In December 2025, Binance Reserve Proof has come to the forefront with impressive metrics that reflect the exchange’s robust financial health. The latest update reveals that the Binance BTC reserve stands at an impressive 102.11%, accompanied by a substantial wallet balance of 630,677.19 BTC. Additionally, the USDT reserve rate is notable at 109.16%, showcasing Binance’s commitment to maintaining high liquidity and stability within its ecosystem. Combined, these figures highlight the exchange’s reliability and strength, which are critical as it navigates the evolving landscape of cryptocurrency. With the ETH BNB reserves also reported at healthy levels, Binance’s December updates demonstrate a proactive approach to transparency and investor confidence in the crypto market.

As we delve into Binance’s recent disclosure regarding its financial reserves, we observe significant improvements that enhance user trust across cryptocurrency platforms. The reserve proof revealed for December 2025 showcases Binance’s commitment to transparency, demonstrating a healthy balance in Bitcoin reserves alongside a robust USDT reserve rate. This thorough crypto reserve update not only signals the platform’s operational security but also reflects broader industry trends in digital asset management. By maintaining strong ETH BNB reserves, Binance positions itself as a leader in ensuring liquidity and user safety in the fast-paced crypto environment. Such updates are essential for stakeholders looking to understand the dynamics of major exchanges in the ever-evolving cryptocurrency landscape.

