently, as legislation solidifies, the prospects for Bitcoin reaching its all-time high in 2026 become more feasible, supported by a growing infrastructure and enhanced trust in the digital asset space.

Navigating the Future of Bitcoin Investment Strategies

As Bitcoin sets its sights on a potential all-time high in 2026, investors are urged to reevaluate their strategies in light of new data and market dynamics. Grayscale’s analysis challenges established patterns, indicating that traditional investment approaches tied to the four-year cycle may no longer be applicable. Investors must adapt to the evolving landscape by incorporating insights about institutional behaviors and macroeconomic factors into their decision-making processes.

Additionally, diversifying investment portfolios to include Bitcoin-related financial products, such as ETFs, might represent a strategic shift worth considering. By doing so, investors can capitalize on the potential gains promised by institutional interest and legislative developments while mitigating risks tied to market fluctuations. In this regard, a proactive and informed approach could position investors advantageously as we move toward 2026 and beyond.

Frequently Asked Questions

What is the Bitcoin all-time high prediction for 2026?

Grayscale’s latest report predicts that Bitcoin will reach a new all-time high in 2026, challenging the traditional four-year cycle theory often used to forecast Bitcoin’s price movements.

How does the Grayscale Bitcoin report impact Bitcoin all-time high predictions for 2026?

The Grayscale Bitcoin report suggests that the current market dynamics driven by institutional investments in ETFs could support a new Bitcoin all-time high by 2026, indicating a shift from past price cycles.

What is the significance of the four-year cycle theory in predicting Bitcoin’s price in 2026?

The four-year cycle theory posits that Bitcoin experiences significant price movements approximately every four years due to halving events. However, recent findings from Grayscale suggest that this theory may not effectively predict Bitcoin’s all-time high in 2026 due to changing market conditions.

Will the Bitcoin ETF impact the all-time high prediction for 2026?

Yes, the rise of Bitcoin ETFs is believed to concentrate institutional investment, potentially driving Bitcoin’s price upward and contributing to a forecasted all-time high in 2026, as outlined in the Grayscale report.

How does crypto legislation influence Bitcoin’s price prediction for 2026?

Bipartisan support for crypto legislation in the U.S. may create a more favorable environment for Bitcoin, facilitating institutional adoption that could help it achieve an all-time high by 2026.

What factors contribute to the Bitcoin all-time high prediction in 2026 post market pullback?

Despite a recent 32% pullback, market analysts view this as typical in a bullish environment. The combination of favorable macroeconomic conditions, expected interest rate cuts, and robust institutional investment indicates a strong potential for reaching a new all-time high by 2026.

How do analysts view the relationship between Bitcoin’s current price movements and its all-time high forecast for 2026?

Analysts suggest that while Bitcoin has seen fluctuations, these are often part of normal bull market behavior. The Grayscale report adds confidence that Bitcoin could hit an all-time high in 2026, regardless of short-term volatility.

| Key Point | Details |

|---|---|

| Forecast of Bitcoin’s All-Time High | Grayscale predicts Bitcoin will reach an all-time high in 2026. |

| Refuting the Four-Year Cycle Theory | The report disputes the widely held belief that Bitcoin’s price fluctuates according to a four-year cycle. |

| Market Structural Changes | Institutional funds are more concentrated in ETFs and digital asset pools, rather than retail exchanges. |

| CEO’s Outlook | Tom Lee, CEO of BitMine, predicts Bitcoin will hit a new high in January 2025. |

| Macroeconomic Factors | Favorable conditions like potential interest rate cuts and bipartisan support for crypto legislation in the U.S. are seen as boosting market support. |

| Normal Pullback in Bull Markets | Grayscale notes that a 32% pullback in Bitcoin’s price is typical during a bull market and not indicative of a long-term downtrend. |

Summary

Bitcoin all-time high 2026 is anticipated by Grayscale Research, challenging the traditional four-year cycle theory. This forecast highlights an evolving market environment, where institutional investment in digital assets is predominant. The prediction aligns with broader macroeconomic conditions that favor crypto growth, suggesting potential for new highs in Bitcoin’s price by 2026. Analysts and industry leaders see this as a pivotal moment for the cryptocurrency, indicating resilience despite fluctuations. As Bitcoin’s trajectory unfolds, investors remain optimistic about its future, reinforcing the potential of reaching unprecedented values in the coming years.

Related: More from Bitcoin News | JPMorgan: New Legis. Could Spark Bitcoin Growth | Bitcoin Fork Proposal Fails to Gain Support