Bitcoin accumulation has emerged as a significant trend among large investors in early 2024, particularly during the ongoing market fluctuations. With Bitcoin’s price recently experiencing a notable drawdown from its all-time highs, many institutional players have seized the opportunity to increase their holdings. This behavior suggests a bullish outlook for BTC, as these large investors, often referred to as “whales,” demonstrate confidence in a future price rally. Market analysis indicates that this trend of accumulating Bitcoin, especially among those holding over 100 BTC, could potentially lead to significant price movements, echoing previous patterns from past market cycles. As Bitcoin price predictions fluctuate, the actions of these large investors may serve as critical indicators for the overall health of the cryptocurrency market.

In the current landscape of cryptocurrency, the term “Bitcoin gathering” resonates more than ever, as substantial stakeholders continue to bolster their portfolios despite recent price dips. This surge in Bitcoin gathering reflects a robust belief in the long-term potential of BTC, as evidenced by notable strategies deployed by seasoned market players and institutional giants. Observations on January accumulation trends reveal increasing confidence that echoes throughout the crypto community, showcasing that the decision to stockpile Bitcoin is seen as an essential move amidst volatile market conditions. As many analysts explore the potential implications of these behaviors on Bitcoin’s future trajectory, the interplay between bullish sentiment and market dynamics offers rich ground for further Bitcoin market analysis.

| Key Points | Details |

|---|---|

| Bitcoin’s Current Status | BTC is currently priced at approximately $88,759 after a significant 30% drawdown from its all-time highs. |

| Investor Behavior | Large holders, referred to as ‘sharks’, are buying the dip, indicating long-term confidence in Bitcoin. |

| Shark Accumulation Rate | Sharks have been accumulating Bitcoin at the fastest rate since 2013, suggesting they see the recent price drop as a buying opportunity. |

| Price Predictions | Some analysts predict a potential crash to $35,000 in February due to market trends, while institutions suggest a bullish outlook for 2026. |