Overview of Binance December 2025 Reserve Proof

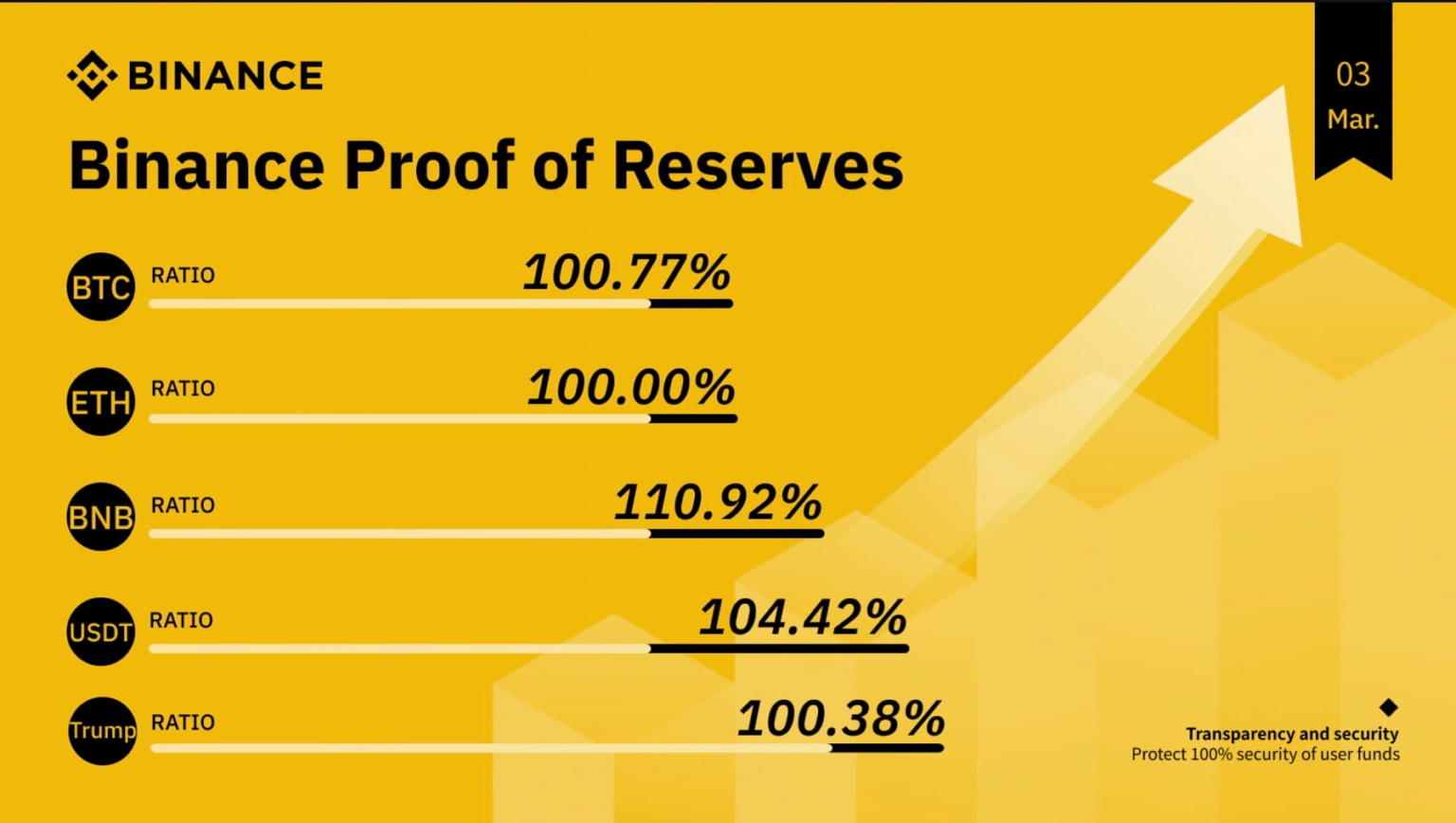

The cryptocurrency exchange Binance has recently provided its December 2025 reserve proof, an essential update that highlights the resilience and operational integrity of the platform. With a BTC reserve rate of 102.11%, Binance is showcasing its capability to back each user’s holdings with real assets. As of the latest report, the wallet holds an impressive balance of 630,677.19 BTC, reflecting the platform’s commitment to maintaining robust liquidity and stability. Such figures are crucial for users seeking a reliable exchange amidst the volatility inherent in the crypto market.

Additionally, Binance has reported a USDT reserve rate of 109.16%, indicating that its reserves exceed the amount of USDT in circulation on the exchange. The wallet balance of 37,446,672,411.804 USDT reinforces users’ trust in Binance’s ability to manage large transactions seamlessly. Transparency in reserve management not only promotes confidence but also highlights Binance’s strategic focus on providing secure trading and investment opportunities for its users.

Significance of Binance BTC and USDT Reserve Rates

The BTC and USDT reserve rates reported by Binance are significant indicators of the platform’s health and reliability. A reserve rate above 100% suggests that Binance holds more than enough assets to cover all user liabilities regarding these currencies. This is particularly important in the crypto space, where trust can be fragile amidst market fluctuations. By maintaining a BTC reserve rate of 102.11% and USDT reserve rate of 109.16%, Binance not only sets a benchmark for other exchanges but also reassures investors about the safety of their assets.

Moreover, these reserve rates place Binance in a strong position against competitors, drawing users who prioritize security and transparency. As the crypto landscape evolves, having such robust reserves can differentiate Binance from other service providers that may not fully disclose their reserve status. As investors look to safeguard their investments, Binance’s commitment to maintaining high reserve levels becomes increasingly attractive, promoting long-term growth and user loyalty.

Binance December Updates: ETH and BNB Reserves

In addition to impressive BTC and USDT reserve rates, Binance also revealed that it has maintained an ETH reserve rate of 100% and a BNB reserve rate of 112.32%. The impressive balance of 4,041,415.554 ETH alongside 44,278,972.355 BNB held in reserve further emphasizes Binance’s capacity to support and grow its ecosystem. Such strong reserves reflect the exchange’s strategic foresight in the allocation of resources towards both Ethereum and Binance Coin, two significant players in the crypto world.

These updates are essential for users who trade ETH and BNB, providing them with assurances about the exchange’s stability and operational integrity. The ability to maintain full reserves for ETH alongside exceeding BNB reserves demonstrates Binance’s commitment to not only servicing current user needs but also adapting to future market dynamics. As these cryptocurrencies continue to gain traction, Binance’s proactive management of its assets positions the exchange favorably amongst its peers.

Understanding the Impact of Crypto Reserve Management

The way exchanges manage their reserves has a substantial impact on user trust and market dynamics in the cryptocurrency landscape. By offering transparency through regular reserve proofs like those from Binance, exchanges can build a reputation for reliability that is crucial for attracting and retaining users. For instance, the recent showcase of Binance’s robust BTC and USDT reserves coupled with healthy ETH and BNB levels establishes it as a leader in the space.

Moreover, effective reserve management aids in mitigating risks associated with market volatility. When users are aware of a platform’s ability to back its transactions and liabilities, they are more likely to engage in trading activities without fear of sudden liquidity issues. This trust can enhance trading volumes and user engagement on the platform, further strengthening its market position and encouraging a vibrant trading community.

The Future of Binance and Its Reserve Strategy

As we look towards the future, Binance’s strategic emphasis on maintaining high reserve rates could influence its positioning significantly within the crypto industry. With the competitive landscape constantly evolving, users will likely continue seeking platforms that demonstrate financial integrity and security. This could prompt Binance to further enhance its reserve management strategies, adapting to the latest trends and demands in the market.

Furthermore, the cryptocurrency community is increasingly attentive to issues surrounding reserve transparency, especially after various incidents involving less reputable exchanges. Binance’s commitment to providing clear updates on its reserves, notably the BTC, USDT, ETH, and BNB figures, not only helps cement its reputation as a trusted platform but also sets a standard for accountability within the crypto space. This proactive stance will be crucial for its ongoing success in attracting new users while retaining existing ones.

Potential Risk Factors in Reserve Management

Despite the strong performance reflected in Binance’s December reserve proof, risks still abound in the crypto landscape that could impact reserve management. One such risk is regulatory scrutiny, as authorities worldwide tighten regulations surrounding cryptocurrency exchanges. Depending on how regulations develop, exchanges may be required to adjust their reserve strategies, which could influence their operational procedures and ultimately, their market standing.

