The Binance deposit address plays a crucial role in the ever-evolving world of cryptocurrency transactions, serving as the unique identifier for user accounts on the Binance platform. Recent reports have highlighted a fascinating connection between prominent figures in the crypto space: Yili Hua and Garrett Jin, often referred to as “BTC OG Insider Whale.” Both individuals have been observed using the same Binance deposit address, raising intriguing questions regarding the nature of their transactions and collaborations. Notably, large transfers of USDT and ETH have flowed through this address, subsequently landing in a Binance hot wallet, illustrating the active movement of assets among elite traders. Such developments emphasize the importance of security and monitoring in a market where the reuse of deposit addresses can lead to significant implications.

In the world of digital currencies, a deposit address from Binance is essential for facilitating transactions and asset management. Noteworthy figures like Yili Hua and Garrett Jin have recently sparked interest by sharing a common deposit address, which they utilize for substantial dealings in the cryptocurrency market. This intersection of high-profile activity suggests a compelling narrative surrounding the management of funds, especially when linked to a Binance hot wallet. As these large-scale transactions unfold, the nature of the relationships between significant holders, or whales, becomes increasingly important for market observers and participants alike. Understanding these dynamics underlines the critical role of deposit addresses in safeguarding and maneuvering assets in the fast-paced crypto landscape.

| Key Point | Details |

|---|---|

| Shared Binance Deposit Address | Yili Hua and Garrett Jin both used the same Binance deposit address, raising questions about the activity of these notable figures. |

| On-chain Transactions | Yili Hua’s Trend Research wallet transferred 7.989 million USDT to another address (0xcdF), which is linked to Garrett Jin’s recent transaction of 10,000 ETH. |

| Address Links | Both transactions were ultimately moved to a Binance hot wallet (0x28C), highlighting the interconnectedness of their activities. |

| Potential Coincidence or Reuse | While shared addresses could imply a link between the two, such coincidences in large institutions are rare. |

| Whale Activity | The actions of these whales are significant, especially in light of market fluctuations and should be closely monitored. |

Summary

The Binance deposit address plays a crucial role in the cryptocurrency ecosystem, particularly highlighted by the recent findings that Yili Hua and Garrett Jin are using the same address. This unusual activity suggests a deeper connection or possibly shared funding channels, despite the general rule that each user should have a unique deposit address. As the cryptocurrency landscape continues to evolve, monitoring such patterns can provide insight into market movements and whale behaviors, reminding investors to remain vigilant.

Analyzing the Shared Binance Deposit Address

The revelation that Yili Hua and Garrett Jin utilize the same Binance deposit address raises significant questions within the cryptocurrency community. This finding, reported by Odaily Planet Daily, indicates a potential collaboration or shared funding mechanism between two influential figures in the market. With the growing scrutiny of cryptocurrency transactions, the implications of shared wallet addresses can impact investor trust and perception, especially when dealing with large amounts like the recent transfers of USDT and ETH.

In a decentralized system where anonymity is valued, the use of the same Binance deposit address by high-profile individuals such as the BTC OG Insider Whale can lead to speculation regarding their intentions. The likelihood of two distinct entities leveraging identical addresses is low; this could suggest either coordinated efforts to manage assets or potential implications of insider trading. Such transactions involving Binance hot wallets could attract regulatory attention given the significance of each party’s holdings in the broader market.

The Role of Binance Hot Wallets in Cryptocurrency Transactions

Binance hot wallets play a crucial role in facilitating seamless cryptocurrency transactions for users around the globe. They are designed for quick access and efficient transfers, making them a preferred choice for traders and institutions engaging in high-volume exchanges. The transfer of substantial amounts of USDT and ETH to Binance’s hot wallets from shared deposit addresses illuminates the operational dynamics of how crypto assets move within these platforms.

