Binance withdrawals have become a hot topic in the cryptocurrency world, especially in light of recent large transactions. Just hours ago, two new addresses performed significant withdrawals totaling 3,500 BTC and 30,000 ETH, which amounts to a staggering $312 million combined. This surge in cryptocurrency movement has caught the attention of many, not just due to the amounts involved, but also because it reflects the current trends in Binance news and user activity. High-profile BTC withdrawals like these can indicate potential shifts in market confidence, as traders respond to the dynamic nature of cryptocurrency prices. Understanding the motivations behind such large withdrawals from Binance is essential for anyone looking to navigate the volatile crypto landscape safely.

In recent developments, significant movements of digital assets from Binance have raised eyebrows among cryptocurrency enthusiasts. Two newly minted wallets have made headlines by extracting a massive 3,500 Bitcoin alongside 30,000 Ether, equating to $312 million in total. These substantial transfers underscore a noteworthy pattern in the realm of crypto trading and may hint at broader market implications. Observers of Binance news and trends are keenly analyzing these withdrawals, as they often signal shifts in investor sentiment and strategies. Exploring the landscape of large asset withdrawals can provide crucial insights into the attitudes and behaviors of cryptocurrency traders.

| Address | Amount Withdrawn | Value (USD) |

|---|---|---|

| 17oiCa…fQdZ | 3,500 BTC | $249 million |

| 0x929f…faE9 | 30,000 ETH | $63 million |

Summary

Binance withdrawals are making headlines as two recently created addresses have withdrawn a staggering 3,500 BTC and 30,000 ETH, aggregating to a total value of $312 million. This significant transaction highlights the ongoing activities within the Binance platform and the movement of large quantities of cryptocurrency, which are essential for both investors and market analysts to monitor.

Massive Withdrawals from Binance: BTC and ETH Breakdown

In a significant event for the cryptocurrency market, two newly created addresses have made headlines after withdrawing a total of 3,500 BTC and 30,000 ETH from Binance, equating to a staggering $312 million. These withdrawals, valued at $249 million for Bitcoin and $63 million for Ethereum, showcase the ongoing activity and movement within the cryptocurrency landscape. Such large withdrawals often indicate substantial shifts in trading strategies or investor sentiment, which can impact market dynamics significantly.

Monitoring platforms like Lookonchain highlight the rapid pace of these transactions, underlining the importance of tracking large withdrawals from Binance to understand market trends. With the rise of these massive transfers, investors and analysts alike are keenly observing how these movements of BTC and ETH might influence cryptocurrency prices and trading volumes in the days to come.

Understanding the Impact of Large Withdrawals on Cryptocurrency Prices

The withdrawal of a combined 3,500 BTC and 30,000 ETH from Binance raises critical questions regarding market stability and price reactions. When funds of this magnitude are removed from exchanges, it often leads to volatility, as other investors may interpret these actions as a sign of impending market changes. Traders actively monitor such withdrawals alongside Binance news to anticipate potential price fluctuations in both Bitcoin and Ethereum.

Moreover, large withdrawals can also suggest that investors are moving their assets to personal wallets for long-term holding or into DeFi platforms where they can earn yields. As such, the cryptocurrency movement around these two addresses adds another layer of complexity to market forecasting, as observers analyze whether these withdrawals indicate a bullish sentiment or a strategic shift toward liquidity.

Binance Withdrawals: What Investors Should Know

Investors should keep a close eye on Binance withdrawals, as they can greatly influence market sentiment and trading strategies. The recent large withdrawal of 3,500 BTC and 30,000 ETH is just one example illustrating the shifts in investor behavior. When significant amounts are withdrawn, it may signal that traders are preparing for volatility or are simply taking profits after price hikes.

Additionally, understanding the motivations behind large transactions can help investors make informed decisions. Are these withdrawals indicative of larger market sentiment, or do they reflect individual strategies? By staying updated on Binance news related to these events, traders can better gauge potential market movements, especially in contexts of BTC withdrawals and ETH withdrawals that affect overall trading volume.

BTC and ETH: Navigating the Landscape of Cryptocurrency Withdrawals

Navigating the intricacies of cryptocurrency withdrawals, particularly for Bitcoin (BTC) and Ethereum (ETH), demands an understanding of market trends and investor behavior. The recent withdrawals from Binance, totaling over $300 million, emphasize the scale of trading activity and the potential for price implications. Such movements are essential for anyone looking to engage seriously in the cryptocurrency market.