Additionally, unforeseen market fluctuations or liquidity crises can pose challenges even for well-established exchanges like Binance. While the platform currently boasts impressive BTC, USDT, ETH, and BNB reserves, constant vigilance is essential. Users should remain aware of the potential risks involved in the industry and stay informed about how Binance, and similar platforms, manage both their resources and the regulatory landscape.

Market Response to Binance’s Reserve Updates

Market response to Binance’s reserve updates, particularly the BTC reserve rate of 102.11% and USDT reserve rate of 109.16%, has been predominantly positive. Investors and traders often react favorably to such transparent disclosures, which instill confidence in the exchange’s operational solidity. Enhanced trust usually correlates with increased trading volumes and heightened interest from new users, effectively leading to a feedback loop of growth and stability.

Further, the positive sentiment that arises from such updates can also influence the broader cryptocurrency market. When a leading exchange like Binance showcases its strengths through substantial reserves and transparent practices, it can enhance confidence in the entire sector, potentially leading to increased valuations across various cryptocurrencies. Thus, Binance’s reserve announcements not only impact its internal ecosystem but can also ripple through the wider crypto industry.

Conclusion: Binance’s Commitment to Transparency and Security

In conclusion, Binance’s December 2025 reserve proof highlights its unwavering commitment to transparency, security, and operational integrity. With strong BTC, USDT, ETH, and BNB reserve rates, the exchange positions itself as a reliable platform in a volatile market. Regular updates regarding reserves are not merely an operational necessity; they are vital marketing tools that enhance user trust and encourage a vibrant trading community.

As Binance continues to navigate the complexities of the cryptocurrency industry, its focus on maintaining high reserves will likely play a crucial role in its strategy for long-term success. The exchange’s proactive approach sets an example for other platforms, advocating for a culture of transparency and accountability within the crypto space. As we move forward into 2026 and beyond, Binance’s dedication to these principles will be integral to its ongoing evolution and market leadership.

Frequently Asked Questions

What is the Binance Reserve Proof for December 2025?

The Binance Reserve Proof for December 2025 showcases the platform’s financial health, highlighting a Bitcoin (BTC) reserve rate of 102.11%, a USDT reserve rate of 109.16%, as well as ETH at 100% and BNB at 112.32%. This indicates that Binance holds more assets in reserves than the liabilities associated with these assets.

How does the Binance BTC reserve relate to the December 2025 update?

In the December 2025 update, Binance reported a BTC reserve rate of 102.11%, meaning it holds 102.11% of customer deposits in Bitcoin. The platform currently has a wallet balance of 630,677.19 BTC, which provides assurance of financial stability for its users.

What does the USDT reserve rate of 109.16% mean for Binance users?

The USDT reserve rate of 109.16% indicates that Binance holds 109.16% in reserves compared to the USDT issued. With a total of 37,446,672,411.804 USDT in its wallet, this high reserve rate provides users with confidence in the platform’s ability to cover its stablecoin liabilities.

Can you explain the significance of the ETH BNB reserves highlighted in the December 2025 updates?

The December 2025 updates show that Binance has an ETH reserve rate of 100% and a BNB reserve rate of 112.32%. This means Binance fully backs its customers’ ETH deposits and has ample reserves (44,278,972.355 BNB) for BNB, enhancing trust in its services.

What are the latest crypto reserve updates from Binance as of December 2025?

As of December 2025, Binance’s crypto reserve updates reveal a BTC reserve rate of 102.11%, a USDT reserve rate of 109.16%, ETH reserve rate at 100%, and BNB at 112.32%. These figures reflect a robust asset backing for each cryptocurrency, crucial for user security.

How do the December Binance updates impact investor confidence?

The December updates from Binance, including strong reserve rates of BTC, USDT, ETH, and BNB, significantly bolster investor confidence. These metrics demonstrate Binance’s strong financial foundation and commitment to properly managing user assets, which is vital in the volatile crypto market.

| Asset | Reserve Rate | Wallet Balance |

|---|---|---|

| BTC | 102.11% | 630,677.19 BTC |

| USDT | 109.16% | 37,446,672,411.804 USDT |

| ETH | 100% | 4,041,415.554 ETH |

| BNB | 112.32% | 44,278,972.355 BNB |

Summary

The Binance Reserve Proof for December 2025 showcases substantial asset reserves, highlighting the platform’s financial health and transparency. With the BTC reserve rate at a robust 102.11% and a significant wallet balance of over 630,000 BTC, Binance affirms its commitment to maintaining liquidity. Additionally, USDT’s reserve rate surpasses 109%, underlining the stability in its pegged value. Ethereum (ETH) holds a 100% reserve while BNB surpasses 112% in its reserve rate, further solidifying Binance’s position in the cryptocurrency market. Overall, the December 2025 reserve proof reflects Binance’s strong operational integrity and reliability among users in the crypto space.