Bitcoin accumulation is becoming a hot topic in the cryptocurrency world, especially as institutional players like BlackRock have recently invested a staggering $900 million into Bitcoin. This significant purchase comes at a time when sales from long-term Bitcoin holders are plummeting to unprecedented lows, hinting at a potential shift in market dynamics. As 2023 unfolds, the trends in Bitcoin investment strategies indicate a growing optimism with reduced selling pressure, suggesting that many are holding on tight to their assets. With BlackRock’s recent moves, Bitcoin market analysis shows a promising future for those looking to accumulate during this phase. Analysts are keenly observing these developments as they could signal the beginning of a bullish accumulation trend in the coming months.

The concept of Bitcoin accumulation encompasses the strategic gathering of this cryptocurrency over time, particularly by savvy investors who recognize the growing significance of digital assets. With major investment firms initiating large purchases, such as BlackRock’s hefty Bitcoin buy, the narrative of long-term holders withdrawing from the market further strengthens. Trends observed in 2023 suggest that methodologies around cryptocurrency investment are evolving, where traditional financial institutions are adapting to market signals. As the selling activity of seasoned Bitcoin holders declines, many believe this could lead to a robust foundation for future value appreciation. Investment strategies centered around accumulating Bitcoin in this climate may soon prove to be a wise choice in a shifting economic landscape.

The Impact of BlackRock’s Bitcoin Purchases on Market Sentiment

BlackRock’s recent purchase of approximately $900 million in Bitcoin has generated significant buzz within the cryptocurrency community. This institutional investment not only signals a robust belief in Bitcoin’s long-term value but also reflects broader market sentiments. As one of the largest asset management firms globally, BlackRock’s decision to accumulate BTC amidst a decline in selling from long-term holders indicates a potential shift in the market dynamics. The growing interest from institutions, like BlackRock, could serve as a stabilizing force, encouraging other institutional players to examine Bitcoin as a viable investment option.

The influence of such significant purchases extends beyond just BlackRock itself. It suggests a trend where institutional funds are leaning towards a long-term holding strategy in the Bitcoin market. As long-term holders reduce their selling activities, market pressures tend to ease, promoting healthier price movements. This situation has been further corroborated by reduced inflows of long-term holdings into exchanges, highlighting a cautious approach from seasoned investors. The implication is clear: as institutions and long-term investors accumulate Bitcoin, this could herald the next phase of market recovery.