Furthermore, the behaviors associated with these cryptocurrencies reflect broader financial trends and sentiment. Are traders opting for secure storage in wallets, or are they moving funds in anticipation of bullish trends? Observing these patterns not only aids individual investors but can also provide insights into the overall health of the cryptocurrency market.

Binance News: Tracking the Movement of Funds in Crypto Exchanges

Keeping abreast of Binance news is crucial for anyone involved in cryptocurrency trading, as it highlights the latest developments and activities on the exchange. The recent withdrawal of 3,500 BTC and 30,000 ETH emphasizes the importance of monitoring activity, as these significant transactions often correlate with market fluctuations. Tracking such movements is essential for traders aiming to capitalize on emerging trends.

Regular updates on cryptocurrency exchanges like Binance can provide vital information for investors. Understanding the reasons behind significant withdrawals and remaining aware of the market’s pulse enables traders to position themselves advantageously. Whether it’s BTC withdrawals or shifts in ETH holdings, staying informed is key to navigating today’s volatile market.

Analyzing Cryptocurrency Movement on Binance: A Deeper Dive

The recent withdrawal of 3,500 BTC and 30,000 ETH from Binance exemplifies the robust activity and engagement that characterizes the world of cryptocurrency. Analyzing these movements can reveal insights into broader trends and investor psychology. The significant volume of funds leaving exchanges points to either an increasing confidence among long-term holders or a strategic pivot by traders.

Moreover, understanding these movements of cryptocurrencies is vital for predicting future price behaviors. Large withdrawals can lead to tightening liquidity on the exchange, which in turn could impact purchasing patterns and price stabilization. By analyzing the ongoing cryptocurrency movement, investors can make more educated predictions about market volatility and potential trading strategies.

The Role of Binance in Cryptocurrency Withdrawals: A Market Overview

Binance plays a pivotal role in the cryptocurrency ecosystem, particularly concerning withdrawals of significant sums. The withdrawal of 3,500 BTC and 30,000 ETH illustrates the exchange’s influence as a trading platform and its impact on the market’s liquidity. The scale of transactions processed by Binance positions it as a key player in the pricing dynamics of both Bitcoin and Ethereum.

Understanding the operational mechanics of Binance can provide insights into the broader market. Investors should be aware of how withdrawals might signal changing investor sentiment or shifts toward other investment avenues, such as DeFi or long-term holdings. Binance’s performance and news related to its operations are essential for predicting the next steps in the cryptocurrency trading landscape.

Impact of Large Withdrawals from Binance on Market Trends

The impact of large withdrawals from Binance cannot be understated, especially when it involves coins like BTC and ETH. Market analysts often observe that such movements correlate directly with price shifts, as they signal potential changes in liquidity and investor sentiment. The recent combined withdrawal of 3,500 BTC and 30,000 ETH is an excellent case study in understanding these dynamics.

As the cryptocurrency market continues to evolve, stakeholders—ranging from institutional investors to individual traders—must pay close attention to these withdrawals to anticipate trends. Price drop or increase scenarios may arise following such large-scale transactions, making it imperative for informed trading and investment decisions. Understanding these implications enhances the ability to navigate the complex landscape of cryptocurrency.

Best Practices for Investors: Managing Risks with Coinbase Withdrawals

For cryptocurrency investors, particularly those using exchanges like Binance, managing risks associated with withdrawals is crucial. The recent withdrawal of a remarkable 3,500 BTC and 30,000 ETH exemplifies the potential for volatility in response to sudden liquidity changes. Adopting best practices helps mitigate risks while reaping the benefits of cryptocurrency trading.

Investors should stay informed on market trends and the latest Binance news to assess their strategies critically. Regularly monitoring large withdrawals and their implications can empower traders to make timely decisions, whether it’s holding, selling, or diversifying their investments. By applying these risk management strategies, investors can better navigate the choppy waters of cryptocurrency markets.

Frequently Asked Questions

What is the process for Binance withdrawals of BTC and ETH?

To initiate Binance withdrawals for BTC or ETH, navigate to your wallet, select the cryptocurrency you wish to withdraw, and click ‘Withdraw’. Enter the desired amount, paste your destination wallet address, and confirm the transaction. Ensure that you have completed any necessary identity verification to proceed with larger withdrawals.

Have there been any large withdrawals from Binance recently?

Yes, recently there were significant withdrawals from Binance, including 3,500 BTC and 30,000 ETH, totaling approximately $312 million. Such large withdrawals often attract attention in the cryptocurrency market and can influence trading activity.

