Binance stock tokens are set for a potential revival, marking a significant step forward in the intersection of cryptocurrency and traditional finance. These digital tokens represent shares of publicly traded companies, allowing investors to engage in fractional stock trading without the need to purchase entire shares. With Binance trading features tailored to enhance investor experiences, users can track the market performance of their assets in real-time. Investing in stock tokens offers an innovative route that appeals to both seasoned traders and newcomers alike. As interest grows, understanding how stock tokens operate is crucial—especially as Binance prepares to navigate the legal landscape surrounding these cryptocurrency stocks.

In recent developments, cryptocurrency stocks are gaining traction as innovative financial instruments in the digital asset space. The concept of fractional stock tokens allows individuals to own portions of shares from major corporations, democratizing access to investments that were traditionally reserved for wealthier investors. With Binance’s exploration into reintroducing these digital assets, the platform is poised to redefine investment opportunities via advanced trading features. As stock tokens are further clarified, more users may find themselves attracted to the benefits of investing in this new market segment. This evolution not only enhances the landscape of trading but also bridges the gap between traditional equities and digital currencies.

| Key Points |

|---|

| Binance is considering the re-launch of stock tokens, which were previously discontinued in 2021. |

| Stock tokens represent shares of publicly listed companies, allowing fractional ownership. |

| These tokens are settled on the blockchain and track real-time prices of the underlying assets. |

| A Binance spokesperson mentioned that offering stock tokens aligns with their goal of bridging traditional finance and cryptocurrency. |

| Legal challenges remain, being tied to current cryptocurrency legislation in Congress. |

| Industry insiders suggest that product launches will face delays due to this legislation. |

Summary

Binance stock tokens represent a transformative potential in the investment landscape by allowing investors to own fractions of shares in major companies like Apple and Microsoft. As Binance explores the possibility of re-launching these digital tokens, they aim to enhance the accessibility of traditional financial assets through blockchain technology. However, the path forward faces legal complexity, with recent developments in cryptocurrency legislation posing challenges that could delay the implementation of such investment products. Navigating these hurdles will be crucial for Binance as it seeks to innovate and expand its offerings in the evolving crypto market.

What Are Binance Stock Tokens?

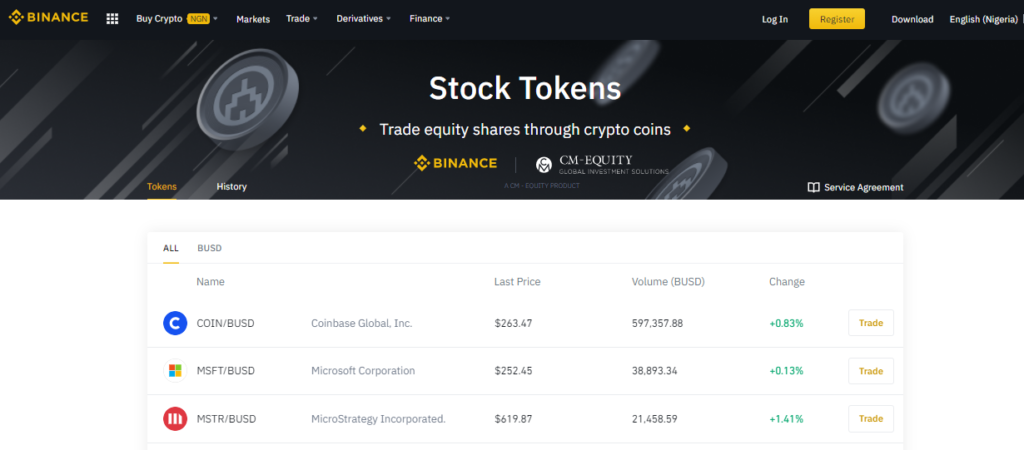

Binance stock tokens are innovative digital assets that represent shares of publicly traded companies, such as Apple and Microsoft. As fractional stock tokens, these units allow investors to purchase portions of these shares, making the investment process more accessible to a broader audience. The distinct feature of stock tokens is their representation of underlying assets on the blockchain, ensuring that every token’s value corresponds to the current market price of the actual stock. This mechanism allows for real-time tracking and has changed how individuals and institutions engage with traditional stock markets.

