The Binance SAFU fund is making headlines as it continues to strengthen Binance’s commitment to securing assets in the volatile cryptocurrency market. Recently, CZ, the CEO of Binance, tweeted an announcement highlighting that the SAFU fund will be utilized to acquire Bitcoin, effectively reinforcing the exchange’s confidence in the leading cryptocurrency. This strategic move comes at an opportune moment, as on-chain data reveals that the SAFU fund’s Bitcoin reserves now hold an impressive 6,230 BTC. In the realm of Binance crypto news, this initiative not only showcases the overarching strategy for enhancing security but also reflects users’ increasing trust in Binance’s ability to manage and safeguard their investments. The ongoing developments regarding the SAFU fund Bitcoin are likely to be a pivotal point in the exchange’s long-term vision for solidifying its financial foundation within the digital asset landscape.

The concept of the Binance SAFU fund represents a safety net for users amidst the ever-changing dynamics of the cryptocurrency landscape. As the premier platform for trading Bitcoin, Binance is taking significant steps to bolster its security measures by utilizing its emergency fund to acquire more digital assets. Known for its transparency, the exchange’s recent revelations about its Bitcoin reserves, which are backed by on-chain data, underscore its commitment to safeguarding user funds. Moreover, the recent CZ Twitter announcement has sparked interest in how the exchange plans to strategically manage its asset holdings while maintaining user confidence. This proactive approach to asset management and security not only positions Binance favorably against other exchanges but also serves to enhance its reputation as a trusted place for cryptocurrency trading.

| Key Point | Details |

|---|---|

| CZ’s Retweet | CZ announced on platform X that Binance will continue utilizing the SAFU fund to invest in Bitcoin. |

| Long-term Confidence | This decision reinforces Binance’s confidence in the longevity and stability of Bitcoin. |

| Timing of Adjustment | The adjustment of the SAFU fund is considered timely for acquiring Bitcoin reserves. |

| On-chain Data | The Binance SAFU fund currently holds 6,230 BTC in a specific address (1BAuq…WQkD). |

Summary

The Binance SAFU fund is pivotal in reinforcing the exchange’s commitment to Bitcoin, as evidenced by CZ’s announcement about its ongoing investment strategy. This proactive approach not only showcases Binance’s confidence in Bitcoin’s future but also reflects strategic decision-making in the context of market conditions. With the SAFU fund holding a significant amount of Bitcoin, it serves as a safeguard for the platform’s users, thus enhancing customer trust in Binance.

Understanding the Importance of the Binance SAFU Fund

The Binance SAFU fund, an acronym for Secure Asset Fund for Users, was established to protect clients’ funds in extreme situations. Recently, Binance’s CEO, Changpeng Zhao (CZ), confirmed on platform X that the fund will continue to purchase Bitcoin, showcasing the exchange’s endurance in the face of market volatility. By strategically utilizing the SAFU fund as part of its Bitcoin reserves, Binance is affirming its long-term belief in Bitcoin, which remains the leading cryptocurrency by market capitalization.

This proactive approach not only reassures users of their assets’ safety but also highlights Binance’s commitment to maintaining liquidity during turbulent market conditions. As a result, users can have heightened confidence in engaging with Binance, knowing that their interests are safeguarded. Moreover, the transparency regarding the SAFU fund’s Bitcoin holdings strengthens user trust and fortifies Binance’s reputation as a reliable exchange in the crypto industry.

CZ’s Twitter Announcement: A Boost to Market Sentiment

CZ’s announcements on Twitter regarding Binance’s future plans often send ripples through the cryptocurrency community. This time, his statement about the SAFU fund’s continued investment in Bitcoin is particularly significant. The timing of this announcement aligns perfectly with current market changes, where positive news can sway investor sentiment swiftly. The combination of CZ’s influence and the strategic moves by Binance provides a robust environment for potential investors looking at Bitcoin.