Understanding Bitcoin Accumulation and Its Indicators

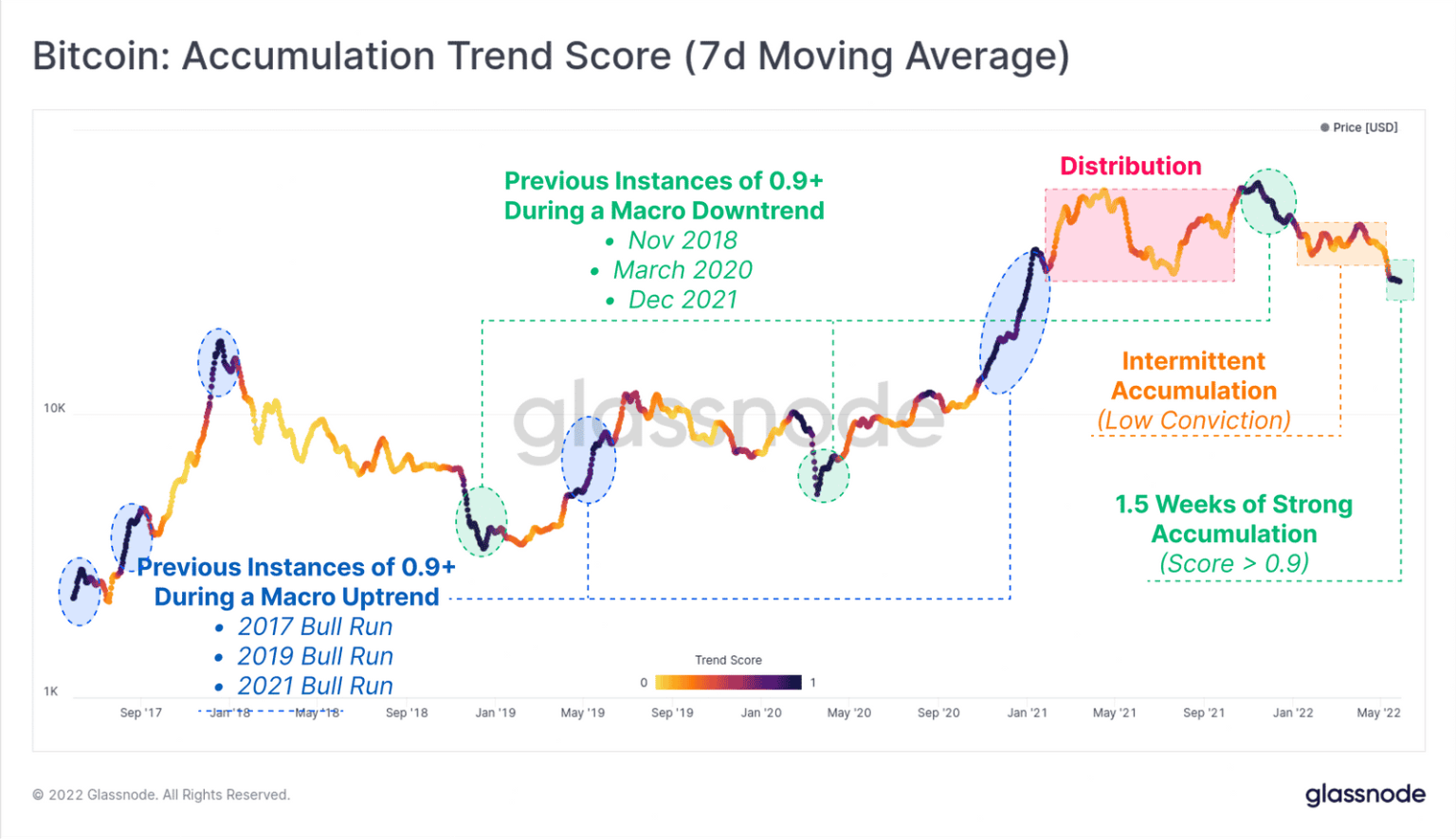

Bitcoin accumulation refers to a phase where investors, particularly long-term holders, begin to acquire Bitcoin rather than sell it off, typically indicating confidence in the asset’s future performance. Current metrics, such as the Exchange Inflow Coin Days Destroyed (CDD), indicate that the selling activity of long-term holders has reached an unprecedented low since 2017, and this accumulation phase is an essential indicator of potential price stabilization. With Bitcoin’s price undergoing significant adjustments, the reluctance of long-term holders to sell strengthens the case for a strategic accumulation scenario.

In conjunction with this, the current Net Unrealized Profit/Loss (NUPL) metric, hovering around the 0.3 level, helps illuminate the market’s cautious optimism regarding Bitcoin’s future. This state suggests that while many holders are experiencing moderate profits, the speculative frenzy often seen at market peaks is absent. Therefore, when we analyze these indicators, it becomes evident that the current market positioning may reflect a reset phase where institutional accumulation of Bitcoin could pave the way for future growth.

Long-Term Bitcoin Holders: A New Era of Investment Strategies

The role of long-term Bitcoin holders in the market cannot be overstated, especially as they transition into a phase of reduced selling activity. Long-term holders often adopt strategies that favor patience rather than immediate gains, which has proven beneficial as evidenced by their recent inactivity in selling, even during price rallies. This shift toward an accumulation-centric strategy signals a growing confidence in Bitcoin’s fundamental value and its trajectory. Investors keen on Bitcoin should keep an eye on this shifting paradigm, as it could lead to significant price movements in the upcoming months.