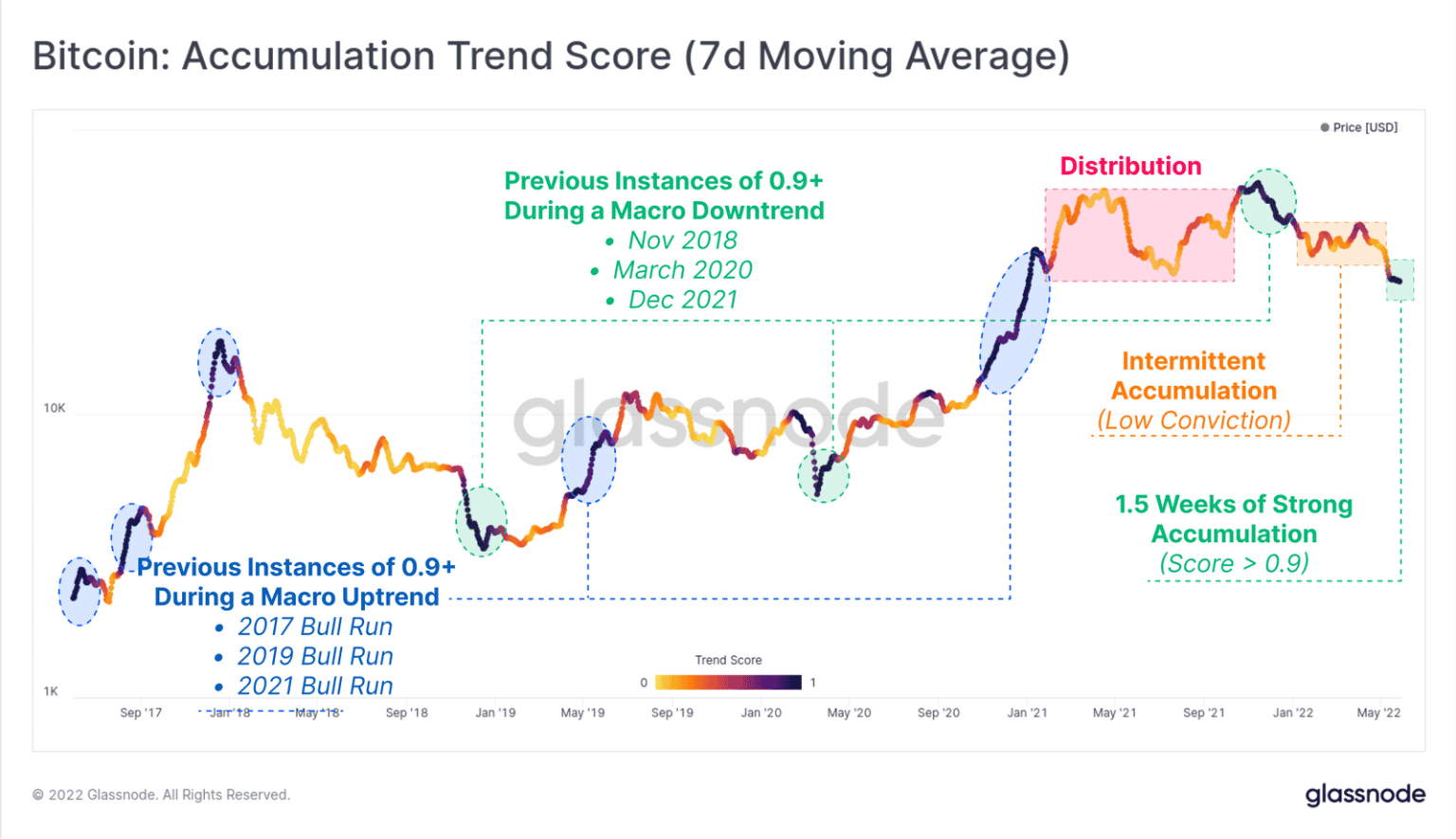

| Historical Significance | Previous accumulation spikes have led to major price rallies, suggesting potential future increases in Bitcoin’s value. |

Summary

Bitcoin accumulation remains a strategic move for large investors as they seize the opportunity presented by recent price dips. The data reflects a strong buying trend among those with substantial holdings, often predicting positive movements in the future. While some analysts voice concerns about potential downtrends in the short term, the overall sentiment among institutional investors points towards a long-term bullish confidence. This dynamic exemplifies the evolving nature of Bitcoin’s market and the ongoing interest from significant players in the cryptocurrency space.

Understanding Bitcoin Accumulation Trends

Bitcoin accumulation has been a significant trend among large investors in January 2024, particularly as the price experienced a notable drawdown. As Bitcoin retraced to around $88,759, many large holders, commonly known as whales and sharks, began to see this as an optimal time to increase their positions. The data from Glassnode indicates that entities holding between 100 and 1,000 BTC have dramatically accelerated their buying activities, reminiscent of patterns seen during Bitcoin’s previous rallies. This accumulation reflects not only a bullish outlook but also an underlying confidence that the market will recover from its current slump.

The behavior of these large investors is critical for future Bitcoin price predictions. Their willingness to buy the dip indicates a long-term bullish sentiment, suggesting that they foresee higher valuations in the coming months. Historically, such accumulation patterns have preceded significant rallies, where Bitcoin has surged in value by considerable margins. Therefore, understanding these trends can provide insight into potential price shifts and the overall market dynamics.

The Bullish Outlook of Large Investors in Bitcoin

In recent market analysis, the sentiment among large investors regarding Bitcoin remains overwhelmingly positive despite short-term price fluctuations. Many believe that the ongoing corrections provide a unique opportunity to accumulate Bitcoin at a lower price. This bullish outlook is evident as institutional players have continually increased their holdings throughout January. With predictions of a strong recovery by mid-2026, fueled by heightened institutional adoption, these investors are positioning themselves strategically to capitalize on future price increases.

However, the presence of potential bear traps poses a cautionary note. Some analysts have noted that Bitcoin could face challenges in the upcoming weeks, suggesting that the usual cyclical dynamics of the asset may not apply as strictly as before. Observations of the BTC price trends indicate that while there may be volatility, the underlying trend of accumulation by large investors supports the forecast of an upturn in Bitcoin’s market value.