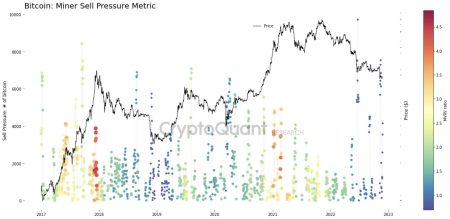

The implication of CZ’s statements can be profound. Investors typically look to leaders in the space for cues on market viability and direction. With claims surrounding the SAFU fund and its allocation to Bitcoin reserves, it suggests that major players in the market remain bullish on Bitcoin, which is reflected in on-chain data trends. As transactions and investments surge, investors are likely to keep a close watch on Binance’s activities for insights into future Bitcoin price movements.

Analyzing On-Chain Data: The SAFU Fund’s Bitcoin Holdings

On-chain data plays a crucial role in assessing the health of cryptocurrency exchanges and their reserves. In this context, Binance’s SAFU fund address, which currently holds 6,230 BTC, is a noteworthy statistic. This data provides transparency into the fund’s capacity to act as a buffer in case of emergencies, reinforcing user confidence in Binance’s operational integrity. Such a high balance in Bitcoin reserves implies that Binance is well-prepared to handle various market scenarios.

Furthermore, the on-chain data indicates the liquidity available within the SAFU fund to support user withdrawals if necessary. This level of transparency is essential in the crypto environment, where trust can often be a scarce commodity. As more users engage with the exchanges, the visibility into how their funds are safeguarded becomes pivotal. The continued growth of the SAFU fund in Bitcoin further signifies that Binance is positioning itself as a stalwart in the digital asset landscape.

The Role of Binance in Bitcoin Adoption

Binance has long been a significant player in the cryptocurrency market, particularly in fostering Bitcoin adoption. By continuing to utilize the SAFU fund for Bitcoin purchases, Binance is not just preserving assets for its users but also actively participating in the overall stability and growth of the Bitcoin ecosystem. This role is compounded by proactive measures aimed at enhancing liquidity and offering investors a safety net during fluctuating market phases.

Ultimately, Binance’s strategies, combined with on-chain data and community engagement via social media announcements from CZ, play a fundamental role in shaping Bitcoin’s narrative as a stable and reliable investment. As Binance leads by example, it might inspire other exchanges to develop similar funds to protect user interests, thereby enhancing the credibility and integrity of the broader cryptocurrency market.

Recent Binance Crypto News: Impacts on the Market

Recent news from Binance, particularly regarding the SAFU fund, has substantial implications for the cryptocurrency market. Reports indicate that the exchange will leverage the SAFU fund not only as an insurance mechanism but also as a proactive investment in Bitcoin. Such news often leads to increased trading volumes as traders react to favorable developments. Moreover, the market generally tends to follow the sentiment set by major exchanges like Binance.

Additionally, consistent updates from Binance about its activities, including the SAFU fund’s transactions, can lead to heightened investor scrutiny regarding the overall health of the Bitcoin market. Analysts and enthusiasts monitor such insights closely, as any change in the fund’s Bitcoin reserves could influence market trends and investor behavior. Thus, Binance’s ability to communicate effectively and transparently remains critical in shaping market perceptions.

How the SAFU Fund Enhances User Trust

The SAFU fund represents a significant commitment from Binance to ensure user trust and security. By publicly disclosing its Bitcoin reserves and outlining its strategy for safeguarding assets, Binance establishes itself as a frontrunner among cryptocurrency exchanges. Users are likely to feel more secure knowing that their investments are protected by such a robust fund, reinforcing their confidence in trading on the platform.

Moreover, this initiative allows Binance to differentiate itself from competitors who may not have similar security measures in place. As the cryptocurrency landscape continues to evolve, the importance of user trust cannot be overstated. Transparency around the SAFU fund and its operational details creates a more user-friendly environment, encouraging more participants to enter the Bitcoin market.

Future Predictions for Binance and Bitcoin

With the ongoing use of the SAFU fund to bolster Bitcoin reserves, industry analysts are optimistic about Binance’s future trajectory. The exchange’s strategy signals a strong belief in Bitcoin’s longevity and potential for substantial growth. As more investors take notice of Binance’s moves, the correlation between exchange activity and Bitcoin price dynamics will likely become increasingly apparent.