Moreover, this behavioral change among long-term holders impacts the overall market dynamics. By demonstrating restraint from selling, these long-term investors effectively minimize supply in the market, potentially increasing demand and positively influencing Bitcoin’s price. The strategic approach taken by these holders highlights an understanding of broader market cycles and reaffirms the importance of adopting sound investment strategies. In this evolving landscape, those looking to enter the Bitcoin market may consider long-term holding as a viable approach.

2023 Bitcoin Trends: Predictions and Market Analysis

As we step into 2023, the Bitcoin market is exhibiting trends that could shape its trajectory significantly. With institutional purchasing such as BlackRock’s continuing to gain momentum, analysts are increasingly optimistic about Bitcoin reaching new heights. The confluence of increased institutional interest and reduced selling pressure from long-term holders creates a conducive environment for potential price appreciation. Market observers are closely monitoring these developments, as they may signal the start of a bullish phase for Bitcoin.

Furthermore, key indicators such as the SOPR Ratio and declining long-term seller activity provide insights into potential market shifts. Historically, when these signals align, Bitcoin often enters an uptrend as market sentiment grows more robust. By analyzing these 2023 Bitcoin trends, investors can refine their strategies and prepare for potential volatility in the market, ensuring they remain equipped to make informed decisions based on real-time data and trends.

Bitcoin Investment Strategies for New Investors

For new investors entering the Bitcoin market, understanding effective investment strategies is essential for navigating its volatility. Given BlackRock’s recent accumulation of Bitcoin, newcomers should evaluate long-term holding strategies, which have become increasingly popular among seasoned investors. By adopting a buy-and-hold strategy, investors can potentially capitalize on Bitcoin’s long-term growth prospects while mitigating the risks associated with short-term price fluctuations.

Additionally, seeking to comprehend market analysis, particularly in relation to institutions’ behaviors, enhances understanding and decision-making. By aligning investments with trends such as reduced selling from long-term holders and rising institutional interest, new investors can better position themselves for long-term success in Bitcoin. Staying informed and continuously analyzing market indicators will empower investors to make strategic choices in a marketplace that is both dynamic and filled with opportunities.

BlackRock’s Role in Shaping the Future of Bitcoin

BlackRock’s strategic move to accumulate Bitcoin signifies a pivotal moment in the cryptocurrency space. The firm’s large-scale investments not only affirm the growing acceptance of Bitcoin as a mainstream asset but also indicate that institutional investors see long-term value in this digital currency. As the largest asset manager globally, BlackRock’s continued interest in Bitcoin enhances its credibility among retail investors and underscores the importance of institutional confidence in bolstering market stability.

Furthermore, BlackRock’s approach to Bitcoin accumulation serves as an encouraging precedent for other institutions considering similar investments. The firm’s actions might stimulate more institutional capital to enter the crypto market, which is crucial for legitimizing Bitcoin and helping it to mature as an asset class. This kind of institutional interest could pave the way for regulatory bodies to create clearer policies, promoting a healthier market environment for all participants.

Market Correction and Its Influence on Bitcoin Holdings

Recent market corrections have elicited a cautious response from Bitcoin investors. However, periods of correction often present unique opportunities for accumulation and growth. As Bitcoin price levels fluctuate, both retail and institutional investors may find advantageous entry points. The market’s recent move downward has seen long-term holders opt to retain their positions, which signals a potential decrease in selling pressure. This behavior underscores a broader trend of accumulation as stakeholders aim to capitalize on lower prices for future gains.

Moreover, understanding these market corrections is vital for predicting potential recoveries. With metrics like CDD and NUPL hitting historically significant levels, it’s clear that a reset might be underway. As long-term holders minimize selling during these corrections, market dynamics shift, leading to increased confidence among buyers. Consequently, as corrections stabilize, the prospect for a bullish trend becomes more tangible, suggesting that the accumulation phase may indeed mark a harbinger of positive price movements in the near future.