However, utilizing hot wallets also brings certain risks, such as exposure to cyber threats. While Binance implements robust security measures, users must remain vigilant, especially when dealing with large amounts. In the case of the shared deposit address used by Yili Hua and Garrett Jin, understanding the flow of assets into a hot wallet can unveil insights into market movements and strategies employed by major cryptocurrency players. This kind of analysis is vital for recognizing patterns in trading behaviors, particularly during volatile market conditions.

Insights into BTC OG Insider Whale Activities

The BTC OG Insider Whale, identified as Garrett Jin, has been active in transferring large amounts of cryptocurrency recently. This activity, particularly the move of 10,000 ETH to a new address, followed by the transfer to a Binance hot wallet, reflects strategic positioning likely intended to capitalize on market conditions. Such behaviors indicate a meticulous approach to asset management often seen among institutional investors or high-net-worth individuals.

These movements seem to correlate with broader trends in the cryptocurrency landscape, including shifts in Bitcoin dominance and the behaviors of other market whales. Understanding why individuals like Garrett Jin engage in these transactions provides critical insight into market liquidity and the psychology of large traders during highs and lows. As reports surface regarding whale activities, keeping a tab on BTC OG Insider’s patterns offers valuable information for investors seeking to navigate this unpredictable terrain.

The Connection Between Yili Hua and Trend Research

Yili Hua’s association with Trend Research adds another layer of intrigue to the dynamics at play in cryptocurrency transactions. The recent findings illustrate how closely intertwined influential figures are within this evolving market. The transfer of funds from Trend Research to the Binance deposit address shared with Garrett Jin exemplifies the collaborative nature often found in blockchain ecosystems, where information and funding sources can overlap.

This relationship could signify a strategic alliance aimed at enhancing their positions within the market. By utilizing the same Binance deposit address, both parties not only streamline their transactions but also reinforce their standing as serious market players. As we decode these connections, it’s essential to monitor their activities continuously, as the decisions made by Yili Hua and Garrett Jin can significantly influence market sentiment and trends.

Understanding the Implications of Shared Wallets

The implications of two significant players in the cryptocurrency ecosystem sharing a wallet address cannot be overstated. Shared wallets can denote various scenarios, from mere coincidence to complex funding strategies. If entities such as Garrett Jin and Yili Hua, who are known quantities in the market, use the same Binance deposit address, it raises red flags regarding transparency and market integrity, especially if significant transactions are involved.

From an analytical standpoint, this should prompt a deeper inquiry into the streams of cryptocurrency transactions emanating from shared addresses. In the age of blockchain visibility, understanding these flows helps investors gauge trust in the cryptocurrency market. It’s crucial for traders to consider these dynamics, as the interaction between large players can impact liquidity and ultimately dictate price movements in the crypto space.

Market Reactions to Whale Movements

The movements of cryptocurrency whales can drastically affect market behavior. When influential figures like Yili Hua and Garrett Jin make significant trades, they often set off a chain reaction of market responses, influencing retail investors’ sentiments and actions. Traders often analyze these whale activities to foresee potential price shifts, making it imperative to stay informed about high-stakes transactions, especially those linked to Binance.

As the crypto market continues to evolve, understanding how whale transactions correlate with market trends—especially during downturns—can provide a strategic edge. The actions of these major players, particularly in challenging times, highlight the need for continuous observation and analysis, thereby helping lesser investors to navigate through uncertainty and potential market volatility.

The Impact of Insider Knowledge on Market Dynamics

Insider knowledge and connections among major cryptocurrency players can significantly sway market dynamics. The relationship between Yili Hua and Garrett Jin, particularly the shared Binance deposit address, may suggest a level of insider collaboration that could affect market stability. Such informality raises questions about the integrity of trading operations and the fine line between strategic business relationships and unethical practices.

As cryptocurrency markets are still in a nascent stage, the impact of insiders can lead to biased trading practices, often pushing the boundaries of regulatory frameworks. Observing how players like the BTC OG Insider Whale operate within these coalesced networks can reveal patterns that illuminate market tactics, giving savvy traders an upper hand in anticipating market movements based on the nuanced activities of key stakeholders.