Furthermore, Binance’s commitment to security and transparency could position it as a leader in fostering broader crypto acceptance. As institutional interest in Bitcoin grows, exchanges like Binance that prioritize user safety and offer innovative funds like SAFU will likely gain an edge in the competitive landscape. Thus, as Bitcoin adoption increases and cryptocurrencies evolve, Binance may emerge not only as a trading platform but also as a pioneer in securing user interests.

The Significance of Bitcoin Reserves for Exchanges

In the realm of cryptocurrency exchanges, maintaining adequate Bitcoin reserves is vital to ensuring operational stability and user confidence. As the leading cryptocurrency, Bitcoin serves as a benchmark for other cryptocurrencies, making its management crucial for exchanges like Binance. By allocating SAFU funds to Bitcoin reserves, Binance emphasizes the importance of liquidity and user protection, vital aspects in minimizing panic during market downturns.

Moreover, these reserves act as a crucial buffer for exchanges, enabling them to meet user withdrawals promptly. A strong Bitcoin reserve also acts as a signal to the market, indicating the exchange’s reliability and stability. Customers are more likely to engage and trade on platforms that can confidently demonstrate their ability to secure and manage these dominant digital assets.

Leveraging Transparency in Binance’s Operations

Transparency is essential for any financial institution, and this holds particularly true for cryptocurrency exchanges, where skepticism can affect user engagement. Binance’s approach to sharing information about the SAFU fund and its usage for Bitcoin reserves is a prime example of leveraging transparency to build customer trust. By openly communicating the health of its reserves and the rationale behind its strategies, Binance sets a new standard in the industry.

This transparency not only mitigates fears regarding potential liquidity issues but also cultivates a more knowledgeable user base. As users become more informed about the SAFU fund’s role and its impact on overall market stability, they are more likely to participate actively in trading and staking cryptocurrencies on the platform. In this way, Binance’s transparent operational guidelines may very well lead to an increase in customer loyalty and an expansion of its user community.

Frequently Asked Questions

What is the Binance SAFU fund and how does it work?

The Binance SAFU fund, or Secure Asset Fund for Users, is a safety net created by Binance to protect users’ funds in the event of unforeseen circumstances. It operates by allocating a portion of Binance’s profits to build reserves, which can be used to cover losses or protect users. Recently, CZ announced on X that the SAFU fund will be utilizing Bitcoin reserves, reaffirming Binance’s confidence in Bitcoin.

How much Bitcoin does the Binance SAFU fund currently hold?

According to the latest on-chain data, the Binance SAFU fund currently holds approximately 6,230 BTC in its secure wallet address (1BAuq…WQkD). This significant amount showcases Binance’s commitment to maintaining a robust safety net for its users.

What was CZ’s announcement regarding the Binance SAFU fund and Bitcoin?

CZ recently tweeted that Binance will continue using the SAFU fund to purchase Bitcoin, indicating a strategic move that aligns with the current market conditions. This announcement highlights Binance’s long-term belief in Bitcoin as an asset and its aim to ensure user security through its SAFU fund.

How does the Binance SAFU fund impact the security of user funds?

The Binance SAFU fund directly enhances the security of user funds by ensuring that a reserve is in place to cover potential losses. By integrating Bitcoin reserves into the SAFU fund, Binance is not only bolstering the fund’s value but also gaining from potential appreciation in Bitcoin’s price, which can lead to improved user protection.

Why is the timing of the SAFU fund adjustment to Bitcoin reserves considered ideal?

The timing of adjusting the Binance SAFU fund to serve as Bitcoin reserves is seen as ideal due to the current favorable market conditions for Bitcoin, as highlighted by CZ. This strategic timing allows Binance to leverage potential growth in Bitcoin’s value while enhancing the security framework surrounding user assets.

Where can I find more Binance crypto news related to the SAFU fund?

To stay updated on Binance crypto news regarding the SAFU fund and other developments, you can follow official announcements from Binance on their blog and social media platforms. Additionally, industry news sites frequently cover updates and analysis related to Binance and its SAFU fund activities.