The concept of Binance stock tokens merges the traditional finance world with the cryptocurrency ecosystem, providing a platform for users to take advantage of the volatility and potential gains within both. These tokens are not merely a speculative tool; rather, they allow for easier diversification in investment portfolios, as investors can buy small fractions of high-value stocks that might otherwise be out of reach. The transparent nature of the blockchain technology used to handle these tokens enables users to have greater confidence in their transactions and ownership.

The Advantages of Investing in Fractional Stock Tokens

Investing in fractional stock tokens, such as those proposed by Binance, offers several advantages over traditional stock trading. First, it democratizes access to the stock market, allowing retail investors to buy fractions of expensive stocks without needing a substantial initial capital. For instance, rather than purchasing a full share of a $1,000 stock, an investor can buy a fraction for as little as $10. This flexibility is especially appealing to younger or less wealthy investors and makes it easier to build diverse investment portfolios.

Moreover, fractional stock tokens simplify the trading process by requiring less commitment and less capital upfront. Investors can participate in the stock market at their convenience, potentially taking advantage of rapid market movements without being locked into long-term positions with large investments. Additionally, because these stock tokens are built on blockchain technology, transactions can occur swiftly and reliably, enhancing trading efficiency in a fluctuating marketplace. Overall, the adoption of fractional stock tokens is paving the way for a new era of investing.

Challenges Facing Binance in Relaunching Stock Tokens

While the relaunch of Binance’s stock tokens presents exciting opportunities, several challenges remain. The primary concern is navigating the complex legal landscape surrounding cryptocurrency and tokenized assets. The current regulatory framework in many jurisdictions, including proposed legislation in Congress, poses potential hurdles. For Binance, complying with these legal standards is crucial to ensure that their stock tokens meet all necessary requirements and remain viable offerings in the competitive crypto space.

Additionally, the market itself is in a state of flux as regulators and participants adapt to the evolving nature of digital assets. Investors may also exhibit caution regarding the reliability and security of stock tokens, particularly because the previous launch was halted in 2021 due to regulatory issues. Building trust in these digital financial products will require Binance to demonstrate their efficiency, transparency, and long-term value. An effective communication strategy will be essential to highlight the benefits of stock tokens while addressing associated risks.

Binance Trading Features for Stock Tokens

The Binance platform is renowned for its robust trading features, which will be integral to the success of their stock tokens. Users will experience enhanced liquidity, allowing for seamless buying and selling of stock tokens in real time. The incorporation of advanced trading tools, such as limit orders and market orders, empowers investors to execute trades at optimal market conditions. Furthermore, the ability to leverage Binance’s existing infrastructure ensures a high level of security and efficiency when trading these digital assets.

Moreover, Binance aims to provide educational resources linked to stock tokens, helping investors understand their features and risks. This educational approach can foster informed investment decisions, allowing users to better navigate the complexities of trading fractional stock tokens. As the platform focuses on integrating traditional financial products within the cryptocurrency ecosystem, these trading features could significantly enhance the overall user experience and attract a new demographic of investors.

Understanding Cryptocurrency Stocks

Cryptocurrency stocks, often referred to as digital shares, differ significantly from traditional stock investments. While traditional stocks represent ownership in a company, cryptocurrency stocks, such as the ones Binance proposes, provide fractional ownership of the company’s shares in a digital format. This modern approach merges the concepts of blockchain technology and stock market investments, creating a unique vehicle for trading and investment.

With the rise of cryptocurrency, the boundary between digital assets and classical finance is continuing to blur. Investors are increasingly recognizing the potential of these digital stocks as a viable alternative investment avenue. They offer the benefits of fractional ownership, alongside the innovative features of blockchain such as transparency and security. As more platforms explore these digital assets, the concept of cryptocurrency stocks will likely evolve and gain further traction among investors.

Investing in Stock Tokens: What You Need to Know

Before investing in stock tokens, it’s essential to understand their unique features and the market dynamics involved. Each stock token serves as a representation of a specific stock’s value, allowing for fractional investing without the need to acquire an entire share. This opens up investment opportunities for people with limited budgets, making it easier for more individuals to participate in the stock market, especially with high priced stocks. However, investors should carefully research and evaluate the companies and assets they wish to invest in.

