Binance leverage adjustment is set to take center stage in the crypto trading realm with significant updates coming on November 28, 2025. The leading cryptocurrency exchange has announced changes to the leverage and margin levels for various U-standard perpetual contracts, including popular pairs such as VFYUSDT, BASUSDT, and AIOTUSDT. These adjustments reflect Binance’s ongoing commitment to enhancing trading conditions and maintaining a secure environment for leverage trading. Traders and investors should stay informed, as these updates could impact their positions dramatically. Stay tuned for the latest Binance news to ensure you’re prepared for the upcoming changes in margin levels.

In an upcoming development, Binance is making important modifications to its trading parameters, which will affect the leverage available on several U-standard perpetual contracts. This significant measure will enhance the overall trading experience for those involved in cryptocurrency markets. The planned leverage adjustments aim to provide a more balanced approach to risk management for traders engaging in margin trading. As the exchange gears up for this transition, participants must remain vigilant and adapt their strategies accordingly. This update highlights the dynamic nature of crypto trading and the necessity for traders to stay abreast of regulatory changes in the liquidity landscape.

Understanding Binance Leverage Adjustment

Binance has recently announced a significant adjustment in leverage and margin levels for various U-standard perpetual contracts. This change, set to take effect on November 28, 2025, at 14:30 Beijing time, emphasizes the platform’s ongoing commitment to optimizing trading conditions for its users. Traders should brace for the implications that this adjustment may have on their existing positions, particularly for contracts such as VFYUSDT, BASUSDT, and AIOTUSDT. Understanding how these leverage modifications impact risk management and potential rewards is crucial for anyone involved in leverage trading.

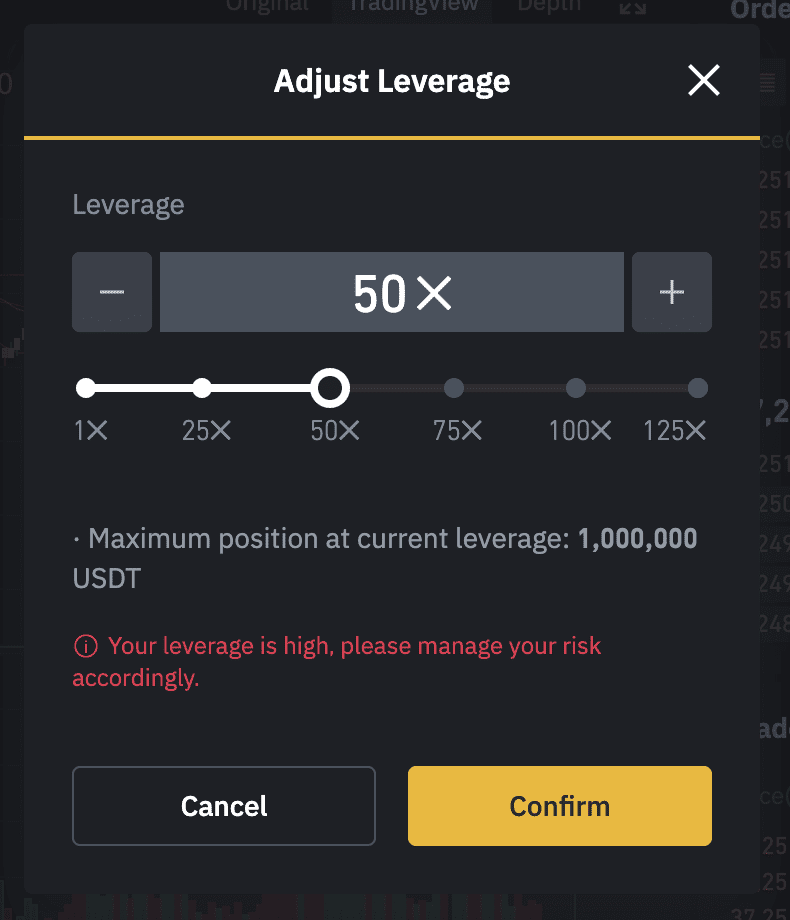

Adjusting leverage levels is a critical component of trading strategies on platforms like Binance. It allows traders to amplify their positions but simultaneously increases risk exposure. As the leverage adjustment progresses, Binance aims to create a balanced trading environment that accommodates both seasoned investors and newcomers to crypto trading. By carefully calibrating margin levels, Binance is not only ensuring compliance with market regulations but also enhancing trader performance under varying market conditions.