Are BTC withdrawals from Binance instant?

BTC withdrawals from Binance are typically processed quickly, often within a few minutes. However, network congestion and transaction fees can affect the confirmation time on the blockchain.

Can I track my Binance withdrawals?

Yes, users can track their Binance withdrawals by checking the transaction history in their account under the ‘Funds’ section. For further visibility, you can also use a blockchain explorer by entering the transaction ID provided after the withdrawal.

What should I do if my cryptocurrency withdrawal from Binance is delayed?

If your cryptocurrency withdrawal from Binance is delayed, first check the transaction status on the blockchain using the transaction ID. If there’s an issue or if the status is still pending after a reasonable time, contact Binance support for assistance.

What are the fees for withdrawing BTC or ETH from Binance?

Binance charges a network fee for BTC and ETH withdrawals, which can vary based on network congestion and the asset being withdrawn. You can review the current fees on the Binance withdrawal page before completing your transaction.

What security measures does Binance have for withdrawals?

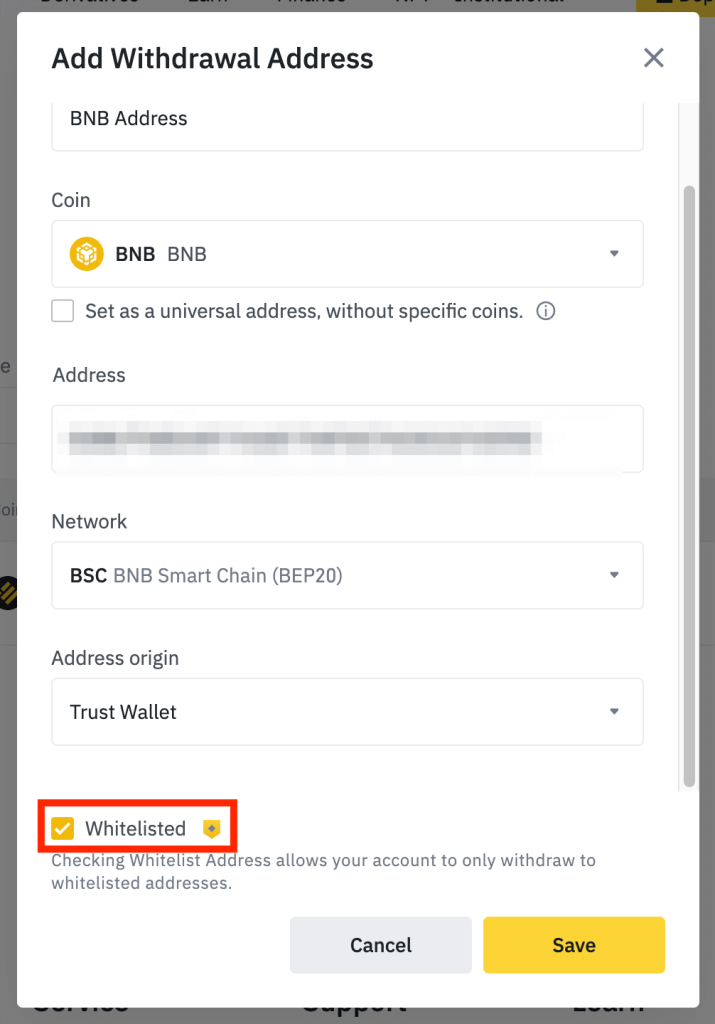

Binance implements several security measures for withdrawals, including Two-Factor Authentication (2FA), withdrawal address whitelisting, and email verification for withdrawal requests, ensuring a secure experience for users.

What impact do large withdrawals from Binance have on the cryptocurrency market?

Large withdrawals from Binance, such as the recent 3,500 BTC and 30,000 ETH movements, can indicate changes in market sentiment and might lead to fluctuations in cryptocurrency prices. Traders often monitor these activities to gauge market trends.

Are there restrictions for Binance withdrawals based on account levels?

Yes, Binance enforces withdrawal limits based on account verification levels. Users with unverified accounts face lower withdrawal limits compared to fully verified users. Upgrading your verification status can increase your withdrawal capabilities.

How can I stay updated on Binance news regarding withdrawals?

To stay informed on Binance news and updates regarding withdrawals, consider following their official blog, social media channels, and cryptocurrency news outlets. Regular updates can provide insights into operational changes and market trends.