Additionally, potential investors should remain informed about regulatory developments affecting stock tokens. Keeping an eye on the ongoing discussions in Congress can provide insights into the future of trading these digital financial assets. Understanding the legal implications and any potential changes in regulation will be vital for making informed investment decisions in the evolving landscape of stock tokens.

The Future Outlook for Binance Stock Tokens

The future of Binance stock tokens looks promising, especially as the demand for innovative investment vehicles continues to rise. As Binance explores the re-launch of its stock tokens, the platform aims to address legal hurdles and enhance its offerings to provide optimal trading experiences. The potential inclusion of additional stocks and companies will further expand the opportunities for investors, fostering diversification in digital asset portfolios. Binance’s established reputation in the cryptocurrency sector and commitment to user experience may position it to capitalize on this growing trend.

Furthermore, as public interest in cryptocurrencies and blockchain technology expands, so does the likelihood of regulatory clarity surrounding stock tokens. Improved regulations would result in greater investor confidence and a more conducive environment for trading. If Binance can effectively navigate these challenges, stock tokens may become a crucial element of the cryptocurrency landscape, bridging the gap between traditional finance and the digital asset revolution.

Final Thoughts on Binance Stock Tokens and Their Impact

The exploration of stock tokens by Binance comes at a crucial juncture in the cryptocurrency market. As investors seek new ways to diversify their portfolios, the prospect of fractional stock tokens offers a compelling option that combines the benefits of blockchain technology with traditional stock market investments. The ability to engage in fractional investments enhances accessibility, potentially leading to increased participation in the financial market.

However, the future of Binance stock tokens hinges on multiple factors, including regulatory developments, market acceptance, and the platform’s ability to demonstrate their value proposition. As the company continues its efforts to re-launch and innovate within this framework, it could play a significant role in shaping the broader discourse on digital asset investment and the evolution of stock trading. Keeping abreast of these changes will be crucial for both new and seasoned investors looking to navigate the future landscape of stock tokens.

Frequently Asked Questions

What are Binance stock tokens and how do they work?

Binance stock tokens are digital tokens that represent fractional shares of publicly listed companies. Designed for cryptocurrency investors, these tokens allow users to buy portions of stocks like Apple or Microsoft without needing to purchase whole shares. They are stored and settled on the blockchain, providing real-time tracking of the underlying asset’s price.

How does investing in stock tokens on Binance differ from traditional stock investing?

Investing in stock tokens on Binance allows users to purchase fractional shares, enabling access to stock ownership without significant capital. Unlike traditional investments, Binance stock tokens leverage blockchain technology for secure transactions and ownership verification, making them a flexible option for crypto investors.

Are there specific Binance trading features for stock tokens?

Yes, Binance offers various trading features for stock tokens, including real-time price tracking, the ability to trade fractional amounts, and the integration of traditional finance with cryptocurrency. These features aim to enhance user experience and accessibility in investing in stock tokens.

Why did Binance discontinue stock tokens in 2021, and what has changed since?

Binance discontinued stock tokens in 2021 due to regulatory challenges surrounding the cryptocurrency market structure. Since then, Binance has been exploring a potential re-launch of stock tokens, aiming to address legal obstacles and incorporate them into their trading platform effectively.

What challenges does Binance face in re-launching stock tokens?

One significant challenge Binance faces in re-launching stock tokens is navigating the regulatory landscape. Current legislation moving through Congress poses delays for such products. However, Binance is committed to bridging traditional finance with cryptocurrency by overcoming these legal hurdles.

Can I trade stock tokens on Binance with cryptocurrency?

Yes, you can trade Binance stock tokens using cryptocurrency. This feature allows investors to leverage their digital assets to purchase fractional shares of publicly traded companies, providing a unique investment opportunity directly within the crypto trading ecosystem.

What are the benefits of using Binance stock tokens for investors?

The benefits of Binance stock tokens include fractional ownership, increased accessibility to high-value stocks, and the ability to trade 24/7 unlike traditional stock markets. Additionally, these tokens leverage the security and transparency of blockchain technology, which can enhance investor confidence.