Caution Amidst Accumulation: The Bull Trap Scenario

Despite the prevailing bullish sentiment, there are voices of caution regarding Bitcoin’s price movements. Analysts like Lofty have highlighted the risk of a ‘bull trap,’ particularly after Bitcoin’s failure to maintain key support levels. This situation could lead to a further price decline, with forecasts suggesting a potential drop to around $35,000 in February. Such warnings serve as a reminder of the inherent volatility within the cryptocurrency market and emphasize the importance of careful market analysis.

Despite these bearish forecasts, the ongoing accumulation by large investors suggests that many are still viewing the current price declines as opportunities rather than warning signs. The dynamic between bullish accumulation and bearish market sentiment creates a unique situation wherein investors must navigate carefully. Continued monitoring of trading patterns will be essential to discern future market directions, especially as major players solidify their holdings.

Institutional Support: A Driving Force for Bitcoin

Institutional support has emerged as a driving force behind Bitcoin’s potential price recovery. Companies like Grayscale Investments are optimistic about Bitcoin reaching new all-time highs in the near future, attributing this expectation to an influx of institutional capital. As large institutional players continue to accumulate Bitcoin, the confidence in Bitcoin’s long-term viability strengthens, underscoring the belief that the market will eventually rebound from its current volatility.

Furthermore, the actions of these institutions indicate a strategic shift, where large investors are not only viewing Bitcoin as a digital asset but also as a hedge against inflation and economic uncertainty. Their active participation contributes to a more stable market environment, leading to a more optimistic outlook for Bitcoin’s future. This institutional backing could play a crucial role in mitigating price volatility and enhancing investor confidence over the long term.

Market Sentiment: Evaluating Bitcoin’s Future Potential

The current market sentiment surrounding Bitcoin is a mixture of cautious optimism and speculative caution. As large investors continue to buy the dip amid price corrections, the overall sentiment remains poised for potential growth. The ongoing observations of Bitcoin accumulation indicate a robust belief in the cryptocurrency’s long-term value, compelling more investors to consider historical trends in their strategies.

However, the balance between optimism and caution is delicate. Analysts continue to monitor the market closely, considering both bullish and bearish signals. This is especially critical as fluctuations in Bitcoin’s price could lead to rapid changes in market sentiment, impacting future accumulation strategies. Thus, a comprehensive market analysis, blending technical insights with investor behavior, is fundamental in evaluating Bitcoin’s future potential.

The Role of Large Investors in Shaping Bitcoin’s Future

Large investors are playing a vital role in shaping the trajectory of Bitcoin, particularly through their buying behaviors during market dips. Their actions not only signal confidence in Bitcoin’s future but also influence the wider market dynamics. As these investors accumulate assets during downturns, they set the stage for potential recoveries, creating a ripple effect among smaller investors.

Moreover, the rise of large holders, including various institutional entities, is leading to increased scrutiny of Bitcoin’s market movements and price predictions. Their ability to act as stabilizers in tumultuous market conditions can help mitigate extreme fluctuations, contributing to a more predictable trading environment for all participants. Therefore, understanding the motivations and strategies of these large investors is crucial for anyone interested in navigating the complexities of the Bitcoin market.

Navigating Market Volatility: Insights for Investors

For investors looking to navigate the complexities of Bitcoin’s market volatility, gaining insights from large investors becomes paramount. These entities, often equipped with extensive market research and resources, are in a position to make informed decisions that can significantly affect market trends. Their strategies—whether they are buying during dips or selling to realize profits—offer key indicators of market sentiment and potential future price movements.

Additionally, staying informed about overall market analysis and Bitcoin price predictions can equip investors with the knowledge necessary to minimize risks. Understanding the implications of market volatility allows for better decision-making, empowering investors to make strategic trades rather than follow reactive measures based on short-term price movements. In doing so, they can enhance their potential for successful investing in the volatile cryptocurrency landscape.

Exploring the Future of Bitcoin Trading Strategies

As Bitcoin continues to capture the attention of investors globally, exploring effective trading strategies becomes essential. The market’s inherent volatility presents unique challenges and opportunities, where strategic accumulation during price corrections could yield significant returns for savvy investors. Techniques such as dollar-cost averaging or value averaging during downturns can help practitioners better position themselves for future uptrends.

