Binance Futures leaderboards are an essential tool for cryptocurrency traders seeking to enhance their trading strategies and profitability. These dynamic rankings showcase top traders and their impressive performance, allowing users to analyze successful tactics and replicate their results. As of December 5, 2025, the leaderboard was dominated by the user ‘0xPickleCati’, who amassed a staggering $45.46 million in profits through their adept Binance Futures trading. By examining such high-performing accounts, traders can glean valuable insights from on-chain trading analysis, ultimately aiming to maximize their own cryptocurrency trading profits. The current leaderboard reflects not only individual successes but also shifts in market sentiment and strategy, fueling competition among traders to achieve excellence in profit from futures contracts.

The Binance Futures trading scene is characterized by its competitive nature, where standout traders frequently make headlines for their exceptional earnings. The smart money rankings offer a glimpse into the lucrative world of futures trading, showcasing users who have expertly navigated market volatility. Recently, the account ‘0xPickleCati’ gained recognition for generating impressive returns, reflecting the vibrant ecosystem of cryptocurrency investment opportunities. By leveraging insightful on-chain trading analysis, aspiring traders can adopt strategies that align with the top performers on the leaderboards, thereby enhancing their chances of securing profitable outcomes. Keeping an eye on these leaderboards not only highlights successful practices but also encourages newcomers to develop their skills in the fast-paced realm of futures contracts.

Understanding the Binance Futures Smart Money Leaderboard

The Binance Futures smart money leaderboard showcases the top performers in the cryptocurrency trading space, highlighting traders who have executed successful strategies to maximize their profits. This leaderboard serves as a source of inspiration for both novice and experienced traders looking to enhance their future contracts trading performance. By analyzing the tactics and approaches of leaders such as ‘0xPickleCati’, traders can gain insights into effective methods for navigating market volatility and generating substantial returns.

The shift in leadership on the Binance Futures smart money leaderboard, with users like ‘0xPickleCati’ achieving impressive profits, underscores the dynamic nature of cryptocurrency trading. Traders are advised to stay updated on who leads this ranking, as it can influence market trends and sentiment. Following these top performers often leads to valuable on-chain trading analysis that can help others replicate similar success by adopting strategies such as effective risk management and timing their entries and exits.

Profit from Futures Contracts: Strategies and Insights

Profiting from futures contracts requires a keen understanding of market trends, paired with comprehensive risk management strategies. The recent success of ‘0xPickleCati’, who earned over $45 million, exemplifies the significance of tactical entry and exit points. By studying market behaviors, such as the sharp rise in profits during specified periods, traders can identify patterns that might signal lucrative opportunities for positioning their trades.

A robust approach to futures trading includes utilizing technical analysis alongside fundamental insights from on-chain data. For example, ‘0xPickleCati’ likely leveraged these methodologies to time their trades effectively—particularly evident during the October market downturn where shorting the market became profitable. Engaging with community insights and adapting strategies from market leaders can significantly enhance trading outcomes over time.

On-Chain Trading Analysis: A Game Changer for Futures Trading

On-chain trading analysis is revolutionizing the way traders engage with cryptocurrency markets, particularly within the realm of futures contracts. This analytical approach involves tracking blockchain transactions to gather insights about trading volumes, market sentiment, and user behaviors. Traders can identify significant players and trends that influence their trading decisions, making on-chain analysis an invaluable tool for those looking to replicate the successes of top performers like ‘0xPickleCati’.

Incorporating on-chain trading insights allows for a more nuanced understanding of market dynamics. By examining the trading patterns leading up to events such as the one witnessed by ‘0xPickleCati’ during specific profitable periods, other traders can adopt similar strategies. This method enhances potential profits while minimizing losses by aligning trades with verified market trends.

Key Factors Driving Cryptocurrency Trading Profits

Several key factors contribute to maximizing cryptocurrency trading profits, especially in futures markets. Understanding market dynamics, timing, and strategic entry and exit points are fundamental to success. Notably, traders should pay attention to liquidity levels, volatility, and news events that can impact prices. The surprising profits made by ‘0xPickleCati’ during periods of intense market movement serve as a reminder of how critical it is to stay attuned to these elements.

Moreover, employing a diversified trading strategy across different periods can yield significant benefits, as seen in the fluctuating profits of top traders. By adopting a mixed approach, combining short and long positions, traders can hedge risks while capitalizing on emerging opportunities. Observing the strategies of leaders on the Binance Futures leaderboard reveals valuable lessons on how to harness these factors effectively.

Leveraging Market Trends on Binance Futures

To succeed in Binance Futures trading, it’s essential to leverage current market trends wisely. Traders must frequently analyze market conditions and sentiment among major cryptocurrency assets to optimize their trading strategies. The shifts in the leaderboard indicate how quickly fortunes can change within the space, and understanding these dynamics is crucial for anyone looking to achieve substantial returns similar to leaders like ‘0xPickleCati’.