Impact of Margin Levels on Trading Strategies

Margin levels are fundamentally intertwined with a trader’s approach in the volatile world of cryptocurrency. With Binance’s upcoming adjustment to margin levels for several U-standard perpetual contracts, traders must reassess their strategies. Higher margin requirements might necessitate a reduction in leveraged positions, thereby influencing overall trading outcomes. For instance, those holding positions in VFYUSDT or BASUSDT need to consider potential adjustments to their collateral and risk management techniques. As margin levels change, the strategies that once proved successful may require reevaluation to align with these new conditions.

Furthermore, the significance of proper margin usage extends beyond individual trades; it also impacts a trader’s portfolio management and overall risk profile. As Binance implements these margin adjustments, traders need to ensure they are adequately capitalized to meet new requirements without jeopardizing their financial stability. By staying updated with Binance news and understanding these adjustments, traders can navigate through potential challenges and identify opportunities for profit in the dynamic crypto market.

Navigating U-Standard Perpetual Contracts on Binance

U-standard perpetual contracts represent a growing choice among traders seeking flexibility in their trading strategies. As Binance adjusts leverage and margin levels for these contracts, it’s essential for traders to grasp what these changes entail. For example, with an increase in leverage, a trader can control a larger position with a relatively small amount of capital. However, understanding the mechanics of these contracts, coupled with the impact of leverage trading, is vital to achieving success. Traders can benefit by familiarizing themselves with how varying contract structures function under updated margins and leverage scenarios.

Additionally, Binance’s commitment to its U-standard perpetual contracts reflects its innovative approach in the crypto trading landscape. This evolution not only enhances market liquidity but also offers traders unique ways to capitalize on market movements. As the proposed changes take effect, it benefits participants to engage in continuous learning and adjustment of their trading methodologies. Being well-versed in the nuances of each U-standard perpetual contract can significantly enhance trading outcomes, ensuring that traders are well-positioned to take advantage of the market’s fluctuations.

The Future of Leverage Trading on Binance

Leverage trading on Binance is entering a new phase with the upcoming adjustments to leverage and margin levels. As the platform continuously evolves, traders must remain agile and informed about changes that could affect their trading positions. Considering that the crypto market is notorious for its volatility, understanding these adjustments can help traders manage their risk more efficiently. The ability to adjust leverage offers traders the opportunity to maximize profitability while adhering to responsible trading practices.

Moreover, the shift in margin levels signifies Binance’s proactive stance in protecting traders from the inherent risks of leverage trading. In a rapidly changing market, such enhancements can lead to more sustainable trading practices and improved user experiences. As we look towards the future, traders will need to evaluate how these adjustments fit into their broader crypto trading strategies, ensuring that they maintain a competitive edge while aligning themselves with Binance’s updated framework.

Staying Updated with Binance News

As the crypto landscape evolves, staying informed about relevant Binance news is crucial for all traders. The recent announcement regarding the adjustment of leverage and margin levels for U-standard perpetual contracts is just one of the many updates that traders need to stay abreast of. Regularly checking Binance’s official channels can provide insights into upcoming changes, new trading features, and other essential updates that could impact trading strategies and market movements.

Additionally, Binance’s updates often include educational resources that can help traders understand the implications of changes in leverage and margin levels. Participating in community discussions and forums can also offer traders valuable perspectives from peers who are navigating similar adjustments. By leveraging these resources and engaging with the community, traders can enhance their overall trading acumen, making more informed decisions in an ever-competitive market.

Adapting to the Adjusted Crypto Trading Environment

As Binance prepares to adjust its leverage and margin levels, the need for adaptation becomes imperative for traders. This transition requires a thorough understanding of how new margin requirements will affect trading behavior and portfolio strategies. Traders must carefully assess their risk tolerance and position sizes in response to these changes, ensuring they can sustain their trading practices without placing undue financial strain on themselves.

Moreover, adapting to an adjusted trading environment also means embracing new strategies that align with the revised leverage parameters. Traders should explore alternative methods that optimize their positions while balancing risk and reward. As the market adapts, remaining flexible and responsive to changes will allow traders to maintain a competitive edge and exploit potential opportunities that arise in the crypto trading ecosystem.

Risk Management Strategies for New Margin Levels

With the adjustment of margin levels on Binance, it is crucial for traders to revisit their risk management strategies. Effective risk management plays a pivotal role in ensuring long-term success in the crypto trading market, especially when engaging in leverage trading. Traders should recalibrate their stop-loss orders, position sizes, and overall capital allocation to align with the new margin requirements. By taking proactive measures to manage risk, traders can better navigate the inherent volatility of cryptocurrencies.