Navigating Regulation in Cryptocurrency Transactions

As the cryptocurrency market attracts more attention, particularly with notable transactions like those involving Yili Hua and Garrett Jin, regulatory bodies are increasingly scrutinizing such activities. The shared Binance deposit address illuminates potential regulatory challenges, especially when transactions involve large sums and prominent figures in the space. Regulators must address these complexities to maintain fairness and transparency in the market.

The need for a robust regulatory framework is evident, as the lack of clear guidelines on shared wallet use can lead to unforeseen consequences. Investors should remain aware of how regulatory developments could affect trading practices, particularly for large transactions conducted through popular platforms like Binance. Monitoring these developments is essential for all market participants hoping to navigate this dynamic landscape responsibly.

Future Trends in Cryptocurrency Transactions

As cryptocurrency technology matures, we are likely to see evolving trends in how transactions are executed, particularly with complex dealings involving prominent figures like Yili Hua and Garrett Jin. A focus on greater transparency, possibly through improved wallet tracking solutions, could reshape trust dynamics within the space. Additionally, the potential for decentralized finance (DeFi) to create more secure, user-friendly environments will make shared deposit times more intricate.

Future trends will likely also include enhanced regulatory oversight as jurisdictions seek to clamp down on fraudulent or unethical behavior stemming from shared wallets. As these prominent players navigate their relationships and transactions, the industry can expect a shift towards more accountable practices, ensuring that substantial movements through platforms like Binance occur within a compliant framework that protects all market participants.

Frequently Asked Questions

What is a Binance deposit address and how is it used in cryptocurrency transactions?

A Binance deposit address is a unique identifier associated with a user’s Binance account that allows for the receipt of cryptocurrencies. When users want to deposit cryptocurrencies, they use this address to ensure their transactions are properly credited to their account. It’s essential for maintaining the security and organization of cryptocurrency transactions on platforms like Binance.

Can multiple users share the same Binance deposit address?

Typically, a Binance deposit address is unique to each user, particularly for frequently used addresses in large transactions. However, as seen in the case of Yili Hua and Garrett Jin, it is theoretically possible for independent large holders to use the same Binance deposit address due to circumstances such as address reuse or sharing funding channels (OTC trading). Such scenarios are rare, though.

What implications arise from Yili Hua and Garrett Jin using the same Binance deposit address?

The fact that Yili Hua and Garrett Jin share the same Binance deposit address raises questions about their possible relationship or similar funding sources, as described by Lookonchain’s monitoring. However, without further evidence, this could also be a coincidence, given that deposit addresses are generally expected to be user-exclusive.

How do large transactions affect Binance deposit addresses?

Large transactions can lead to notable activity on Binance deposit addresses, as seen when Garrett Jin moved 10,000 ETH and Yili Hua transferred 7.989 million USDT. Transactions of this size can indicate significant movements among institutional holders and may influence user perceptions regarding the security and usage of Binance hot wallets.

Why are Binance hot wallets important for cryptocurrency storage?

Binance hot wallets are crucial for accommodating the liquidity needs of the exchange, allowing for quick and easy transactions. They ensure that users can deposit and withdraw funds efficiently. However, as with any hot wallet, they are more susceptible to online risks compared to cold storage options.

What does the term ‘BTC OG Insider Whale’ refer to in relation to Binance deposit addresses?

The term ‘BTC OG Insider Whale’ characterizes notable cryptocurrency holders, like Garrett Jin, who possess substantial amounts of Bitcoin and influence market trends. This designation highlights their importance in monitoring deposit addresses such as those on Binance, where transaction sizes can convey insights into market movements.