Additionally, utilizing tools available for market analysis can provide traders with an edge when it comes to recognizing trends and potential reversal points. Traders can benefit from social trading platforms, indicators, and community discussions centered around market behavior. Emulating the strategies of successful traders, particularly during market volatility, can drastically enhance overall profitability in futures contracts.

Decoding the Profit and Loss Curve in Futures Trading

The profit and loss curve is a vital aspect of assessing overall performance in futures trading. Understanding this curve allows traders to visualize their trading journey, including periods of significant profit, like those experienced by ‘0xPickleCati’. By closely monitoring these curves, traders can identify patterns that suggest strategic adjustments, potentially enhancing their future endeavors to secure higher profits.

By recognizing key moments of growth and decline within their performance metrics, traders can also develop a more disciplined approach to their trading activities. Implementing practices to scrutinize past trades against current market conditions may empower traders to craft a more realistic and effective trading strategy, ensuring they capitalize on future opportunities.

Shorting in Cryptocurrency Futures: Risks and Rewards

Shorting has proven to be a profitable strategy in cryptocurrency futures, evident in the recent gains credited to traders like ‘0xPickleCati’. This approach involves selling futures contracts in anticipation of a market decline, allowing traders to buy back at a lower price for profit. While the rewards can be substantial, it requires in-depth market analysis and timely decision-making to mitigate risks associated with this trading method.

Traders looking to employ shorting strategies should carefully consider market trends, volatility, and potential price movements informed by real-time data. Properly executed short positions can yield high returns, particularly during downturns. By analyzing the circumstances that precipitate these market dips, traders can enhance their ability to capitalize on such opportunities within the futures landscape.

The Role of Community Insights in Futures Trading

Engaging with trading communities can significantly bolster a trader’s knowledge base and market insight. The collaborative sharing of strategies, experiences, and data analysis can serve as a foundation for better decision-making. Community discussions surrounding the Binance Futures leaderboard and the performance of traders like ‘0xPickleCati’ can unveil techniques and insights that might otherwise go unnoticed.

By connecting with fellow traders and participating in forums, individuals can gain diverse perspectives on market movements and strategies for maximizing their profits. This communal approach not only fosters learning but also enables traders to stay informed about emerging trends and shifts that can influence their trading outcomes.

Balancing Risk and Reward in Futures Trading

Striking a balance between risk and reward is fundamental to achieving long-term success in futures trading. Traders must assess their risk tolerance while employing strategies to safeguard against potential losses. With the fluctuations experienced by top traders, including the journey of ‘0xPickleCati’, it is evident that understanding when to take calculated risks can be the difference between profitable trades and significant losses.

Successful traders often set clear risk management rules, such as using stop-loss orders and diversifying their portfolios. These tactics provide a safety net that allows them to engage in more aggressive strategies without jeopardizing their overall capital. Implementing such principles is essential for anyone aspiring to reach the profit levels seen on the Binance Futures smart money leaderboard.