Furthermore, employing advanced risk assessment tools can enhance a trader’s ability to adjust their strategies effectively. As margin levels fluctuate, having a clear understanding of one’s risk exposure and mitigation techniques can mean the difference between success and failure. Utilizing risk management software or platforms that integrate analytics can empower traders to make data-driven decisions that adapt seamlessly to Binance’s updated trading environment.

Leveraging Educational Resources for Optimal Trading

The landscape of crypto trading is ever-changing, and leveraging educational resources offered by platforms like Binance can significantly empower traders during periods of adjustment. With the announcement of leverage and margin level changes, traders can benefit from utilizing tutorial materials, webinars, and community insights that Binance provides. These resources often clarify updates and articulate how they affect trading strategies, especially concerning U-standard perpetual contracts.

Educating oneself about the mechanics of leverage trading, effective margin use, and the specifications of Binance’s contracts can lead to enhanced trading proficiency. In an environment where knowledge is power, traders who invest time in learning from available resources are better equipped to tackle changes and seize trading opportunities. Whether through official Binance channels or third-party educational platforms, continuous learning remains a critical asset for anyone involved in the rapidly evolving crypto market.

Preparing for Market Volatility Post-Adjustment

Following the adjustments to leverage and margin levels on Binance, traders should brace themselves for potential market volatility. Such changes can induce fluctuations in contract valuations due to the shifting dynamics of trading behaviors. Understanding how the market typically reacts to leverage adjustments is crucial for formulating effective trading strategies post-announcement. Traders should expect an influx of market activity as their peers simultaneously respond to these changes, which could create both opportunities and challenges.

Adopting a proactive approach to trading during volatile periods involves reassessing one’s trading plan and risk exposure. Adjustments to stop-loss orders, position limits, and the overall trading strategy will be necessary to accommodate the anticipated fluctuations. By preparing for market volatility and remaining vigilant in their trading operations, traders can navigate the transitional period effectively while positioning themselves to capitalize on market oscillations.

Frequently Asked Questions

nn

What is the Binance leverage adjustment for U-standard perpetual contracts?

Binance will adjust the leverage and margin levels for U-standard perpetual contracts, including VFYUSDT, BASUSDT, and AIOTUSDT, on November 28, 2025. This adjustment aims to optimize trading conditions and may affect existing positions during the update.

nn

How will the leverage changes on Binance affect margin levels?

The upcoming Binance leverage adjustment will result in changes to margin levels for several U-standard perpetual contracts. Traders will need to review their positions as the adjusted leverage could impact their risk exposure and margin requirements.

nn

When is the Binance leverage adjustment scheduled?

The Binance leverage adjustment is scheduled for November 28, 2025, at 14:30 Beijing time. The update will take approximately one hour, during which existing positions will be impacted.

nn

What should traders know about the Binance leverage and margin levels before the adjustment?

Traders should be aware that the Binance leverage adjustment will modify margin levels, affecting how much capital is required for maintaining positions. It’s essential to keep up with Binance news for updates on specific leverage ratios for U-standard perpetual contracts.

nn

Can I still trade during the Binance leverage adjustment period?

During the Binance leverage adjustment period on November 28, 2025, trading will continue, but traders should be cautious as margin levels and leverage could temporarily change, impacting their existing and new positions.

nn

What are U-standard perpetual contracts on Binance?

U-standard perpetual contracts on Binance are crypto trading products that allow for leveraged trading on various cryptocurrencies. Adjustments to leverage and margin levels for these contracts are aimed at enhancing trading efficiency and managing market volatility.

nn

How does Binance leverage trading work?

Binance leverage trading allows traders to borrow funds to increase their buying power, enabling them to trade larger positions than their account balance. The upcoming adjustments to leverage levels for U-standard perpetual contracts may influence trading strategies.

nn

What are the implications of the Binance news on leverage adjustments for traders?

The Binance news regarding leverage adjustments highlights the need for traders to assess their current positions and strategies. Changes in margin levels may increase or decrease the risk in their trading accounts, requiring adjustments to their trading plans.

nn

Summary

Binance leverage adjustment is set to take place on November 28, 2025, impacting various U-standard perpetual contracts such as VFYUSDT, BASUSDT, and AIOTUSDT. This adjustment will occur at 14:30 Beijing time, taking approximately one hour to complete, and traders should be aware that their existing positions may be affected during this time. Maintaining an understanding of these changes is crucial for effective trading strategies.

nn