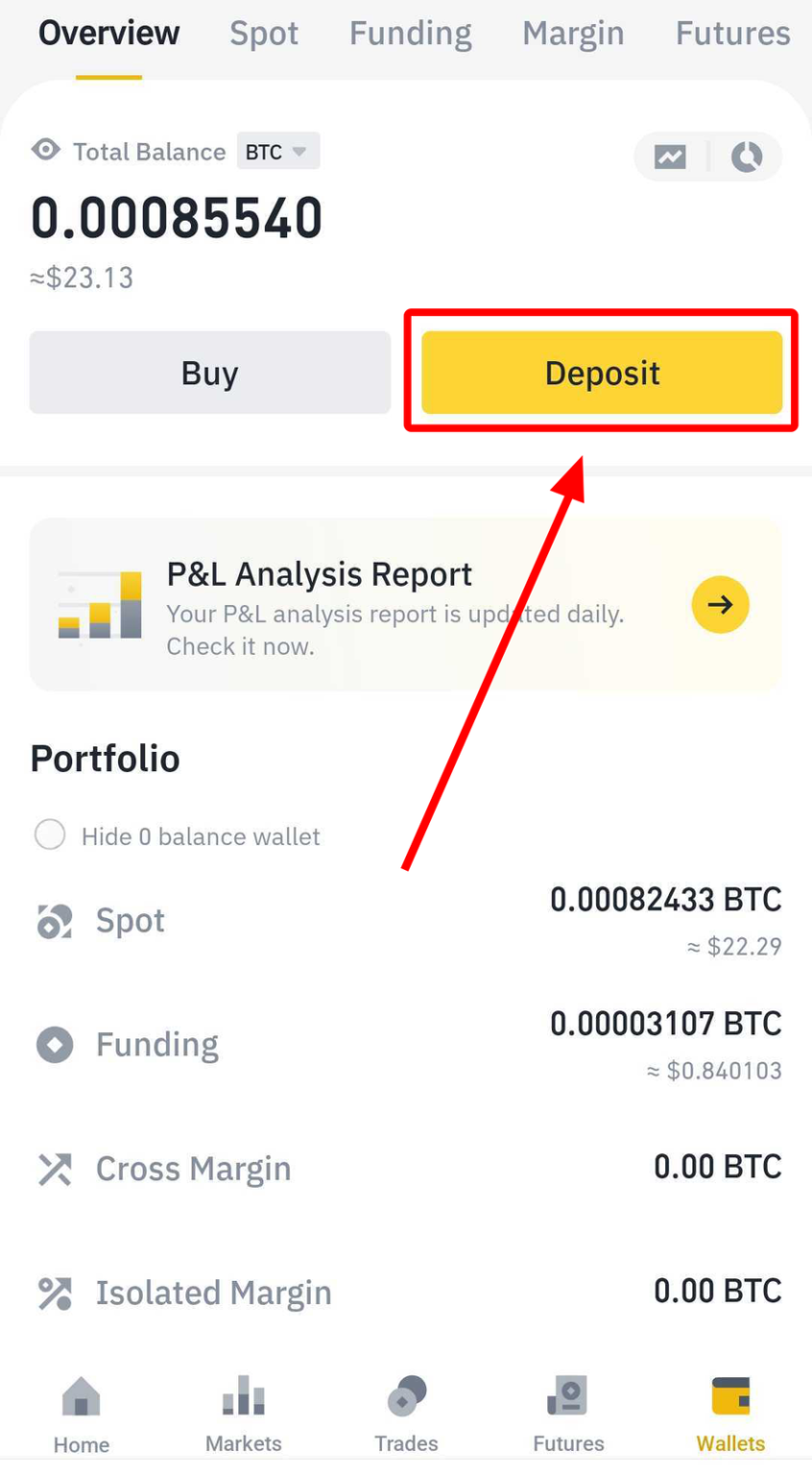

How can I create a Binance deposit address for my account?

To create a Binance deposit address, simply log into your Binance account, navigate to the ‘Wallet’ section, and select ‘Deposit.’ Choose the cryptocurrency for which you need an address, and the system will generate a unique Binance deposit address for that currency, ensuring you can securely receive your funds.

What should I consider when using a Binance deposit address for transactions?

When using a Binance deposit address, ensure the address matches the cryptocurrency you are sending to avoid loss of funds, double-check the address before making a transfer, and be aware of any transaction fees that may apply. It’s also advisable to monitor your transaction history as part of good security practices.