Frequently Asked Questions

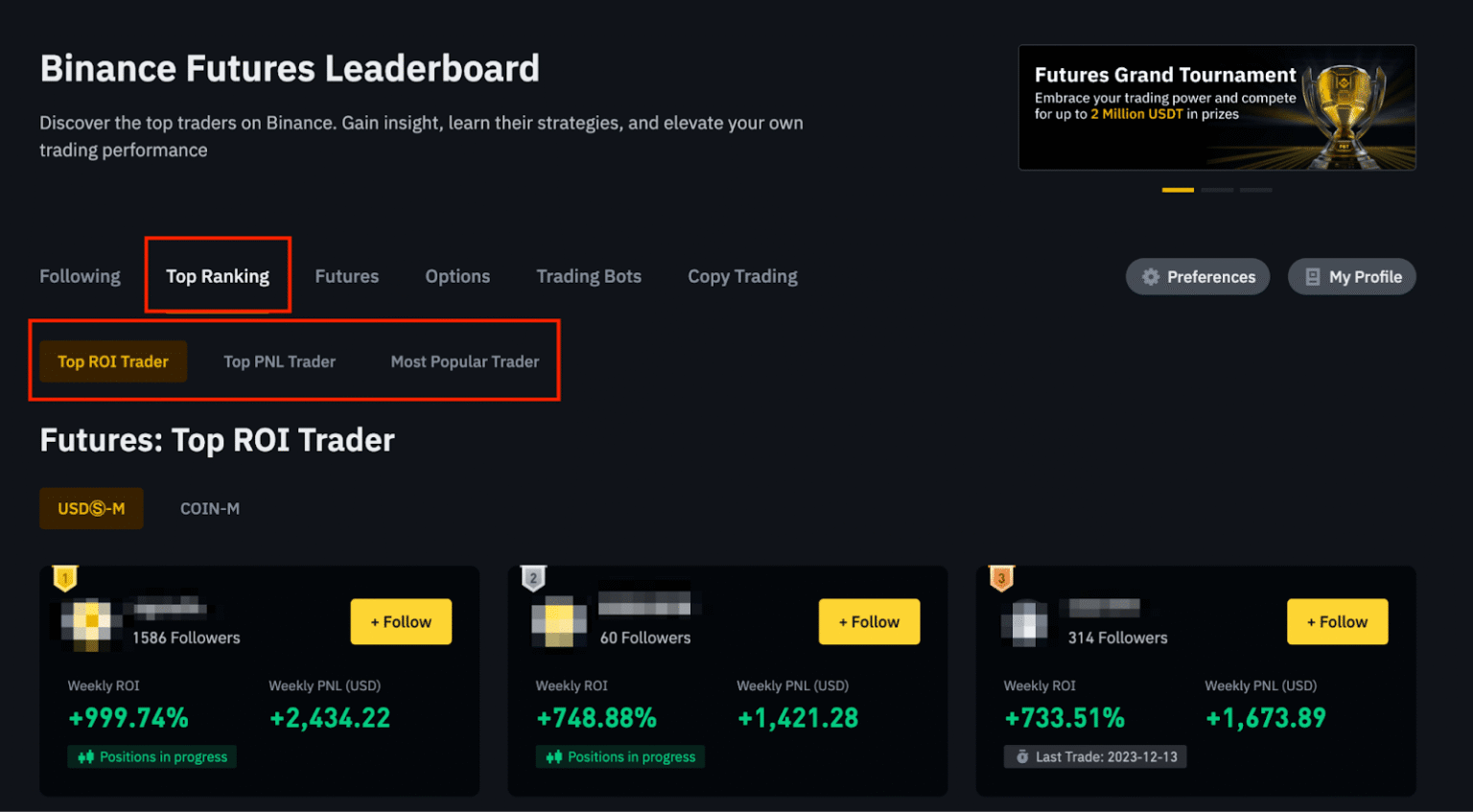

What are Binance Futures leaderboards and how can I access them?

Binance Futures leaderboards showcase top traders based on their profits from futures contracts. You can access the leaderboards by logging into your Binance account and navigating to the Futures section, where you can view rankings based on various metrics including cumulative profit.

How does the Binance Futures smart money leaderboard work?

The Binance Futures smart money leaderboard ranks traders who are identified as making significant profits in cryptocurrency trading. This leaderboard is based on real-time trading data and highlights traders like ‘0xPickleCati’, who has reportedly made $45.46 million in profits, showcasing successful on-chain trading analysis.

How can I profit from Binance Futures trading?

To profit from Binance Futures trading, consider utilizing strategies such as leverage, market analysis, and following successful traders featured on the Binance Futures leaderboards. Learn from their trading behavior and data provided by on-chain analysts to improve your own trading profits.

What insights can I gain from analyzing the Binance Futures leaderboards?

Analyzing the Binance Futures leaderboards can provide insights into the trading strategies of high-performing traders, including periods of significant growth and tactics employed during market downturns, as seen in the case of ‘0xPickleCati’, who adjusted their positions during the October 11 market crash.

What trends can be observed from the Binance Futures smart money leaderboard?

Trends from the Binance Futures smart money leaderboard often reveal high-performing strategies, market volatility responses, and peak trading periods. For example, users like ‘0xPickleCati’ demonstrated growth during specific months indicating optimal trading strategies aligned with market conditions.

Are there risks associated with following Binance Futures leaderboards?

Yes, while Binance Futures leaderboards provide valuable insights, relying solely on them without conducting your own research can be risky. Always consider individual trading risk tolerance and market dynamics before following the strategies of top-ranked traders.

How often does the Binance Futures leaderboard get updated?

The Binance Futures leaderboard is updated in real-time, reflecting current profits and trading activities of users. This allows traders to monitor the best-performing accounts and adjust their strategies dynamically, enhancing their on-chain trading analysis.

| Key Points |

|---|

| User ‘0xPickleCati’ leads Binance Futures leaderboard with $45.46 million in profit |

| Profit was reported as of December 5, 2025 |

| On-chain analyst Ai monitored and confirmed the trading success |

| Growth periods identified: January-April 2024, October-November 2024, and July-October 2025 |

| Profits suspected from shorting during the market crash on October 11, 2025 |

Summary

The Binance Futures leaderboards are now highlighting the impressive achievements of user ‘0xPickleCati’, who has successfully accumulated a staggering $45.46 million in profits. This remarkable feat showcases not only the potential of strategic trading on the Binance Futures platform but also the importance of market analysis and data tracking. With key growth periods and strategic shorting during market declines, ‘0xPickleCati’ sets a high standard for traders aiming to excel in futures trading.