The Future Outlook of Bitcoin After Accumulation Phases

As we analyze the trends and behaviors surrounding Bitcoin accumulation, it becomes evident that the future outlook is closely tied to institutional movements and long-term holder strategies. The current phase of accumulation amongst these groups suggests a foundation for sustained growth, as diminishing selling pressure typically precedes price increases. This transition could pave the way for Bitcoin to recover and thrive, especially as institutional interest continues to solidify.

Looking ahead, it’s imperative for investors to monitor ongoing developments within the market. The interplay between long-term holders and institutional investments like those from BlackRock will be crucial in shaping Bitcoin’s future. As Bitcoin evolves and gains acceptance, periods of accumulation are likely to inform potential bullish trends, ushering in a new era in cryptocurrency investment. Investors should consider these factors in crafting their strategies, positioning themselves to leverage the upcoming opportunities in the Bitcoin market.

Frequently Asked Questions

What are the implications of BlackRock’s recent Bitcoin purchase on Bitcoin accumulation trends?

BlackRock’s acquisition of nearly $900 million in Bitcoin may signal a positive shift in Bitcoin accumulation trends. As this institutional investor increases its holdings, it reflects confidence in Bitcoin’s long-term value, coinciding with a significant decrease in selling pressure from long-term holders, which has not been seen since 2017.

How does the activity of long-term Bitcoin holders influence Bitcoin accumulation?

The behavior of long-term Bitcoin holders plays a crucial role in Bitcoin accumulation. Currently, these holders are selling at their lowest rates in years, indicating a strong commitment to their investments. This trend creates a favorable environment for accumulation, as it suggests reduced selling pressure and potential price stabilization.

What might the 2023 Bitcoin trends reveal about future accumulation strategies?

2023 Bitcoin trends indicate a cautious accumulation phase, with institutional investors like BlackRock leading the charge. The ongoing low selling rates from long-term holders and the low Exchange Inflow Coin Days Destroyed (CDD) metric suggest that Bitcoin accumulation strategies focused on acquiring and holding assets are becoming increasingly prevalent.

Why is Bitcoin market analysis crucial for understanding accumulation patterns?

Bitcoin market analysis provides insights into price movements, investor behavior, and the overall sentiment within the cryptocurrency market. Understanding these dynamics helps identify accumulation patterns, especially in light of recent developments like BlackRock’s substantial Bitcoin purchases and the reduced selling activity among long-term holders.

What Bitcoin investment strategies should be considered in light of current accumulation signs?

Given the recent accumulation signs, investors might consider strategies that emphasize long-term holding and carefully timed entry points. Focusing on the behavior of institutional players like BlackRock and monitoring long-term holder activity can help shape effective Bitcoin investment strategies that align with market trends.

| Key Points | Details |

|---|---|

| BlackRock Bitcoin Acquisition | In the first week of January, BlackRock acquired nearly $900 million worth of Bitcoin. |

| Long-term Holder Selling Rate | Selling by long-term Bitcoin holders has dropped to levels not seen since 2017. |

| Onchain Data Insights | Onchain data indicates a potential accumulation phase among certain wallet groups. |

| Current Holdings | BlackRock currently holds approximately 780,400 BTC, valued at around $70 billion. |

| Market Conditions | The decrease in long-term supply and changes in exchange inflow metrics indicate a potential accumulation phase. |

| Recent Buying Trends | BlackRock has been accumulating Bitcoin consistently, indicating confidence in future market performance. |

| Unrealized Profit/Loss Data | Bitcoin’s NUPL is around 0.3, signaling a cautious transition from recovery to better market conditions. |

Summary

Bitcoin accumulation has become a focal point as BlackRock significantly increased its Bitcoin holdings in early January. This surge coincides with decreased selling activity from long-term holders, marking a potential shift in market sentiment. The confluence of these factors suggests that the crypto market could be entering a period of renewed accumulation, indicating that investors are beginning to regain confidence in Bitcoin’s long-term value.

Related: More from Bitcoin News | Stablecoin Strength Pressures Bitcoin Treasury | Analysts: No Evidence of Jane Street Bitcoin Manipulation, ETF Demand Soars