Moreover, understanding the impact of large investors on market dynamics can enhance individual trading strategies. As institutional participation increases, individuals can leverage this insight to anticipate potential market movements. By aligning their strategies with the trends set by large holders, they can take advantage of the bullish sentiment, ultimately maximizing their investment returns in the long run.

The Impact of Market Trends on Bitcoin Price Outlooks

Market trends play a critical role in shaping predictions for Bitcoin’s future price outlook. As observed, the behavior of large investors—especially during accumulation phases—can significantly influence market sentiment and price action. With many institutions now viewing Bitcoin as a viable asset class, their buying patterns during periods of market correction bring both stability and optimism to potential future price movements.

Additionally, analyzing historical trends allows investors to draw parallels with current market conditions, aiding in the formation of informed predictions. Analysts suggest that understanding these dynamics can provide valuable insights into Bitcoin’s price predictions, particularly as institutional adoption rises. Thus, keeping a close watch on market trends can empower investors to navigate the uncertainty of the Bitcoin landscape effectively.

Frequently Asked Questions

What are the current trends in Bitcoin accumulation among large investors?

Large investors, often referred to as “sharks,” are currently accumulating Bitcoin at an accelerated rate, reminiscent of patterns last observed in 2013. This activity indicates a significant confidence in Bitcoin’s long-term potential, as these entities see the recent drawdown in Bitcoin’s price as a buying opportunity.

How does Bitcoin price prediction affect investor strategies for accumulation?

Bitcoin price predictions can significantly influence investor strategies for accumulation, especially during price corrections. Investors closely monitor market analysis and predictions, such as those suggesting potential future highs or declines, to time their accumulation effectively and maximize their investment returns.

What was the trend for BTC accumulation in January 2024?

In January 2024, Bitcoin accumulation showed a notable trend where entities holding between 100 and 1,000 BTC, known as “sharks,” ramped up their purchases, demonstrating confidence in Bitcoin’s market potential despite a price decline from previous highs.

What insights can be gathered from Bitcoin market analysis regarding accumulation phases?

Bitcoin market analysis often reveals that periods of increased accumulation by large holders typically precede substantial price rallies. Historical data suggests that these phases can foreshadow bullish trends, encouraging investors to accumulate during price dips.

Is large-scale BTC accumulation a bullish indicator for Bitcoin’s future?

Yes, large-scale BTC accumulation is generally considered a bullish indicator for Bitcoin’s future price trajectory. The sustained buying by large investors and market analysts suggests confidence in Bitcoin’s long-term prospects, despite short-term price fluctuations that may indicate sell-offs or corrections.

What warning signs should investors be aware of while accumulating Bitcoin?

Investors should be aware of potential warning signs such as predictions of sharp declines in Bitcoin’s price due to market corrections or bearish trends, like the concern about a “bull trap”. Such indicators could signal the need for caution even amidst general accumulation trends.

How does the BTC accumulation trend reflect on upcoming Bitcoin price movements?

The BTC accumulation trend often reflects an optimistic outlook on future price movements. When investors, especially large holders, increase their Bitcoin positions during price dips, it typically signals confidence in upcoming price rallies, influencing overall market sentiment.

What role do institutional investments play in Bitcoin accumulation?

Institutional investments play a crucial role in Bitcoin accumulation, as large financial entities and corporations often drive significant buying activity. Their presence in the market can elevate confidence levels among individual investors, leading to increased overall accumulation and adoption of Bitcoin.

How do past BTC accumulation spikes correlate with future price performance?

Historically, spikes in BTC accumulation have been closely associated with subsequent strong price increases. For example, previous accumulation periods have led to price gains of over 160% within a year, highlighting a correlation between accumulation activity and positive future price performances.

What are the implications of a bearish outlook on Bitcoin accumulation strategies?

A bearish outlook on Bitcoin, such as predictions of significant price drops, can lead to altered accumulation strategies among investors. Concerns about market corrections may prompt investors to reassess their positions or delay accumulation plans until market conditions stabilize.